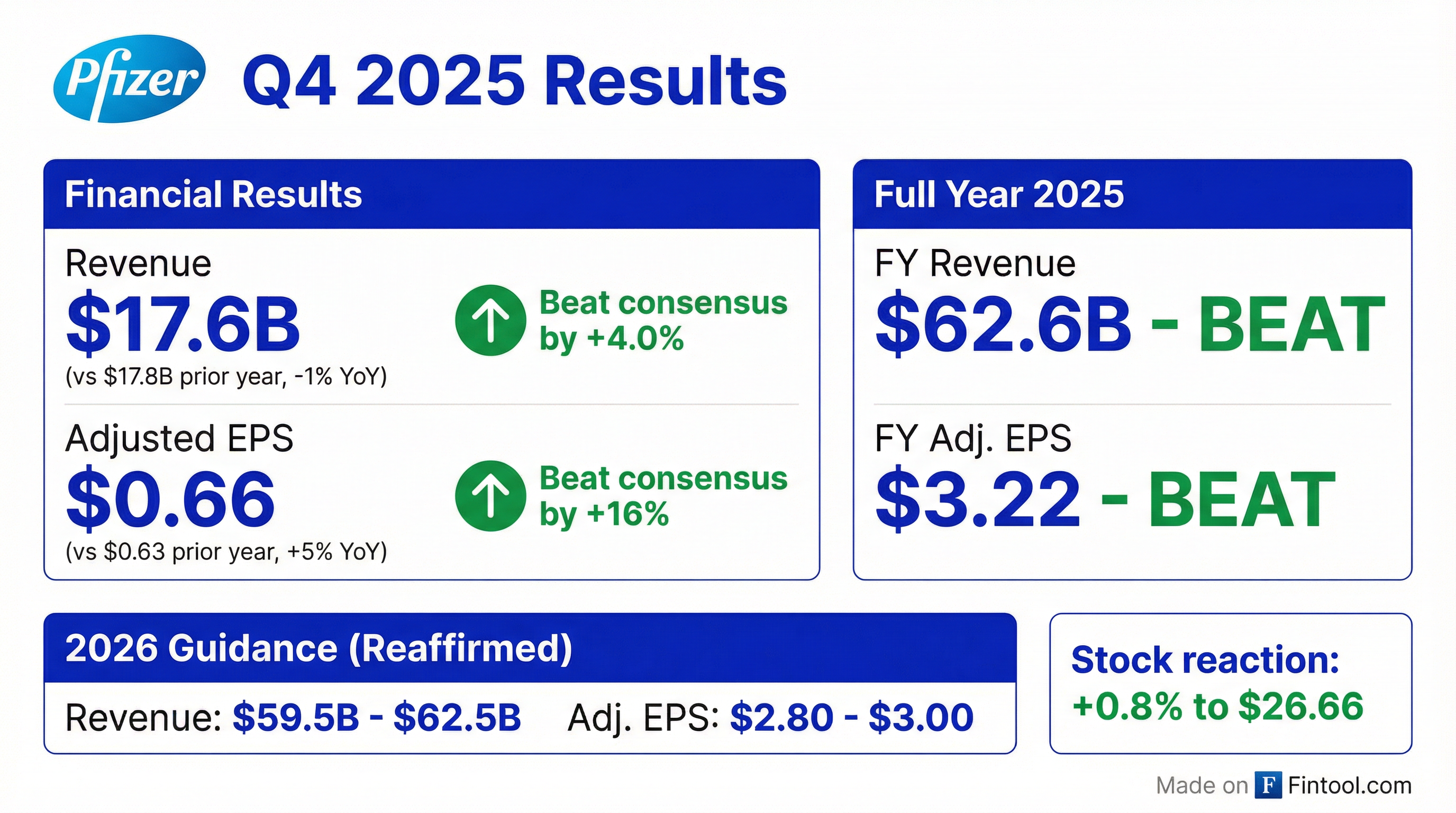

Earnings summaries and quarterly performance for PFIZER.

Executive leadership at PFIZER.

Albert Bourla

Chief Executive Officer

Aamir Malik

Chief U.S. Commercial Officer

Andrew Baum

Chief Strategy and Innovation Officer

Chris Boshoff

Chief Scientific Officer and President, Research & Development

David Denton

Chief Financial Officer

Mike McDermott

Chief Global Supply and Quality Officer

Board of directors at PFIZER.

Cyrus Taraporevala

Director

Dan Littman

Director

James C. Smith

Director

James Quincey

Director

Joseph Echevarria

Director

Mortimer J. Buckley

Director

Ronald Blaylock

Director

Scott Gottlieb

Director

Shantanu Narayen

Lead Independent Director

Susan Desmond-Hellmann

Director

Susan Hockfield

Director

Suzanne Nora Johnson

Director

Research analysts who have asked questions during PFIZER earnings calls.

Courtney Breen

AllianceBernstein

9 questions for PFE

David Risinger

Leerink Partners

9 questions for PFE

Evan Seigerman

BMO Capital Markets

9 questions for PFE

Mohit Bansal

Wells Fargo & Company

9 questions for PFE

Steve Scala

Cowen

9 questions for PFE

Terence Flynn

Morgan Stanley

9 questions for PFE

Asad Haider

Goldman Sachs

7 questions for PFE

Christopher Schott

JPMorgan Chase & Co.

7 questions for PFE

Umer Raffat

Evercore ISI

7 questions for PFE

Vamil Divan

Guggenheim Securities

7 questions for PFE

Akash Tewari

Jefferies

6 questions for PFE

Kerry Holford

Berenberg

5 questions for PFE

Rajesh Kumar

HSBC

5 questions for PFE

Trung Huynh

UBS Group AG

5 questions for PFE

Alex Hammond

Sidoti & Company, LLC

4 questions for PFE

Alexandria Hammond

Wolfe Research

3 questions for PFE

Geoff Meacham

Citigroup Inc.

3 questions for PFE

Geoffrey Meacham

Citi

3 questions for PFE

Louise Chen

Cantor Fitzgerald

3 questions for PFE

Carter L. Gould

Barclays

2 questions for PFE

Chris Schott

JPMorgan Chase & Company

2 questions for PFE

Chris Shibutani

Goldman Sachs Group, Inc.

2 questions for PFE

Jason Gerberry

Bank of America Merrill Lynch

2 questions for PFE

Michael Yee

Jefferies

2 questions for PFE

Srikripa Devarakonda

Truist Financial Corporation

2 questions for PFE

Tim Anderson

Bank of America

2 questions for PFE

Timothy Anderson

BofA Securities

2 questions for PFE

Aakash Tiwari

Jefferies Financial Group Inc.

1 question for PFE

Jeff Meacham

Citigroup Inc.

1 question for PFE

Umar Rafiq

Evercore Inc.

1 question for PFE

Recent press releases and 8-K filings for PFE.

- In the Phase 3 EV-304 trial, perioperative PADCEV (enfortumab vedotin) plus pembrolizumab cut the risk of recurrence or death by 47% versus neoadjuvant gemcitabine/cisplatin (HR 0.53; 95% CI 0.41–0.70; 1-sided p<.0001).

- The regimen yielded a 55.8% pathological complete response at surgery versus 32.5% with standard chemotherapy (difference 23.4%; 95% CI 16.7–29.8; 1-sided p<.0001).

- Overall survival was improved, with a 35% reduction in risk of death (HR 0.65; 95% CI 0.48–0.89; 1-sided p=.0029).

- Safety was consistent with prior data, with grade ≥3 adverse events in 75.7% of patients versus 67.2% in the chemotherapy arm, and no new safety signals.

- PatentVest released its “The Oral Small-Molecule GLP-1 Race: Beyond Orforglipron” Pulse report, analyzing 50 oral GLP-1 programs and reviewing 1,200+ patent documents across 26 clinical-stage assets.

- The report highlights a $71 billion injectable GLP-1 market with under 5% patient reach, prompting 50 oral programs aiming for 12–16% weight-loss efficacy to capture the remaining market.

- Since 2023, $47 billion has been committed to GLP-1 deals; with semaglutide’s patent cliff in 2031 and tirzepatide’s in 2036, long-term exclusivity hinges on patent depth and defensibility.

- Leading programs from Eli Lilly, Novo Nordisk, Pfizer, Roche, AstraZeneca, Gilead and others are assessed for patent scope—from genus claims to method-of-use coverage—to forecast which assets can secure 20-year franchises.

- In a phase 1 study, VH184, a third-generation integrase inhibitor, maintained steady drug levels through Month 7, supporting up to twice-yearly dosing.

- In vitro data show VH184 has improved potency and an enhanced resistance profile versus bictegravir against resistant HIV strains, indicating a higher barrier to resistance.

- VH499, an investigational capsid inhibitor, was well tolerated in phase 1 trials and maintained stable drug levels for up to six months, supporting ultra-long-acting twice-yearly dosing.

- ViiV Healthcare plans to advance VH184 into phase 2b studies to optimize dosing schedules and further assess its twice-yearly regimen potential.

- The U.S. FDA granted full approval to Pfizer’s BRAFTOVI® (encorafenib) in combination with cetuximab and fluorouracil-based chemotherapy for adult patients with metastatic colorectal cancer harboring a BRAF V600E mutation, making it the only approved targeted first-line regimen in this setting.

- Phase 3 BREAKWATER trial data showed a 51% reduction in risk of death (HR 0.49) and a 47% reduction in risk of progression or death (HR 0.53) versus chemotherapy (± bevacizumab), with median overall survival of 30.3 months versus 15.1 months and median progression-free survival of 12.8 months versus 7.1 months.

- Full approval follows December 2024’s accelerated approval and is based on the trial’s dual primary endpoints (ORR and PFS) plus key overall survival data, and allows flexibility to use BRAFTOVI with cetuximab alongside different fluorouracil-based regimens such as mFOLFOX6 and FOLFIRI.

- The FDA granted full approval to encorafenib (Braftovi) combined with cetuximab and fluorouracil-based chemotherapy for adults with metastatic colorectal cancer harboring a BRAF V600E mutation, building on an accelerated approval from December 2024.

- Approval was based on the global Phase 3 BREAKWATER trial, which demonstrated a median progression-free survival of 12.8 months for the encorafenib + cetuximab + mFOLFOX6 arm.

- In the randomized portion of BREAKWATER, 236 patients received the Braftovi combination versus 243 patients in the control arm, with primary endpoints of PFS, objective response rate, and overall survival.

- Regulators require confirmation of the BRAF V600E mutation using an FDA-approved test (Qiagen Therascreen BRAF V600E RGQ PCR Kit), and BREAKWATER data were presented at the 2026 ASCO Gastrointestinal Cancers Symposium.

- Announced a new liver-targeted genetic disease program, BEAM-304, to correct PAH gene mutations in PKU patients with an IND filing expected in 2026.

- Entered a $500 million non-dilutive credit facility with Sixth Street—$100 million funded at close, $300 million tied to milestones and $100 million optional—with a minimum $200 million drawdown, extending cash runway into mid-2029.

- Reported $1.25 billion in cash, cash equivalents and marketable securities at December 31, 2025; full-year R&D expenses of $409.6 million, G&A expenses of $113.8 million, and a net loss of $80.0 million; Q4 net income was $244.3 million ($2.37 per share).

- Expecting updated Phase 1/2 data for BEAM-302 by end of Q1 2026 and planning a BLA submission for risto-cel in sickle cell disease as early as year-end 2026.

- Pfizer obtained exclusive China commercialization rights for the GLP-1 therapy ecnoglutide in a deal worth up to $495 million, with Hangzhou Sciwind Biosciences retaining marketing authorization.

- Ecnoglutide is approved in China for adults with type 2 diabetes and is under regulatory review for chronic weight management; Chinese trials showed 15.1% placebo-adjusted weight loss, 92.8% of patients achieved clinically meaningful weight reduction, and over 80% reached HbA1c below 7%.

- Under the agreement, Sciwind will oversee R&D, registration, manufacturing, and supply, while Pfizer’s payments include an upfront fee plus regulatory- and sales-based milestones.

- The collaboration accelerates Pfizer’s strategic footprint in China’s metabolic field and positions it to compete in the growing weight-loss market against Novo Nordisk, Eli Lilly, and local rivals.

- Phase 2 data show ratutrelvir 600 mg daily for 10 days had fewer treatment-related adverse events (10% vs 23.3%) and comparable time to sustained symptom resolution versus PAXLOVID® in eligible and ineligible COVID-19 patients (HR 1.31; p=0.018)

- The absence of viral rebound and a favorable tolerability profile support further evaluation of ratutrelvir for acute COVID-19 and potential Long COVID prevention

- Preclinical studies of tivoxavir marboxil tablets demonstrated 30% increased exposure over the prototype, with modelling predicting 28-day, once-monthly influenza prophylactic coverage

- The FDA has placed the US IND for tivoxavir marboxil on clinical hold over mutagenicity concerns, with formal feedback expected by March 16, 2026; non-US studies remain on track

- Pfizer’s BRAFTOVI plus cetuximab and FOLFIRI regimen achieved a statistically significant improvement in progression-free survival in Cohort 3 of the Phase 3 BREAKWATER trial.

- The regimen delivered a 60.9% objective response rate vs. 40.0% with control, and a secondary analysis indicated an overall survival improvement.

- The safety profile was consistent with known effects, with no new safety signals identified.

- Pfizer plans to submit detailed BREAKWATER data to the FDA to support potential approval, building on earlier accelerated approval for a related BRAFTOVI combination.

- Pfizer’s investigational BRAFTOVI regimen (encorafenib + cetuximab + FOLFIRI) in Cohort 3 of the Phase 3 BREAKWATER trial showed a statistically significant and clinically meaningful improvement in progression-free survival in previously untreated BRAF V600E-mutant metastatic colorectal cancer patients.

- Overall survival, a descriptive secondary endpoint, also demonstrated clinically meaningful prolongation with the BRAFTOVI regimen versus FOLFIRI ± bevacizumab.

- Safety findings for the triplet were consistent with known profiles of each component, with no new safety signals identified at the time of analysis.

Fintool News

In-depth analysis and coverage of PFIZER.

Pfizer Licenses Novavax's Matrix-M Adjuvant for Up to $530M

Pfizer Goes 'All In' on Obesity With 10 Phase 3 Trials Planned After $10B Metsera Bet

350 Drug Price Hikes Set for January Despite Trump's 'Historic' Pharma Deals

Patient Death in Hympavzi Trial Deepens Pfizer's Blood Disorder Woes

Quarterly earnings call transcripts for PFIZER.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more