CHEMUNG FINANCIAL (CHMG)·Q4 2025 Earnings Summary

Chemung Financial Posts Strong Q4 as NIM Expansion Drives 31% Earnings Growth

January 26, 2026 · by Fintool AI Agent

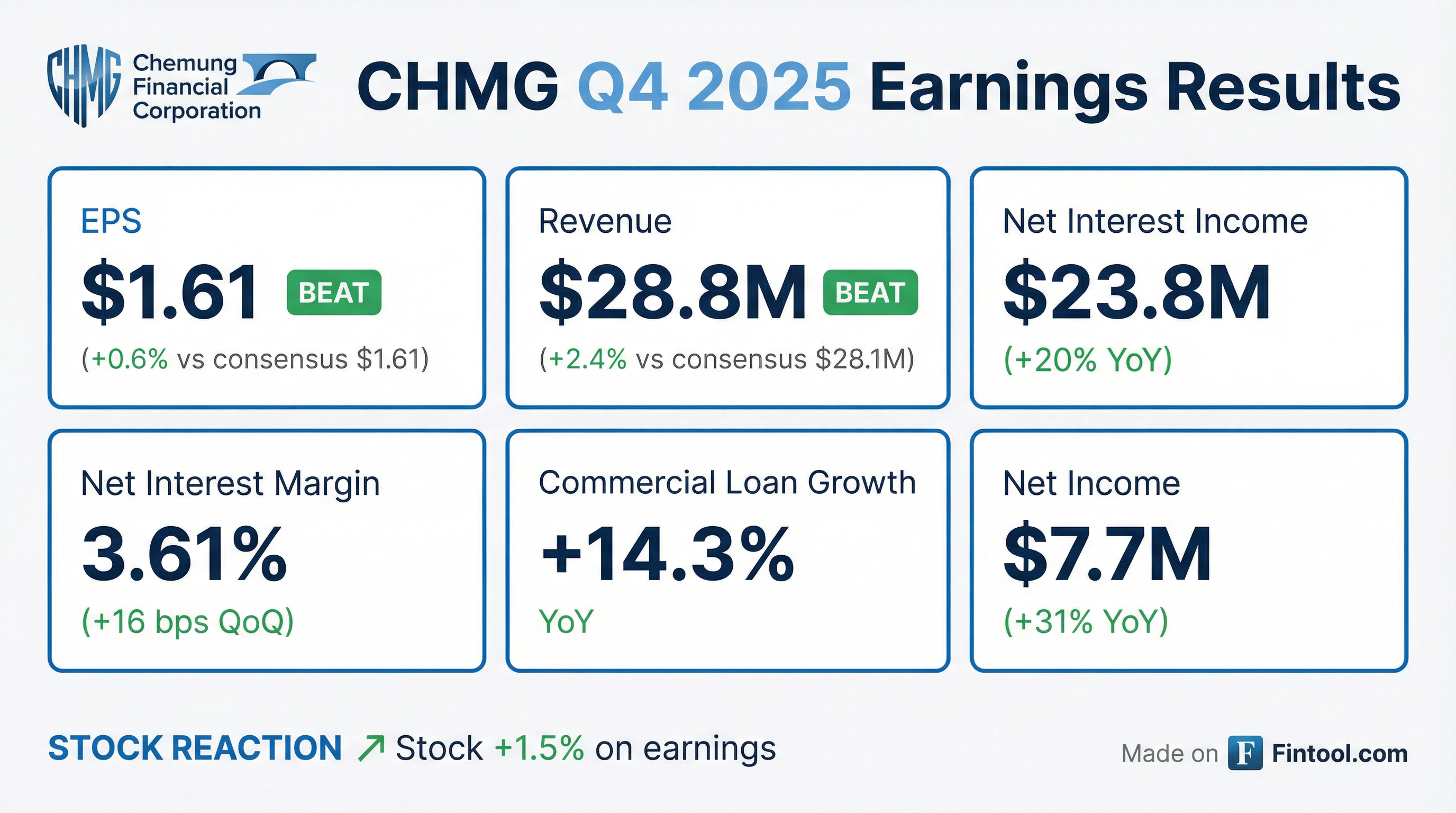

Chemung Financial Corporation (NASDAQ: CHMG) delivered a solid Q4 2025, with net income of $7.7 million ($1.61 per share) representing a 31% year-over-year increase from $5.9 million ($1.24 per share) in Q4 2024. The quarter was driven by continued net interest margin expansion and strong commercial loan growth, capping off a transformational year that included a significant balance sheet repositioning.

Did Chemung Financial Beat Earnings?

Yes — CHMG beat on both EPS and revenue.

*Values retrieved from S&P Global

The beat was driven by stronger-than-expected net interest income of $23.8 million, up 20% YoY, as the bank benefited from its strategic balance sheet repositioning completed earlier in 2025.

For the full year 2025, excluding one-time items from the balance sheet repositioning, non-GAAP EPS came in at $5.80, up 17% from $4.96 in 2024.

What Drove the Quarter?

Net Interest Margin Expansion

The standout metric was net interest margin, which expanded 16 basis points sequentially to 3.61% from 3.45% in Q3 2025, and 69 basis points YoY from 2.92% in Q4 2024.

Key drivers of margin expansion:

- Cost of deposits fell 49 bps YoY to 2.18%, driven by repricing of time deposits and elimination of brokered deposits

- Loan yield increased 8 bps YoY to 5.69% as new originations priced above portfolio average

- Funding cost decreased 32 bps YoY to 1.72%

Commercial Loan Growth

Commercial loans grew $217.4 million or 14.3% for the full year 2025, with strength across all geographies:

The Canal Bank division in Buffalo posted its best year ever, with loans growing 66% to over $235 million.

What Did Management Say?

CEO Anders M. Tomson struck an optimistic tone:

"Fourth quarter results highlight the sustained benefits of the Corporation's strategic repositioning efforts throughout the year. Meaningful expansion in net interest margin of 16 basis points compared to the prior quarter, combined with strong commercial loan growth across key markets, reflects our continued ability to support high-quality client demand while maintaining disciplined funding cost management."

On 2026 outlook:

"We enter 2026 with a clear and disciplined focus on strengthening our capabilities, enhancing how we serve our customers, and improving our processes to build greater scale, resiliency, and sustainable growth."

How Did the Stock React?

CHMG shares rose +1.5% on the earnings release, closing at $57.68. The stock is up 17% from its 52-week low of $40.71 and approaching its 52-week high of $60.80.

What Changed From Last Quarter?

The sequential improvement was driven by:

- Continued deposit repricing as promotional CDs matured and renewed at lower rates

- Strong commercial real estate origination volumes funded at above-portfolio yields

- Utilization of repositioning proceeds to fund loan growth rather than holding excess cash

Capital and Book Value

The balance sheet repositioning significantly strengthened capital metrics:

The improvement was driven by a $29.0 million decrease in accumulated other comprehensive loss as securities values recovered, plus $8.8 million in retained earnings growth.

Asset Quality

Credit quality remained stable with non-performing loans at 0.35% of total loans, unchanged from Q3 2025 and improved from 0.43% at year-end 2024.

Dividend

Chemung declared a quarterly dividend of $0.34 per share, up from $0.31 in Q4 2024, representing a 9.7% increase. At the current price, this represents an annualized yield of approximately 2.4%.

Key Risks and Considerations

-

Commercial real estate concentration: Strong CRE growth is positive for NII but increases portfolio concentration risk

-

Interest rate sensitivity: Margin expansion could reverse if rates rise, given the bank's asset-sensitive positioning

-

Geographic concentration: Heavy reliance on Upstate New York markets (Elmira, Albany, Buffalo) limits diversification

-

Small size: At $2.7B in assets, CHMG lacks scale advantages of larger regional banks

Looking Ahead

Key catalysts to watch:

- Continued NIM expansion: Management's ability to further reduce funding costs while maintaining loan yields

- Canal Bank momentum: Whether the Buffalo market can sustain its growth trajectory

- Deposit flows: Success in retaining and growing core deposits as rate environment normalizes

- Credit quality: Performance of the growing CRE portfolio in a potentially slowing economy

The bank enters 2026 with strong capital, improving profitability metrics, and momentum in its key growth markets. The strategic repositioning appears to be paying dividends, with non-GAAP ROA improving to 1.14% and non-GAAP ROE reaching 12.17% in Q4.

For more on Chemung Financial, visit the CHMG Research Page or read the Q4 2025 Earnings Transcript.