Earnings summaries and quarterly performance for CHEMUNG FINANCIAL.

Executive leadership at CHEMUNG FINANCIAL.

Anders M. Tomson

President and Chief Executive Officer

Dale M. McKim III

Chief Financial Officer and Treasurer

Daniel D. Fariello

Executive Vice President and President, Capital Bank Division

Jeffrey P. Kenefick

Executive Vice President and Regional President; Interim Head of Wealth Management

Kimberly A. Hazelton

Executive Vice President, Retail Client Services, Marketing and Business Services

Loren D. Cole

Chief Information Officer

Mary E. Meisner

Chief Risk Officer

Peter K. Cosgrove

Chief Credit Officer

Vincent M. Cutrona

Executive Vice President and President, Canal Bank Division

Board of directors at CHEMUNG FINANCIAL.

David J. Dalrymple

Chair of the Board

David M. Buicko

Director

Denise V. Gonick

Director

G. Thomas Tranter Jr.

Director

Jeffrey B. Streeter

Director

Joseph F. Meade IV

Director

Raimundo C. Archibold Jr.

Director

Richard E. Forrestel Jr.

Director

Robert H. Dalrymple

Director

Ronald M. Bentley

Director

Stephen M. Lounsberry III

Director

Thomas R. Tyrrell

Director

Research analysts covering CHEMUNG FINANCIAL.

Recent press releases and 8-K filings for CHMG.

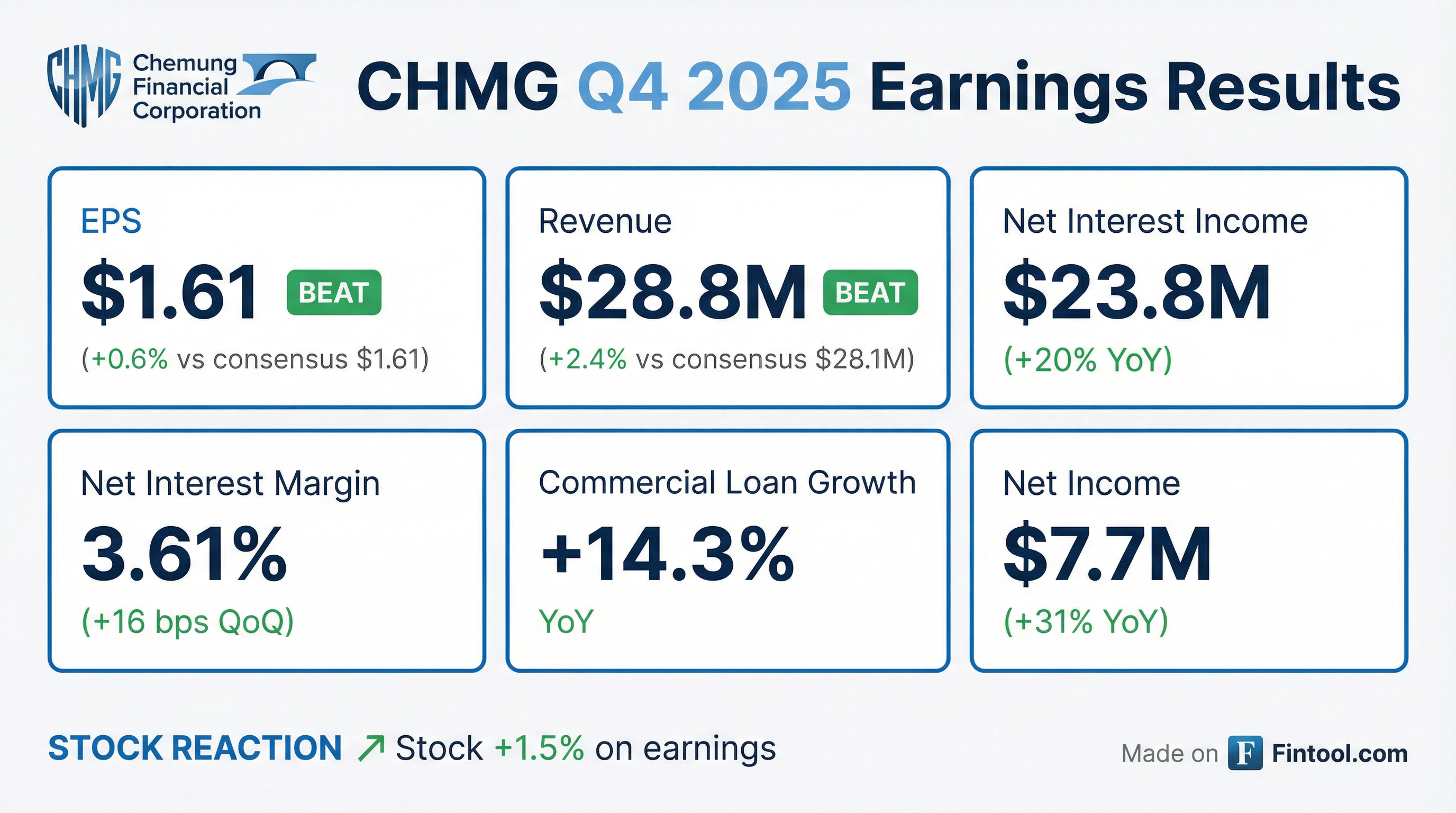

- Chemung Financial Corporation reported Q4 2025 EPS of $1.61 and full-year 2025 non-GAAP net income of $27.9 million, with a Net Interest Margin of 3.61% for Q4 2025.

- The company completed a balance sheet restructuring in June 2025, selling over $245 million of low-yielding AFS securities and raising $45 million in subordinated debt to improve profitability and strengthen capital ratios.

- For 2025, annual loan growth was 9.6%, including 14.3% commercial loan growth, and the quarterly dividend increased from $0.31 in Q4 2024 to $0.34 in Q3 2025, leading to $1.32 YTD dividends per share.

- As of December 31, 2025, the company maintained strong capital with a Total Risk Based Capital Ratio of 15.30% and a TCE Ratio of 8.66%.

- Chemung Financial Corporation reported net income of $7.7 million, or $1.61 per share, for the fourth quarter of 2025, and annual net income of $15.1 million, or $3.14 per share, for the year ended December 31, 2025.

- The company's net interest margin increased to 3.61% in Q4 2025, up 16 basis points from the prior quarter, and increased to 3.26% for the full year 2025, up 50 basis points from the prior year.

- Annual loan growth in 2025 totaled $198.1 million, or 9.6%, with commercial loan growth increasing by $217.4 million, or 14.3%.

- The 2025 annual net income was impacted by a $17.5 million loss on the sale of securities as part of the Corporation's balance sheet repositioning.

- Dividends declared for the fourth quarter of 2025 were $0.34 per share.

- Chemung Financial Corporation reported Q3 2025 earnings per share (EPS) of $1.62, net income of $7.8 million, a return on average assets (ROA) of 1.15%, and a return on average equity (ROE) of 12.89%.

- The company's net interest margin (NIM) expanded by 40 basis points to 3.45% in Q3 2025, driven by a 32 basis point increase in the average yield on interest-earning assets to 5.15% and a 9 basis point decrease in the cost of funds to 1.85%.

- A strategic balance sheet restructuring involved selling approximately $245 million of low-yielding available-for-sale securities, paying off $155.0 million in wholesale funding, and raising $45 million in subordinated debt, which contributed to enhanced profitability metrics and strengthened capital ratios.

- As of September 30, 2025, the company maintained strong capital ratios with a Tier 1 Leverage ratio of 9.66%, a Tier 1 Capital / CET1 ratio of 14.21%, a Total Capital ratio of 15.44%, and a TCE ratio of 8.36%.

- The company increased its quarterly dividend to $0.34 per share in Q3 2025 and had a market capitalization of $252.7 million as of September 30, 2025, with its Trust and Wealth Management division managing $2.4 billion in assets.

- Chemung Financial Corporation reported net income of $7.8 million, or $1.62 per share, for the third quarter of 2025, a significant turnaround from a net loss of $6.5 million, or $1.35 per share, in Q2 2025, and an increase from $5.7 million, or $1.19 per share, in Q3 2024.

- Net interest income grew 9% quarter-over-quarter to $22.7 million in Q3 2025, largely due to balance sheet repositioning efforts. The net interest margin increased by 40 basis points to 3.45% in Q3 2025 from 3.05% in Q2 2025.

- The company announced a $0.02 per share dividend increase in Q3 2025, resulting in a declared dividend of $0.34 per share.

- Total year-to-date loan growth was approximately 8.4% on an annualized basis, and non-performing loans decreased to $7.8 million, or 0.35% of total loans, as of September 30, 2025.

- Chemung Financial Corporation reported a GAAP net loss of $6.5 million and Non-GAAP net income of $6.3 million for Q2 2025, with a Non-GAAP EPS of $1.31.

- The company executed a strategic balance sheet restructuring in Q2 2025, which included selling $245.5 million in AFS securities, resulting in a $17.5 million pre-tax loss, and issuing $45.0 million in Fixed-to-Floating Rate Subordinated Notes.

- As of June 30, 2025, total loans reached $2.132 billion, showing 6.6% annualized loan growth for the quarter, and the net interest margin expanded to 3.05%.

- The company's capital ratios as of June 30, 2025, include a Tier 1 Leverage ratio of 8.96% and a Total Capital ratio of 15.16%.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more