Earnings summaries and quarterly performance for CHUNGHWA TELECOM CO.

Research analysts who have asked questions during CHUNGHWA TELECOM CO earnings calls.

Recent press releases and 8-K filings for CHT.

Chunghwa Telecom Reports Q4 and Full Year 2025 Un-Audited Results, Provides 2026 Guidance

CHT

Earnings

Guidance Update

New Projects/Investments

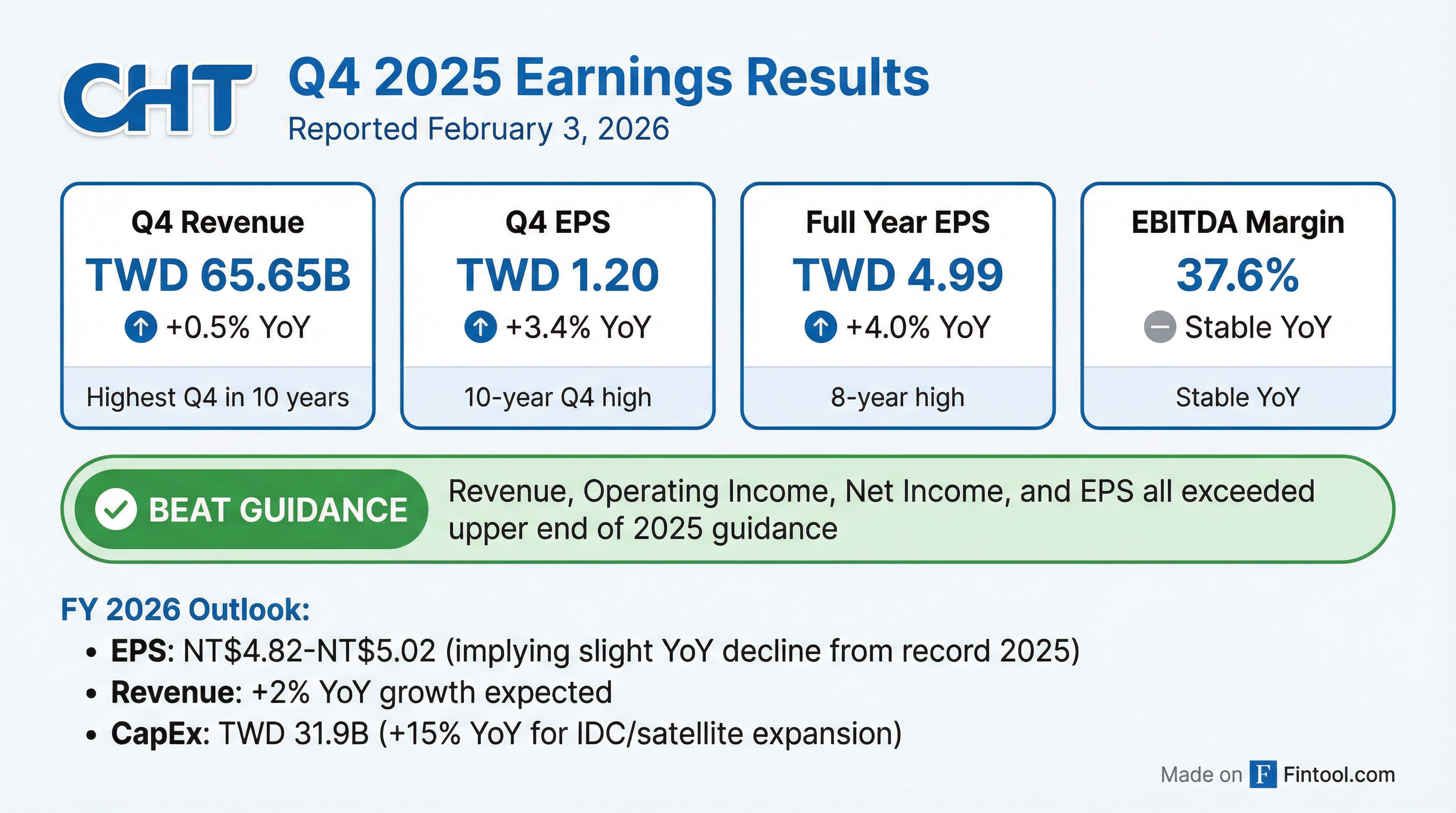

- For the fourth quarter of 2025, Chunghwa Telecom reported total revenue of NT$ 65.65 billion, an increase of 0.5% year-over-year, and net income attributable to stockholders of the parent increased by 3.2% to NT$ 9.29 billion. Basic earnings per share (EPS) for the quarter was NT$1.20.

- For the full year 2025, total revenue increased by 2.7% to NT$236.11 billion, with net income attributable to stockholders of the parent increasing by 4.0% to NT$ 38.69 billion. The company's full-year EPS reached NT$4.99, and all key financial metrics exceeded the high-end target of their full-year guidance.

- Looking ahead to 2026, Chunghwa Telecom expects total revenue to increase by 2.5%~3.2% to NT$241.99~NT$243.68 billion, with EPS projected to be NT$4.82~NT$5.02.

- The company plans to increase its Acquisition of Property, Plant and Equipment in 2026 by NT$4.07 billion to NT$31.91 billion, driven by investments in submarine cables, satellite networks, cloud AI internet data centers, and enhancements to mobile and fixed broadband businesses.

4 days ago

Chunghwa Telecom Reports Record Full Year 2025 Results and Provides 2026 Guidance

CHT

Earnings

Guidance Update

New Projects/Investments

- Chunghwa Telecom reported exceptional full year 2025 financial performance, with revenue reaching an all-time high of TWD 236.11 billion and EPS of TWD 4.99, an 8-year high, both exceeding guidance.

- For Q4 2025, consolidated revenue increased 0.5% year-over-year to TWD 65.65 billion, and EPS rose to TWD 1.20, marking the highest fourth-quarter EPS in 10 years.

- The company issued 2026 guidance, projecting total revenue to increase between 2% year-over-year and EPS in the range of NT$4.82-NT$5.02.

- Chunghwa Telecom plans a 2026 CapEx budget of TWD 31.91 billion, with mobile-related CapEx decreasing by 6.3% and non-mobile CapEx increasing for strategic investments in submarine cables and IDC data centers.

- Strategic initiatives for 2026 include leveraging mobile and fixed broadband leadership, expanding ICT, AI, and satellite services, with pre-6G related opportunities expected to generate over TWD 10 billion in combined revenue.

4 days ago

Chunghwa Telecom Reports Strong Q4 and Full-Year 2025 Results, Provides 2026 Guidance

CHT

Earnings

Guidance Update

New Projects/Investments

- Chunghwa Telecom reported strong financial performance for Q4 2025, with consolidated revenue increasing 0.5% year-over-year to TWD 65.65 billion and EPS rising to TWD 1.20, marking the highest fourth-quarter revenue in nearly a decade and highest Q4 EPS in 10 years.

- For the full year 2025, the company exceeded the upper end of its guidance for revenue, operating income, income before tax, and EPS, achieving an all-time high total revenue of TWD 236.11 billion and an 8-year high EPS of TWD 4.99.

- Looking ahead to 2026, Chunghwa Telecom expects total revenue to increase between 2% year-over-year and projects EPS to be in the range of NT$4.82-NT$5.02, with a budgeted CapEx of TWD 31.91 billion.

- The company solidified its leadership in Taiwan's mobile market in 2025 with a 41% mobile revenue market share and 39.7% subscriber market share, while also focusing on pre-6G related opportunities in AIoT, satellite, and big data services, expecting combined revenue to surpass TWD 10 billion in 2026.

4 days ago

Chunghwa Telecom Reports Strong Q4 and Full-Year 2025 Results, Provides 2026 Guidance

CHT

Earnings

Guidance Update

New Projects/Investments

- Chunghwa Telecom reported strong financial performance for Q4 2025 and full year 2025, with full year revenue reaching TWD 236.11 billion and EPS at TWD 4.99, an eight-year high, both exceeding guidance.

- For Q4 2025, consolidated revenue was TWD 65.65 billion, a 0.5% year-over-year increase and the highest fourth-quarter revenue in nearly a decade, with EPS of TWD 1.20, the highest Q4 EPS in 10 years.

- The company provided 2026 guidance, expecting total revenue to increase between 2% year-over-year and EPS to be in the range of NT$4.82-NT$5.02.

- Strategic growth was driven by continued mobile market leadership with a 41% revenue market share and strong 5G penetration , alongside a 15% year-over-year increase in recurring ICT revenue , and strategic investments in submarine cables and IDC data centers. The company also secured 4.6 billion kWh of renewable energy to support its 2045 net zero commitment.

4 days ago

Chunghwa Telecom's Offices Raided by Prosecutors

CHT

Legal Proceedings

- On January 5, 2026, the Taiwan Yilan District Prosecutors Office raided the staff offices of Chunghwa Telecom's local business operation centers.

- The company is fully cooperating with the investigation.

- Chunghwa Telecom has stated that this event has no effect on its finances and business.

Jan 13, 2026, 1:32 AM

Chunghwa Telecom Announces November 2025 Operating Results

CHT

Earnings

Revenue Acceleration/Inflection

- For November 2025, Chunghwa Telecom reported revenue of approximately NT$21.45 billion, net income attributable to stockholders of the parent of approximately NT$3.46 billion, and earnings per share (EPS) of NT$0.44.

- For the eleven months ended November 30, 2025, the company's revenue was approximately NT$212.85 billion, with net income attributable to stockholders of the parent reaching approximately NT$36.02 billion, and EPS of NT$4.64.

- Net sales for November 2025 increased by 6.07% compared to November 2024, totaling NT$21,453,973 thousand.

- Net sales for the January to November 2025 period grew by 3.82% year-over-year, reaching NT$212,849,854 thousand.

Dec 10, 2025, 11:00 AM

Chunghwa Telecom reports on prosecutor's office raid and renewable energy purchase

CHT

Legal Proceedings

New Projects/Investments

- On December 3, 2025, the Taiwan Taoyuan District Prosecutors Office, directed by the Kaohsiung Investigation Branch of the Investigation Bureau, Ministry of Justice, raided the staff offices of Chunghwa Telecom's local business operation centers.

- Chunghwa Telecom stated it is fully cooperating with the investigation and that the event has no effect on the Company's finances and business.

- On December 5, 2025, Chunghwa Telecom announced the purchase of renewable energy from GREENET CO., LTD. for a period of 20 years, totaling at least 4.6 billion kWh of diversified green electricity.

- This purchase is part of the company's goals to reduce carbon emissions by 50% and achieve 100% renewable energy usage in IDC data centers by 2030, meet RE100 by 2040, and reach net-zero emissions by 2045.

Dec 8, 2025, 11:24 AM

Chunghwa Telecom to Participate in Investor Conference and Announces Equipment Purchase

CHT

New Projects/Investments

- Chunghwa Telecom Co., Ltd. will participate in an investor conference hosted by IBF Securities on November 27, 2025, at 12:30 pm Taipei time.

- The company announced the purchase of mobile broadband service equipment for a mobile broadband construction project from Ericsson Taiwan Ltd..

- The accumulated transaction amount for this equipment purchase is NT$1.196 billion, with the latest award date being November 28, 2025.

Dec 1, 2025, 11:09 AM

Chunghwa Telecom Announces October 2025 Operating Results

CHT

Earnings

Revenue Acceleration/Inflection

- Chunghwa Telecom reported revenue of approximately NT$20.93 billion and earnings per share (EPS) of NT$0.41 for October 2025.

- For the ten months ended October 31, 2025, the company's revenue was approximately NT$191.40 billion and EPS was NT$4.20.

- Net sales for October 2025 increased by 4.05% to NT$20,932,738 thousand compared to October 2024.

- Net sales for the ten months ended October 31, 2025, grew by 3.57% to NT$191,395,880 thousand compared to the same period in 2024.

Nov 10, 2025, 11:02 AM

Chunghwa Telecom Announces Nine-Month 2025 Financial Results

CHT

Earnings

- Chunghwa Telecom Co., Ltd. announced its consolidated financial statements for the nine months ended September 30, 2025.

- For the period, the company reported operating revenue of 170,463,142 thousand NTD.

- Profit attributable to owners of parent for the nine months was 29,406,456 thousand NTD.

- Basic earnings per share for the period stood at 3.79 NTD.

- As of September 30, 2025, total assets were 513,095,556 thousand NTD.

Nov 7, 2025, 11:06 AM

Quarterly earnings call transcripts for CHUNGHWA TELECOM CO.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more