Earnings summaries and quarterly performance for Cigna.

Executive leadership at Cigna.

David Cordani

Chief Executive Officer

Brian Evanko

Executive Vice President, Chief Financial Officer, and President and Chief Executive Officer, Cigna Healthcare

David Brailer

Executive Vice President and Chief Health Officer

Nicole Jones

Executive Vice President, Chief Administrative Officer, and General Counsel

Noelle Eder

Executive Vice President, Global Chief Information Officer

Board of directors at Cigna.

Donna Zarcone

Director

Elder Granger

Director

Eric Foss

Director

Eric Wiseman

Lead Independent Director

George Kurian

Director

Kathleen Mazzarella

Director

Kimberly Ross

Director

Mark McClellan

Director

Michael Hennigan

Director

Neesha Hathi

Director

Philip Ozuah

Director

Research analysts who have asked questions during Cigna earnings calls.

Andrew Mok

Barclays

7 questions for CI

Erin Wright

Morgan Stanley

7 questions for CI

Justin Lake

Wolfe Research, LLC

7 questions for CI

Lisa Gill

JPMorgan Chase & Co.

7 questions for CI

Charles Rhyee

TD Cowen

6 questions for CI

Scott Fidel

Stephens Inc.

5 questions for CI

Jason Cassorla

Guggenheim Partners

4 questions for CI

Joshua Raskin

Nephron Research

4 questions for CI

Kevin Fischbeck

Bank of America

4 questions for CI

A.J. Rice

UBS Group AG

3 questions for CI

Albert Rice

UBS

3 questions for CI

George Hill

Deutsche Bank

3 questions for CI

Stephen Baxter

Wells Fargo & Company

3 questions for CI

Adam Ron

Bank of America Corporation

2 questions for CI

Ann Hynes

Mizuho Financial Group

2 questions for CI

Andrew Rice

UBS

1 question for CI

Benjamin Hendrix

RBC Capital Markets

1 question for CI

Lance Wilkes

Sanford C. Bernstein & Co., LLC

1 question for CI

Michael Hop

Baird

1 question for CI

Ryan Langston

TD Cowen

1 question for CI

Sarah James

Cantor Fitzgerald

1 question for CI

Recent press releases and 8-K filings for CI.

- Cigna Group reaffirms projected full-year 2026 consolidated adjusted income from operations of at least $30.25 per share

- Guidance was first disclosed in a February 5, 2026 press release and will be reiterated in upcoming investor meetings

- Adjusted income from operations excludes net investment gains/losses, amortization of acquired intangible assets and special items, reflecting management’s key profitability metric

- Form 8-K filed February 27, 2026, signed by CFO Ann M. Dennison

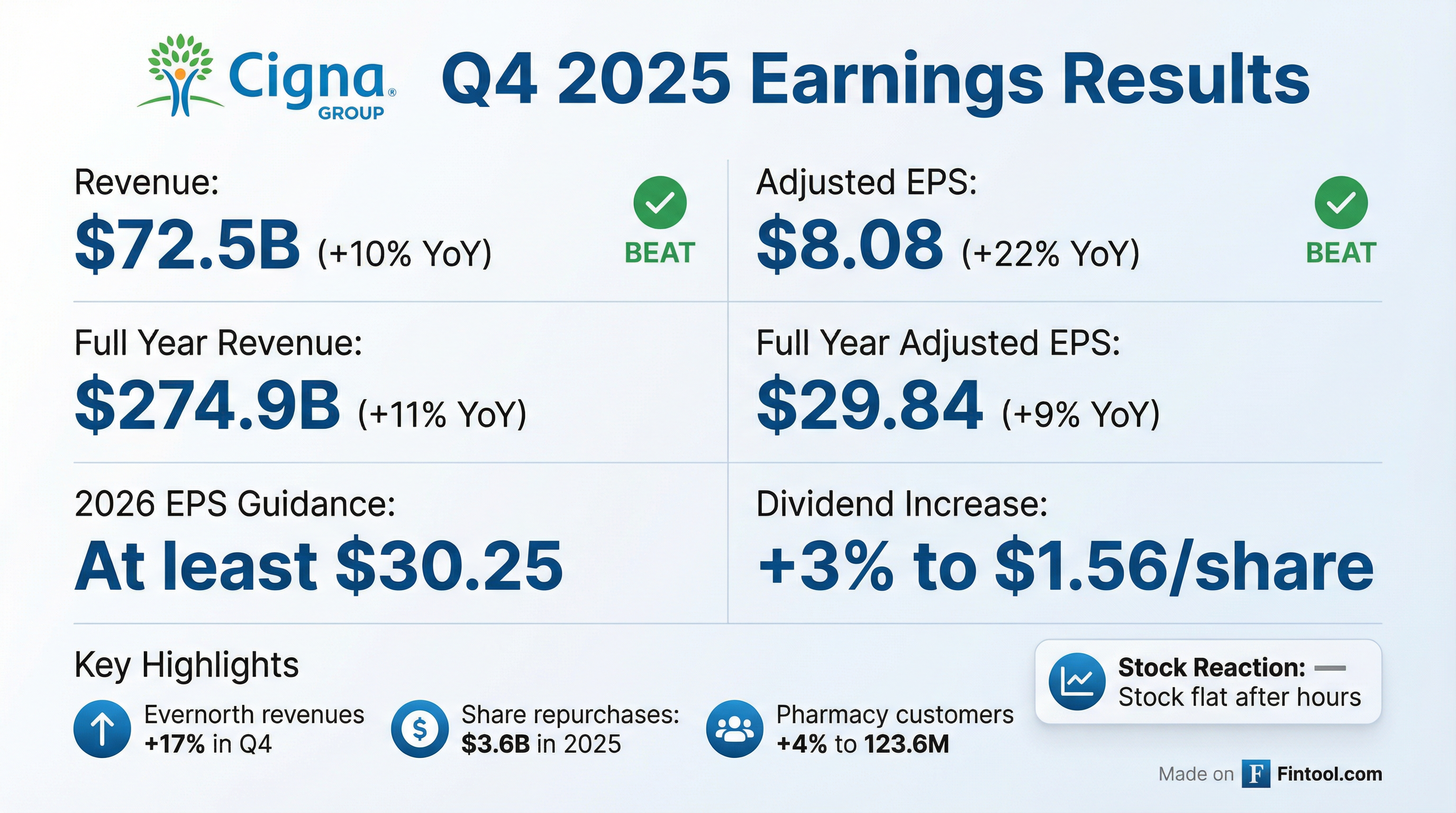

- Cigna delivered adjusted EPS of $8.08 vs. $7.88 expected and revenue of $72.4 billion (+10.4% YoY), topping FactSet estimates.

- GAAP results showed net income of $1.234 billion and EPS of $4.64, both down year-over-year.

- For fiscal 2026, Cigna guided to adjusted EPS of at least $30.25 and revenue near $280 billion, below analysts’ forecasts, and forecast a medical cost ratio of 83.7%–84.7%.

- Cantor Fitzgerald warned of Medicare Advantage rate risks after a 0.09% CMS advance notice, while Mizuho raised its 12-month price target to $325, citing decelerating utilization trends.

- The Cigna Group delivered full-year 2025 adjusted revenue of $275 billion (+11%) and adjusted EPS of $29.84 (+9%), and in Q4 recorded $483 million of after-tax special charges (-$1.82/share).

- Announced a global settlement with the FTC on its pharmacy benefits business, providing $7 billion of out-of-pocket cost relief over 10 years for 100 million customers, enhancing insulin and brand-drug affordability and increasing transparency under a new fee-based PBM model.

- Returned over $5 billion to shareholders in 2025 via dividends and share repurchases, and set a 2026 adjusted EPS outlook of at least $30.25, backed by stable PBM margins and continued strategic investments.

- Pharmacy Benefit Services retained >97% of clients for 2026 and expects its margin profile to remain similar under the transparent, no-rebate model; moving its GPO back to the U.S. may raise the effective tax rate by up to 1% if unmitigated.

- Full-year 2025: Adjusted revenue $275 B (+11%) and adjusted EPS $29.84 (+9%); $7 B in out-of-pocket relief over 10 years via FTC settlement for 100 M customers.

- Q4 segment performance: Evernorth revenue $63.1 B (pre-tax adj. earnings $2.2 B); specialty & care services $26.7 B rev (+14%), $1 B earnings; PBM rev $36.3 B, $1.2 B earnings; Cigna Healthcare revenue $11.2 B, pre-tax adj. earnings $734 M; MCR ~60 bps above plan.

- 2026 guidance: Consolidated revenue ~$280 B; adjusted EPS ≥$30.25; Evernorth earnings ≥$6.9 B; Cigna Healthcare earnings ≥$4.5 B; Q1 ~25% of full-year EPS; end-year medical members ~18.1 M; tax rate ~19%.

- Capital outlook: 2025 operating cash flow $9.6 B; 2025 buybacks $3.6 B and dividends $1.6 B; end-2025 debt-to-capital ~43%; in 2026 expect $9 B cash flow, $1.3 B CapEx, $1.6 B dividends; shares ~261–265 M.

- Strong 2025 financials: delivered full-year adjusted revenue of $275 billion (+11%) and adjusted EPS of $29.84 (+9%); returned over $5 billion to shareholders through dividends and share repurchases.

- FTC settlement and PBM model: reached global settlement resolving all FTC pharmacy benefits matters, including a 10-year, $7 billion out-of-pocket cost relief program for 100 million customers, and launched a rebate-free, transparent pharmacy benefits model.

- 2026 guidance: expects consolidated adjusted EPS of at least $30.25; segment targets include Evernorth adjusted earnings ≥ $6.9 billion and Cigna Healthcare ≥ $4.5 billion.

- Capital and cash flow priorities: generated $9.6 billion of 2025 operating cash flow; repurchased 11.9 million shares for $3.6 billion and paid $1.6 billion in dividends; 2026 outlook calls for $9 billion cash flow, $1.3 billion capex, $1.6 billion dividends and progress toward a 40% debt-to-capital ratio.

- Total revenues for 2025 rose 11% to $274.9 billion, with Q4 revenues of $72.5 billion, up 10% year-over-year.

- 2025 shareholders’ net income was $6.0 billion ( $22.18 per share); Q4 net income was $1.2 billion ( $4.64 per share).

- 2025 adjusted income from operations reached $8.0 billion ( $29.84 per share); Q4 adjusted operations income was $2.15 billion ( $8.08 per share).

- The Board increased the quarterly dividend to $1.56 per share and Cigna repurchased 11.9 million shares (~$3.6 billion) in 2025.

- For 2026, Cigna projects adjusted revenues of approximately $280 billion and adjusted income from operations of at least $7.95 billion ( $30.25 per share).

- Full-year 2025 revenues rose 11% to $274.9 B; shareholders’ net income was $6.0 B ( $22.18/share) and adjusted income from operations was $8.0 B ( $29.84/share).

- In Q4 2025, total revenues of $72.5 B (+10%) delivered shareholders’ net income of $1.2 B ( $4.64/share) and adjusted income from operations of $2.1 B ( $8.08/share).

- 2026 outlook: adjusted revenues of ~$280 B and adjusted income from operations of at least $7.95 B ( $30.25/share).

- The board increased the quarterly dividend to $1.56 per share (from $1.51).

- FTC settlement requires Express Scripts to eliminate spread pricing, decouple rebates and fees from list prices, relocate its GPO Ascent to the U.S., and undergo 10 years of FTC monitoring.

- From 2027, Express Scripts must adopt a cost-plus reimbursement model for independent pharmacies (three or fewer), to cover acquisition, dispensing, and monitoring costs with reasonable profit.

- The agreement addresses alleged anticompetitive PBM practices that inflated drug prices and harmed independent pharmacies, as highlighted by NCPA leadership.

- Cigna, alongside Aetna, UnitedHealthcare, and Humana, now covers AI-based coronary plaque analysis under the new Category I CPT code 75577, effective January 1, 2026.

- This coverage extends access to tens of millions of commercially insured patients for AI-enabled quantitative plaque assessment.

- The permanent CPT code 75577 enables nationally valued reimbursement for AI‐driven quantification and characterization of coronary atherosclerotic plaque from CCTA in outpatient and imaging settings.

- In December 2025, the AMA/ACC issued guidance recommending quantitative coronary plaque analysis to enhance risk assessment and guide preventive therapy in patients with visual plaque evidence on CTA.

- AM Best affirmed the Financial Strength Rating of A+ (Superior) and Long-Term Issuer Credit Rating of aa- (Superior) for HCSC Group, and A (Excellent) and a (Excellent) for HCSC Medicare & Supplemental Group, all with a stable outlook.

- Ratings reflect HCSC Group’s strongest balance sheet, adequate operating performance amid 2025 challenges, and strong risk-adjusted capitalization (BCAR), supported by robust liquidity and a $1.25 billion revolving credit facility plus over $2.0 billion FHLB borrowing capacity.

- HCSC’s statutory financial leverage rose to just under 20% after new debt issuances in 2024 and 2025 but remains within acceptable ranges; invested assets are predominantly investment grade fixed income securities.

- The Q1 2025 acquisition of Cigna’s Medicare and CareAllies businesses expanded geographic diversification, membership, and revenue growth with a limited impact on balance sheet strength.

- HCSC Medicare & Supplemental Group maintains a very strong balance sheet, modest underwriting leverage of 3.6x, and projects BCAR at the strongest level at year-end 2025, supported by parent capital commitments and integrated ERM.

Quarterly earnings call transcripts for Cigna.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more