Cigna (CI)·Q4 2025 Earnings Summary

Cigna Beats Estimates, Settles FTC Investigation, Commits to Rebate-Free PBM Model

February 5, 2026 · by Fintool AI Agent

The Cigna Group delivered a strong Q4 2025, with revenue and adjusted EPS both exceeding Street expectations. But the bigger news came alongside earnings: a comprehensive FTC settlement resolving all pharmacy benefit investigations and the passage of federal PBM reform legislation. Full-year adjusted EPS came in at $29.84 (+9% YoY), and management guided 2026 EPS of at least $30.25.

What Is the FTC Settlement?

The headline development this quarter was a global settlement with the Federal Trade Commission, announced the day before earnings. This comprehensive resolution covers:

- The industry-wide insulin lawsuit

- All ongoing PBM investigations

- Future transparency and pricing requirements

Key terms of the settlement:

CEO David Cordani framed the settlement as validation of the company's strategic pivot:

"We were well positioned to execute on the terms of this settlement because of the new pharmacy benefit model that we began developing in the beginning of 2025 and announced in the third quarter of 2025."

The settlement coincided with federal PBM reform legislation passing this week, giving Cigna regulatory clarity on both fronts.

Did Cigna Beat Earnings?

Yes — Cigna beat on both revenue and EPS.

*Consensus from S&P Global

This marks the 7th consecutive quarter Cigna has beaten EPS estimates. Full year 2025 results were equally strong:

The sharp improvement in GAAP EPS reflects the absence of the prior year's $2.7 billion one-time investment loss that depressed 2024 results.

What Did Management Say?

CEO David Cordani painted a stark picture of healthcare cost drivers to justify the company's strategic pivot:

"Since 2000, the cost of a hospital stay has increased more than 220%. And according to 2024 data, the median price of a new drug launch was over $370,000, compared to only $2,000 just 20 years ago."

How Cigna is fighting back on affordability:

- Biosimilar adoption — $0 out-of-pocket for Humira and Stelara alternatives; $100B+ in biosimilar savings expected by 2030

- Prior auth reduction — 15% fewer prior authorizations year-over-year

- Site of care optimization — Guiding patients to lower-cost settings

- Trump Rx partnership — Evernorth is pharmacy partner dispensing EMD Serono fertility treatments

Key business highlights:

- Specialty business now 35% of company income (up from 25% three years ago)

- PBM retention exceeded 97% for 2026

- SELECT segment customers grew 7% in 2025

- Customer NPS improved YoY in each of largest businesses

Key operational metrics from the call:

- SG&A ratio improved to 5.0% from 5.9% YoY

- Debt-to-capitalization lowered to 43.0% from 44.9% sequentially

- Share repurchases — $3.6 billion (11.9 million shares) during 2025

How Did Segments Perform?

Evernorth Health Services

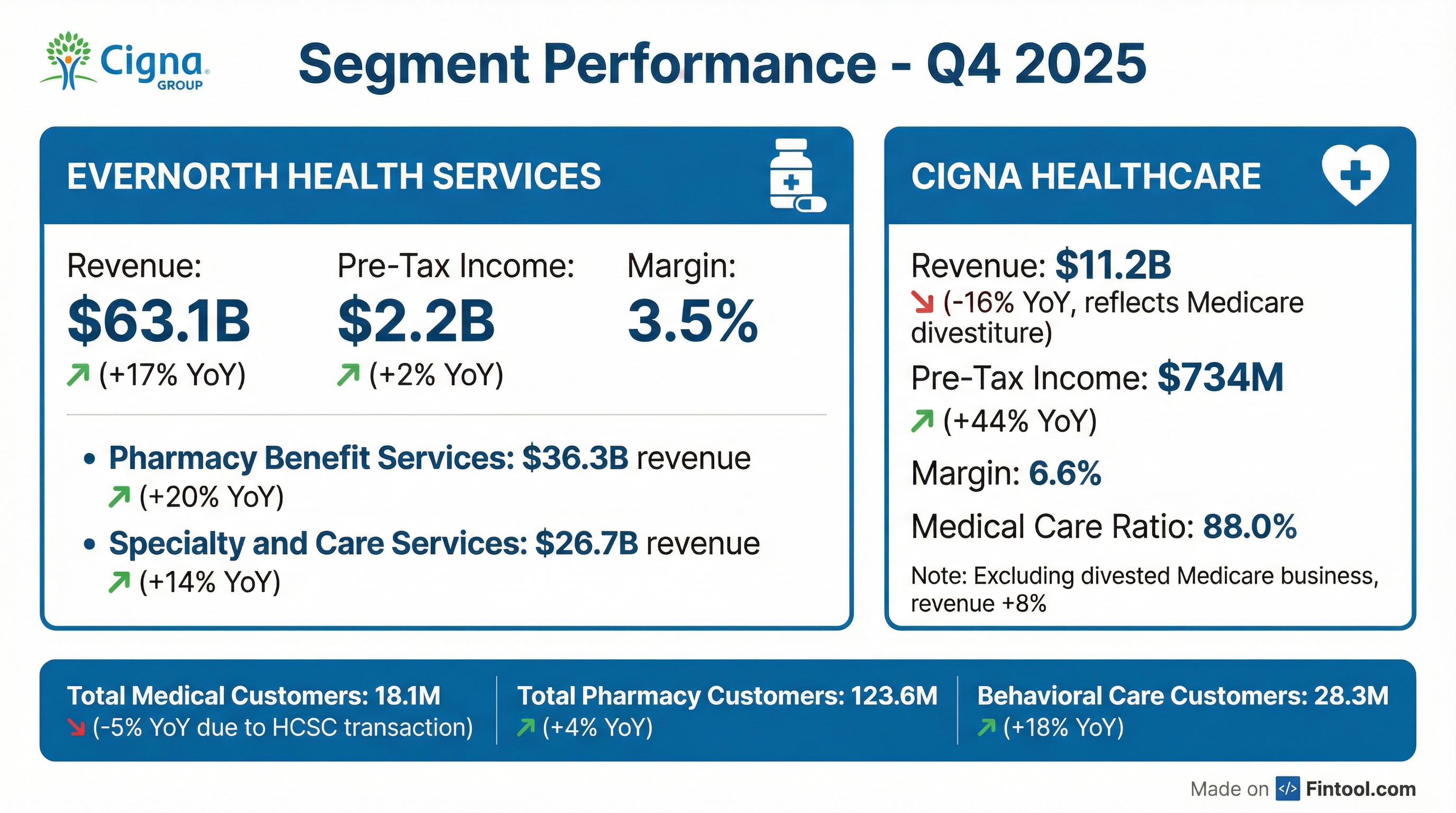

Evernorth, Cigna's pharmacy benefit and specialty services arm, continued to drive growth:

Within Evernorth:

- Pharmacy Benefit Services: Revenue of $36.3B and $1.2B in earnings, reflecting strategic investments in patient experience

- Specialty and Care Services: Revenue +14% to $26.7B and $1B in earnings — now 35% of company income (up from 25% three years ago)

Specialty growth drivers:

- 13% YoY growth in specialty prescriptions

- Inflammatory, asthma, and allergy categories led growth

- Humira biosimilar penetration reached "vast majority" of eligible scripts

- $400B+ addressable market growing at high single-digit rates

- Long-term income growth target: 8%-12% annually

Cigna Healthcare

The insurance segment saw revenue decline due to the March 2025 divestiture of Medicare businesses to HCSC, but profitability improved sharply:

Excluding the divested Medicare business, Cigna Healthcare revenue actually grew 8% YoY, driven by premium rate increases. Higher medical costs in Q4 equated to 60 bps MCR impact ($50M) without notable concentration in any part of the portfolio.

2026 membership outlook:

- Total medical customers expected flat at ~18.1 million

- SELECT and middle-market growth offset by national accounts decline

- Individual exchange business to end 2026 with <300,000 customers (prioritizing margin over growth)

- Group risk business expected stable at ~2.2 million lives

What Did Cigna Guide For 2026?

Management issued 2026 guidance that came in roughly in-line with Street expectations:

*Consensus from S&P Global

Segment-level guidance:

- Evernorth Pre-Tax Income: At least $6.9B

- Cigna Healthcare Pre-Tax Income: At least $4.5B

- Medical Care Ratio: 83.7% to 84.7%

- Medical Customers: ~18.1 million (stable)

The dividend increase to $1.56/quarter ($6.24 annualized) implies ~2.3% yield at current prices.

When Will the Rebate-Free Model Launch?

Management provided the most detailed timeline yet for the industry-leading transition:

How compensation will work in the new model:

- Core admin fee — Per member or per script, delinked from drug price, grows with inflation

- Clinical program fees — Risk-based compensation for innovations and outcomes

COO Brian Evanko confirmed the margin profile remains unchanged:

"We expect to achieve a comparable level of profitability between the legacy model and the new model, although the sources of profit will evolve."

The new model includes "price-assured technology" that guarantees patients the lowest possible price at the pharmacy counter — whether that's the negotiated price, a cash pay alternative, or their copay.

Client and broker reception: Early feedback has been positive, with 97%+ retention rate for 2026 in pharmacy benefit services.

What Changed From Last Quarter?

Key differences from Q3 2025:

The Cigna Healthcare margin declined sequentially due to normal stop loss seasonality, but pre-tax income still grew 44% YoY.

How Did Customer Relationships Change?

The medical customer decline reflects the HCSC transaction (Medicare divestiture). Excluding that impact, medical customers were flat YoY. Behavioral care surged 18% due to onboarding a new government contract.

How Did the Stock React?

Cigna shares were volatile on earnings day:

The stock initially spiked on the beat but retreated as investors digested the in-line 2026 guidance. After-hours trading showed recovery toward prior levels.

Year-to-date context: CI trades at $271.71 vs its 52-week high of $350 and low of $239.51, sitting 22% below peak levels despite consistent execution.

Capital Allocation Priorities

Management outlined clear capital deployment for 2026:

The company repurchased 11.9 million shares for $3.6 billion in 2025 , and the 2026 weighted average share count guidance of 261-265 million suggests continued buyback activity.

What New Products Did Cigna Launch?

Clarity — Cigna Healthcare's newest offering launched in November 2025:

The product puts customers "in control so they can focus on getting the care they need" with cost transparency available at point of care.

Other 2025 launches:

- Progyny and Carrot partnerships for fertility coverage

- Headspace collaboration for mental health support

- EnreachRx patient support model for GLP-1 pharmacies

- Patient Assurance Program expansion to GLP-1 medicines (caps member out-of-pocket costs)

What Were the Key Q&A Takeaways?

On margin sustainability: CEO Cordani confirmed the long-term growth algorithm remains intact: "No change in overall margin profile, and therefore no change in the growth algorithm over time for pharmacy benefit services business."

On tax headwind from GPO move: The relocation to the U.S. could impact the effective tax rate by "up to 1% over time if unmitigated" — but management views this as "totally manageable" against the 10%-14% long-term EPS growth target.

On revenue recognition: No changes expected to how revenue is recognized in PBS, even with the transition to fee-based pricing.

On specialty growth drivers: Inflammatory, asthma, and allergy categories drove the strongest prescription growth. Humira biosimilar penetration reached "the vast majority of eligible scripts" in 2025.

On membership mix: SELECT segment mix is ~2/3 self-funded, with net growth coming from ASO and level-funded solutions. No unusual in-group enrollment trends observed.

On 2026 MCR expectations: Q1 2026 medical care ratio expected below 81% (reflecting typical seasonality).

Key Risks and Concerns

Management flagged several risk factors in the forward-looking statements:

- Drug pricing pressure: Ability to manage healthcare costs amid price competition and inflation

- Rebate model transition: Efficiently transitioning to rebate-free pricing

- Regulatory environment: Government-sponsored program uncertainties

- Pharma concentration: Maintaining relationships with key pharmaceutical manufacturers

- Cybersecurity: Preventing data security incidents and AI-related risks

The Individual and Family Plans business within Cigna Healthcare showed higher medical costs in 2025, contributing to the full-year MCR increase from 83.2% to 84.4%.

Forward Catalysts

Near-term watch items:

- Q1 2026 earnings (EPS expected slightly above 25% of full-year guidance)

- Clarity product adoption and client feedback

- Rebate-free model infrastructure buildout (investment spending more back-half weighted in 2026)

- Further biosimilar adoption — oncology, bone, autoimmune drug classes next

Longer-term:

- January 2027 launch of rebate-free model for Cigna Healthcare fully insured book

- Shields Health Solutions integration and specialty capabilities expansion

- Targeting 40% debt-to-capitalization ratio (down from 43% currently)

- Behavioral care contract ramp following 18% customer growth

Sources: CI Q4 2025 Earnings Call Transcript, CI Q4 2025 8-K, S&P Global consensus estimates. Report generated by Fintool AI Agent.