Core Laboratories Inc. /DE/ (CLB)·Q4 2025 Earnings Summary

Core Lab Beats Q4 on Strong International Demand, But Q1 Guidance Disappoints

February 5, 2026 · by Fintool AI Agent

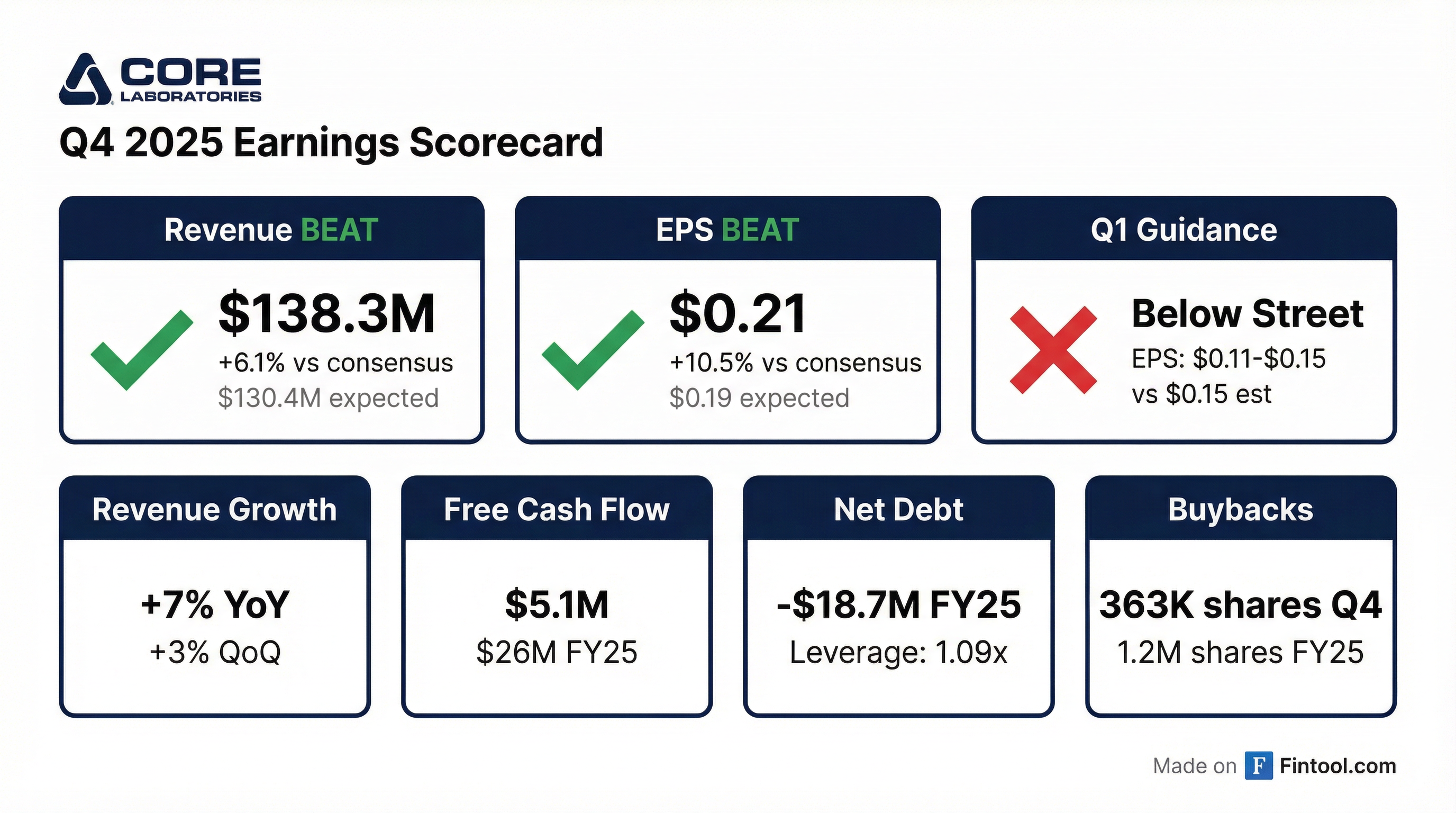

Core Laboratories (NYSE: CLB) delivered a strong Q4 2025, beating both revenue and EPS estimates on robust international demand for reservoir description services. Revenue of $138.3M topped consensus by 6.1% and grew 7% year-over-year, while adjusted EPS of $0.21 beat by 10.5%. However, shares dipped ~1.5% in aftermarket trading as Q1 2026 guidance came in below Street expectations due to severe weather disruptions and higher interest costs.

Did Core Lab Beat Earnings?

Yes — Core Lab beat on both revenue and EPS.

*Values retrieved from S&P Global

The beat was driven by strong international demand for Core Lab's proprietary reservoir description technologies, particularly in the Middle East where the company successfully completed a comprehensive unconventional reservoir rock study for a National Oil Company.

What Changed From Last Quarter?

Revenue accelerated, but margins compressed slightly:

Key drivers of margin compression:

- Expanded international sanctions from Russia-Ukraine conflict

- Pass-through revenue with low margins from a collaborative project

- Tariff-driven raw material cost increases in Production Enhancement

- Provision for uncollectible receivables — a one-time charge

What Did Management Guide?

Q1 2026 guidance came in mixed — revenue in-line but EPS below Street:

*Values retrieved from S&P Global

Why Is Q1 Guidance Weak?

SVP Gwen Gresham detailed several headwinds:

- Severe weather disruptions: Freezing conditions in early January disrupted both client activities and Core Lab operations in North America

- European weather damage: Adverse weather in Europe and the Mediterranean suspended client crude assay work and damaged one of Core Lab's facilities

- Seasonal patterns: Typical Q1 sequential decline in activity

- Higher interest expense: A $50M term loan drawn January 12, 2026 at ~200 bps higher than the retired 4%+ fixed-rate notes

- Tariff headwind: Raw material cost increases contributing ~$0.02-$0.03/quarter EPS drag

How Did the Stock React?

Core Lab shares closed at $19.61 on February 4, down 0.9% on the day. In aftermarket trading following the earnings release, shares fell further to $19.35, down approximately 1.5% from the regular session close.

The muted stock reaction despite the Q4 beat reflects investor concern about the soft Q1 guidance and margin headwinds from tariffs and weather disruptions.

Segment Performance

Reservoir Description (67% of revenue)

The core reservoir testing business delivered strong results on international demand:

Key wins:

- Colombia Palagua Field: Conducted advanced geomechanics and reservoir characterization study in the Middle Magdalena Valley, addressing sand production risks and enabling more efficient water flood programs for enhanced oil recovery

- Brazil Carbon Capture & Storage: Leveraging the Solintec acquisition, Core evaluated ~100 meters of core from a CO2 injector well using Nitro Digital Rock Tomography for an ethanol producer's emissions reduction initiative

- Increased regional study sales in Africa (West African Offshore, North Africa) and Brazil's Pelotas Basin

Production Enhancement (33% of revenue)

The completions-focused segment showed resilience despite headwinds:

Notable projects:

- Pulverizer Award Win: The proprietary Pulverizer system received the 2025 Offshore Well Intervention Global Award for Plug and Abandonment Innovation from the Offshore Network, with multiple international deployments scheduled for early 2026

- Middle East P&A Operation: Deployed ~200 feet of Pulverizer technology across two zones for a national oil company, providing a faster and cheaper alternative to conventional section milling

- Plugless Completion Evaluations: Multiple U.S. operators engaged Core Lab to evaluate diverter-based stage isolation using SpectraStim proppant tracer diagnostics — results confirmed successful stimulation in test cases

Capital Allocation & Balance Sheet

Core Lab continued its shareholder-friendly capital allocation strategy:

Balance sheet highlights:

- Net debt of $90.2M, down 70% over six years ($205.8M cumulative reduction)

- Leverage ratio of 1.09x — lowest level in nine years

- ROIC of 9.7% for Q4 2025

CEO Larry Bruno emphasized Core's milestone anniversary: "As Core Lab celebrates its ninetieth anniversary, the company's granite anniversary, our staff's collective expertise and their dedication to servicing our clients continues to be the foundation of the company's success."

On capital allocation priorities: "If you look at how we've been allocating capital between debt reduction and share buybacks, that's probably a good optics on where we're going for the near term."

Industry Outlook

Management struck a cautiously optimistic tone on the macro environment, with CEO Bruno presenting a bullish longer-term thesis for international exploration:

Positives:

- Global crude oil demand growth of 0.9-1.4 million bpd forecast for 2026 by IEA, EIA, and OPEC

- IEA estimates global production would decline ~8% per year absent reinvestment, with nearly 90% of upstream capex since 2019 going to production sustainment rather than expansion

- U.S. tight oil production flattening at ~13.6 million bpd in 2026, essentially flat YoY

- IEA's current policy scenario shows oil demand rising to 113 million bpd by 2050; EIA reference case shows ~120 million bpd

- Resilient international activity with multi-year offshore developments across South Atlantic margin, North and West Africa, Norway, Middle East, and Asia-Pacific

Headwinds:

- Tariff pressures and OPEC+ production policy uncertainty

- U.S. land completion activity expected down in H1 2026 vs H1 2025

- Commodity price volatility impacting short-cycle activities

Q&A Highlights

Venezuela Re-Entry Potential

When asked about potential Venezuela operations, CEO Larry Bruno noted Core Lab has nearly 60 years of history in the country and holds valuable legacy data that could be monetized: "If you're a wellhead company, if you're into patching pipe, if you're into fixing leaks and environmental remediation, that's probably gonna be where the first dollars are made down there. We would probably follow operators into the country, and we have mobile lab capabilities that we can deploy." This opportunity is characterized as a 2027+ story rather than near-term.

Middle East & North Africa Expansion

Bruno confirmed that despite the Saudi Aramco activity pullback affecting drilling-focused peers, Core Lab maintained strong engagement: "We did not see the pullback in activity that some of the more drilling-focused companies did. They're a great client for us and have been for decades."

The company recently held a technology conference addressing opportunities across North Africa (Algeria, Libya, Tunisia, Egypt), seeing opportunities in "assessing damaged and underdeveloped fields that have been wilting under years of neglect" and emerging unconventional opportunities in the region.

Capital Allocation Strategy

CFO Chris Hill confirmed the company sees the stock as undervalued and will continue opportunistic share repurchases while managing leverage. Bruno added there's a 0.25 point interest rate reduction if leverage falls below 1.0x — a target within close proximity of the current 1.09x level.

Tariff Impact Quantified

CFO Chris Hill quantified the tariff headwind at approximately $0.02-$0.03 per quarter of EPS, primarily in Production Enhancement but also some impact in Reservoir Description. The company is mitigating by shipping chemical tracers directly to international labs (like Abu Dhabi) rather than routing through the U.S.

Exploration Trend Accelerating

Bruno emphasized the exploration wave is already underway: "We've got a nice portfolio of project commitments in front of us... We do see an increase in FIDs around the world that are all — they're not indications, they are facts that are showing that an international wave is coming." He noted 2025 Reservoir Description performance would have been meaningfully better absent a series of client dry holes that resulted in no cores or fluids for analysis.

Full Year 2025 Summary

What to Watch

- Weather recovery: Management expects client operations to recover from January weather disruptions — Q1 results will show if guidance proves conservative

- Tariff mitigation: Production Enhancement margins face ~$0.02-$0.03/quarter EPS drag; watch for success in direct shipping to international labs to bypass U.S. tariffs

- Exploration wave confirmation: Bruno noted FID increases and project commitments are "facts showing an international wave is coming" — execution against client commitments is key

- Leverage ratio below 1.0x: A 0.25 point interest rate reduction kicks in if achieved — currently at 1.09x

- Pulverizer commercialization: Multiple international deployments scheduled for early 2026 following the award win

Core Laboratories will report Q1 2026 earnings on or around May 6, 2026.