Earnings summaries and quarterly performance for Core Laboratories Inc. /DE/.

Executive leadership at Core Laboratories Inc. /DE/.

Lawrence Bruno

Chairman, President and Chief Executive Officer

Christopher Hill

Senior Vice President and Chief Financial Officer

Gwendolyn Gresham

Senior Vice President, Corporate Development and Investor Relations

Mark Tattoli

Senior Vice President, Secretary and General Counsel

Board of directors at Core Laboratories Inc. /DE/.

Research analysts who have asked questions during Core Laboratories Inc. /DE/ earnings calls.

Joshua Jayne

Daniel Energy Partners

3 questions for CLB

Sean Mitchell

Daniel Energy Partners

3 questions for CLB

Stephen Gengaro

Stifel Financial Corp.

3 questions for CLB

Don Crist

Johnson Rice & Company L.L.C.

2 questions for CLB

John Daniel

Daniel Energy Partners

2 questions for CLB

David Smith

Truist Securities

1 question for CLB

Recent press releases and 8-K filings for CLB.

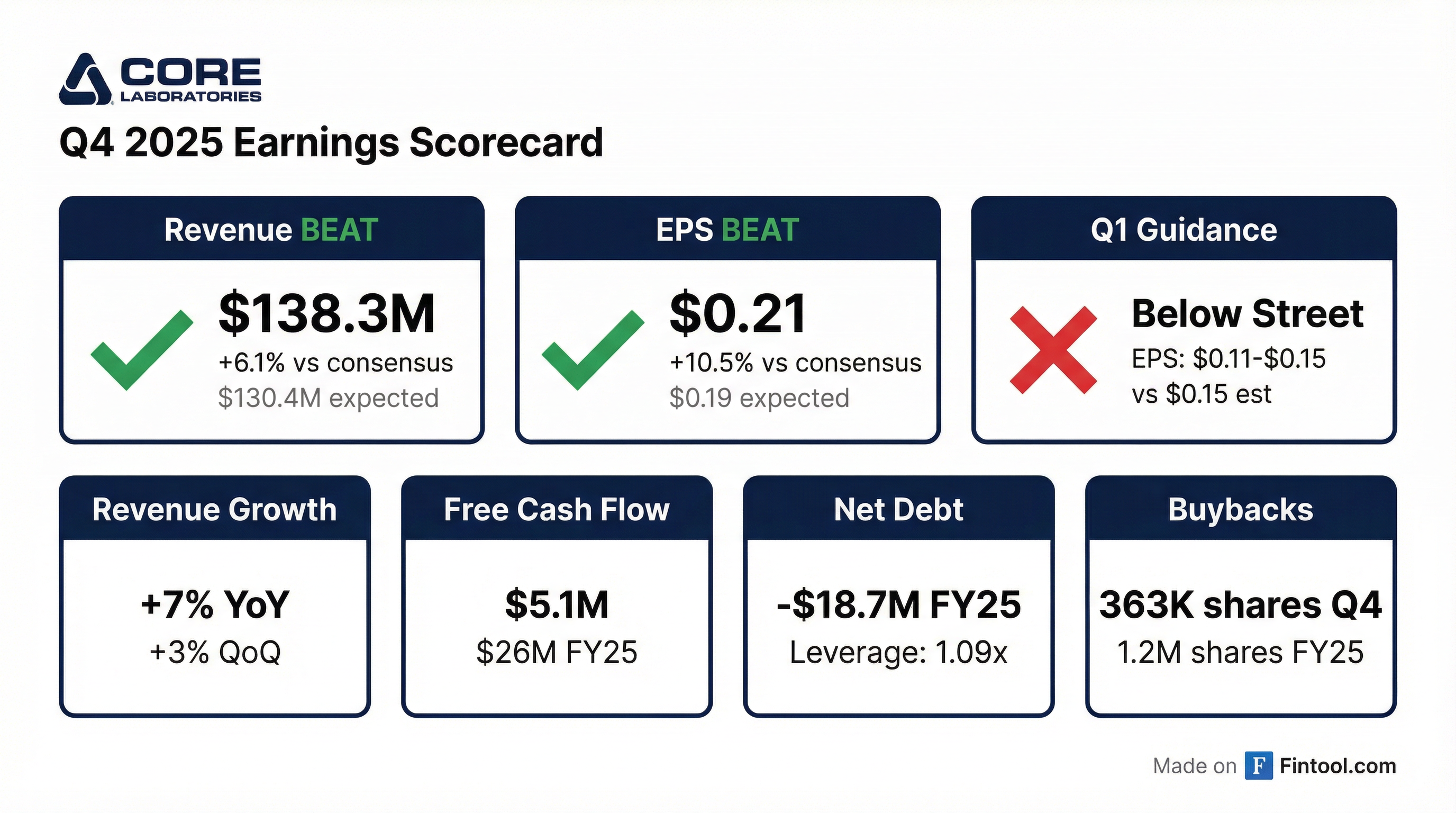

- Core Laboratories reported Q4 2025 revenue of $138.3 million, a 3% sequential increase, and full year 2025 revenue of $526.5 million, up slightly compared to 2024.

- The company generated $5.1 million in free cash flow in Q4 2025 and returned free cash to shareholders by repurchasing 363,000 shares for $5.7 million during the quarter, marking the fifth consecutive quarter of share buybacks.

- Net debt was reduced by $18.7 million in 2025, ending the year at $90.2 million, and has been reduced by 70% since Q4 2019.

- For Q1 2026, Core Laboratories projects revenue between $124 million and $130 million and EPS between $0.11 and $0.15, with guidance reflecting impacts from severe weather and higher interest rates due to a term loan drawn in January 2026.

- The company anticipates continued demand for its services driven by international exploration and development, as U.S. onshore production growth is flattening and significant investment is needed globally to offset natural field depletion.

- Core Laboratories reported Q4 2025 revenue of $138.3 million, a 3% sequential increase, and full year 2025 revenue of $526.5 million, which was up slightly year-over-year.

- Net income ex items for Q4 2025 was $9.7 million, resulting in diluted EPS ex items of $0.21.

- The company repurchased 363,000 shares for $5.7 million in Q4 2025, marking the fifth consecutive quarter of share buybacks, with 1.2 million shares repurchased for $15.5 million for the full year 2025.

- For Q1 2026, Reservoir Description revenue is projected to range from $82 million to $86 million, with operating income between $6.8 million and $8.2 million.

- Strong international demand for proprietary technologies and completion diagnostic services helped offset headwinds from geopolitical conflicts, commodity price volatility, and tariffs impacting raw material costs.

- Core Lab reported Q4 2025 revenue of $138.3 million, a 3% sequential increase, and full year 2025 revenue of $526.5 million, up slightly year-over-year.

- Diluted EPS ex items for Q4 2025 was $0.21, with net income ex items at $9.7 million.

- The company repurchased 363,000 shares for $5.7 million in Q4 2025 and 1.2 million shares for $15.5 million for the full year, while reducing net debt by $18.7 million to $90.2 million by year-end.

- For Q1 2026, Core Lab forecasts revenue of $124 million-$130 million and EPS of $0.11-$0.15, anticipating sequential declines due to seasonal patterns and severe weather events.

- Geopolitical conflicts and tariffs negatively impacted product sales and Production Enhancement margins, with tariffs expected to cost $0.02-$0.03 per quarter.

- Core Laboratories Inc. reported Q4 2025 revenue of $138.3 million, an increase of 7% year-over-year, and full-year 2025 revenue of $526.5 million. Diluted EPS, excluding specific items, was $0.21 for Q4 2025 and $0.75 for the full year 2025.

- The company generated $5.1 million in free cash flow for Q4 2025 and $26.0 million for the full year 2025. Core Laboratories reduced net debt by $18.7 million in 2025 to $90.2 million as of December 31, 2025, and repurchased approximately 1.2 million shares for $15.5 million during the full year.

- For Q1 2026, Core Laboratories anticipates Reservoir Description revenue to range from $82.0 million to $86.0 million and Production Enhancement revenue to range from $42.0 million to $44.0 million.

- Core Laboratories reported Q3 2025 revenue of $134.5 million, a 3% sequential increase, and diluted earnings per share (ex items) of $0.22, up from $0.19 in the prior quarter.

- The company generated $6.5 million in free cash flow in Q3 2025 and repurchased over 462,000 shares for $5 million, representing approximately 1% of outstanding shares.

- For Q4 2025, Core Laboratories projects revenue to range from $132 million to $136 million and diluted earnings per share to be between $0.18 and $0.22.

- Both Reservoir Description and Production Enhancement segments showed sequential revenue growth in Q3 2025, with Reservoir Description revenue at $88.2 million (up 2%) and Production Enhancement revenue at $46.3 million (up 6%).

- Core Lab maintains a constructive outlook, anticipating continued demand growth for crude oil in 2025 and beyond, driven by non-OECD countries, and expects significant annual investment in oil and gas resource development due to accelerating natural decline rates.

- Core Laboratories Inc. reported Q3 2025 revenue of $134.5 million, an increase of over 3% compared to Q2, with operating income (ex-items) of $16.6 million and earnings per diluted share (ex-items) of $0.22.

- The company generated $6.5 million in free cash flow during Q3 2025 and returned $5 million to shareholders by repurchasing over 462,000 shares of company stock.

- For Q4 2025, Core projects revenue to range from $132 million to $136 million, with operating income between $14 million and $16.1 million, and EPS expected to be $0.18 to $0.22.

- Core Laboratories maintains a constructive outlook, aligning with IEA, EIA, and OPEC+ forecasts for crude oil demand growth of 0.7 to 1.3 million barrels per day in 2025 and beyond, driven by the need for continued investment to offset accelerating natural declines in existing fields.

- Core Laboratories (CLB) announced the acquisition of Brazil-based integrated geological services company, Solintec, on September 30, 2025.

- Solintec provides upstream oil and gas geological services to companies operating in Brazil, including in-country mineralogic and sedimentary descriptive analysis.

- The acquisition is expected to strengthen Core Lab's local presence and expand the range of high-value services in Brazil, which Core Lab views as a key growth market.

- Core Lab and Solintec have been collaborating since 2022 through a technical services arrangement.

- Core Laboratories reported Q2 2025 revenue of $130.2 million, a 5% sequential increase compared to Q1 2025, and achieved $0.19 diluted earnings per share (ex-items).

- The company saw sequential improvements in operating income, operating margins, and free cash flow, with Reservoir Description revenue up 7% and Production Enhancement revenue up 3% compared to Q1.

- Core Lab returned excess free cash to shareholders by repurchasing 237,000 shares for $2.7 million and reduced net debt by over $9 million, bringing the leverage ratio to 1.27, its lowest in eight years.

- For Q3 2025, Core projects revenue to range from $127.5 million to $134.5 million and diluted earnings per share (ex-items) to range from $0.18 to $0.22.

- Overall revenue declined 4% sequentially to $123.6 million due to seasonal trends and expanded sanctions impacting international demand.

- Reservoir Description reported $80.9 million in revenue with a 10% operating margin, while Production Enhancement maintained flat revenue with margin improvement driven by high-margin diagnostic services.

- The company reduced net debt by approximately $5 million, repurchased nearly 132,000 shares valued at $2 million, and continued paying its quarterly dividend to strengthen shareholder value.

- Revenue of $123.6 million was reported for Q1 2025, down 4% sequentially and 5% year-over-year, with GAAP EPS of $0.00 and non-GAAP EPS of $0.14.

- Operating income was $4.4 million (GAAP) and $11.8 million excluding items, while free cash flow reached $3.9 million, up over 50% year-over-year, and net debt was reduced by $4.9 million.

- The company repurchased 131,598 shares valued at approximately $2.0 million and announced a quarterly cash dividend.

Quarterly earnings call transcripts for Core Laboratories Inc. /DE/.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more