Columbia Financial (CLBK)·Q4 2025 Earnings Summary

Columbia Financial Beats on EPS as NIM Expansion Accelerates

February 2, 2026 · by Fintool AI Agent

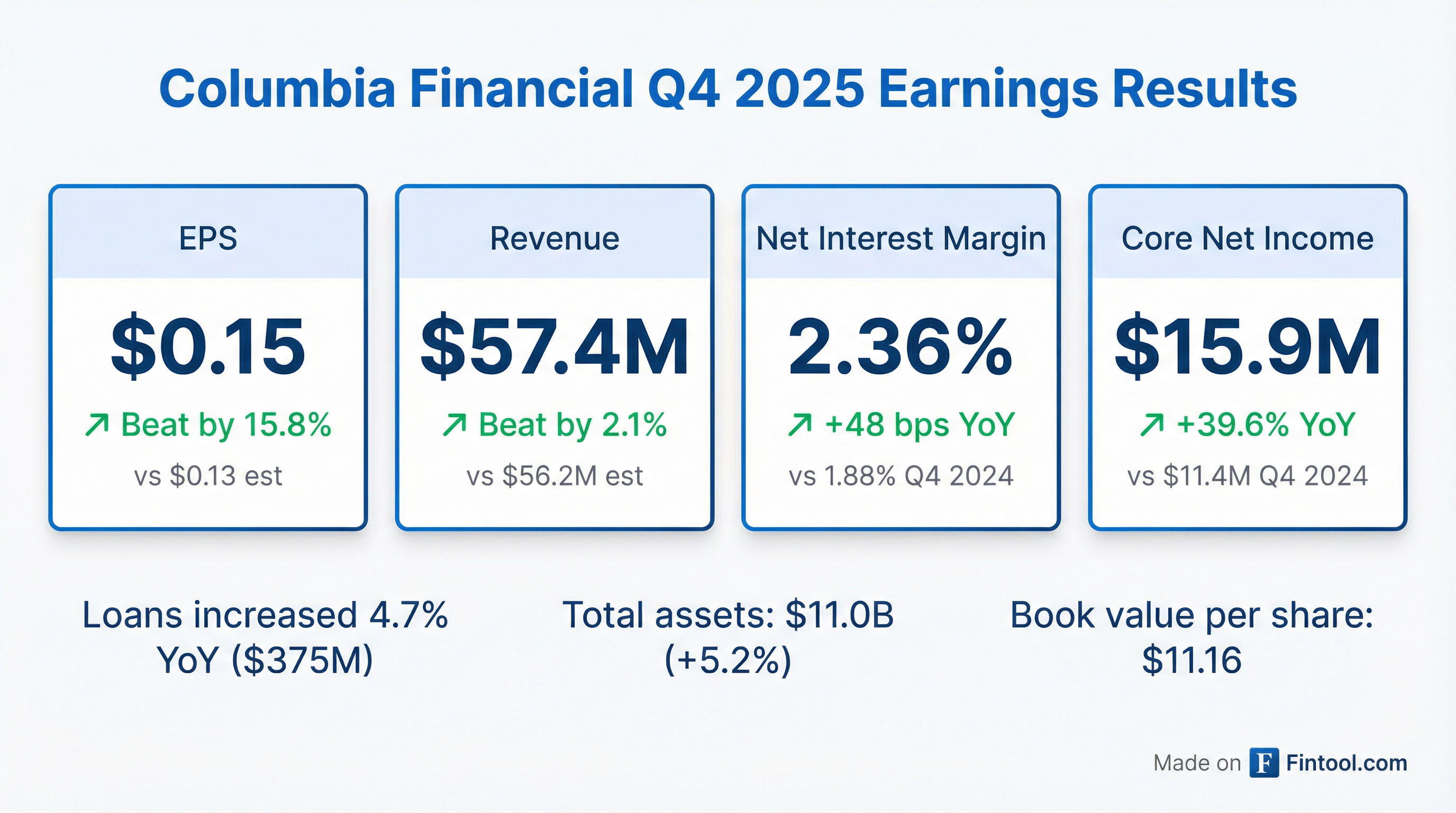

Columbia Financial (NASDAQ: CLBK) reported Q4 2025 results that beat consensus on both earnings and revenue, marking the fourth consecutive quarterly beat as the New Jersey-based bank continues to reap benefits from its 2024 balance sheet repositioning. EPS of $0.15 beat estimates by 15.8%, while net interest margin expanded 48 basis points year-over-year to 2.36%.

Did Columbia Financial Beat Earnings?

Yes — Columbia Financial beat on both EPS and revenue.

Core net income reached $15.9 million in Q4 2025, an increase of 39.6% compared to $11.4 million in Q4 2024. The improvement was primarily driven by:

- Higher net interest income (+$13.8M, +29.7% YoY) from both increased interest income and decreased interest expense

- Lower provision for credit losses (-$799K, -27.8% YoY) as net charge-offs declined

- Non-interest income swing (+$32.3M) due to the prior year including a $34.6M loss from securities transactions

What's Driving the Margin Expansion?

The headline story for CLBK remains net interest margin (NIM) expansion. Q4 2025 NIM of 2.36% represents a 48 basis point improvement from the 1.88% recorded in Q4 2024.

The NIM improvement stems from two factors:

-

Balance sheet repositioning in Q4 2024: The company sold lower-yielding securities and prepaid higher-cost borrowings, taking a one-time $37.9M pre-tax loss that continues to benefit earnings

-

Favorable rate environment: The 75 basis point decrease in market interest rates in late 2025 lowered deposit and borrowing costs faster than asset yields repriced

What Did Management Say?

CEO Thomas J. Kemly highlighted the strategic progress:

"We are pleased with the results we achieved in 2025, which reflect our strategies of focusing on margin expansion, improving our asset mix by continuing to expand commercial lending, efficiency improvement through technology and investing in the infrastructure required for sustainable growth."

Management emphasized the company's strong balance sheet and capital position as enablers for continued growth in an improving economic environment.

How Did Loans and Deposits Perform?

Loan growth remained solid with loans receivable increasing $375.1 million, or 4.7%, for the year to $8.2 billion.

Deposits increased $347.9 million, or 4.3%, to $8.4 billion, with the mix shifting toward money market accounts (+$223.3M) and certificates of deposit (+$109.7M).

What Changed From Last Quarter?

The key delta from Q3 2025 is continued NIM expansion (2.36% vs 2.29%) and improved asset quality metrics:

Are There Any Red Flags?

Non-performing loans increased to $38.0 million (0.46% of gross loans) from $21.7 million (0.28%) at year-end 2024 — an increase of $16.3 million.

The increase was driven by:

- One $5.9M construction loan (mixed-use building) designated non-performing

- Increase in non-performing commercial business loans (11 to 35 loans YoY)

- Higher non-performing commercial real estate loans (4 to 9 loans YoY)

However, the allowance for credit losses coverage ratio remains healthy at 176.84% of non-performing loans, and net charge-offs declined to $534K from $1.4M in Q4 2024.

How Did the Stock React?

The earnings were released after market close on February 2, 2026. Prior to the release, CLBK shares closed at $16.27.

The stock trades at approximately 1.46x book value and 1.62x tangible book value.

Capital Position

Columbia Financial maintained strong capital ratios:

The company repurchased 873,304 shares at approximately $15.29 per share ($13.4 million total) during 2025.

Key Takeaways

- Beat consensus on both EPS (+15.8%) and revenue (+2.1%) — fourth consecutive quarterly beat

- NIM expansion continues — 2.36% in Q4 (+48 bps YoY), benefiting from 2024 balance sheet repositioning

- Loan growth solid — +4.7% YoY driven by commercial lending expansion

- Credit quality mixed — NPLs increased but charge-offs declined; coverage remains healthy

- Capital deployment — $13.4M in buybacks; strong capital ratios well above requirements

Data sourced from Columbia Financial Q4 2025 8-K filing dated February 2, 2026.