Earnings summaries and quarterly performance for Columbia Financial.

Executive leadership at Columbia Financial.

Thomas J. Kemly

President and Chief Executive Officer

Allyson Schlesinger

Senior Executive Vice President and Head of Consumer Banking

Dennis E. Gibney

Senior Executive Vice President and Chief Financial Officer

Jenifer W. Walden

John Klimowich

Senior Executive Vice President and Chief Risk Officer

Manesh Prabhu

Mayra L. Rinaldi

Executive Vice President, Corporate Governance & Culture; Corporate Secretary

Oliver E. Lewis, Jr.

Executive Vice President, Head of Commercial Banking

W. Justin Jennings

Executive Vice President, Operations

Board of directors at Columbia Financial.

Research analysts covering Columbia Financial.

Recent press releases and 8-K filings for CLBK.

- Columbia Bank and Northfield Bank have entered into a merger agreement valued at approximately $597 million, with Columbia Bank as the surviving entity. This transaction, combined with a second step conversion to a fully public stockholding company, is expected to be completed in early Q3 2026.

- The combined organization will become the third-largest regional bank headquartered in New Jersey, with pro forma total assets of approximately $18 billion and over 100 branches, expanding its footprint into Brooklyn and Staten Island.

- The transaction is projected to yield approximately 50% earnings accretion in 2027, a tangible book value dilution of 4.4%, and an earnback period of 1.8 years, with pro forma earnings at 1.06% return on average assets and an efficiency ratio of approximately 48%. Northfield stockholders will receive consideration per share ranging from $14.25-$14.65, representing an over 15% premium compared to NFBK's closing price on January 30, 2026.

- Columbia Bank (CLBK) and Northfield Bank announced a merger valued at approximately $597 million, with Northfield Bank merging into Columbia Bank.

- The transaction, expected to be completed in early Q3 2026, will create the third-largest regional bank headquartered in New Jersey with pro forma total assets of approximately $18 billion.

- The merger is projected to result in 50% earnings accretion in 2027, a 4.4% tangible book value dilution, and an earnback on tangible book value of 1.8 years.

- Columbia also adopted a plan for a second step conversion to a fully public stockholding company form, which is expected to eliminate the minority discount embedded in Columbia's stock.

- The combined entity is projected to achieve a pro forma 2027 return on average assets (ROA) of 1.06% and an efficiency ratio of approximately 48%.

- Columbia Financial, Inc. (CLBK) is undergoing a second-step conversion to become a fully public company, simultaneously acquiring Northfield Bancorp, Inc..

- The second-step offering is expected to generate gross proceeds of ~$1.4 billion to $1.9 billion, while the acquisition of Northfield has a deal value ranging from $597 million to $613 million.

- The combined company is projected to achieve a pro forma scale of ~$18 billion in assets, ~$12 billion in loans, and ~$13 billion in deposits.

- This transaction is anticipated to result in ~50% accretion to 2027 estimated EPS for Columbia and is strategically designed to eliminate Columbia's "minority discount" and expand its market presence.

- Columbia Financial (CLBK) announced a merger agreement with Northfield Bank, valued at approximately $597 million, with Northfield merging into Columbia Bank.

- Concurrently, Columbia adopted a plan for a second step conversion to a fully public stockholding company. Both transactions are expected to close in the third quarter of 2026.

- The combined entity will form the third-largest regional bank headquartered in New Jersey, boasting pro forma total assets of approximately $18 billion and over 100 branches.

- The merger is projected to be 50% accretive to earnings per share in 2027, with a tangible book value dilution of 4.4% and an earnback period of 1.8 years.

- Northfield stockholders will receive merger consideration per share ranging from $14.25-$14.65, which represents an over 15% premium compared to Northfield's closing price on January 30, 2026.

- Columbia Financial, Inc. (CLBK) and Northfield Bancorp, Inc. (NFBK) announced an agreement for Columbia to acquire Northfield in a transaction valued at approximately $597 million.

- The combination will create the third largest regional bank headquartered in New Jersey, with pro forma total assets of $18 billion based on financial data as of December 31, 2025.

- Concurrently, Columbia announced a second-step conversion to reorganize into a fully public stock holding company, with the merger occurring immediately after the conversion.

- The merger is anticipated to be 50% accretive to Columbia's 2027 earnings per share on a pro forma basis.

- Columbia Financial, Inc. (CLBK) announced an agreement to acquire Northfield Bancorp, Inc. (NFBK) in a transaction valued at approximately $597 million.

- The combined entity will have pro forma total assets of $18 billion as of December 31, 2025, making it the third largest regional bank headquartered in New Jersey.

- Concurrently, Columbia will undergo a "second-step" conversion, reorganizing into a fully public stock holding company, with shares representing the majority ownership of Columbia Bank MHC to be sold to the public at $10.00 per share.

- The merger is anticipated to be 50% accretive to Columbia's 2027 earnings per share and is expected to be completed early in the third quarter of 2026.

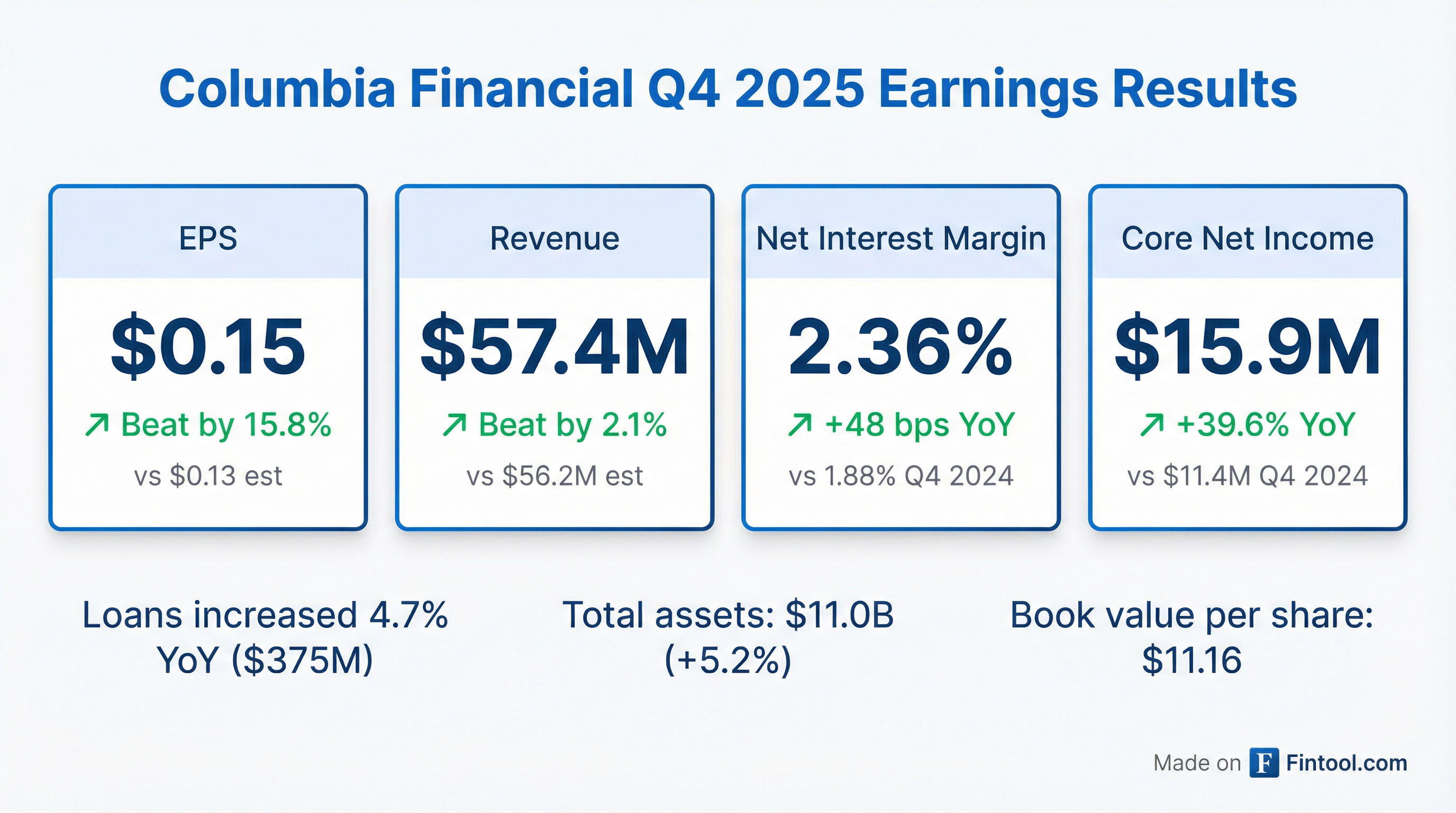

- Columbia Financial, Inc. reported net income of $15.7 million, or $0.15 per basic and diluted share, for the quarter ended December 31, 2025, a significant improvement from a net loss of $21.2 million, or $0.21 per basic and diluted share, for the quarter ended December 31, 2024. For the full year ended December 31, 2025, the company reported net income of $51.8 million, or $0.51 per basic and diluted share, compared to a net loss of $11.7 million, or $0.11 per basic and diluted share, for the year ended December 31, 2024.

- The increase in net income for both periods was primarily driven by higher net interest income, a decrease in provision for credit losses, and higher non-interest income.

- Net interest income increased by $13.8 million, or 29.7%, to $60.2 million for Q4 2025 compared to Q4 2024, and by $43.7 million, or 24.5%, to $221.6 million for FY 2025 compared to FY 2024. This was largely due to an increase in interest income and a decrease in interest expense, with the 2024 balance sheet repositioning transaction having a notable impact.

- The company's net interest margin increased by 48 basis points to 2.36% for Q4 2025 and by 42 basis points to 2.24% for FY 2025, compared to the respective prior year periods.

- Total assets increased by $543.3 million, or 5.2%, to $11.0 billion at December 31, 2025, compared to $10.5 billion at December 31, 2024, primarily due to increases in cash and cash equivalents, debt securities available for sale, and loans receivable, net.

- Columbia Financial, Inc. reported a net income of $15.7 million, or $0.15 per basic and diluted share, for the quarter ended December 31, 2025, a significant improvement from a net loss of $21.2 million, or $0.21 per share, for the same quarter in 2024. For the full year ended December 31, 2025, net income was $51.8 million, or $0.51 per share, compared to a net loss of $11.7 million, or $0.11 per share, in 2024.

- Core net income for Q4 2025 increased 39.6% to $15.9 million from $11.4 million in Q4 2024, and for the full year 2025, it rose 128.0% to $53.0 million from $23.2 million in 2024.

- The company's net interest margin (NIM) increased by 48 basis points to 2.36% for Q4 2025 compared to Q4 2024, and by 42 basis points to 2.24% for the full year 2025 compared to 2024. This expansion was significantly influenced by a balance sheet repositioning transaction implemented in 2024.

- Loans receivable increased by $375.1 million, or 4.7%, for the year ended December 31, 2025.

- Dennis E. Gibney has been promoted to First Senior Executive Vice President and Chief Banking Officer of Columbia Financial, Inc. and Columbia Bank, effective January 29, 2026.

- In connection with this, Thomas Splaine, Jr. has been appointed Executive Vice President and Chief Financial Officer of Columbia Financial, Inc. and Columbia Bank, effective January 29, 2026.

- Mr. Gibney, previously CFO, will now oversee finance, credit, special assets, legal, commercial banking, consumer banking, and technology functions, and was credited with expanding the Company's asset base from $5 billion to over $10 billion.

- Mr. Splaine, previously Chief Accounting Officer, will be responsible for the Company's accounting and treasury departments.

- Columbia Financial, Inc. (CLBK) presented its Q3 2025 financial performance, reporting net income of $36.1 million and basic and diluted EPS of $0.35 for the nine months ended September 30, 2025.

- As of September 30, 2025, the company's total assets were $10.9 billion, with deposits of $8.2 billion and loans receivable, net, of $8.2 billion.

- The net interest margin increased 40 basis points to 2.20% for the nine months ended September 30, 2025, compared to 1.80% for the same period in 2024, with the Q3 2025 annualized net interest margin at 2.29%.

- In September 2025, the Board authorized a new share repurchase program for 1,800,000 shares, and the company repurchased 183,864 shares for $2.8 million during that month. The company is also focused on being positioned for a potential second step conversion and evaluating merger opportunities.

Fintool News

In-depth analysis and coverage of Columbia Financial.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more