CLEANSPARK (CLSK)·Q1 2026 Earnings Summary

CleanSpark Q1 2026: Bitcoin Miner Pivots to AI as Stock Plunges 19%

February 5, 2026 · by Fintool AI Agent

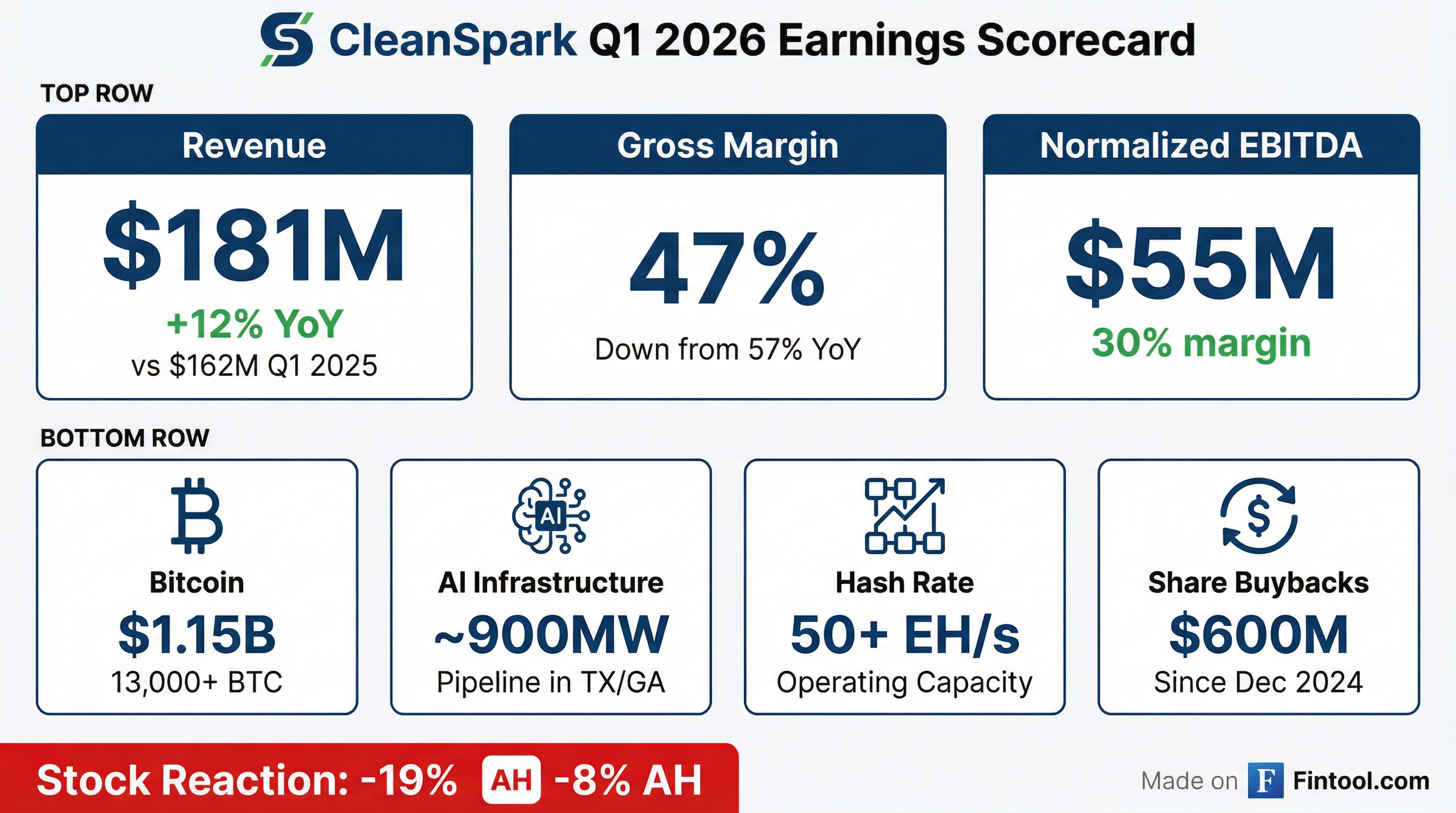

CleanSpark delivered Q1 FY2026 revenue of $181 million, up 12% year-over-year but down 19% sequentially, as the Bitcoin miner accelerates its transformation into an AI infrastructure platform. The stock collapsed 19% during trading and fell another 8% after-hours to $7.58, as Bitcoin's decline to ~$63,000 triggered $350 million in non-cash mark-to-market losses and investors awaited a concrete hyperscaler deal announcement.

Did CleanSpark Beat Earnings?

No. CleanSpark missed on both key metrics, though the miss was driven largely by non-cash Bitcoin fair value adjustments rather than operational weakness.

*Values retrieved from S&P Global

The headline net loss of $379 million (vs. net income of $247 million a year ago) was entirely driven by Bitcoin mark-to-market adjustments. CFO Gary Vecchiarelli emphasized that on a normalized basis, EBITDA was $55 million at a 30% margin, representing "cash generated from our operations."

Operational headwinds included:

- Network difficulty rising faster than Bitcoin price

- Some of the lowest hash prices in history during the quarter

- Power costs of $0.056/kWh (up from $0.049/kWh YoY)

How Did the Stock React?

Brutal. CLSK dropped 19% during trading (from $10.22 to $8.27) on 41.3 million shares — more than 3x average volume — and fell another 8% after-hours to $7.58.

The selloff reflects three concerns:

- Bitcoin exposure: Bitcoin fell to ~$63,000, crushing their $1.15B holdings value

- No AI deal yet: Despite "advanced discussions," no lease signed

- Sector rotation: Broader crypto mining selloff amid risk-off sentiment

What Did Management Guide?

CleanSpark did not provide explicit financial guidance but offered extensive strategic visibility:

AI Data Center Timeline :

- Previously said lease signing within "less than a year" — now "highly accelerated"

- Working on "basis of design" directly with hyperscaler counterparties

- Sandersville has a "clear front-runner" by "an order of magnitude"

Capital Allocation :

- CapEx focused on AI data centers at $9-11M per megawatt

- Bitcoin mining investment "doesn't make a lot of sense" at current prices

- No equity issuance planned — "dilution is not a strategy"

What Changed This Quarter?

CleanSpark is executing a dramatic strategic pivot. Here's what's different from 90 days ago:

Current U.S. Footprint — 1,809 MW Contracted Capacity :

New Asset Acquisitions :

- Sealy (Austin County, TX): 271 acres, 285MW, energization Q1 2027

- Brazoria County, TX: Up to 477 acres, 300-600MW, energization Q4 2027-Q1 2028

- Sandersville expansion: 122 acres adjacent to existing substation

Key Management Quotes

On AI Demand — CEO Matt Schultz :

"We saw Amazon earlier today talk about their commitment to invest $200 billion in AI infrastructure in 2026, exceeding the $140 billion estimated by the street... the fear of a bubble is highly overstated."

On Hyperscaler Discussions — CEO Matt Schultz :

"There are multiple potential offtake tenants for Sandersville... I would say there is a specific front-runner by an order of magnitude, to the extent that our team is collaborating with their team on the site placement."

On Capital Discipline — CFO Gary Vecchiarelli :

"Our outstanding share count has decreased almost 20% in the last 15 months, as we have not issued a single share of equity on the ATM or other offering. To echo Matt, dilution is not a strategy, discipline is."

Balance Sheet Strength

CleanSpark closed the quarter with substantial liquidity following its November convertible offering:

Key Capital Actions:

- $1.15B 0% convertible notes closed November 2025 (due 2030/2032)

- $463M share repurchases in Q1, $600M+ total since Dec 2024

- ~20% of shares outstanding repurchased

- Over $800M liquidity available without selling Bitcoin HODL

Digital Asset Management (DAM) Performance

CleanSpark's treasury management strategy continues to deliver incremental returns:

The DAM team added a basis trade strategy, capturing the spread between Bitcoin spot and futures prices:

Q&A Highlights

On lease terms improving : Management noted that early AI leases had "punitive components" like losing significant revenue for one-day delays. CleanSpark is intentionally waiting for more balanced terms and building to "basis of design" with customers to eliminate delivery risk.

On Bitcoin mining economics at $63K : CEO Schultz said less than 10% of their fleet is unprofitable at current hash prices. The company is deploying 13.5 joule/terahash immersion-cooled miners to further improve efficiency from the current 16.07 J/TH.

On ERCOT batch study process : The Sealy and Brazoria sites are "in very favorable position" due to completed large load studies, executed interconnects, and location selection at points least impacted by ERCOT's new evaluation process.

On financing AI data centers : CFO Vecchiarelli cited Cipher's recent $2B high-yield bond (6.8% rate, 6x oversubscribed) as evidence of strong capital markets appetite for Grade A tenant-backed deals.

Forward Catalysts

What to Watch

- Hyperscaler announcement: The single biggest catalyst — management says there's a "clear front-runner" for Sandersville

- Bitcoin price: Current $63K level makes ~10% of fleet uneconomic; further decline would pressure operations

- Network difficulty: Saturday's adjustment expected to be largest downward since China mining ban, which would help margins

- ERCOT process: Final language still pending on large load batch studies; CleanSpark believes their Texas sites are well-positioned