Earnings summaries and quarterly performance for CLEANSPARK.

Executive leadership at CLEANSPARK.

S. Matthew Schultz

Chief Executive Officer

Brian Carson

Chief Accounting Officer

Gary Vecchiarelli

President and Chief Financial Officer

Harry Sudock

Chief Business Officer

Scott Garrison

Executive Vice President & Chief Development Officer

Taylor Monnig

Chief Operating Officer and Chief Technology Officer

Board of directors at CLEANSPARK.

Research analysts who have asked questions during CLEANSPARK earnings calls.

Brian Dobson

Chardan Capital Markets

7 questions for CLSK

John Todaro

Needham & Company

6 questions for CLSK

Paul Golding

Macquarie Capital

6 questions for CLSK

Brett Knoblauch

Cantor Fitzgerald & Co.

5 questions for CLSK

Mike Colonnese

H.C. Wainwright & Co., LLC

5 questions for CLSK

Greg Lewis

BTIG

4 questions for CLSK

Jim McIlree

Chardan Capital

4 questions for CLSK

Stephen Glagola

JonesTrading

4 questions for CLSK

Gregory Lewis

BTIG, LLC

3 questions for CLSK

Jon Hickman

Ladenburg Thalmann

3 questions for CLSK

Michael Colonnese

H.C. Wainwright & Co.

3 questions for CLSK

Nick Giles

B. Riley Securities

3 questions for CLSK

Bill Papanastasiou

Keefe, Bruyette & Woods (KBW)

2 questions for CLSK

Gareth Gacetta

Cantor Fitzgerald

2 questions for CLSK

Mike Grondahl

Lake Street Capital Markets

2 questions for CLSK

Reggie Smith

JPMorgan Chase & Co.

2 questions for CLSK

James McIlree

Chardan Capital Markets

1 question for CLSK

Tyler DiMatteo

BTIG, LLC

1 question for CLSK

Recent press releases and 8-K filings for CLSK.

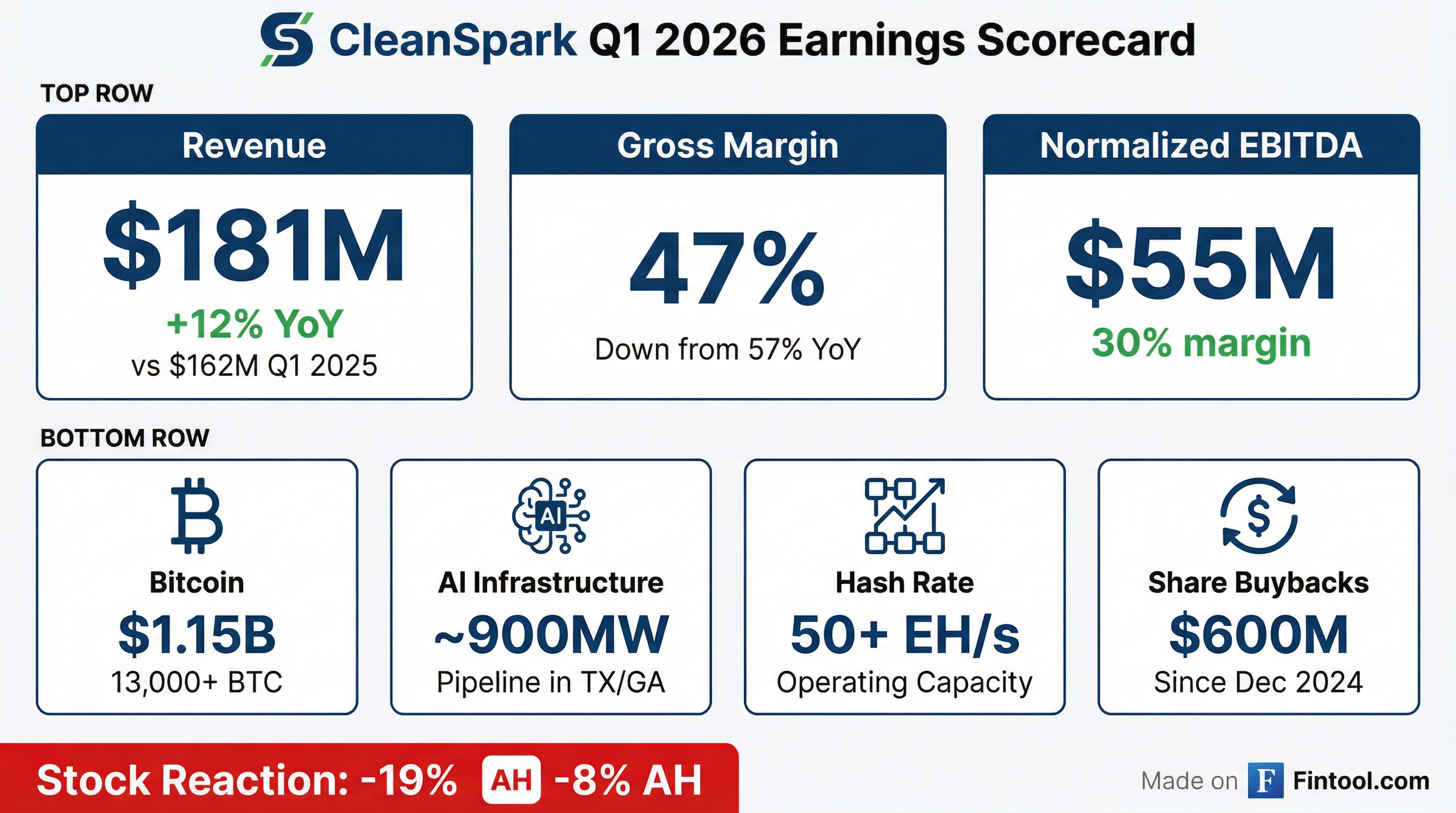

- CleanSpark reported $180 million in revenue for Q1 2026 with a gross margin exceeding 47%, but recognized a net loss of approximately $379 million and negative adjusted EBITDA of $295 million, primarily driven by non-cash mark-to-market adjustments to Bitcoin's fair value.

- The company completed a $1.15 billion convertible offering in November 2025, using $460 million of the proceeds for share repurchases, which has contributed to a nearly 20% decrease in outstanding shares over the last 15 months.

- CleanSpark is strategically evolving into a digital infrastructure and data center development company, with Bitcoin mining funding the platform and AI monetizing it, planning to direct the overwhelming majority of capital expenditure towards AI data centers.

- The Digital Asset Management (DAM) strategy generated $13 million in cash returns during the quarter, achieving an annualized return of 4.2% on its average Bitcoin HODL balance.

- CleanSpark reported revenue of $181.2 million and a net loss of $378.7 million for the first quarter of fiscal year 2026.

- As of Q1 2026, the company's liquidity included $458 million in cash and cash equivalents, 13,099 Bitcoin valued at $1.15 billion, and $400 million in available LOC capacity.

- The company is evolving its business strategy to expand into the market for high-performing computing (HPC) and artificial intelligence (AI) solutions and data centers.

- CleanSpark's U.S. operations feature 1,809 MW of contracted capacity and an average fleet efficiency of 16.07 J/Th as of December 31, 2025.

- CleanSpark is evolving into a digital infrastructure and data center development company, with Bitcoin mining funding the platform and AI monetizing it.

- For Q1 2026, the company reported revenue of $181 million and a gross margin of 47%. A net loss of $379 million and negative adjusted EBITDA of $295 million were primarily driven by non-cash mark-to-market adjustments to Bitcoin's fair value; normalized EBITDA was $55 million.

- The company completed a $1.15 billion convertible offering in November 2025, using proceeds to repurchase $460 million in shares and retaining approximately $420 million in net cash proceeds.

- CleanSpark is expanding its AI infrastructure, acquiring 271 acres in Austin County, Texas (285 MW) and initiating a second development in Brazoria County, Texas (300 MW expandable to 600 MW), establishing a Houston-area hub with almost 900 MW of aggregate potential utility capacity. The company is redirecting capital expenditure towards AI data center builds.

- CleanSpark reported $180 million in revenue and a 47% gross margin for Q1 2026, with a net loss of $379 million and negative adjusted EBITDA of $295 million, though normalized EBITDA was $55 million.

- The company is evolving into a digital infrastructure and data center development company, expanding into AI while Bitcoin mining remains foundational and funds the platform.

- In November 2025, CleanSpark completed a $1.15 billion convertible offering and used part of the proceeds to repurchase $460 million worth of shares, contributing to over $600 million in total share repurchases since December 2024, reducing shares outstanding by approximately 20%.

- CleanSpark acquired 271 acres in Austin County, Texas, with 285 MW of contracted power, and initiated a second development in Brazoria County, Texas, with 300 MW expandable to 600 MW, establishing a Houston-area infrastructure hub for AI campus deployments.

- CleanSpark, Inc. reported quarterly revenues of $181.2 million for the first fiscal quarter of 2026, an 11.6% increase compared to the same period last year.

- For Q1 FY 2026, the company recorded a net loss of ($378.7 million), or ($1.35) per basic share, and an Adjusted EBITDA of ($295.4 million).

- As of December 31, 2025, CleanSpark's balance sheet included $458.1 million in cash, $1.0 billion in Bitcoin, and $1.3 billion in working capital.

- The company secured up to 890 megawatts of new utility potential capacity in the Houston region and acquired an additional 122-acre parcel for its Sandersville site, advancing its multi-gigawatt AI infrastructure platform.

- CleanSpark reported quarterly revenues of $181.2 million for the first quarter of fiscal year 2026, an 11.6% increase from the prior year, alongside a net loss of ($378.7 million) or ($1.35) per basic share for the three months ended December 31, 2025.

- As of December 31, 2025, the company's balance sheet showed $458.1 million in cash, $1.0 billion in Bitcoin, and total assets of $3.3 billion.

- The company secured up to 890 megawatts of new utility-grade power capacity in the Houston region and acquired an additional 122-acre parcel for its Sandersville site, progressing towards AI tenancy.

- CleanSpark is evolving its business strategy to build an infrastructure platform with multiple earnings streams, leveraging bitcoin mining for cash flow and AI infrastructure for long-term asset monetization.

- CleanSpark announced a definitive agreement to acquire up to 447 acres in Brazoria County, Texas, along with a long-term transmission facilities extension agreement, positioning the company to develop a data center with an initial 300 MW demand load and potential expansion to 600 MW. The closing is expected in Q1 2026.

- For January 2026, CleanSpark produced 573 Bitcoin and reported an operational hashrate of 50.0 EH/s.

- As of January 31, 2026, the company held 13,513 Bitcoin and sold 158.63 Bitcoin for $14,554,391 at an average price of $91,752 per BTC.

- CleanSpark will host a live webcast on Thursday, February 5, 2026, at 4:30 p.m. ET to discuss its fiscal first quarter 2026 financial results.

- CleanSpark, Inc. has entered into a definitive agreement to acquire up to 447 acres of land in Brazoria County, Texas, for a large-scale data center project.

- This project is designed to support a 300 MW demand load with potential expansion up to 600 MW, with the closing expected in Q1 2026.

- The acquisition is CleanSpark's second strategic development in the greater Houston region, aiming to establish a regional power and infrastructure hub for artificial intelligence (AI) and high-performance computing (HPC) workloads.

- With this addition, CleanSpark is approaching a gigawatt of total potential capacity in the Houston area.

- CleanSpark released its unaudited mining and operations update for the month ended December 31, 2025.

- The company achieved over 10% year-over-year production growth despite ongoing network difficulty increases.

- CleanSpark is advancing AI infrastructure plans in Georgia, Texas, and beyond.

- The company demonstrated fast-acting demand response for TVA in Tennessee, curtailing hundreds of megawatts of mining power within 10 minutes of request.

- CleanSpark produced 622 Bitcoin in December 2025, contributing to a calendar year 2025 total of 7,746 Bitcoin, an increase of more than 10% year-over-year.

- As of December 31, 2025, the company held 13,099 Bitcoin and sold 577 Bitcoin in December for $51,461,322 at an average price of $89,210 per BTC.

- The company is expanding its focus to include AI compute, marked by the hiring of a new SVP for AI Data Centers, selecting Submer as a strategic partner, and entering the Texas market with a 271-acre site and 285 megawatts of power for AI data centers.

- CleanSpark closed an upsized $1.15 billion zero-coupon convertible notes offering to support its power portfolio expansion.

- The company demonstrated its operational flexibility by curbing Bitcoin mining power consumption in Tennessee for the Tennessee Valley Authority (TVA) during high demand, responding within 10 minutes of the request.

Fintool News

In-depth analysis and coverage of CLEANSPARK.

Quarterly earnings call transcripts for CLEANSPARK.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more