CIMPRESS (CMPR)·Q2 2026 Earnings Summary

Cimpress Hits First-Ever Billion Dollar Quarter, Raises Full-Year Guidance

January 29, 2026 · by Fintool AI Agent

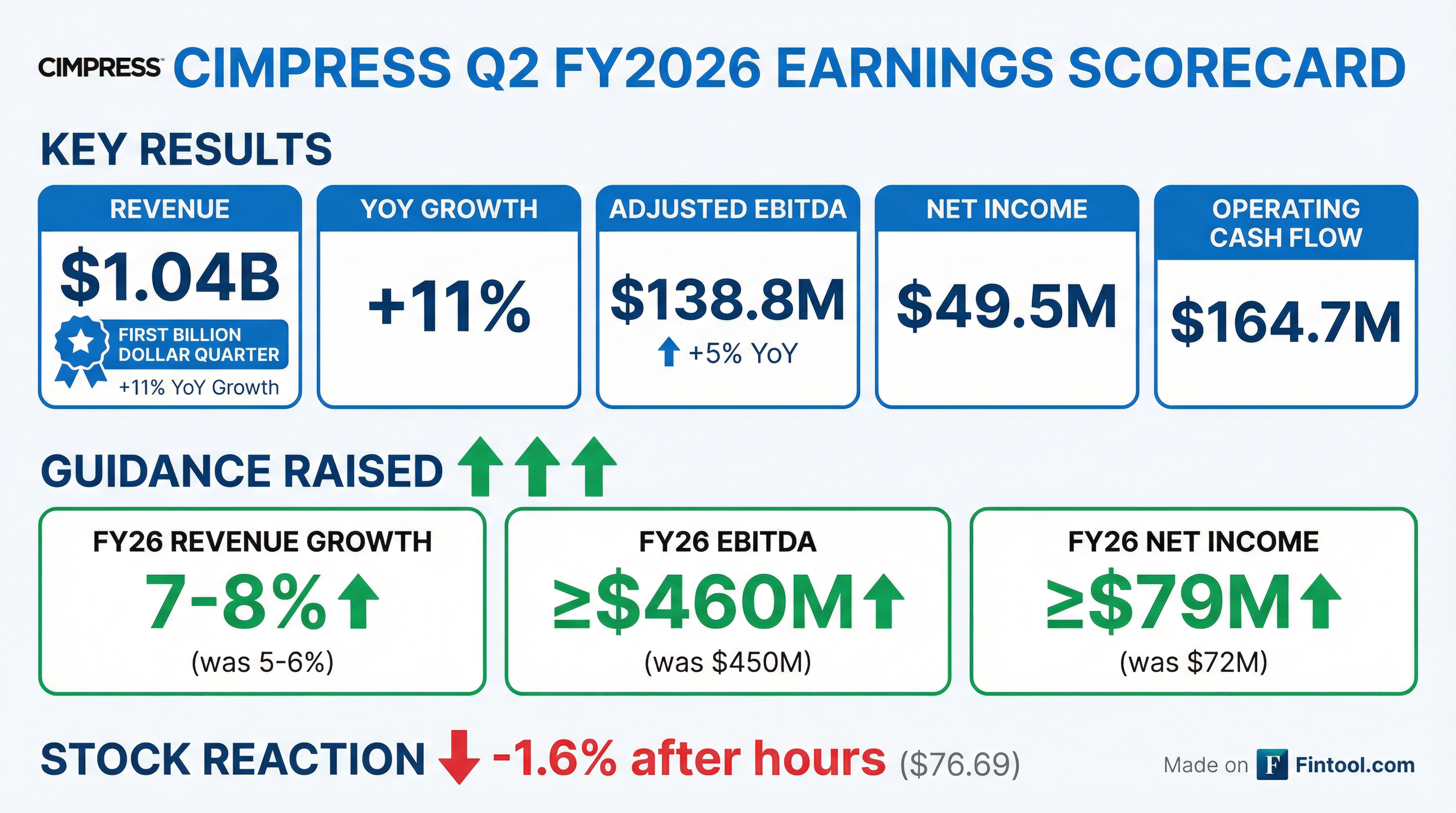

Cimpress (NASDAQ: CMPR) achieved a historic milestone in Q2 FY2026, posting its first-ever quarter with revenue above $1 billion. The mass customization platform company reported revenue of $1.04B (+11% reported, +4% organic constant-currency), driven by broad-based strength across all segments . Management responded by raising full-year guidance, citing confidence in both near-term execution and long-term FY2028 targets.

Despite the strong results and guidance raise, shares traded down ~1.6% in after-hours trading to $76.69, suggesting much of the positive momentum was already priced into the stock after its 100%+ rally from 52-week lows.

Did Cimpress Beat Earnings?

Yes. Cimpress delivered strong results that exceeded their prior guidance trajectory:

The net income decline requires context: Operating income actually grew $7.1M, but this was more than offset by a $30M+ reduction in unrealized gains on currency hedges compared to Q2 FY2025 . This is a non-cash, non-operational item that reverses over time.

Organic Growth Remained Healthy

On an organic constant-currency basis (stripping out currency benefits and a recent acquisition), revenue grew 4% . This is notable because:

- Q1 FY2026 organic growth was also 4%

- FY2025 full-year organic growth was 3%

- Management originally guided to 2-3% organic growth for FY2026

What Did Management Guide?

Management raised FY2026 guidance across all key metrics, reflecting strong first-half execution:

FY2028 Targets Reiterated

Management expressed increased confidence in their 3-year targets :

- Net Income: At least $200M (vs. ~$79M guided for FY2026)

- Adjusted EBITDA: At least $600M (vs. ~$460M guided for FY2026)

- FCF Conversion: ~45% of Adjusted EBITDA

- Net Leverage: Meaningfully below 2.0x (currently ~3.0x)

The bridge to FY2028 targets includes $70-80M in annualized efficiency benefits exiting FY2027 from manufacturing, technology, and cross-business collaboration initiatives .

How Did the Stock React?

CMPR shares closed at $77.91 (-0.7%) on January 28, 2026, then traded down to $76.69 (-1.6%) in after-hours trading following the earnings release.

Context matters: The stock has more than doubled from its 52-week low of $35.21, so some profit-taking after a guidance raise is not unusual. The stock is trading near its 52-week high of $81.98.

What Changed From Last Quarter?

Several notable shifts from Q1 FY2026:

Positives

- First billion-dollar quarter: Revenue crossed $1B for the first time, a psychological and operational milestone

- Guidance raised: All FY2026 metrics increased

- Leverage improving: Net leverage dropped to ~3.0x from 3.13x in Q1

- Acquisition contribution: PrintBrothers tuck-in acquisition added ~$18M revenue

Challenges

- Hurricane impact: ~$2M EBITDA impact from Jamaica hurricane affecting Vista's North America CARE operations

- Tariff costs: $1.0M net tariff impact after pricing increases (expected to lessen in future quarters)

- Production start-up costs: $1.5M for North America production network expansion

- Gross margin compression: 47% in Q2 FY2026 vs. 48% in Q2 FY2025, driven by tariff-related cost/price dynamics at National Pen

Segment Performance Breakdown

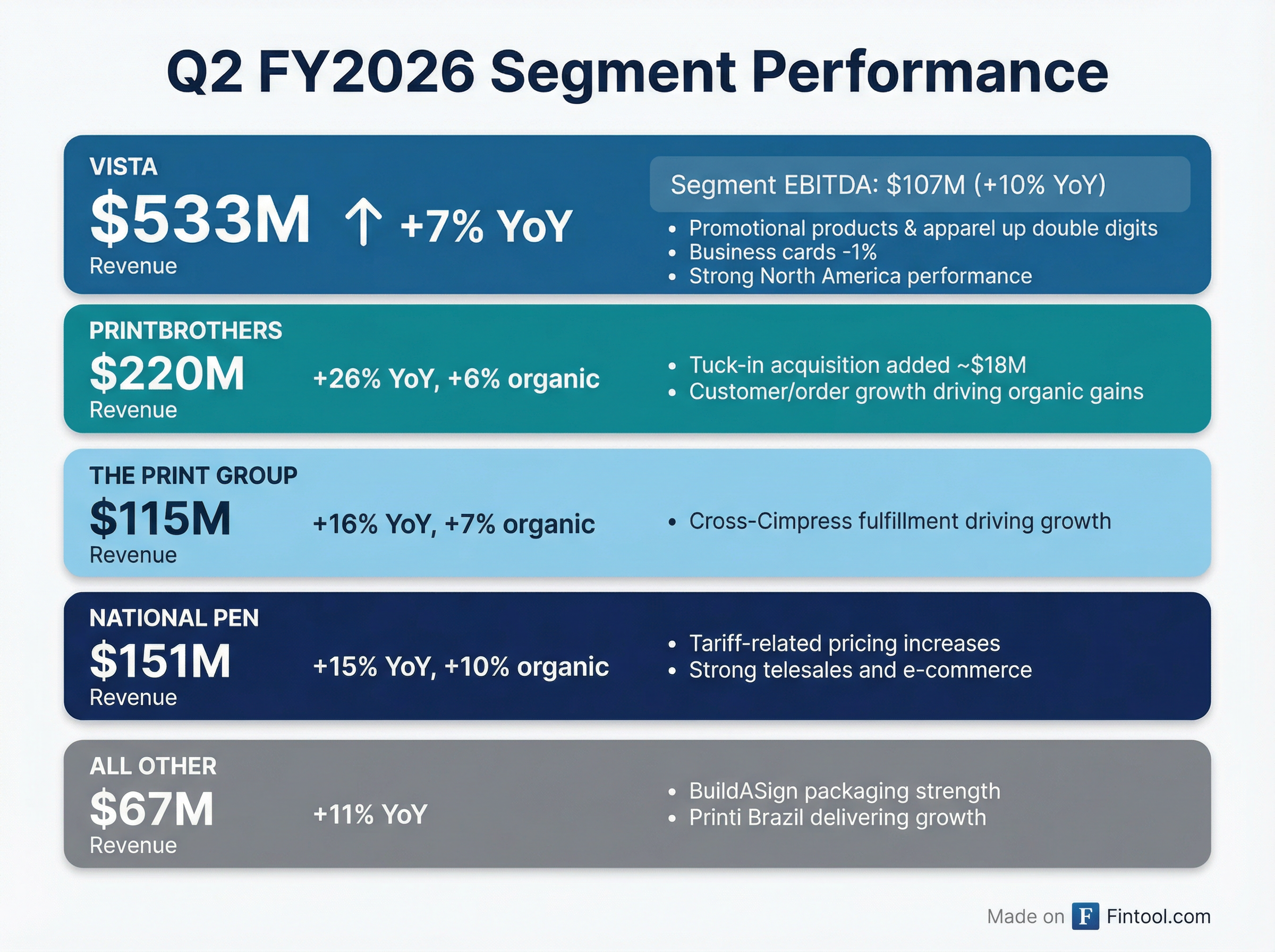

Vista (51% of Revenue)

Key driver: Elevated product categories (promotional products, apparel, gifts, packaging) grew at double-digit rates, offsetting a 1% decline in business cards . North America showed particular strength.

PrintBrothers (21% of Revenue)

Key driver: Tuck-in acquisition contributed ~$18M revenue and $1.3M EBITDA. Organic growth driven by customer and order count increases .

The Print Group (11% of Revenue)

Key driver: Cross-Cimpress fulfillment continued to drive strong segment revenue growth .

National Pen (14% of Revenue)

Key driver: Cross-Cimpress fulfillment, tariff-related pricing increases, and solid telesales/e-commerce growth . Gross margins compressed 400 bps due to tariff dynamics.

All Other Businesses (6% of Revenue)

Key driver: BuildASign strength in packaging products and Printi's continued growth in Brazil .

Capital Allocation and Balance Sheet

Share Repurchases

Management repurchased 369,711 shares for $25.5M at an average price of $68.86 per share . Additional payments of $3.6M for 54,444 shares related to equity award withholding taxes.

Leverage Path

- FY2026 target: Slightly below FY2025's 3.1x

- FY2027 target: ~2.5x

- FY2028 target: Meaningfully below 2.0x (subject to capital allocation choices including buybacks)

Key Strategic Initiatives

Management highlighted several initiatives driving toward FY2028 targets :

- Manufacturing efficiency: Continued build-out of focused production hubs to enable COGS benefits

- Technology consolidation: Increased use of shared software services to eliminate duplicative costs

- Cross-business collaboration: Expanded collaboration between Vista, National Pen, and BuildASign for product development, sourcing, marketing, and manufacturing

- M&A pipeline: "Healthy pipeline of tuck-in M&A and potential partnership opportunities"

Risks and Concerns

- Tariff exposure: While management expects tariff impact to "lessen in future quarters as supply chain remediation continues to ramp," this remains a risk

- Currency headwinds: 5% currency headwind in Q2 reported growth; guidance assumes "full-year currency rates similar to recent average rates"

- Gross margin pressure: Consolidated gross margin at 47% is down from 48% a year ago

- Jamaica operations: Partial insurance recovery expected but timing uncertain

- High leverage: At ~3x, the balance sheet remains leveraged despite improvement

What to Watch Next Quarter

- Tariff remediation progress: Management expects tariff impact to lessen

- Organic growth sustainability: Can 4%+ organic growth continue into H2?

- Gross margin trajectory: Will tariff pricing/cost dynamics normalize?

- PrintBrothers acquisition integration: Continued accretion?

- Net leverage path: Progress toward year-end target

Q&A Highlights From the Earnings Call

The January 29 earnings follow-up call provided additional color on several key topics:

Cross-Cimpress Fulfillment (XCF) Momentum

XCF doubled year-over-year, demonstrating the power of Cimpress's shared manufacturing platform:

"We have the opportunity to lower costs, improve quality, improve speed, expand our product lines, increase utilization of invested capital by aggregating all this volume into these focused production hubs." — Robert Keane

Holiday Season Results

Management provided granular detail on holiday performance :

- US holiday cards/calendars: Flat YoY (solid given the secular decline in legacy products)

- Canada holiday cards: Double-digit growth

- Europe consumer: Down slightly YoY (tough comp from strong Q2 FY2025)

- Consumer YTD (Vista): Flat in constant currency with slight gross profit growth

Austria Tuck-In Acquisition Details

The PrintBrothers acquisition was highly accretive :

The deal was sourced and led by the local Druck.at team, exemplifying Cimpress's decentralized M&A approach.

Pixartprinting North America Update

The US Pixartprinting expansion remains on plan :

- H1 FY2026 revenue: ~$3M (small but growing fast quarter-over-quarter)

- Ad spend: Not yet activated on US site beyond small tests

- Focus: Building production capabilities before scaling marketing

- Opportunity: Serve as XCF fulfillment partner for Vistaprint in multi-page, small formats, and labels

Vista/National Pen/BuildASign Collaboration

Management clarified what will and won't be shared :

"We can optimize our advertising spend across those different brands that all may show up in the same Google Search... and make sure we're getting the best ROI across the board for all of Cimpress, not an individual brand." — Robert Keane

FY2028 Bridge Update

Sean Quinn walked through the FY2028 target bridge pillars :

Agentic Commerce

When asked about AI-powered shopping, Robert Keane signaled Cimpress is positioning for this shift :

"Agentic commerce is coming. We are working on that, and we feel comfortable that we will be at, if not in the lead, baton thrower, but very much at the front of the parade."

Jamaica Operations Recovery

Operations have largely stabilized following the October hurricane :

- Teams back at desks with renovations ongoing

- Tunisia and Philippines facilities provided backup during peak

- No continued financial drag expected in H2

- Insurance recovery process active (timing may extend to FY2027)

Capital Allocation: Buybacks Still Attractive

Management strongly endorsed continued buybacks at current levels :

- Q2 repurchases: $25M+ at average price below $70

- Current view: "Very attractive at current price levels"

- H2 expectation: Some repurchases, "probably a bit less in terms of intensity" vs Q2

- M&A hurdle: Any tuck-in deals in the pipeline exceed the 15% return threshold

Earnings Call: January 29, 2026 — View Full Transcript

Related Documents: