Earnings summaries and quarterly performance for CIMPRESS.

Executive leadership at CIMPRESS.

Board of directors at CIMPRESS.

Research analysts covering CIMPRESS.

Recent press releases and 8-K filings for CMPR.

Cimpress Reports Record Q2 2026 Revenue and Raises Full-Year Guidance

CMPR

Earnings

Guidance Update

M&A

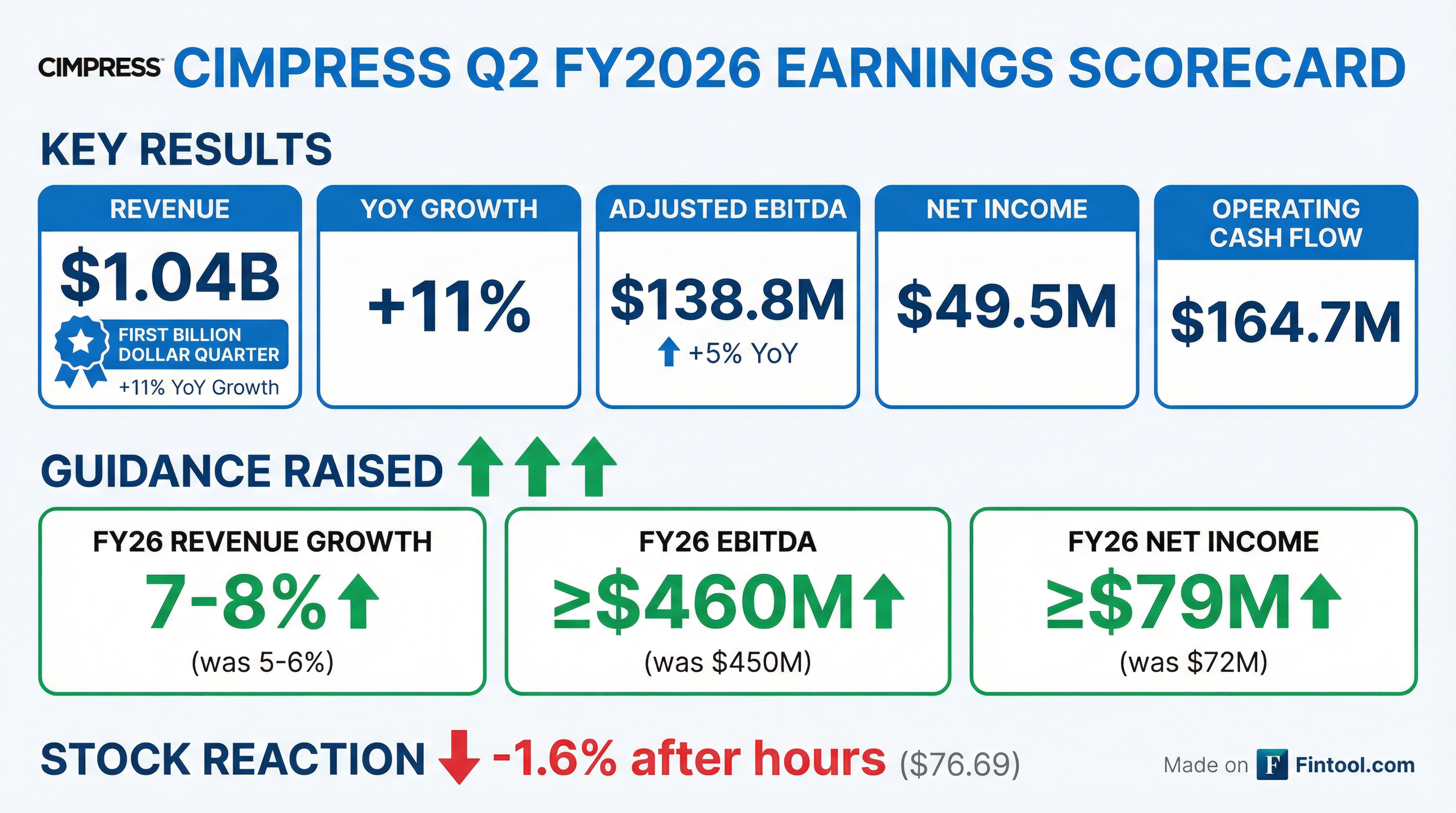

- Cimpress reported a record Q2 2026, exceeding $1 billion in quarterly revenue for the first time ever, with organic constant currency growth of 4% through the first half of the year, surpassing its annual guidance range.

- The company raised its fiscal 2026 guidance, now expecting reported revenue growth of 7%-8% and adjusted EBITDA of at least $460 million, an increase from the previous $450 million.

- Cimpress reiterated its fiscal 2028 targets, including adjusted EBITDA of at least $600 million and an expectation to exit fiscal 2028 with net leverage below 2.0 times.

- Strategic initiatives, such as the focus on "elevated products" and Cross-Cimpress Fulfillment (XCF), are driving growth, with XCF volume doubling to over $80 million in H1 2026 from H1 2025.

- The company completed a tuck-in acquisition of an Austrian printing group with annual revenues of about $70 million and annualized EBITDA of about $5 million prior to synergies, for an enterprise value comfortably below five times pre-synergy EBITDA.

Jan 29, 2026, 1:00 PM

CMPR Reports Strong Q2 2026 Results and Raises Full-Year Guidance

CMPR

Earnings

Guidance Update

Share Buyback

- Cimpress (CMPR) reported strong Q2 2026 financial results, with revenue exceeding $1 billion for the first time and organic constant currency growth of 4%. This performance was supported by strategic progress in elevated products, which drove a 9% year-over-year increase in variable gross profit per customer.

- Based on strong first-half results, the company raised its fiscal 2026 guidance, now expecting revenue growth of 7%-8% and adjusted EBITDA of at least $460 million.

- Management reiterated its confidence in achieving its fiscal 2028 targets, including adjusted EBITDA of at least $600 million and net leverage below 2.0 times.

- Cimpress allocated over $25 million to share repurchases in Q2 2026 at an average price below $70 and anticipates further repurchases in the second half of the year.

Jan 29, 2026, 1:00 PM

Cimpress Reports Strong Q2 2026 Results and Raises Fiscal 2026 Guidance

CMPR

Earnings

Guidance Update

M&A

- Cimpress reported strong Q2 2026 financial results, with Vista's organic constant currency revenue growing 5% year-over-year and consolidated adjusted EBITDA increasing by $6.6 million.

- The company has raised its fiscal 2026 guidance, now expecting revenue growth of 7%-8% and adjusted EBITDA of at least $460 million.

- Cimpress remains confident in achieving its fiscal 2028 targets, which include adjusted EBITDA of at least $600 million and net leverage below 2.0 times.

- Strategic progress includes 9% year-over-year growth in Vista's variable gross profit per customer and the doubling of Cross-Cimpress fulfillment (XCF) volume to over $80 million in the first half of fiscal 2026.

- Q2 profitability was negatively impacted by $2 million from a hurricane in Jamaica, $1.5 million in production startup costs, and $1 million in tariffs, though currency provided a $4.1 million benefit to EBITDA.

Jan 29, 2026, 1:00 PM

Cimpress plc Reports Q2 FY2026 Results and Raises Full-Year Guidance

CMPR

Earnings

Guidance Update

Share Buyback

- Cimpress plc achieved its first-ever quarter with revenue above $1 billion in Q2 FY2026, with reported revenue growing 11% and organic constant-currency revenue growing 4% year-over-year.

- For Q2 FY2026, net income decreased $12.1 million to $49.5 million, while adjusted EBITDA increased $6.6 million to $138.8 million.

- The company is raising its FY2026 annual outlook, now expecting revenue growth of 7% - 8% and adjusted EBITDA of at least $460 million.

- During Q2 FY2026, Cimpress repurchased 369,711 shares for $25.5 million and reported net leverage just below 3.0 times trailing-twelve-month EBITDA as of December 31, 2025.

- Cimpress remains confident in its previously disclosed FY2028 financial targets of at least $200 million in net income and $600 million in adjusted EBITDA.

Jan 28, 2026, 9:27 PM

Cimpress Accelerates Product Growth Strategy and Announces Leadership Transition

CMPR

Revenue Acceleration/Inflection

Management Change

New Projects/Investments

- Cimpress is accelerating its strategy for elevated product growth by having National Pen and BuildASign deploy capabilities to further fuel VistaPrint’s product expansion.

- This expanded collaboration is part of a roadmap to achieve previously communicated plans for 4-6% constant currency revenue growth and at least $600 million of adjusted EBITDA in FY2028.

- The company's promotional products category generates approximately $700 million annually and is growing strongly, with VistaPrint's promotional products revenue growing organically at over 10% year over year for the past 18 quarters.

- Peter Kelly, CEO of National Pen, is leaving the company, and Bryan Kranik will succeed him while also retaining his role as CEO of BuildASign.

Jan 13, 2026, 9:05 PM

Cimpress Provides FY2026 Guidance and FY2028 Financial Targets

CMPR

Guidance Update

New Projects/Investments

Revenue Acceleration/Inflection

- Cimpress provided FY2026 guidance including 5%-6% revenue growth (or 2%-3% organic constant currency growth), $450 million adjusted EBITDA, and $140 million adjusted free cash flow.

- The company projects FY2028 adjusted EBITDA to be at least $600 million, with constant currency revenue growth of 4%-6% and EBITDA margins improving from under 13% in FY2025 to about 15% in FY2028.

- Cimpress aims for significant deleveraging, expecting to be meaningfully below 2.0x net leverage by the end of FY2028, down from approximately 3.1x in Q1.

- The company is investing in new equipment and manufacturing locations, with CapEx of about $100 million in FY2026, to drive $70 million-$80 million in annual EBITDA improvement by FY2028, primarily from COGS.

Dec 2, 2025, 4:30 PM

Cimpress Outlines FY2026 Guidance and FY2028 Financial Targets

CMPR

Guidance Update

New Projects/Investments

Revenue Acceleration/Inflection

- Cimpress provided FY2026 guidance, projecting 5-6% revenue growth (or 2-3% organic constant currency growth), $450 million adjusted EBITDA, and $140 million adjusted free cash flow.

- The company outlined an FY2028 framework, targeting at least $600 million adjusted EBITDA and 4%-6% constant currency revenue growth, aiming to increase EBITDA margins from under 13% in FY2025 to about 15%.

- Cimpress expects significant deleveraging, projecting approximately 2.5 times net leverage by the end of FY2027 and meaningfully below two times by the end of FY2028.

- Capital expenditures for FY2026 are projected at about $100 million, primarily for new equipment and manufacturing optimization to support new products and efficiency gains.

- Approximately 65% of Cimpress's cost structure is variable or semi-variable, providing operational flexibility.

Dec 2, 2025, 4:30 PM

Cimpress Outlines FY2026 Guidance and Long-Term FY2028 Financial Framework

CMPR

Guidance Update

New Projects/Investments

Revenue Acceleration/Inflection

- Cimpress provided FY2026 guidance including 5-6% revenue growth (or 2-3% organic constant currency growth) and $450 million adjusted EBITDA, alongside a FY2028 framework targeting at least $600 million adjusted EBITDA and 4-6% constant currency revenue growth.

- The company aims for significant deleveraging, expecting to reach approximately 2.5 times net leverage by the end of FY2027 and meaningfully below two times by the end of FY2028, from 3.1 times in Q1. They have no near-term maturities, with senior notes due 2032 and term loan B due 2028.

- Cimpress is investing in elevated CapEx (approximately $100 million in FY2026) to bring new products to market and optimize manufacturing, expecting $70-$80 million in annual EBITDA improvement by FY2028 from cost savings across the P&L.

- Operating in a $100 billion fragmented market, Cimpress focuses on wallet share gains with higher-value customers and views AI as an opportunity for internal efficiency and potentially democratizing design, which could benefit the sale of physical products.

Dec 2, 2025, 4:30 PM

Cimpress Outlines FY2026 Guidance and Long-Term FY2028 Financial Framework

CMPR

Guidance Update

New Projects/Investments

Revenue Acceleration/Inflection

- Cimpress provided FY2026 guidance, expecting revenue growth of 5%-6% (organic constant currency growth of 2%-3%), adjusted EBITDA of at least $450 million, and adjusted free cash flow of $140 million.

- The company introduced a long-term framework for FY2028, targeting constant currency revenue growth of 4%-6%, adjusted EBITDA of at least $600 million, and adjusted free cash flow conversion of about 45%. This represents an 11% CAGR for EBITDA growth from FY2025 to FY2028.

- Cimpress expects to achieve its FY2028 targets through $70 million-$80 million of cost reductions exiting FY2027, the runoff of $15 million in plant startup costs, and contributions from tuck-in M&A and currency impacts.

- The company aims to reduce its leverage ratio from the current 3.1 times trailing 12-month EBITDA to approximately 2.5 times or below by the end of FY2027, while balancing organic investments and share repurchases.

- Identified risks include potential AI disruption in customer engagement, sales, and design, which could impact advertising effectiveness and search visibility.

Nov 20, 2025, 4:35 PM

Cimpress Outlines FY2026 Guidance and FY2028 Financial Targets

CMPR

Guidance Update

Revenue Acceleration/Inflection

New Projects/Investments

- Cimpress (CMPR) reiterated its FY2026 guidance, expecting 5%-6% revenue growth (2%-3% organic constant currency), at least $450 million in Adjusted EBITDA, and $140 million in Adjusted Free Cash Flow.

- The company introduced a FY2028 framework, targeting 4%-6% constant currency revenue growth, at least $600 million in Adjusted EBITDA, and approximately 45% Adjusted Free Cash Flow conversion from EBITDA. This represents an 11% CAGR for EBITDA from FY2025 to FY2028.

- Key drivers for the FY2028 EBITDA target include $70 million to $80 million in cost reductions exiting FY2027, the run-off of $15 million in FY2026 plant startup costs, and contributions from tuck-in M&A and currency impact.

- Cimpress aims to significantly delever, expecting to be at approximately 2.5 times trailing 12-month EBITDA by the end of FY2027 and meaningfully below two times by FY2028 if targets are met, down from the current 3.1 times.

- The company highlights AI as a potential risk due to its unpredictable impact on customer attraction, sales, and design, but also sees it as a net positive for physical product delivery.

Nov 20, 2025, 4:35 PM

Quarterly earnings call transcripts for CIMPRESS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more