Earnings summaries and quarterly performance for Cannae Holdings.

Research analysts who have asked questions during Cannae Holdings earnings calls.

Recent press releases and 8-K filings for CNNE.

Cannae Holdings, Inc. Announces Fourth Quarter and Full Year 2025 Financial Results and Strategic Priorities

CNNE

Earnings

Share Buyback

New Projects/Investments

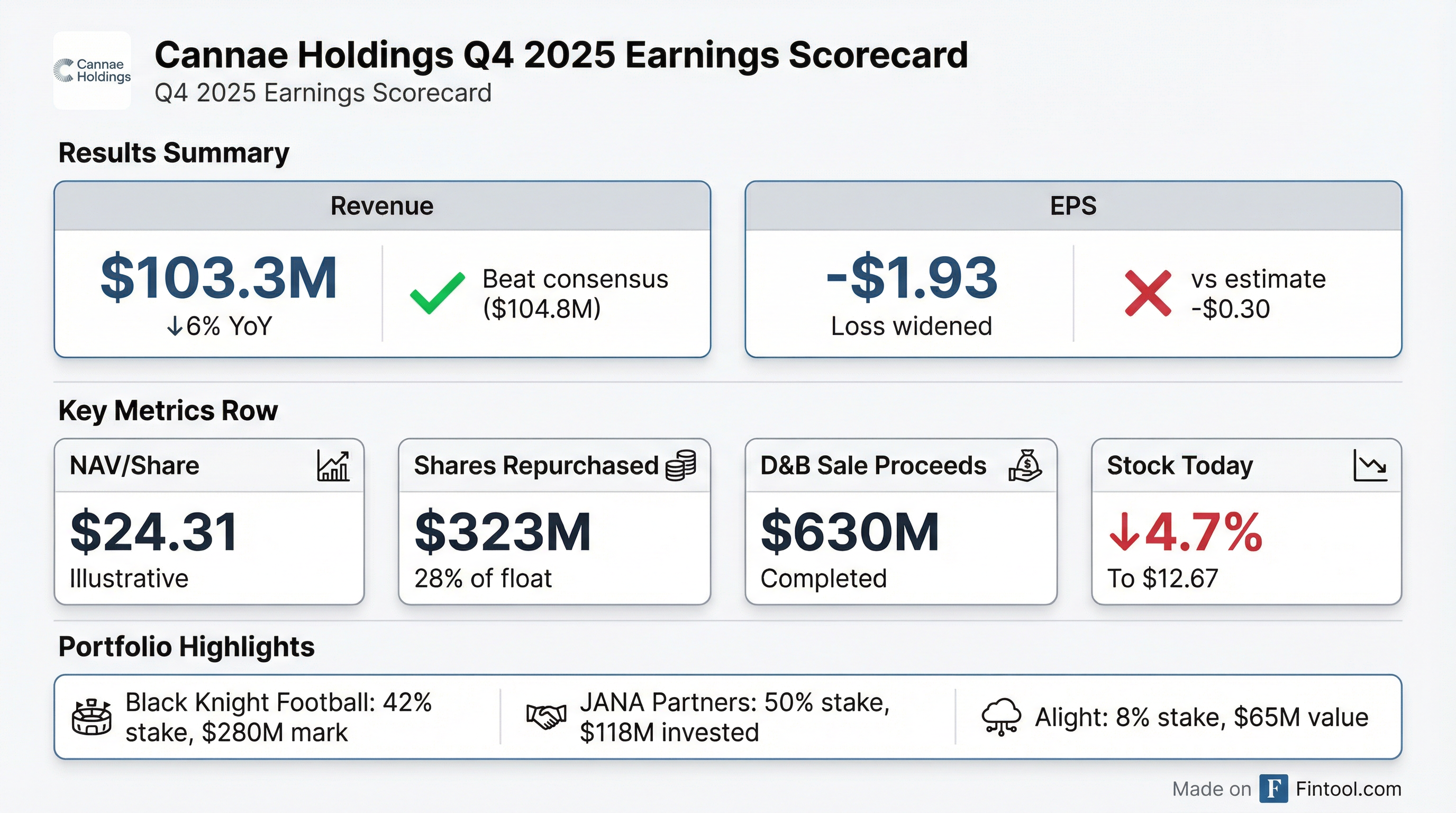

- Cannae Holdings, Inc. reported a net loss attributable to common shareholders of $(93.0) Million for the fourth quarter of 2025 and $(513.2) Million for the full year 2025.

- The company is accelerating its portfolio transformation to concentrate primarily on sports and entertainment-related investments and plans to monetize non-strategic assets.

- In 2025, Cannae generated $630 Million from the sale of Dun & Bradstreet, repurchased $323 Million of stock (representing 28% of shares outstanding), and increased its dividend.

- As of February 20, 2026, Cannae has invested $249 Million in Black Knight Football, representing an approximate 42% ownership interest, and $118 Million in JANA Partners, representing a 50% ownership interest.

4 days ago

Cannae Holdings Reports Q4 and Full-Year 2025 Results, Announces Strategic Portfolio Transformation

CNNE

Earnings

M&A

Share Buyback

- Cannae Holdings reported $103 million in total operating revenues for Q4 2025, a 6% decrease from the prior year, and a full-year 2025 operating loss of $119 million.

- The company is undergoing a significant portfolio transformation, accelerating its focus on sports and entertainment assets, and is exploring strategic alternatives for its restaurant group.

- In 2025, Cannae returned $323 million to shareholders through stock repurchases and increased its quarterly dividend by 25% to $0.15.

- Key investments in 2025 included an additional $50 million in Black Knight Football Club and $67.5 million in JANA Partners, increasing ownership to 50%.

4 days ago

Cannae Holdings Reports Q4 and Full-Year 2025 Results, Announces Strategic Portfolio Transformation

CNNE

Earnings

M&A

Share Buyback

- Cannae Holdings reported Q4 2025 total operating revenues of $103 million, a 6% decrease from the prior year, and a full-year 2025 operating loss of $119 million.

- The company is accelerating its portfolio transformation to concentrate on sports and entertainment-related assets, and is exploring strategic alternatives for its restaurant group as part of monetizing non-strategic assets.

- In 2025, Cannae returned capital to shareholders by repurchasing $323 million of stock, representing 28% of shares outstanding, and increased its quarterly dividend by 25% to $0.15 per quarter, totaling $30 million.

- Significant portfolio activity included the sale of Dun & Bradstreet for $630 million, an additional $50 million investment in Black Knight Football Club, an additional $67.5 million investment in JANA Partners to increase ownership to 50%, and the acquisition of the remaining 60% of FC Lorient for approximately EUR 60 million.

4 days ago

Cannae Holdings Reports Q4 and Full-Year 2025 Results, Announces Strategic Portfolio Shift

CNNE

Earnings

Share Buyback

New Projects/Investments

- Cannae Holdings reported Q4 2025 total operating revenues of $103 million, a 6% decrease from the prior year, and a full-year 2025 operating loss of $119 million.

- The company is accelerating its portfolio transformation to focus primarily on sports and entertainment-related assets, including the sale of Dun & Bradstreet for $630 million and new investments in Black Knight Football Club and JANA Partners, while also exploring strategic alternatives for its restaurant group.

- Cannae returned substantial capital to shareholders in 2025 through $323 million in stock repurchases (representing 28% of shares outstanding) and an increased quarterly dividend of $0.15 per share.

- The company maintains a strong liquidity position with over $147 million in corporate cash and $48 million in corporate debt at year-end 2025, and anticipates a $55 million tax refund in summer 2026.

4 days ago

Cannae Shareholder Carronade Capital Urges Vote for Nominees Ahead of Annual Meeting

CNNE

Board Change

Proxy Vote Outcomes

Executive Compensation

- Carronade Capital, a top shareholder of Cannae Holdings (CNNE) with approximately 3.2 million shares, is urging shareholders to vote "FOR" its four independent director nominees and "WITHHOLD" on Cannae's current nominees at the 2025 Annual Meeting on December 12, 2025.

- Carronade highlights Cannae's -60% total shareholder returns over the past five years and over $650 million paid to Directors and Management since 2017, arguing for improved corporate governance and accountability.

- Independent proxy advisory firms ISS, Glass Lewis, and Egan-Jones unanimously recommend voting for Carronade's nominees and withholding on Cannae's slate.

- The deadline for shareholders to cast their votes is December 11, 2025, at 11:59 pm Pacific Time.

Dec 10, 2025, 2:01 PM

Cannae Holdings Reports Q3 Loss Amid Strategic Portfolio Shift

CNNE

Earnings

Share Buyback

New Projects/Investments

- Cannae Holdings reported a Q3 2025 quarterly loss of $1.06 per share and a slight revenue decline to $106.9 million, primarily due to lower restaurant revenue.

- The company significantly reduced its public investment portfolio from 70% to 20%, generating $630 million from the sale of Dun & Bradstreet.

- Cannae has returned over $500 million to shareholders since announcing its strategic plan, representing 35% of the shares outstanding at that time.

- Investment performance was mixed, with Alight experiencing a 4% revenue decline and significant equity losses, while sports investments like AFC Bournemouth and Black Knight Football Club showed positive growth and successful player trading.

Nov 11, 2025, 12:34 AM

Cannae Holdings Reports Q3 2025 Results, Continues Portfolio Rebalancing and Shareholder Returns

CNNE

Earnings

Share Buyback

New Projects/Investments

- Cannae Holdings reported Q3 2025 operating revenue of $107 million, a decrease from $114 million in the prior year's third quarter, with total operating expenses decreasing by $12 million to $120 million. Net recognized gains were $8 million, and equity and losses of unconsolidated affiliates totaled $57 million.

- The company continued its strategic rebalancing, transitioning its portfolio from 70% public investments to 20% public investments today, having sold $1.1 billion of public company securities since February 2024.

- Cannae generated $630 million in proceeds from the sale of Dun & Bradstreet, using $424 million to repurchase $275 million of its shares, repay $141 million of its margin loan, and distribute $8 million in dividends.

- Since the start of Q3 2025, Cannae repurchased $163 million of stock at an average discount to NAV of 31%, bringing year-to-date repurchases to $275 million, or 23% of shares outstanding. The company has returned over $500 million to shareholders since February 2024.

- Strategic investments include acquiring an additional 30% stake in Jana Partners for $67.5 million, increasing ownership to 50%, and investing $25 million in Black Knight Football, with a future focus on sports and sports-related assets.

Nov 10, 2025, 10:00 PM

Cannae Holdings, Inc. Announces Q3 2025 Financial Results and Strategic Updates

CNNE

Earnings

Share Buyback

M&A

- Cannae Holdings, Inc. reported a net loss attributable to common shareholders of $(68.4) Million, or $(1.25) per share, for the third quarter of 2025, on total operating revenues of $106.9 Million.

- The company continued its capital return program, purchasing $163 Million of its stock in Q3 2025 and $275 Million year-to-date through November 10, 2025, representing 22.9% of shares outstanding at the prior year-end.

- Cannae closed the sale of Dun & Bradstreet on August 26, 2025, receiving $630 Million in cash proceeds, and repaid $141 Million outstanding on its margin loan in Q3 2025.

- Portfolio company Alight reported Q3 2025 revenue of $533 Million and Adjusted EBITDA of $138 Million, but recognized a $1.3 Billion non-cash goodwill impairment, resulting in a net loss of $1,055 Million. Alight also lowered its 2025 guidance.

- Cannae increased its ownership in JANA Partners to 50% with a $67.5 Million purchase in September 2025, and its Black Knight Football Club saw AFC Bournemouth achieve the second highest net player sales income in European football.

Nov 10, 2025, 9:12 PM

Quarterly earnings call transcripts for Cannae Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more