Earnings summaries and quarterly performance for Concentra Group Holdings Parent.

Executive leadership at Concentra Group Holdings Parent.

William K. Newton

Chief Executive Officer

John A. deLorimier

Chief Information and Technology Officer

John Anderson

Chief Medical Officer

Matthew T. DiCanio

President and Chief Financial Officer

Michael Kosuth

Chief Operating Officer – East Group

Su Zan Nelson

Chief Accounting Officer

Board of directors at Concentra Group Holdings Parent.

Research analysts who have asked questions during Concentra Group Holdings Parent earnings calls.

Joanna Gajuk

Bank of America

6 questions for CON

Justin Bowers

Deutsche Bank AG

6 questions for CON

Benjamin Hendrix

RBC Capital Markets

4 questions for CON

Benjamin Rossi

JPMorgan Chase & Co.

4 questions for CON

Jamie Perse

The Goldman Sachs Group, Inc.

4 questions for CON

Stephen Baxter

Wells Fargo & Company

4 questions for CON

Ann Hynes

Mizuho Financial Group

3 questions for CON

Ben Hendricks

RBC Capital Markets

2 questions for CON

Christopher Mitchell

Wells Fargo & Company

2 questions for CON

Anne Hines

Mizuho

1 question for CON

Edward Kressler

TPG Angelo Gordon

1 question for CON

Michael Murray

RBC Capital Markets

1 question for CON

Recent press releases and 8-K filings for CON.

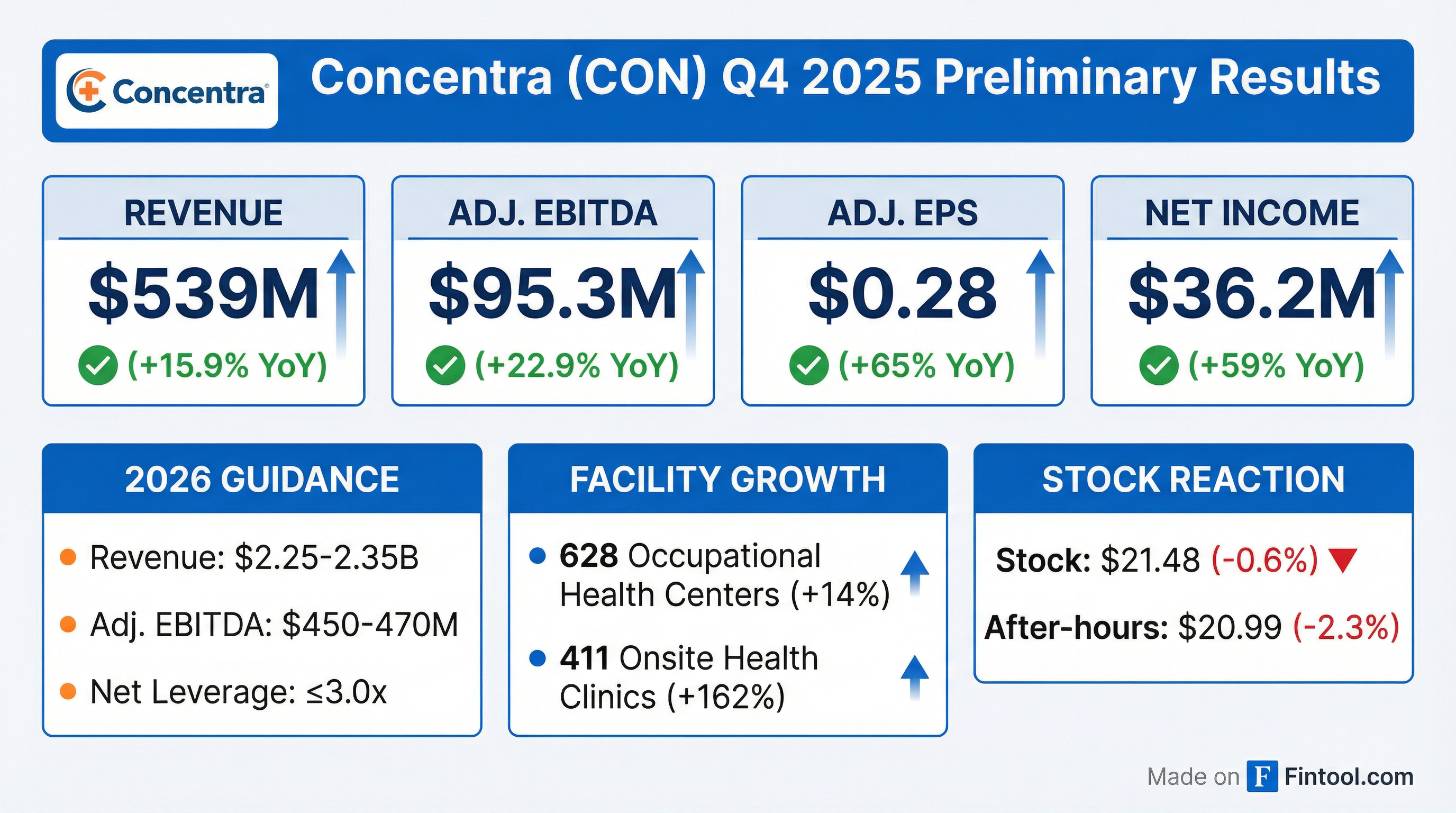

- Concentra Group Holdings Parent reported Q4 2025 total revenue of $539.1 million, a 15.9% increase year-over-year, and Adjusted EBITDA of $95.3 million, up 22.9%. For the full year 2025, revenue reached $2.2 billion and Adjusted EBITDA was $431.9 million.

- The company provided full-year 2026 guidance, projecting revenue between $2.25 billion and $2.35 billion and Adjusted EBITDA between $450 million and $470 million. They also aim for a net leverage ratio of approximately 3 times by the end of 2026.

- Operationally, total patient visits per day increased 9% in Q4 2025 to over 51,000, and 7.7% for the full year 2025 to over 53,000. Revenue per visit was 4.3% higher in FY 2025 compared to 2024.

- Growth initiatives include opening seven de novo sites in 2025 and targeting 7 to 9 de novos in 2026. The company also finalized the Reliant acquisition in January and declared a cash dividend of $0.0625 per share.

- Concentra Group Holdings Parent Inc. reported strong financial performance for Q4 2025, with total revenue increasing 15.9% year-over-year to $539.1 million and Adjusted EBITDA growing 22.9% to $95.3 million.

- For the full year 2025, revenue reached $2.2 billion, a 13.9% increase from 2024, and Adjusted EBITDA was $431.9 million, up 14.6%.

- The company provided full year 2026 guidance, targeting revenue between $2.25 billion and $2.35 billion and Adjusted EBITDA between $450 million and $470 million.

- Operationally, Q4 2025 saw a 9% increase in total patient visits and revenue per visit grew 3.1%. The company also declared a cash dividend of $0.0625 per share and repurchased $22.4 million in shares during 2025.

- Concentra Group Holdings Parent reported strong Q4 2025 results, with total company revenue of $539.1 million, a 15.9% year-over-year growth, and Adjusted EBITDA of $95.3 million, a 22.9% increase. For the full year 2025, revenue reached $2.2 billion and Adjusted EBITDA was $431.9 million, both exceeding the high end of previous guidance.

- Operational highlights include a 9% increase in total patient visits per day in Q4 2025 and a 7.7% increase for the full year 2025, driven by growth in both workers' compensation and employer services visits. Revenue per visit also grew 3.1% in Q4 2025 and 4.3% for the full year.

- The company issued full year 2026 guidance, targeting revenue between $2.25 billion and $2.35 billion, Adjusted EBITDA between $450 million and $470 million, and Free Cash Flow between $200 million and $225 million.

- Strategic plans for 2026 include opening 7 to 9 de novo sites and pursuing smaller bolt-on acquisitions. The board also declared a cash dividend of $0.0625 per share and the company continued its share repurchase program, buying back $22.4 million in shares during Q4 2025.

- Concentra Group Holdings Parent reported FY 2025 Revenue of $2.16 billion and Adjusted EBITDA of $431.86 million , achieving an Adjusted EBITDA margin of 20.0%.

- For Q4 2025, the company's Revenue reached $539.08 million and Adjusted EBITDA was $95.27 million , with an Adjusted EBITDA margin of 17.7%.

- The company provided 2026 Adjusted EBITDA guidance in the range of $450 million to $470 million.

- Concentra also reported FY 2025 Free Cash Flow of $198 million and a Return on Invested Capital (ROIC) of 14.4% for the trailing twelve months ended December 31, 2025.

- Operationally, Concentra is the largest provider of occupational health services in the U.S., with 628 occupational health centers and 411 onsite health clinics across 47 states.

- Concentra Group Holdings Parent, Inc. (CON) reported strong financial results for Q4 2025, with revenue increasing by 15.9% to $539.1 million and net income rising 58.7% to $36.2 million. For the full year 2025, revenue grew 13.9% to $2,163.4 million and Adjusted EBITDA increased 14.6% to $431.9 million.

- The company issued full-year 2026 guidance, projecting revenue in the range of $2.25 billion to $2.35 billion and Adjusted EBITDA between $450 million and $470 million.

- In Q4 2025, Concentra repurchased approximately 1.1 million shares for $22.4 million and declared a quarterly cash dividend of $0.0625 per share. The net leverage ratio stood at 3.4x as of December 31, 2025, with a target of 3.0x or below by the end of 2026.

- Concentra reported preliminary Q4 2025 revenue of $539.1 million, an increase of 15.9% from Q4 2024, and preliminary full year 2025 revenue of $2,163.4 million, up 13.9% from FY 2024.

- Preliminary Q4 2025 net income was $36.2 million and Adjusted EBITDA was $95.3 million, increasing by 58.7% and 22.9% respectively from Q4 2024. For the full year 2025, preliminary net income was $172.8 million and Adjusted EBITDA was $431.9 million, a 14.6% increase from FY 2024.

- The company expects full year 2026 revenue to be in the range of $2.25 billion to $2.35 billion and Adjusted EBITDA in the range of $450 million to $470 million.

- Concentra projects Free Cash Flow of $200 million to $225 million and a net leverage ratio of 3.0x or below for full year 2026.

- As of December 31, 2025, Concentra had 628 occupational health centers and 411 onsite health clinics, and repurchased approximately 1.1 million shares of common stock totaling $22.4 million in Q4 2025.

- Concentra, the largest occupational health services provider in the United States, operates over 1,000 locations (650 bricks and mortar, 400+ on-sites) across over 40 states.

- The company reported approximately $2.2 billion in revenue and $425-430 million in EBITDA from its Q3 earnings call, with a 13% year-over-year growth rate in 2025 (or high single-digit excluding large acquisitions).

- Concentra maintains a highly variable cost structure with approximately 20% adjusted EBITDA margins for the fifth consecutive year and anticipates an average 3% annual rate increase.

- Growth is driven by a strategy of de novos and over 70 acquisitions since 2016, alongside tailwinds from an aging workforce, potential US infrastructure spending, and the AI economy.

- Despite a soft labor market, the company has shown strong organic growth with three consecutive quarters north of 3% to 3.5%.

- Concentra, the largest occupational health services provider in the United States, became a publicly traded company in July 2024 and operates over 1,000 locations.

- For 2025, the company reported approximately $2.2 billion in revenue and $425-430 million in EBITDA, achieving a 13% year-over-year growth rate.

- Concentra announced strong preliminary Q4 2025 visit volumes with 9% overall growth and repurchased 1.1 million shares in the quarter.

- The company is targeting a leverage ratio of 3.5x or less by year-end 2025 and 3.0x or less by year-end 2026, while also expecting 3% rate growth for workers' compensation and 3%-4% for employer services in 2026.

- Concentra's capital allocation priorities include deleveraging, smaller M&A, and share buybacks, with a $100 million share buyback program authorized and a 1.3% dividend yield.

- Concentra, which became a publicly traded company in July 2024, is the largest occupational health services provider in the United States with over 1,000 locations.

- The company has achieved greater than 100% free cash flow conversion and nearly $1 billion in free cash flow generation since 2021.

- Concentra is targeting 3.5 times or less leverage for year-end 2025 and aims for 3 times or less by the end of 2026.

- The board authorized a $100 million share buyback program late last year, with 1.1 million shares repurchased in Q4.

- Preliminary Q4 2025 results indicate strong visit volume growth, including 3.4% in work comp and 2.3% in employer services (excluding Nova), and approximately 9% overall.

- Concentra projects Revenue between $2.145 billion and $2.160 billion and Adjusted EBITDA between $425 million and $430 million for fiscal year 2025.

- For the trailing twelve months (TTM) ended September 30, 2025, the company reported Revenue of $2,089.378 million and Adjusted EBITDA of $414.137 million, with 13% year-over-year growth in both metrics for the year-to-date period ended September 2025.

- Net leverage was 3.6x as of Q3 2025, with a target of ≤3.5x by year-end 2025. The company repurchased ~1.1 million shares in Q4 2025 and has an authorized $100 million share buyback program.

- Concentra is the largest provider of occupational health services in the U.S., operating 628 occupational health centers and 413 onsite health clinics.

Quarterly earnings call transcripts for Concentra Group Holdings Parent.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more