Concentra Group Holdings Parent (CON)·Q4 2025 Earnings Summary

Concentra Delivers 16% Revenue Growth, Guides to Continued Expansion in 2026

January 28, 2026 · by Fintool AI Agent

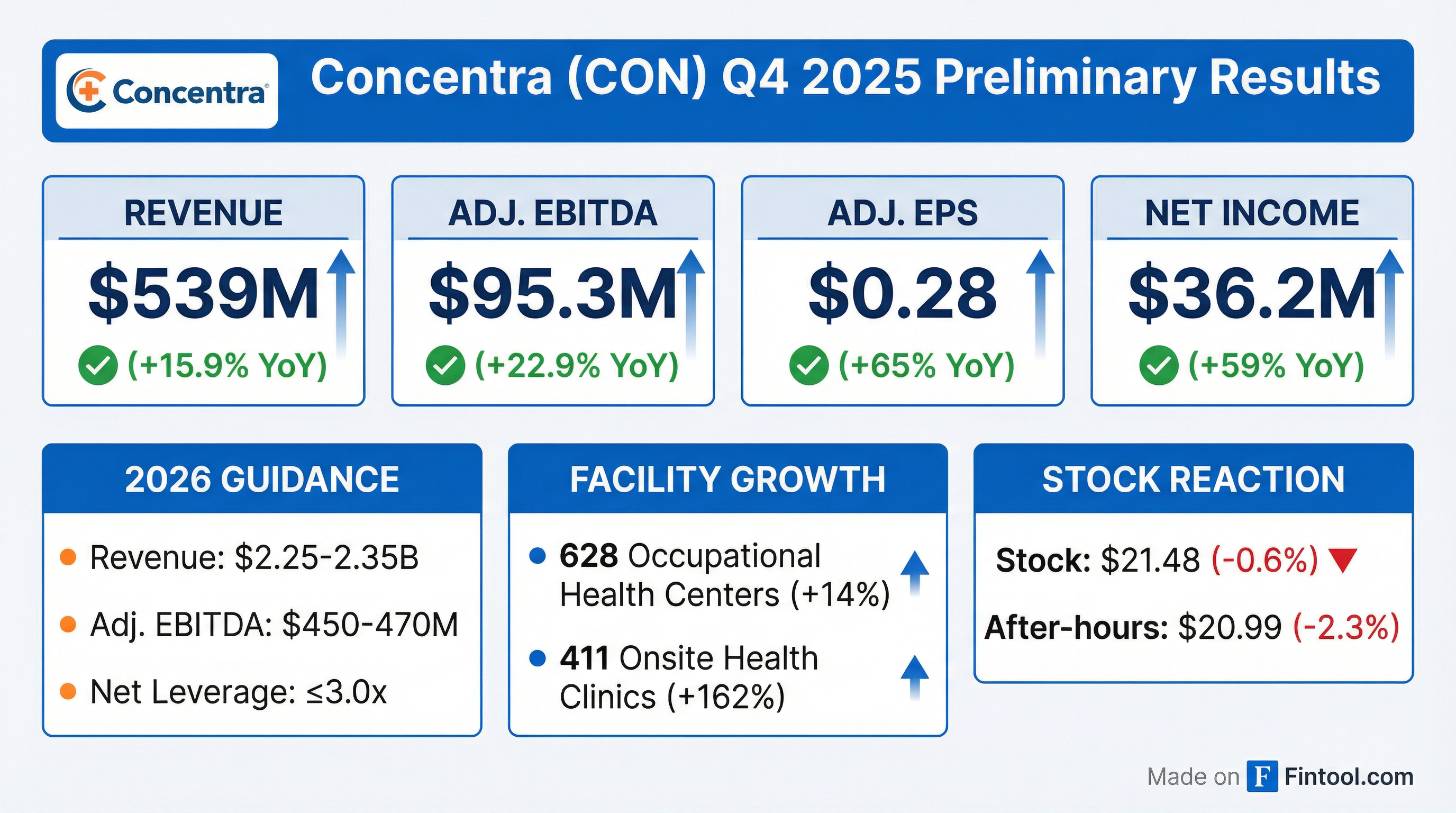

Concentra Group Holdings (NYSE: CON), the nation's largest provider of occupational health services, released preliminary Q4 2025 results that exceeded full-year guidance across all metrics . Revenue surged 15.9% to $539.1M while Adjusted EBITDA jumped 22.9% to $95.3M, demonstrating the company's ability to drive both top-line growth and margin expansion in its first full year as a public company .

Did Concentra Beat Earnings?

The short answer: Yes, across the board. Concentra's preliminary Q4 2025 results exceeded prior guidance and showed accelerating momentum :

For full-year 2025, Concentra also exceeded guidance:

Note on EPS: Year-over-year EPS decline reflects the IPO recapitalization in July 2024, not operational weakness. Adjusted EBITDA margin expanded to 20.0% from 19.8% .

What Did Management Guide?

Concentra provided 2026 guidance that implies continued growth, though at a moderated pace:

Guidance assumptions include: low single-digit organic visit growth (excluding Nova), ~3% rate growth, planned de novo openings, and the Reliant acquisition completed January 19, 2026 .

Margins are expected to remain stable at ~20% Adjusted EBITDA margin, demonstrating that Concentra can absorb public company costs while maintaining profitability .

How Did the Stock React?

Concentra stock closed at $21.48, down 0.6% on the day. In after-hours trading following the preliminary results release, shares traded at $20.99, down approximately 2.3% from the close.

Key context:

- IPO price (July 2024): $22.48

- Current price: $21.48 (4.4% below IPO)

- 52-week range: $18.89 - $24.81

- Market cap: ~$2.75B

The muted reaction suggests the market may have been hoping for stronger 2026 guidance, or concerns about the slower growth trajectory compared to 2025's acquisition-fueled expansion.

What Changed From Last Quarter?

Facility expansion accelerated:

- Occupational health centers grew to 628 (+76 YoY) driven by the Nova Medical Centers acquisition and organic de novos

- Onsite health clinics surged to 411 (+254 YoY) following the Pivot Onsite Innovations acquisition

Operational metrics strengthened:

- Total visits per day increased 9.0% to 51,005

- Workers' compensation visits per day grew 9.1%

- Employer services visits per day grew 9.4%

- Revenue per visit expanded 3.1% reflecting rate increases

Capital allocation:

- Repurchased ~1.1 million shares for $22.4M in Q4 2025

- Net leverage improved to 3.4x, targeting ≤3.0x by end of 2026

- Cash balance of $79.9M with $428M undrawn revolver capacity

Key Quotes From Management

Keith Newton, CEO on 2025 performance:

"The 2025 fiscal year was another transformative year for Concentra as we continued to provide superior outcomes and exceptional experience to our patients and customers, all while significantly growing our business. Our excellent performance in 2025 is a testament to our skilled and dedicated colleagues' efforts to improve the health of America's workforce, one patient at a time."

Matt DiCanio, President & CFO on expansion:

"With over 300 locations added in 2025, we continue to elevate industry standards of care and further enhance Concentra's ongoing efforts to deliver our differentiated value proposition across the United States. We are pleased to share our strong preliminary 2025 results, as well as provide our business outlook for 2026."

Segment Performance

Concentra operates through two primary segments:

Occupational Health Centers (~93% of revenue)

- 628 centers across 47 states

- Serves ~200,000 employer customers including 100% of Fortune 100 companies

- Workers' compensation (65% of revenue) and employer services (33%)

- Revenue per visit: $147.42 in FY 2025 (+4.3% YoY)

Onsite Health Clinics (~6% of revenue)

- 411 onsite clinics (nearly 3x since 2023 after Pivot acquisition)

- Cost-plus contract model provides stable margins

- Organic revenue growth >10% in FY 2025 (excluding Pivot)

- Growing pipeline with >$100M of active opportunities

The Bull Case

-

Dominant market position: Concentra is 10x larger than the next pure-play competitor and treats ~1 in 4 U.S. workplace injuries

-

Recurring revenue model: 98% of top 100 customers have been with Concentra for 10+ years

-

Pricing power: Fee schedule rates have grown ~3% CAGR over 10 years, largely tracking inflation

-

Minimal regulatory risk: <1% revenue from government payors, insulating from Medicare/Medicaid policy changes

-

Strong free cash flow: >110% FCF conversion historically, generating $1B+ from 2021-2025

-

Consolidation opportunity: Fragmented market with hundreds of local/regional targets for M&A at <3x EBITDA multiples

Risks to Watch

-

Leverage: Net leverage at 3.4x remains elevated post-Nova acquisition; execution risk on deleveraging path

-

Slowing growth: 2026 guidance implies significant deceleration from 2025's acquisition-fueled growth

-

Economic sensitivity: Workplace injuries correlate with employment levels; recession could pressure volumes

-

Integration risk: Nova and Pivot acquisitions added 300+ locations that require successful integration

-

Labor costs: While stable historically, healthcare labor inflation remains a risk

Capital Allocation Update

Forward Catalysts

Bottom Line

Concentra delivered a strong finish to its first full year as a public company, exceeding guidance with 14% revenue growth and 15% EBITDA growth while maintaining 20% margins. The 2026 outlook suggests moderation to mid-single-digit organic growth as the company focuses on integrating 300+ acquired locations and deleveraging toward 3.0x.

For investors, the key question is whether Concentra can sustain its acquisition-driven growth algorithm while protecting margins and generating the strong free cash flow needed to service its debt load. At ~12x forward EBITDA with a dominant market position and minimal regulatory risk, Concentra offers a differentiated play on workforce health—but the slowing growth trajectory and elevated leverage warrant monitoring.

Preliminary results are unaudited and subject to change. Full results will be released February 26, 2026.