Earnings summaries and quarterly performance for CANADIAN PACIFIC KANSAS CITY LTD/CN.

Research analysts who have asked questions during CANADIAN PACIFIC KANSAS CITY LTD/CN earnings calls.

Fadi Chamoun

BMO Capital Markets

8 questions for CP

Ken Hoexter

BofA Securities

8 questions for CP

Scott Group

Wolfe Research

8 questions for CP

Steven Hansen

Raymond James

8 questions for CP

Walter Spracklin

RBC Capital Markets

8 questions for CP

Brandon Oglenski

Barclays

7 questions for CP

Jonathan Chappell

Evercore ISI

7 questions for CP

Ravi Shanker

Morgan Stanley

7 questions for CP

Brian Ossenbeck

JPMorgan Chase & Co.

6 questions for CP

Christian Wetherbee

Wells Fargo

6 questions for CP

Ariel Rosa

Citigroup

5 questions for CP

Tom Wadewitz

UBS Group

5 questions for CP

Benoit Poirier

Desjardins Capital Markets

4 questions for CP

Konark Gupta

Scotiabank

4 questions for CP

Thomas Wadewitz

UBS

3 questions for CP

Ari Rosa

Citigroup Inc.

2 questions for CP

Brian Offenbach

JPMorgan

2 questions for CP

Chris Wetherbee

Wells Fargo & Company

2 questions for CP

Daniel Imbro

Stephens Inc.

2 questions for CP

David Vernon

Sanford C. Bernstein & Co., LLC

2 questions for CP

Kevin Chiang

CIBC Capital Markets

2 questions for CP

Stephanie Moore

Jefferies

2 questions for CP

Ravi Shankar

Morgan Stanley

1 question for CP

Recent press releases and 8-K filings for CP.

- Canadian Pacific Kansas City (CPKC) set a new January monthly record in January 2026 for shipping Canadian grain and grain products, moving 2.395 million metric tonnes (MMT).

- The company also achieved a new monthly record for carloads in January 2026, with 24,688 carloads.

- These January 2026 records surpassed the previous highs set in January 2023.

- For the first 26 weeks of the 2025-2026 crop year, CPKC shipped over 15.1 MMT of grain and grain products, marking the largest totals since the 2020-2021 crop year.

- Canadian Pacific Kansas City (CPKC) announced Gordon Trafton has been appointed vice-chair of the board, Marc Parent has been appointed to the board effective January 27, 2026, and Kate Stevenson has been nominated for election at the April 2026 Annual General Meeting.

- The company declared a quarterly dividend of $0.228 per share, payable on April 27, 2026, to shareholders of record on March 27, 2026.

- CPKC announced the early renewal of its normal course issuer bid (2026 NCIB), permitting the purchase for cancellation of up to 44,865,624 common shares (approximately 5% of outstanding shares as of January 19, 2026), with the 2025 NCIB having repurchased 37,348,539 common shares at a weighted average price of $105.53.

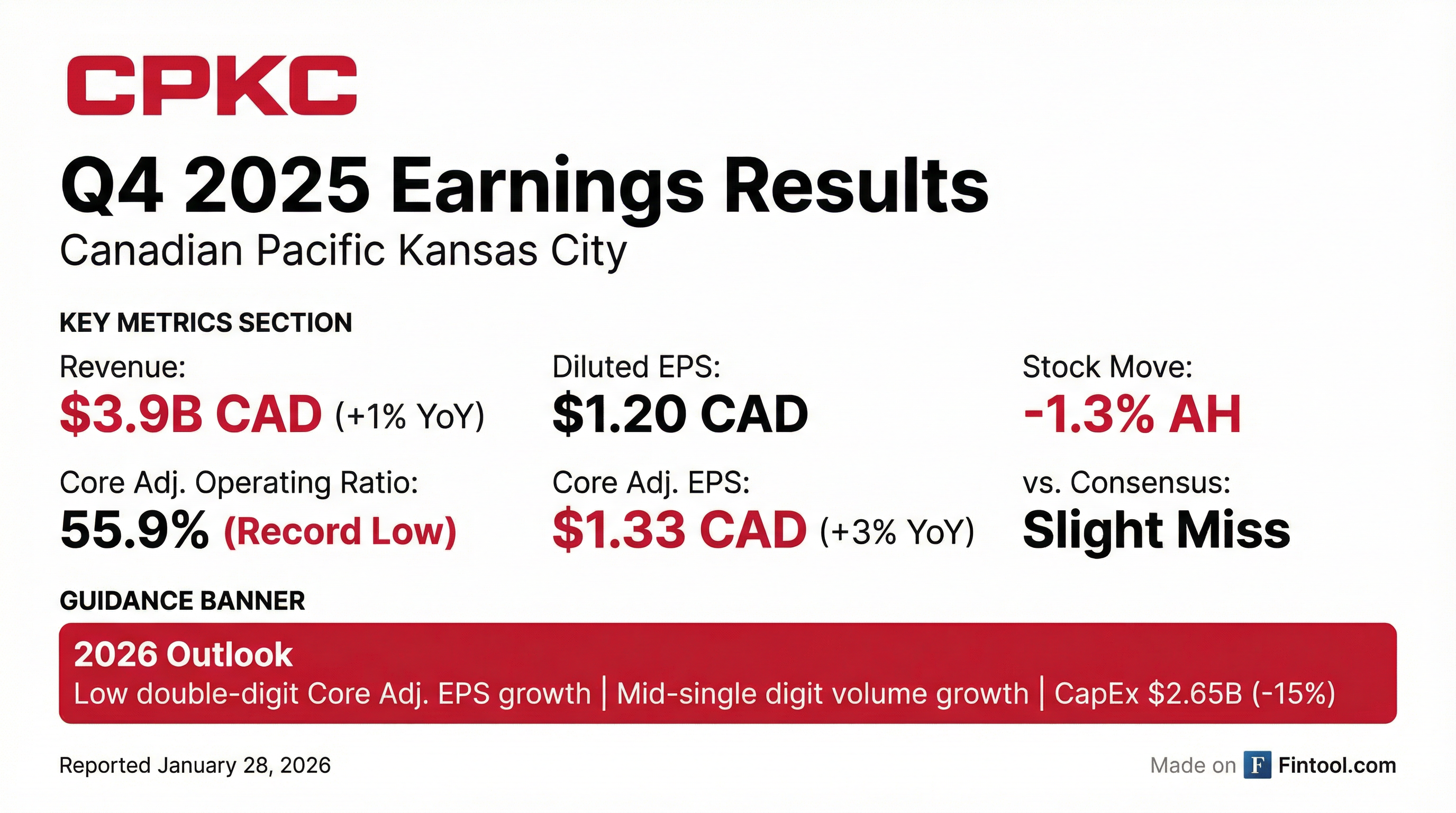

- CPKC reported Q4 2025 revenue of CAD 3.9 billion, an increase of 1% year-over-year, with earnings per share (EPS) of CAD 1.33, up 3%, and an operating ratio of 55.9%. For the full year 2025, revenue reached $15.1 billion, up 4%, and core EPS was $4.61, an 8% increase, with an operating ratio of 59.9%.

- For 2026, the company anticipates mid-single-digit volume growth and low double-digit earnings growth, driven by strong bulk business, record grain harvests, and intermodal expansion.

- CPKC has reduced its 2026 capital outlook by 15% to $2.65 billion and announced a new 5% share repurchase program.

- The company expects to achieve $1.4 billion in synergy targets by the end of 2026, building on a $1.2 billion run rate from 2025.

- Management expects Q1 2026 to be the toughest quarter of the year due to challenging comparisons and weather impacts, with momentum projected to build in Q2 and Q3.

- CPKC reported Q4 2025 revenue of CAD 3.9 billion, an increase of 1% year-over-year, with a core adjusted operating ratio of 55.9% and core adjusted diluted EPS of $1.33, up 3%. For the full year 2025, revenue reached $15.1 billion, a 4% increase, with a core adjusted operating ratio of 59.9% and core adjusted diluted EPS of $4.61, up 8.8%.

- For 2026, the company expects to achieve mid-single-digit volume growth and low double-digit earnings growth, alongside continued margin improvement.

- CPKC announced a new 5% share repurchase program for 2026 and reduced its capital outlook by 15% to $2.65 billion.

- Key operational drivers for 2026 include a record grain harvest in Canada and the US, continued expansion of intermodal services like MMX (up approximately 40% year-over-year), and the addition of 100 new locomotives.

- CPKC reported Q4 2025 revenue of CAD 3.9 billion, up 1%, with an operating ratio of 55.9% and EPS of CAD 1.33, up 3%. For the full year 2025, revenue was CAD 15.1 billion, up 4%, with a core operating ratio of 59.9% and core EPS of CAD 4.61, up 8%.

- For 2026, CPKC expects to deliver mid-single-digit volume growth and low double-digit earnings growth, driven by a record grain harvest in Canada and the U.S., and continued intermodal expansion.

- The company announced a new 5% share buyback program for 2026 and reduced its capital outlook by 15% to CAD 2.65 billion.

- Operational performance in 2025 saw the network become 13% faster and locomotive productivity 13% higher compared to 2023, with 100 new locomotives added in 2025 and another 100 planned for 2026.

- CPKC reported Q4 2025 revenues of $3.9 billion and full-year 2025 revenues of $15.1 billion, representing a one percent increase for the quarter and a four percent increase for the full year.

- For Q4 2025, diluted earnings per share (EPS) was $1.20 and core adjusted diluted EPS was $1.33. Full-year 2025 reported diluted EPS of $4.51 and core adjusted diluted EPS of $4.61.

- The company achieved a record core adjusted operating ratio of 55.9 percent in Q4 2025 and 59.9 percent for the full year 2025.

- CPKC provided 2026 guidance including low double-digit core adjusted diluted EPS growth, mid-single digit volume growth, and capital expenditures of $2.65 billion, which is a reduction of approximately 15% from 2025.

- Canadian Pacific Kansas City (CPKC) reported Q4 2025 revenues of $3.9 billion, a one percent increase, and full-year 2025 revenues of $15.1 billion, up four percent from 2024.

- For Q4 2025, diluted EPS was $1.20, while core adjusted diluted EPS increased three percent to $1.33. Full-year 2025 diluted EPS was $4.51, and core adjusted diluted EPS increased eight percent to $4.61.

- The company achieved a record reported operating ratio of 58.9 percent in Q4 2025 and a record-low core adjusted operating ratio of 59.9 percent for the full year 2025.

- CPKC projects low double-digit core adjusted diluted EPS growth for full-year 2026, along with mid-single digit volume growth and capital expenditures of $2.65 billion.

- The company repurchased $3,942 million in Common Shares for the year ended December 31, 2025.

- Canadian Pacific Kansas City (CPKC) expects to achieve double-digit earnings for the current year (2025) and anticipates mid-single-digit RTM growth with 1-1.5 points of margin improvement in 2026. Multi-year EPS growth could reach 15% or better if the macro environment improves.

- The company projects revenue synergies to reach $1.1 billion by the end of 2025 and an additional $250 million-$300 million in 2026, totaling approximately $1.4 billion.

- Capital expenditures are projected to decrease in 2026 to a long-term target of $2.6 billion-$2.8 billion, enabling increased shareholder returns through a rising dividend payout ratio (targeting 20%-30%) and potential share buybacks.

- Regarding potential industry consolidation, CPKC believes any approval of a UP/NS merger would necessitate significant concessions, which could open new markets and provide benefits to CPKC.

- CPKC anticipates mid-single digit RTM growth for Q4 2025, contributing to approximately 4.5% RTM growth for the full year 2025, with expectations for continued mid-single digit RTM growth and 1 to 1.5 points of margin improvement in 2026.

- The company projects achieving an exit rate of $1.1 billion in revenue synergies for 2025, with an additional $250 million to $300 million expected in 2026, bringing the total to approximately $1.4 billion by the end of 2026.

- Capital expenditures are expected to step down in 2026 to a range of $2.6 billion to $2.8 billion, aligning with long-term targets, and the company plans to increase its dividend payout ratio towards 20%-30% while considering share buybacks.

- CPKC generated approximately $460 million in new annualized revenue in 2025 from increased trade between Canada and Mexico, driven by diversification efforts.

- CPKC anticipates ending the year with double-digit EPS growth, continuing the trend from the previous year, and expects to finish the year strong with 5% RTM volume growth for the year, with November volumes up 7%.

- The company expects to achieve approximately $1.1 billion in revenue synergies for 2025 and projects an additional $200 million-$250 million in synergies for 2026, noting they are in the "mid to probably in the sixth inning or so, seventh inning" of revenue synergy realization.

- Capital expenditure for 2025 is projected to be the highest in company history at CAD 2.9 billion, with a reduction expected to CAD 2.8 billion in 2026, shifting focus from network projects to rolling stock like locomotives.

- CPKC plans to continue its shareholder return approach, having increased its dividend by 20% and repurchased 4% of its outstanding float this year, with an expectation to prioritize share buybacks (around 4% annually) over dividends at current stock price levels.

Quarterly earnings call transcripts for CANADIAN PACIFIC KANSAS CITY LTD/CN.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more