Earnings summaries and quarterly performance for CANADIAN PACIFIC KANSAS CITY LTD/CN.

Research analysts who have asked questions during CANADIAN PACIFIC KANSAS CITY LTD/CN earnings calls.

Fadi Chamoun

BMO Capital Markets

8 questions for CP

Ken Hoexter

BofA Securities

8 questions for CP

Scott Group

Wolfe Research

8 questions for CP

Steven Hansen

Raymond James

8 questions for CP

Walter Spracklin

RBC Capital Markets

8 questions for CP

Brandon Oglenski

Barclays

7 questions for CP

Jonathan Chappell

Evercore ISI

7 questions for CP

Ravi Shanker

Morgan Stanley

7 questions for CP

Brian Ossenbeck

JPMorgan Chase & Co.

6 questions for CP

Christian Wetherbee

Wells Fargo

6 questions for CP

Ariel Rosa

Citigroup

5 questions for CP

Tom Wadewitz

UBS Group

5 questions for CP

Benoit Poirier

Desjardins Capital Markets

4 questions for CP

Konark Gupta

Scotiabank

4 questions for CP

Thomas Wadewitz

UBS

3 questions for CP

Ari Rosa

Citigroup Inc.

2 questions for CP

Brian Offenbach

JPMorgan

2 questions for CP

Chris Wetherbee

Wells Fargo & Company

2 questions for CP

Daniel Imbro

Stephens Inc.

2 questions for CP

David Vernon

Sanford C. Bernstein & Co., LLC

2 questions for CP

Kevin Chiang

CIBC Capital Markets

2 questions for CP

Stephanie Moore

Jefferies

2 questions for CP

Ravi Shankar

Morgan Stanley

1 question for CP

Recent press releases and 8-K filings for CP.

- On March 6, 2026, Canadian Pacific Railway Company, a wholly-owned subsidiary of Canadian Pacific Kansas City Limited, completed an offering of U.S.$1.2 billion in notes.

- The offering consisted of U.S.$600,000,000 aggregate principal amount of 4.000% notes due 2029 and U.S.$600,000,000 aggregate principal amount of 5.500% notes due 2056.

- These notes are fully and unconditionally guaranteed by the parent company, Canadian Pacific Kansas City Limited.

- The 2029 Notes were sold at 99.422% of their principal amount, and the 2056 Notes were sold at 98.137% of their principal amount.

- Canadian Pacific Kansas City Limited (CPKC) announced a US $1.2 billion debt offering through its wholly-owned subsidiary, Canadian Pacific Railway Company.

- The offering consists of US $600 million of 4.000% Notes due 2029 and US $600 million of 5.500% Notes due 2056, which will be guaranteed by CPKC.

- The net proceeds from this offering will be used primarily for refinancing outstanding indebtedness and for general corporate purposes.

- The offering is expected to close on March 6, 2026.

- Canadian Pacific Kansas City Limited (CPKC) announced a US $1.2 billion debt offering through its wholly-owned subsidiary, Canadian Pacific Railway Company.

- The offering includes US $600 million of 4.000% Notes due 2029 and US $600 million of 5.500% Notes due 2056, both guaranteed by CPKC.

- The offering is expected to close on March 6, 2026, with net proceeds primarily for refinancing outstanding indebtedness and general corporate purposes.

- Canadian Pacific Kansas City (CPKC) set new February monthly records in February 2026 for transporting Canadian grain and grain products, moving 2.232 million metric tonnes (MMT) and 23,088 carloads.

- This follows a new January monthly Canadian grain record in January 2026, with 2.395 MMT moved.

- Through the first 30 weeks of the 2025-2026 crop year, CPKC transported over 17.1 MMT of Canadian grain and grain products, marking the largest totals since the 2020-2021 crop year.

- In February 2026, the CPKC network also achieved a February carload and monthly tonnage record for total grain moved in Canada and the United States, with 46,896 carloads and approximately 4.501 MMT transported.

- CPKC's President and CEO, Keith Creel, expressed strong opposition to the proposed Union Pacific (UP) and Norfolk Southern (NS) merger, citing concerns about unnecessary consolidation and anti-competitive behavior, and stating that the deal, as presented, does not enhance competition. He noted that less than 1% of CPKC's revenue would be directly exposed to the competitive dynamic of the combined entity.

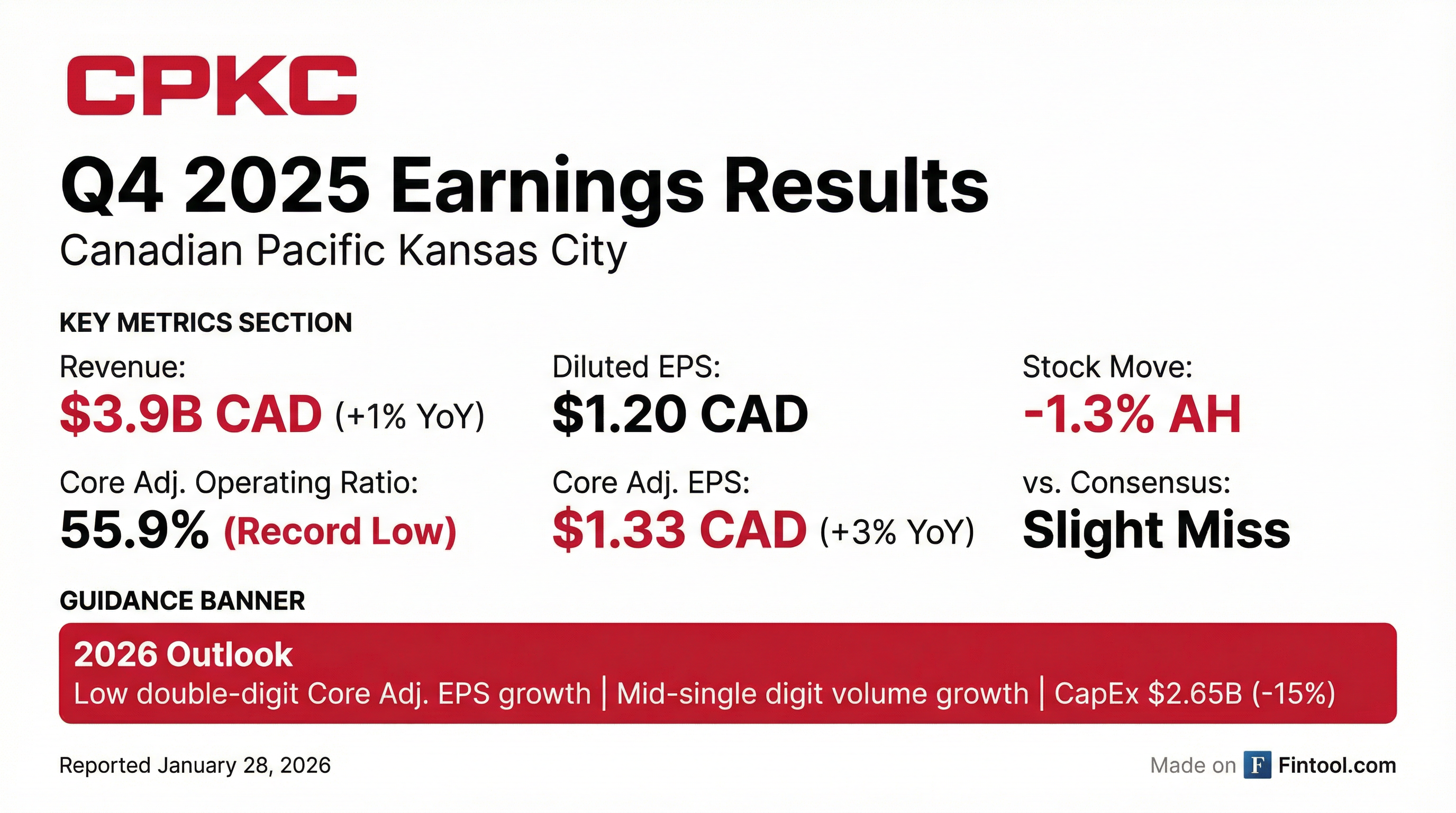

- The company provided a positive business outlook, guiding for double-digit EPS growth and mid-single-digit RTM growth for the year. Despite a slow start in January, February saw an 11% increase month-to-date, bringing the quarter to plus 2.3%.

- CPKC expects to add another $200 million in new revenue synergies this year, building on the $1.2 billion achieved last year from its own merger.

- Capital priorities have shifted, with the capital budget for this year set at $2.6 billion-$2.7 billion, representing a 15% decline year-on-year. This is expected to produce more free cash flow, supporting the 5% share buyback program announced in January.

- Canadian Pacific Kansas City (CPKC) projects double-digit EPS growth and mid-single-digit RTM growth for 2026, driven by a record grain harvest, strong demand on the Chicago-Mexico corridor, and an expected $200 million in new revenue synergies this year from its merger.

- The company's 2026 capital budget is set at $2.6 billion-$2.7 billion, representing a 15% decline year-on-year, and it initiated a 5% share buyback program in January.

- CPKC views the proposed UP Norfolk Southern merger with concern regarding unnecessary consolidation and potential anti-competitive behavior, anticipating significant concessions if the deal proceeds, though their direct revenue exposure to the combined entity is less than 1%.

- Despite a $200 million impact from tariffs in the prior year, CPKC expects to benefit from increased trade between the US, Canada, and Mexico, especially as USMCA renegotiations conclude, with 18% of its revenue currently derived from US-Mexico trade.

- Canadian Pacific Kansas City (CP) anticipates low single-digit positive RTM growth for Q1 2026, with expectations to gain momentum in Q2 and achieve mid-single-digit RTM growth for the full year 2026, which is projected to drive double-digit earnings and operating margin improvement.

- The company has reduced its CapEx target to a sustainable CAD 2.6 billion-CAD 2.7 billion for the next couple of years, following significant network investments, and plans to return capital to shareholders through an upsized buyback of 5% of the stock this year.

- CP remains confident in its target of double-digit core adjusted EPS growth through 2028, with a normalized macro environment potentially leading to stronger growth.

- Growth is being driven by a record grain harvest, strong international intermodal demand, and new initiatives like Americold, which is expected to reach 600 loads per week by mid-2026, and the SMX (Southeast Mexico Express) product, offering competitive transit times to Mexico.

- CP has increased its revenue synergy target from CAD 1 billion to CAD 1.5 billion, with CAD 1.2 billion realized by the end of 2025 and an additional CAD 200 million expected in 2026. The company also stated that if the UP-NS deal is approved, further rail industry consolidation would be inevitable.

- CPKC finished Q4 with strong operating momentum and achieved best-ever operating metrics for Q1, expecting low single-digit positive RTMs for Q1 2026, with momentum anticipated to continue into Q2.

- The company has increased its revenue synergy target from CAD 1 billion to CAD 1.5 billion, with CAD 1.2 billion expected by the end of 2025 and an additional CAD 200 million in 2026.

- CPKC is well-positioned for growth with significant latent capacity, including a second bridge into/out of Mexico and the purchase of another 100 locomotives in 2026, and projects double-digit core adjusted EPS growth through 2028 with a normalized macro.

- Capital spending is projected to decrease to CAD 2.6 billion-CAD 2.7 billion for the next couple of years, and the company has upsized its share buyback to 5% of stock this year.

- CPKC anticipates finishing Q1 2026 with low single-digit positive RTMs, expecting to gain momentum into Q2, supported by a record grain harvest and new initiatives like the SMX product. The company projects single-digit RTM growth to drive double-digit earnings and operating margin improvement.

- The company has increased its revenue synergy target to CAD 1.5 billion, with CAD 1.2 billion realized by the end of 2025 and an additional CAD 200 million expected in 2026.

- CPKC has reduced its CapEx target by 15%, aiming for a sustainable level of CAD 2.6 billion-CAD 2.7 billion for the next few years, and has upsized its share buyback to 5% of stock. The network possesses significant latent capacity, enabling growth at 60-70% incremental margins.

- Canadian Pacific Kansas City (CPKC) set a new January monthly record in January 2026 for shipping Canadian grain and grain products, moving 2.395 million metric tonnes (MMT).

- The company also achieved a new monthly record for carloads in January 2026, with 24,688 carloads.

- These January 2026 records surpassed the previous highs set in January 2023.

- For the first 26 weeks of the 2025-2026 crop year, CPKC shipped over 15.1 MMT of grain and grain products, marking the largest totals since the 2020-2021 crop year.

Quarterly earnings call transcripts for CANADIAN PACIFIC KANSAS CITY LTD/CN.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more