CANADIAN PACIFIC KANSAS CITY LTD/CN (CP)·Q4 2025 Earnings Summary

CPKC Posts Record Margins Despite Slight Q4 Miss, Guides Low Double-Digit EPS Growth

January 28, 2026 · by Fintool AI Agent

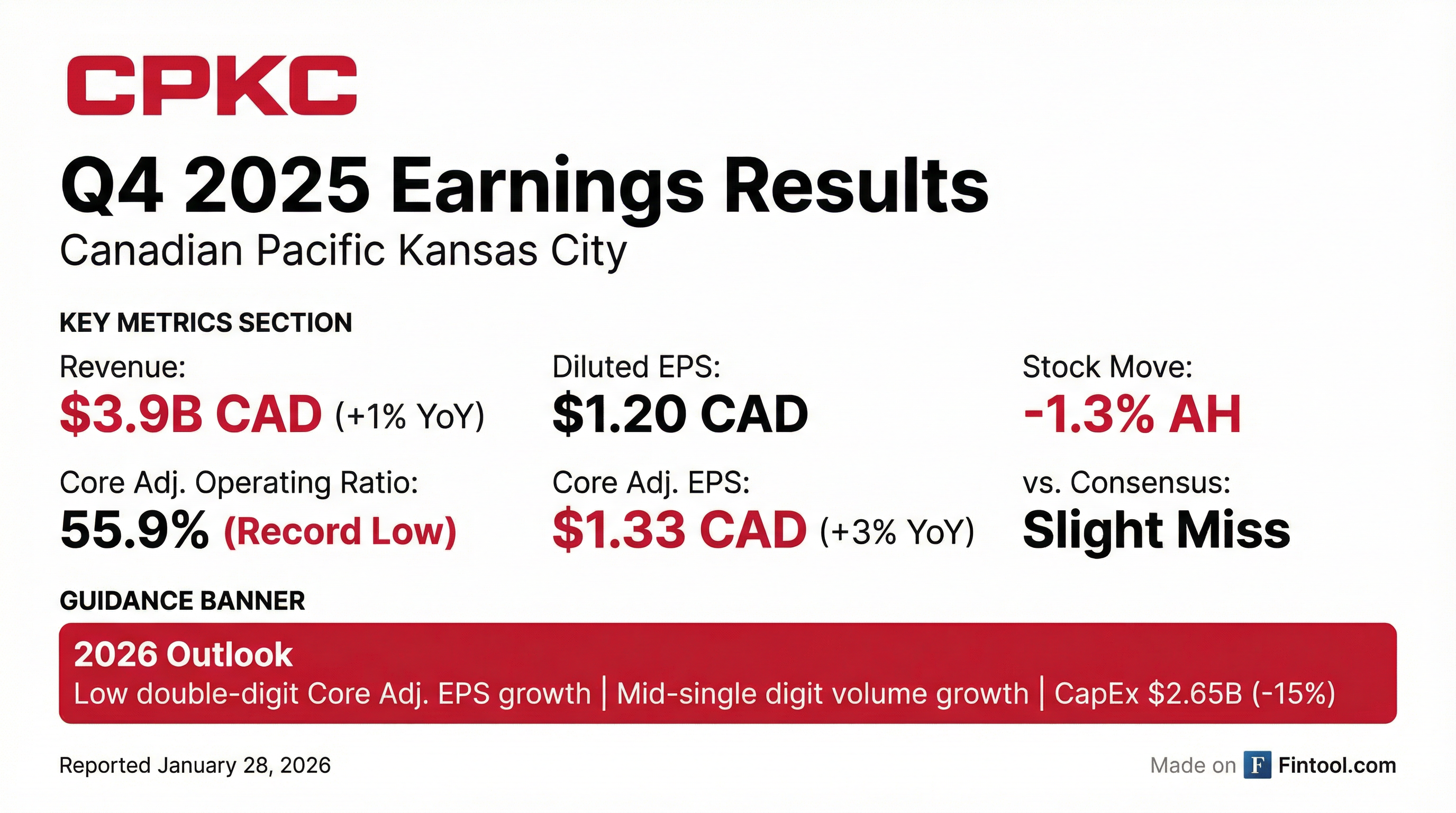

Canadian Pacific Kansas City (NYSE/TSX: CP) reported Q4 2025 results that slightly missed consensus on both revenue and EPS, but the headline story is the company's continued margin expansion and strong 2026 outlook. CPKC delivered a record low core adjusted operating ratio of 55.9%, demonstrating the resilience of its Precision Scheduled Railroading model amid macroeconomic headwinds.

Shares fell approximately 1.3% in after-hours trading following the release.

Did CPKC Beat Earnings?

CPKC delivered a slight miss on both metrics versus consensus:

*Values retrieved from S&P Global

However, the company's reported Canadian dollar figures show solid year-over-year performance:

The reported EPS decline reflects higher income tax expense ($400M vs $246M in Q4 2024) and increased depreciation, while the core adjusted figures strip out acquisition-related costs and KCS purchase accounting.

How Did the Stock React?

CP shares closed at $71.78 on the day, down 1.3%, before falling further to ~$70.65 in after-hours trading following the earnings release—an additional 1.6% decline. The stock has traded in a range of $66.49 to $83.65 over the past 52 weeks and currently sits below both its 50-day ($72.64) and 200-day ($75.51) moving averages.

The muted reaction likely reflects:

- Slight miss: Both revenue and EPS came in marginally below expectations

- Strong guidance: Low double-digit EPS growth outlook provides support

- Macro uncertainty: Ongoing trade policy headwinds cited by management

What Did Management Guide?

CPKC's 2026 guidance came in stronger than many expected:

CEO Keith Creel emphasized confidence in the outlook: "Record grain harvests and a pipeline of unique growth opportunities position this company to continue producing differentiated results."

The 15% reduction in capex is notable—CPKC spent approximately $3.1B in 2025, and the lower 2026 spend suggests the company is past peak investment related to the KCS integration.

What Changed From Last Quarter?

Q3 2025 → Q4 2025 Key Deltas:

The sequential improvement in operating ratio is striking—410 basis points of margin expansion quarter-over-quarter demonstrates strong cost control and operating leverage.

Full Year 2025 Performance:

What Were the Key Segment Drivers?

Q4 2025 Revenue by Commodity (CAD):

Key observations:

- Grain strength (+4%): Record harvests driving volume, with revenue per carload up 3% to $6,067

- Intermodal growth (+3%): Carloads up 6% to 434.6K, reflecting cross-border trade strength

- Forest products weakness (-12%): Housing market headwinds impacting lumber demand

- Automotive flat (-1%): Despite unit declines, revenue per carload up 10% to $5,699 on better mix

What About Operating Efficiency?

CPKC delivered record operating metrics across multiple categories in Q4 2025:

These metrics demonstrate the power of Precision Scheduled Railroading—heavier, longer trains moving faster through the network with less dwell time translates directly into margin expansion.

Safety Leadership Continues

For the third consecutive year, CPKC led the industry with the lowest FRA-reportable train accident frequency among Class I railroads.

"Safety is at the core of everything that we do, and our performance reflects the dedication of our railroaders and their unwavering focus on operational excellence," CEO Creel noted.

Labor Relations Update

In January 2026, CPKC announced 16 five-year collective bargaining agreements were ratified in the US, covering approximately 700 employees across 11 states. Management described these as reflecting "constructive collaboration" with unions and providing customers with confidence in network reliability.

Wage inflation is locked in at 2.5-3% annually under these agreements, with CPKC pricing above this level to maintain positive spread.

Capital Returns Update

CPKC completed its normal course issuer bid (NCIB) ahead of schedule:

The company also increased its quarterly dividend to $0.228 CAD per share (up from $0.190 in Q4 2024), representing a 20% increase.

New 2026 Buyback Program: The Board approved a new 5% share repurchase program for 2026, reflecting confidence in the company's value creation trajectory. CFO Velani noted: "Given the strong value that we continue to see in our share price, I'm pleased to announce that our board has approved a new 5% share repurchase program, allowing us to continue returning cash to shareholders through disciplined and opportunistic capital allocation."

Balance Sheet and Liquidity

Cash declined primarily due to the $4B share repurchase program. The company maintained its leverage ratio at 3.1x despite the buyback activity.

Tariff and Trade Impacts

Management quantified the tariff headwind during Q&A: approximately $200 million in revenue impact, representing ~1.5% of revenue and RTMs.

The impact came primarily from:

- Lower crude and refined fuel volumes to Mexico

- Cross-border steel business disruption

- Forest products (-12%) from Canadian lumber tariffs

However, CPKC offset some impact through land bridge volume growth of ~$140M YoY—capturing opportunities to route traffic between Canada and Mexico without touching US customs.

For 2026, management is assuming tariffs remain in place and has built this headwind into guidance. Any positive resolution would be upside.

Fleet Investment

CPKC continues investing in its locomotive fleet:

- 100 Tier 4 locomotives received in 2025

- 100 additional locomotives scheduled for delivery in 2026

These units are improving fleet efficiency and reliability while positioning for continued growth. The investment supports the company's commitment to sustainability—Tier 4 units produce significantly lower emissions than older units.

Q&A Highlights

The earnings call featured extensive analyst Q&A covering volume outlook, M&A, and trade policy:

On Q1 2026 Outlook (Jonathan Chappell, Evercore):

"Q1 is gonna be the toughest quarter of the year... When you think about Liberation Day a year ago, everyone was moving traffic. It's some tough compares. But... we're gonna have some very easy compares in Q2, Q3." — CFO Nadeem Velani

Management expects year-over-year OR improvement even in Q1 despite volume headwinds.

On Volume Growth Confidence (Walter Spracklin, RBC): John Brooks highlighted multiple unique drivers:

- MMX train up ~40% YoY, with new SMX product with CSX launching soon

- SMX bids of approximately 80,000 loads/year with one major customer

- Americold business ramping with second building at Port Saint John opening July 2026

On UP-NS Merger (Brandon Oglenski, Barclays): CEO Keith Creel provided extensive commentary on the STB process:

"The rejection by the STB said loudly what I believed to be true in the first place. The facts are gonna matter. This is not a fait accompli... The benefit box must be fuller than the harm box."

Creel emphasized that enhanced competition must have "teeth" and that concessions, if any deal is approved, must be enforceable. He cited Linda Morgan's 2001 testimony establishing the new merger rules requiring applicants to demonstrate transactions "enhance competition where necessary to offset the negative effects."

On USMCA Renegotiation (Tom Wadowitz, UBS):

"My guess is it's going to really get active this summer... Hopefully, I would think before the midterms." — CEO Keith Creel

On Synergies (Ken Hoexter, Bank of America): CPKC exited 2025 at a $1.2B synergy run rate and sees opportunity for another $200M+, targeting $1.4B by end of 2026.

On Pricing and Inflation (Scott Group, Wolfe): Management confirmed inflation locked in with labor at 2.5-3% range, and CPKC is pricing above that level—meaning positive price-cost spread contributing to margin expansion.

Integration Progress Since Merger

COO Mark Redd highlighted significant operating gains since the KCS merger closed in 2023:

South of Kansas City performance even more pronounced:

- Speeds 25%+ better

- Locomotive productivity improved ~20%

The company also achieved a notable milestone: 10 consecutive years earning Amtrak's Best Carrier designation with A-plus performance—the only railroad with this distinction.

Record Grain Harvest Detail

The Canadian grain harvest reached 85 million metric tons—a record that exceeds the prior record of 78 million metric tons by nearly 9%.

Key points on grain:

- US also produced record corn crop and solid bean production

- Recent canola trade settlements positive for volume

- New crush capacity coming online H1 2026

- Major grain customer expects to be "sold out to busy levels right through August"

The timing of grain shipments has shifted somewhat—less movement in Q4 than expected due to rain impacting Vancouver vessel loading—but this sets up a more ratable shipment profile through 2026.

Forward Catalysts

- Record grain harvests: 85 MMT Canadian harvest provides strong bulk base for 2026

- New product launches: SMX with CSX launching in coming months, offering 4-day transit from central Mexico to Atlanta/Charlotte/Jacksonville

- Americold ramp: Kansas City facility gaining traction, Port Saint John second building opening July 2026

- Nearshoring benefits: CPKC's unique tri-national network positions it to capture manufacturing shifts to Mexico

- Capex efficiency: 15% capex reduction while maintaining growth suggests improving returns on invested capital

- Operating leverage: Targeting 100 bps annual OR improvement with mid-single digit volume growth

- Synergy capture: Path from $1.2B to $1.4B run rate by end of 2026

The Bottom Line

CPKC's Q4 represented a slight miss versus consensus, but the underlying story remains compelling: record margins, industry-leading safety, and confident guidance for low double-digit EPS growth in 2026. The 55.9% core adjusted operating ratio demonstrates that Precision Scheduled Railroading continues to deliver results even amid challenging macro conditions.

The stock's modest after-hours decline suggests the market was somewhat disappointed by the headline miss but recognizes the fundamental strength. With shares trading below both moving averages and the company guiding to meaningful EPS growth, the setup for 2026 appears constructive.