Crane (CR)·Q4 2025 Earnings Summary

Crane Company Posts Record Year, Beats Q4, and Unveils CEO Transition

January 27, 2026 · by Fintool AI Agent

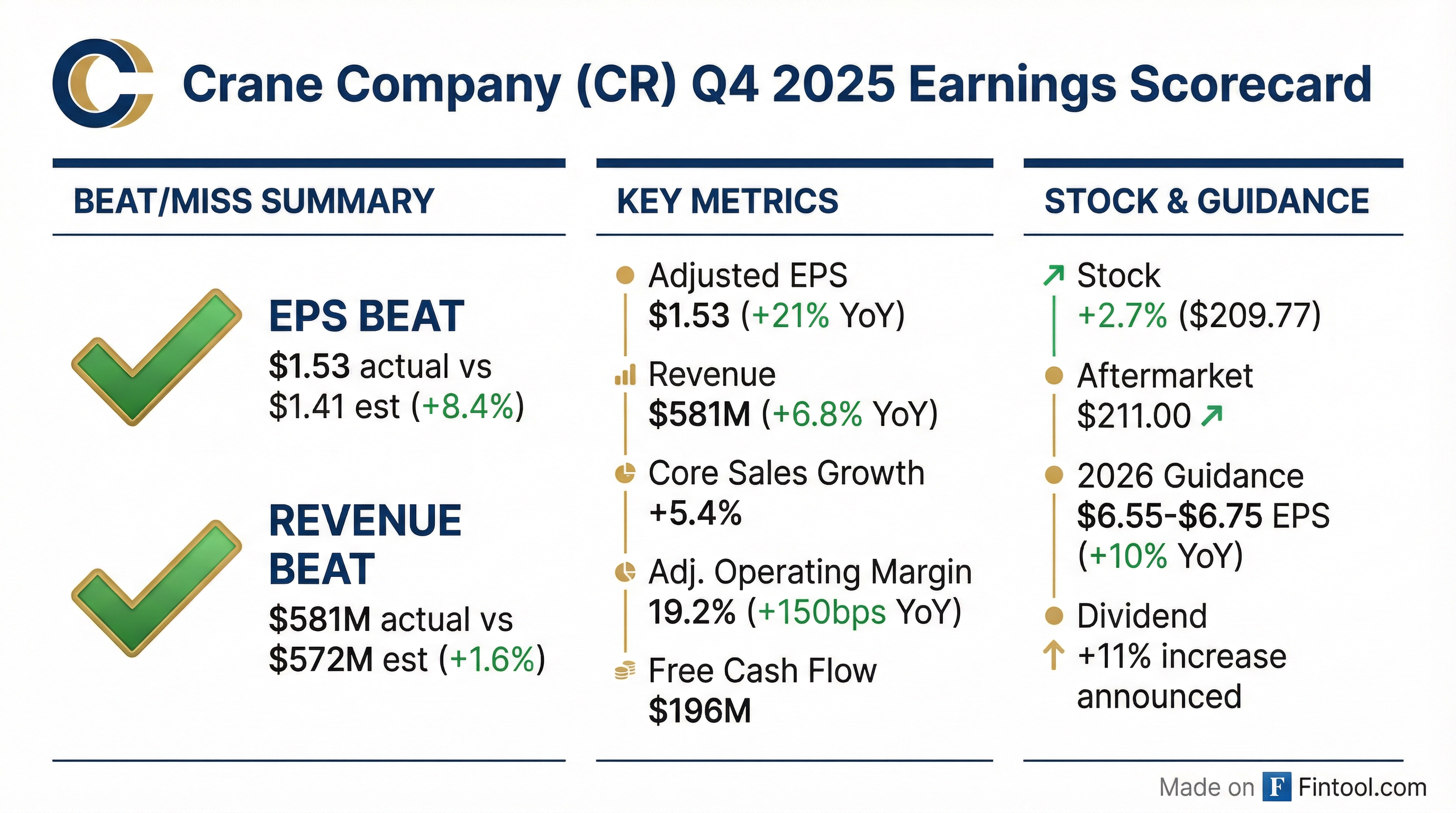

Crane Company (NYSE: CR) delivered another beat-and-raise quarter, posting Q4 2025 adjusted EPS of $1.53, up 21% year-over-year and 8.4% above consensus . Revenue of $581.0 million grew 6.8% driven by 5.4% core sales growth . The company completed a record 2025 with adjusted EPS up 24% for the full year, announced two strategic acquisitions, and unveiled a CEO succession plan.

Did Crane Company Beat Earnings?

Yes — this marks the eighth consecutive quarterly beat. Crane's execution continues to outpace expectations:

The beat was driven by productivity gains, favorable pricing net of inflation, and strength in aerospace and defense end markets . Adjusted EBITDA margin expanded to 21.3%, up from 19.8% a year ago .

Full-year 2025 highlights :

- Adjusted EPS: $6.05, +24% year-over-year

- Revenue: $2.305 billion, +8.2%

- Adjusted Free Cash Flow Conversion: 102%

- Order Backlog: $1.44 billion, +16% year-over-year

How Did the Stock React?

CR shares rose +2.7% to $209.77 on the news, with aftermarket trading at $211.00 — approaching the 52-week high of $214.31. The stock has gained 65% over the past year, significantly outperforming the industrial sector.

The positive reaction reflects:

- The EPS beat extending the win streak to 8 quarters

- 2026 guidance above consensus

- Strategic acquisitions adding growth runway

- Smooth CEO transition signaling continuity

What Did Management Guide?

Crane initiated 2026 adjusted EPS guidance of $6.55-$6.75, representing 10% growth at the midpoint . This is meaningfully above street consensus of ~$6.17.

Important accounting change: Beginning in 2026, Crane is excluding non-cash acquisition-related intangible amortization from adjusted EPS to improve comparability with peers . The 10% growth figure is calculated excluding both the $0.16 one-time insurance recovery benefit in 2025 and intangible amortization in both years .

Key commentary from CEO Max Mitchell :

"For 2026, our guidance is consistent with our established investment thesis grounded in consistent 4% to 6% core sales growth leveraging at 35% to 40%, with disciplined capital deployment creating additional upside over time. We expect that Aerospace & Advanced Technologies will continue to outperform the market."

The guide assumes initial margin dilution from acquisitions in 2026, with "substantial upside from growth of the acquired businesses, synergy realization, and deleveraging in 2027 and beyond" .

What Changed From Last Quarter?

1. CEO Succession Announced

The biggest news beyond the numbers: Alex Alcala named President & CEO effective April 27, 2026 . Max Mitchell will become Executive Chairman "for a transitionary period, expected to be no more than two years" .

Alcala joined Crane in 2013 and has served as EVP & COO, having "literally traveled more than a million miles" as part of Crane's transformation . On the call, Mitchell praised Alcala's "deep operational expertise, proven ability to develop and execute complex strategic initiatives, and unwavering commitment to our high-performance culture" as critical in shaping Crane into its current market position .

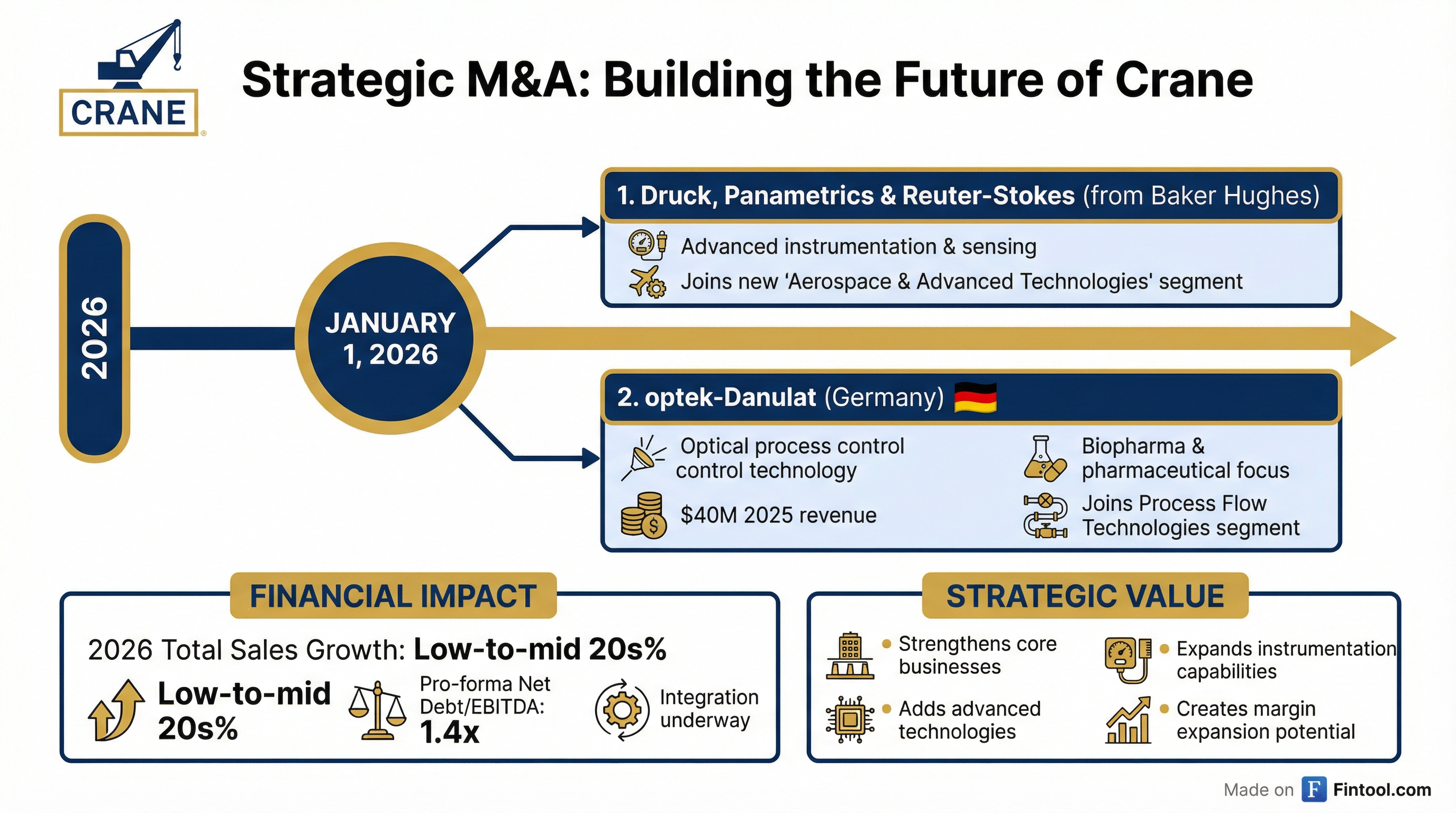

2. Two Acquisitions Completed January 1, 2026

Crane closed two deals on January 1, 2026 :

Druck, Panametrics & Reuter-Stokes (from Baker Hughes)

- Druck: Pressure sensing for aircraft engine monitoring, hydraulics, and ground-based test equipment; joins AAT under SVP Jay Higgs

- Panametrics: Ultrasonic flow meters and moisture analyzers for LNG, cryogenics, wastewater; standalone unit in PFT under SVP Shangaza Dasent

- Reuter-Stokes: Radiation sensing for nuclear plants and homeland security; doubles Crane's nuclear business under Chris Mitchell

optek-Danulat (Germany)

- Inline process control optical measurement solutions

- Serves biopharma, pharmaceutical, and demanding markets

- Generated ~$40M revenue in 2025

- Joins Process Flow Technologies segment

The company now has completed six acquisitions since separation in April 2023 .

3. Segment Renamed to Reflect Evolution

"Aerospace & Electronics" is now "Aerospace & Advanced Technologies" to reflect:

- Capabilities added from the Druck acquisition

- Continued focus on differentiated, proprietary technology solutions

- Long-term strategic direction toward near-adjacent markets

4. Dividend Increased 11%

The Board declared a quarterly dividend of $0.255 per share ($1.02 annualized), up 11% from $0.23 . Payable March 11, 2026 to shareholders of record February 27, 2026.

How Did the Segments Perform?

Aerospace & Advanced Technologies

The segment delivered exceptional growth driven by ongoing strength in aerospace and defense end markets . Commercial OEM sales were up 27% and military OEM up 18%; commercial aftermarket rose 3% while military aftermarket declined 3% . Backlog grew 24.5% year-over-year with core orders up 8%, providing strong visibility into 2026 .

Process Flow Technologies

Process Flow Technologies saw sluggish orders in Q4, with core FX neutral backlog down 7% and orders down 3% driven by weaker chemical markets . Management adopted a "cautious view of 2026 demand levels" and expects core growth to be "flat to low single digits" . However, margin expansion of 170bps — driven by productivity and pricing — demonstrates operational discipline even in softer conditions . Core leverage is expected to be 30%-35% for 2026 .

Cash Flow & Balance Sheet

CFO Rich Maue noted the company has "significant financial flexibility for further capital deployment" despite funding the January acquisitions, with leverage at just 1.4x and a "very robust acquisition pipeline" .

What Are the Risks?

-

Process Flow Technologies softness: Q4 orders were sluggish with core sales down 1.5% and backlog declining . Management is guiding cautiously for this segment in 2026.

-

Integration risk: With six acquisitions since separation, execution risk rises. Management expects acquisition contribution to be "largely offset by interest expense" in 2026 .

-

Tariff and macro uncertainty: The forward-looking disclaimer highlights "changes in global economic conditions (including inflationary pressures and new tariffs)" as a key risk .

-

CEO transition: While planned and orderly, leadership changes always carry execution risk. Alcala's track record is strong, but he will be tested in his first year.

Forward Catalysts

- April 27, 2026: Alex Alcala assumes CEO role; first earnings call as CEO (Q1 2026)

- Integration updates: Progress on Druck, Panametrics, Reuter-Stokes, and optek-Danulat

- Synergy realization: Material upside expected from 2027 onward

- Further M&A: Management signaled a "very robust acquisition pipeline"

- Process Flow recovery: Watch for order stabilization as a positive signal

What Happened on the Q&A?

The earnings call Q&A surfaced several important details not in the press release:

Acquisition Integration Off to Strong Start

COO Alex Alcala provided color on the PSI businesses (Druck, Panametrics, Reuter-Stokes): the outlook is "already exceeding our initial expectations" and they are now expected to be slightly accretive to 2026 earnings — better than the original assumption of no first-year accretion .

For the acquired businesses in 2026, Alcala guided: mid-single-digit revenue growth and ~200 basis points of margin improvement, with greater improvement in subsequent years .

On pricing opportunity at Druck specifically, Alcala noted there is "significant opportunity" to improve pricing over 2026-2027 as contracts expire and get renegotiated .

2026 Aerospace Expectations by End Market

Management provided specific growth expectations for the AAT segment :

F-16 Program Update

The F-16 brake control program was delayed by a few months due to flight test timing shifting from January to early Q2 . As a result, 2026 F-16 revenue is expected in the low $20Ms vs. the $30M annual run rate. The annual rate remains unchanged, and recent orders from the USAF and a foreign military customer extend the program's runway .

Nuclear Exposure Doubled

Reuter-Stokes doubles Crane's nuclear exposure. Alcala outlined four growth vectors :

- Restarts — Holtec, Crane Clean Energy Center (formerly Three Mile Island)

- New construction — Strong position with Westinghouse AP1000 reactors in Europe

- Small modular reactors — Partnership with leader building first SMR in Darlington, Canada

- License extensions — Plants extending to 50+ years requiring upgrades

Process Flow by Region

Chemical markets remain bifurcated :

- Americas & Middle East: Saw order growth in 2025; modest growth expected to continue due to feedstock/energy advantages

- Europe, China, Asia Pac: Down in 2025; not expected to recover in 2026

Management is "not planning for a strong uptick" in chemicals but is "ready for it if it happens" .

Quarterly Cadence

CFO Rich Maue guided to a more back-half weighted year :

- Q1 2026: Roughly flat with Q1 2025 due to acquisition integration costs and higher interest expense

- First half: ~45% of full-year earnings

- Second half: ~55% of full-year earnings

The acquired businesses (Druck, Panametrics, Reuter-Stokes) also have seasonal second-half strength historically .

M&A Capacity

On future deals, CFO Maue stated Crane is "comfortable going to 3x [leverage], even strategically going beyond" for the right acquisition, with a path to return to 2x-2.5x within a "short period of time" . The funnel is "strong" with nothing imminent in Q1 but more expected through 2026 .

Key Management Quotes

On the CEO transition — Alex Alcala :

"I'm truly honored to have been appointed the next Chief Executive Officer of Crane. I've been fortunate to be part of the Crane journey for the past 13 years... But I can tell you, I've never been more excited about our future and the progress we will continue to make for our customers, our associates, our communities, and our shareholders."

On strategic direction — Alex Alcala :

"Growing both segments, doubling the size here in the next coming years is our goal, that continues to create shareholder value and also optionality for the future."

On the investment thesis — Max Mitchell :

"4%-6% core sales growth, and we were just at the high end of that last year. 35%-40% core operating leverage and upside from capital deployment. And that's just the baseline. We're always working to over-deliver."

The Bottom Line

Crane Company delivered another strong quarter to cap a record year. The 8.4% EPS beat, 2026 guidance above consensus, and orderly CEO transition provide confidence in the investment thesis. The Q&A revealed acquisition integration is running ahead of plan, with the PSI businesses now expected to be accretive in year one. The key questions for 2026: Can Process Flow Technologies stabilize while management integrates four new businesses? With leverage at 1.4x, significant M&A capacity, and a proven capital deployment playbook, Crane is well-positioned to continue compounding value.

Related: Crane Company Research | Q3 2025 Earnings