Earnings summaries and quarterly performance for Crane.

Executive leadership at Crane.

Max Mitchell

Chief Executive Officer

Alejandro Alcala

Executive Vice President and Chief Operating Officer

Anthony D’Iorio

Executive Vice President, General Counsel and Secretary

Richard Maue

Executive Vice President and Chief Financial Officer

Tamara Polmanteer

Executive Vice President, Chief Human Resources Officer

Board of directors at Crane.

Research analysts who have asked questions during Crane earnings calls.

Justin Ages

CJS Securities

8 questions for CR

Scott Deuschle

Deutsche Bank

7 questions for CR

Jordan Lyonnais

Bank of America

6 questions for CR

Matt Summerville

D.A. Davidson & Co.

6 questions for CR

Damian Karas

UBS

5 questions for CR

Nathan Jones

Stifel, Nicolaus & Company, Incorporated

5 questions for CR

Tony Bancroft

Gabelli Funds

4 questions for CR

Jeffrey Sprague

Vertical Research Partners

3 questions for CR

Nathan Jones

Stifel

3 questions for CR

George Bancroft

Gabelli Funds

2 questions for CR

Greg Nalbandian

Wolfe Research

2 questions for CR

Jeff Sprague

Vertical Research

2 questions for CR

Matt J. Summerville

DA Davidson

2 questions for CR

Adam Farley

Stifel Financial Corp.

1 question for CR

Ahmet Nayirci

UBS

1 question for CR

Amit Mehrotra

UBS

1 question for CR

Ronald Epstein

Bank of America

1 question for CR

Recent press releases and 8-K filings for CR.

- Crane NXT reported full year 2025 sales growth of 11.4% and Adjusted EPS of $4.06.

- For the fourth quarter of 2025, the company achieved sales growth of 19.5% and Adjusted EPS of $1.27.

- The company introduced full year 2026 guidance with Adjusted EPS of $4.10 to $4.40.

- Crane NXT declared a first quarter 2026 dividend of $0.18 per share, representing an increase of approximately 6% over the prior year.

- In 2025, Crane NXT completed the acquisition of De La Rue Authentication Solutions and the first phase of the Antares Vision acquisition, with the latter expected to be completed in 2026.

- Alex has been appointed the next Chief Executive Officer of Crane, with Max continuing as Executive Chairman.

- In Q4 2025, the company reported 5.4% core sales growth and a 16% increase in adjusted operating profit, primarily driven by the Aerospace and Advanced Technologies segment.

- For 2026, the Aerospace and Advanced Technologies segment expects core sales growth at the high end of 7%-9%, while the Process Flow Technologies segment anticipates flat to low single-digit core growth.

- Recent acquisitions (Panametrics, Druck, Reuter-Stokes, and Optek-Danulat) are now expected to be slightly accretive to earnings in 2026. Full-year 2026 interest expense is projected at approximately $58 million, and the tax rate is estimated at 23%. Net leverage was 1.4 times after the Optek-Danulat acquisition.

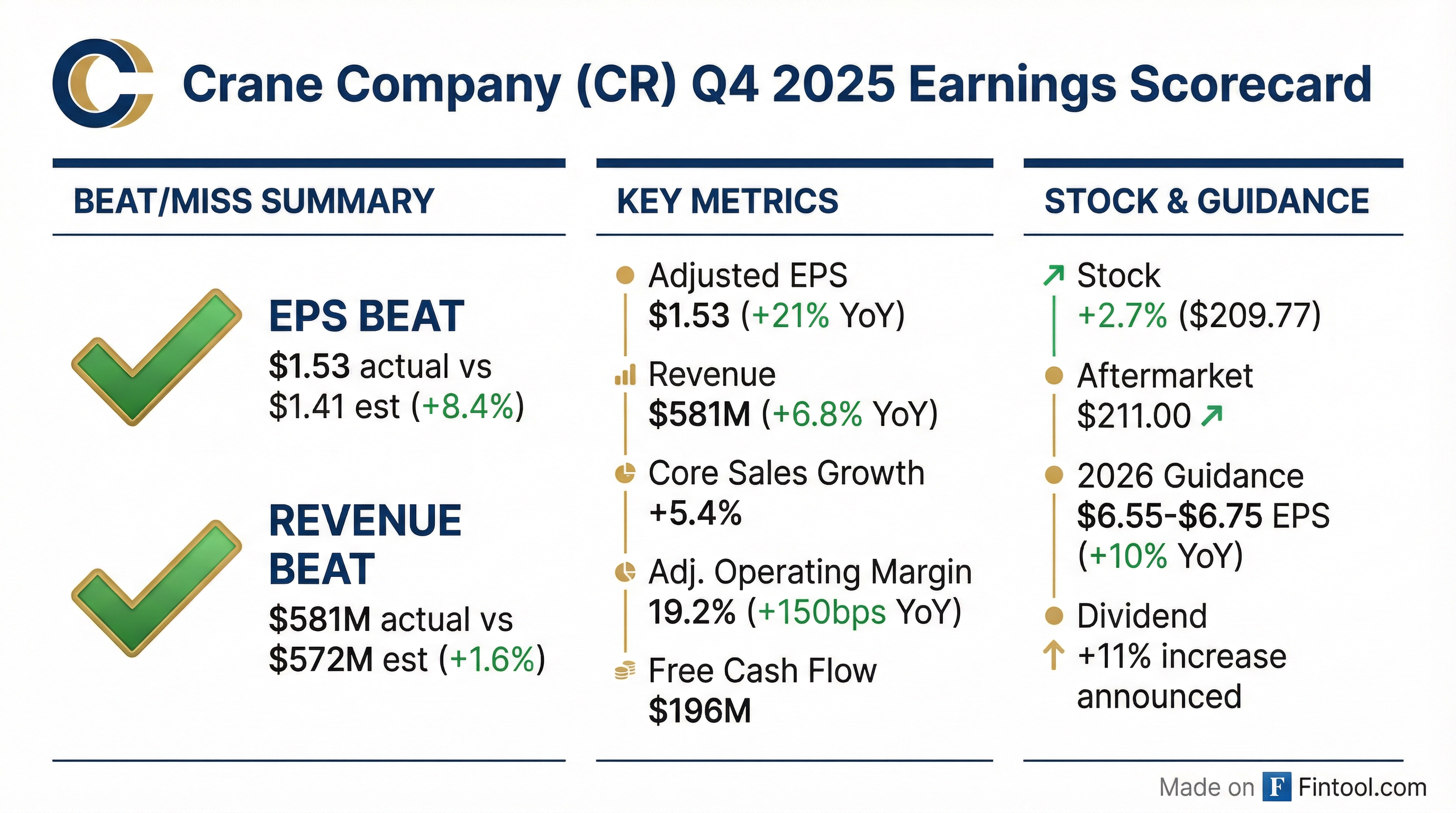

- Crane Company reported Q4 2025 adjusted EPS of $1.53, an increase of 21% over the prior year, driven by 5.4% core sales growth. Full-year adjusted EPS grew by 24%.

- Alex Alcala has been appointed as the next CEO, effective April 27, 2026, with current CEO Max Mitchell transitioning to Executive Chairman for up to two years.

- The company closed several acquisitions on January 1, 2026, including Druck, Panametrics, and Reuter-Stokes, as well as Optek-Danulat (with approximately $40 million in annual sales). These acquisitions are projected to be slightly accretive to 2026 earnings.

- Initial 2026 adjusted EPS guidance is set at $6.55-$6.75, reflecting 10% growth at the midpoint, after excluding a $0.16 benefit from 2025 hurricane recoveries that will not recur.

- Net leverage stands at 1.4 times, and the company is prepared to increase leverage up to 3x or more for strategic acquisitions, aiming to return to 2x-2.5x leverage within a short timeframe.

- Crane Company reported adjusted EPS of $1.53 for Q4 2025, marking a 21% increase over the prior year, and achieved a 24% increase in full-year adjusted EPS.

- The company completed several key acquisitions on January 1, 2026, including the Druck, Panametrics, and Reuter-Stokes brands from Baker Hughes, and Optek-Danulat, which has annual sales of approximately $40 million. These acquisitions increased the company's net leverage to 1.4 times.

- Alex Alcala has been appointed as Crane's next CEO, effective April 27, 2026, with current CEO Max Mitchell transitioning to Executive Chairman for a transitional period.

- For 2026, Crane provided initial adjusted EPS guidance of $6.55-$6.75, representing 10% growth at the midpoint when excluding certain one-time benefits and acquisition-related intangible amortization. The company also announced a change to its non-GAAP adjusted EPS presentation, now excluding non-cash, tax-affected, acquisition-related intangible amortization.

- The recently closed acquisitions are expected to be slightly accretive to 2026 earnings, and the company is prepared to increase leverage up to 3x for strategic deals, with a plan to return to 2x-2.5x within a short period.

- For Q4 2025, Crane reported sales of $581.0 million and adjusted earnings per share (EPS) of $1.53, representing a 6.8% increase in sales and a 21.4% increase in adjusted EPS compared to Q4 2024.

- For the full year 2025, the company achieved sales of $2,305.0 million and adjusted EPS of $6.05, marking an 8.2% increase in sales and a 24.0% increase in adjusted EPS from 2024.

- Crane provided FY 2026 guidance, projecting revenue between $2,845 million and $2,875 million and adjusted EPS between $6.55 and $6.75.

- The 2026 revenue outlook anticipates core sales growth of 4-6% and a significant M&A contribution of approximately 18-20%.

- Crane Co. reported strong Q4 2025 results with adjusted EPS from continuing operations of $1.53, marking a 21% increase year-over-year, and sales of $581.0 million, up 6.8%. The company achieved a record year in 2025, with adjusted EPS up 24% over the prior year.

- The company initiated its full year 2026 adjusted EPS outlook of $6.55-$6.75, reflecting 10% growth at the midpoint compared to 2025. Total sales growth is projected in the low- to mid-20% range, driven by recent acquisitions and mid-single-digit core sales growth.

- Crane Co. completed two strategic acquisitions on January 1, 2026: Druck, Panametrics, and Reuter-Stokes, and optek-Danulat, which generated $40 million in sales in 2025.

- Alex Alcala will be promoted to President & Chief Executive Officer, effective April 27, 2026, with Max Mitchell transitioning to Executive Chairman. Additionally, the company raised its annual dividend by 11% for 2026 to $1.02 per share.

- Crane Company reported strong Q4 2025 financial results, with sales of $581.0 million, up 6.8%, and adjusted EPS from continuing operations of $1.53, up 21%.

- The company initiated its full year 2026 adjusted EPS outlook in the range of $6.55-$6.75, reflecting 10% growth at the midpoint.

- Crane completed two acquisitions on January 1, 2026: Druck, Panametrics, and Reuter-Stokes, as well as optek-Danulat, which generated $40 million in sales in 2025.

- A leadership transition was announced, with Alex Alcala appointed President & Chief Executive Officer and Max Mitchell becoming Executive Chairman, both effective April 27, 2026.

- The annual dividend was raised by 11% for 2026 to $1.02 per share.

- Crane Company completed its acquisition of Precision Sensors & Instrumentation (PSI) on January 1, 2026.

- The purchase price for PSI was $1,060 million, after adjusting for expected tax benefits with a net present value of approximately $90 million.

- Crane Company will provide comments about the acquisition during its upcoming fourth quarter fiscal year 2025 earnings call, with the earnings release scheduled for January 26, 2026, and the teleconference on January 27, 2026, at 10:00 AM (Eastern).

- Crane Company has acquired Baker Hughes' Precision Sensors & Instrumentation (PSI) product line.

- The sale, which includes the Druck, Panametrics, and Reuter-Stokes brands, closed on January 5, 2026.

- The transaction involved cash proceeds of $1.15 billion before customary closing adjustments.

- Crane Company reported Q3 2025 adjusted EPS of $1.64, driven by an impressive 5.6% core sales growth.

- The company raised and narrowed its full-year 2025 adjusted earnings outlook to a range of $5.75 to $5.95 (from a prior view of $5.50 to $5.80), reflecting 20% adjusted EPS growth at the midpoint compared to 2024.

- The pending acquisition of Precision Sensors & Instrumentation from Baker Hughes remains on track to close at year-end (January 1).

- For the full year 2025, Aerospace & Electronics' core sales growth is now anticipated to be up low double digits, while Process Flow Technologies' core growth is expected to fall at the lower end of its low to mid-single-digit range.

- Crane Company's pipeline of acquisitions remains robust, with opportunities in both Aerospace & Electronics and Process Flow Technologies, largely ranging from $100 million to $500 million in deal size.

Fintool News

In-depth analysis and coverage of Crane.

Quarterly earnings call transcripts for Crane.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more