Earnings summaries and quarterly performance for Credo Technology Group Holding.

Executive leadership at Credo Technology Group Holding.

Board of directors at Credo Technology Group Holding.

Research analysts who have asked questions during Credo Technology Group Holding earnings calls.

Karl Ackerman

BNP Paribas

5 questions for CRDO

Quinn Bolton

Needham & Company, LLC

5 questions for CRDO

Thomas O’Malley

Barclays Capital

5 questions for CRDO

Tore Svanberg

Stifel Financial Corp.

4 questions for CRDO

Vivek Arya

Bank of America Corporation

4 questions for CRDO

Richard Shannon

Craig-Hallum Capital Group LLC

3 questions for CRDO

Sujeeva De Silva

Roth MKM

3 questions for CRDO

Vijay Rakesh

Mizuho

3 questions for CRDO

Christopher Rolland

Susquehanna Financial Group

2 questions for CRDO

Joshua Buchalter

TD Cowen

2 questions for CRDO

Sean O'Loughlin

TD Cowen

2 questions for CRDO

Suji Desilva

ROTH MKM

2 questions for CRDO

Toshiya Hari

Goldman Sachs Group, Inc.

2 questions for CRDO

Christopher Roland

Susquehanna

1 question for CRDO

Jay Rakesh

Stifel

1 question for CRDO

Joseph Cardoso

JPMorgan Chase & Co.

1 question for CRDO

Matt Ramsey

TD Cowen

1 question for CRDO

Sebastian Nagy

William Blair

1 question for CRDO

Recent press releases and 8-K filings for CRDO.

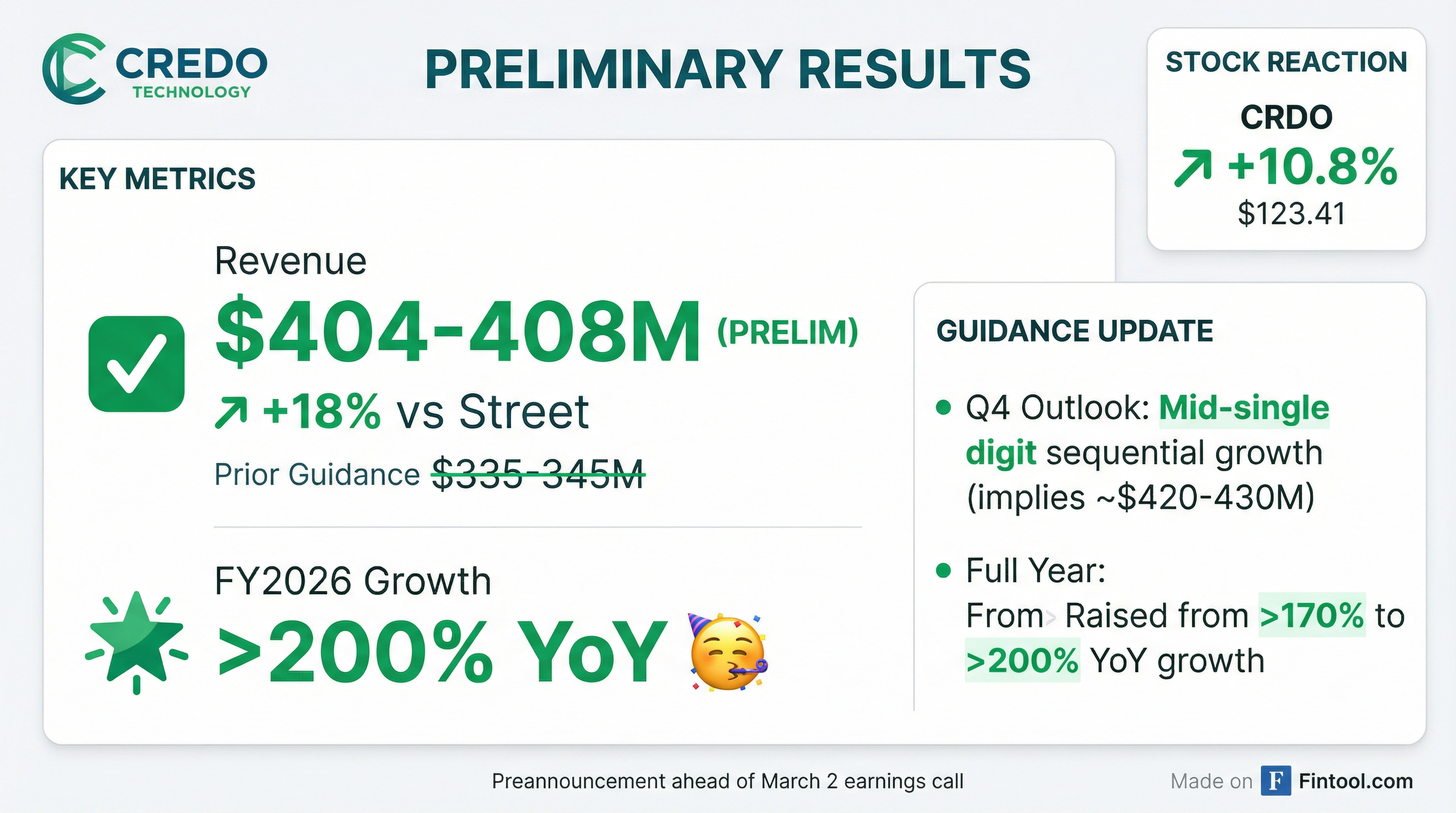

- Credo Technology revised its preliminary Q3 FY2026 revenue guidance to $404–$408 million, significantly exceeding prior guidance of $335–$345 million and consensus near $341 million, citing surging demand for AI infrastructure.

- The company projects more than 200% year-over-year revenue growth for the fiscal year and anticipates mid-single-digit sequential growth into FY2027.

- Following the guidance update, Credo's shares rose approximately 11% in regular trading, with gains approaching 16% in after-hours trading.

- Publicly reported trailing metrics indicate TTM revenue of about $796.13 million, a gross margin near 66.76%, a net margin around 26.63%, and a strong current ratio of approximately 8.8.

- Credo Technology Group Holding Ltd (CRDO) announced preliminary revenue results for the third quarter of fiscal year 2026 and updated revenue guidance for the fourth quarter of fiscal year 2026.

- The company expects to report Q3 FY 2026 revenue in the range of $404 million to $408 million, which is above its previously announced guidance range of $335 million and $345 million.

- Credo anticipates sequential revenue growth in the mid-single digits leading into fiscal year 2027 and projects more than 200% year-over-year growth for the current fiscal year 2026.

- Credo will hold its Q3 FY 2026 earnings conference call on March 2, 2026, to discuss these financial results.

- Credo expects preliminary third quarter fiscal year 2026 revenue to be in the range of $404 million to $408 million, which is above the high-end of its previously announced guidance of $335 million to $345 million.

- The company anticipates mid-single digit sequential revenue growth and more than 200% year-over-year growth for the full fiscal year 2026.

- Credo will disseminate its full third quarter fiscal year 2026 financial results and hold a conference call on March 2, 2026.

- Credo Technology introduced three new product categories: Active LED Cables (ALCs), ZeroFlap Optical Transceivers (ZF Optics), and OmniConnect/Weaver chiplets, designed to address evolving data center interconnect demands.

- ZeroFlap Optical Transceivers are expected to generate material revenue in fiscal 2027 and are projected to achieve 63%-65% gross margins long term.

- Active LED Cables (ALCs) and the OmniConnect/Weaver chiplet solution are both anticipated to see first volumes/revenue in fiscal 2028, with ALCs expanding the market opportunity and OmniConnect offering over $1,000 of content per system.

- The company recently completed a $750 million financing, enhancing its strategic flexibility for potential future tuck-in M&A.

- Credo Technology was named Needham & Company's top pick for 2026, with a mission to redefine high-speed connectivity for AI, cloud, computing, and hyperscale networks.

- The company introduced three new product categories: active micro-LED cables (ALCs), zero-flap optical transceivers (ZF Optics), and OmniConnect/Weaver chiplets.

- These new products are expected to achieve 63%-65% gross margins long-term. ZF Optics are projected to generate material revenue in fiscal 2027, while ALCs and Weaver chiplets are expected to see first volumes/revenue in fiscal 2028.

- Credo recently completed a $750 million financing to maintain strategic flexibility and support potential tuck-in acquisitions.

- The market for active electrical cables (AECs) is considered to be in its early innings, with significant growth opportunities, and Credo is well-positioned for the 800 gig transition.

- Credo Technology (CRDO) outlined its mission to redefine high-speed connectivity for AI, cloud, computing, and hyperscale networks, with reliability serving as a key driver for product development.

- The company introduced three new product categories: active micro-LED cables (ALCs), Weaver Interconnect (chiplets), and Zero-Flap optical transceivers, all targeting 63%-65% gross margins long term.

- Zero-Flap optical transceivers are expected to generate material revenue in fiscal 2027, while ALCs and Weaver chiplets are projected to see first volumes or revenue in fiscal 2028.

- The Weaver chiplet for memory fan-out gearbox applications has a content opportunity of over $1,000 per system for its first partner, enabling two terabytes of memory for inference engines.

- Credo recently closed $750 million in financing, which provides strategic flexibility for potential tuck-in M&A opportunities.

- Credo's management views the current AI investment cycle as a "decade-plus mega trend" that will reshape the world.

- The company is focused on reliability in AI clusters, offering solutions like Active Electrical Cables (AECs) and Zero Flap Optics to ensure stable connections, even for long-distance laser-based links.

- Credo is diversifying its product portfolio with Active Optical Cables (ALCs), PCIe retimers and AECs, and the OmniConnect family (Weaver), which aims to overcome the memory wall for AI inference and could generate $1,000 or higher per GPU.

- All new product pillars are expected to maintain gross margins within the company's long-term model of 63%-65%.

- Credo's management believes the AI investment cycle is in its early innings, representing a decade-plus mega trend, with a strategic focus on reliability for AI infrastructure, particularly the critical GPU-to-switch link.

- The company differentiates its Active Electrical Cables (AECs) through a system-level approach, taking complete ownership from design to supply chain, and aims to be first to deliver, qualify, and ramp products.

- Credo is expanding its product offerings with ZeroFlap Optics, a system-level solution developed with Oracle to provide real-time telemetry for laser-based optics to prevent link failures , and PCIe Gen 6 retimers and AECs, which claim the longest reach and lowest latency.

- A new product family, OmniConnect, introduces "gearboxes" like "Weaver" to address the memory wall in AI inference, potentially adding $1,000 or higher per GPU in content value by enabling larger memory capacities further from the GPU.

- Credo's CFO anticipates that all new product verticals will contribute to the company's long-term gross margin model of 63%-65%.

- Credo views the current AI investment cycle as a "decade-plus mega trend" and is prioritizing reliability in its products, particularly for critical GPU-to-switch links in AI clusters, exemplified by their work with xAI on "zero-flap cluster" copper cables.

- The company maintains a strong competitive stance in Active Electrical Cables (AECs) by owning the entire system, from design to supply chain, enabling rapid response to customer demand and product qualification.

- Credo is developing Active Optical Cables (ALCs) as a superior alternative to Co-packaged Optics (CPO), projecting ALCs will offer one-third the power of CPO, reliability comparable to copper, and half the power of laser-based optics for future high-density routing.

- New product initiatives include Zero Flap Optics (ZFO), a system-level solution developed with Oracle to provide real-time link health telemetry for laser-based optics , and OmniConnect (Weaver), a gearbox designed to overcome the memory wall for AI inference by enabling terabytes of memory capacity further from the GPU.

- All new growth areas, including AECs, ALCs, ZFO, PCIe, and OmniConnect, are anticipated to contribute to Credo's long-term gross margin model of 63%-65%.

- Credo (CRDO) reported record revenue of $268 million in Q2 fiscal 2026, representing 20% sequential growth and an extraordinary 272% increase year-over-year, alongside a non-GAAP gross margin of 67.7% and non-GAAP net income of approximately $128 million.

- For Q3 fiscal 2026, the company guided revenue between $335 million and $345 million, a 27% sequential increase at the midpoint, and anticipates over 170% year-over-year revenue growth for the full fiscal year 2026, with non-GAAP net income more than quadrupling.

- CRDO introduced three new growth pillars: Zero-flap Optics, Active LED Cables (ALCs), and OmniConnect gearboxes (Weaver), which are projected to expand its total addressable market to over $10 billion.

- The AEC product line continued its strong growth, with four hyperscalers each contributing over 10% of total revenue in Q2, and a fifth hyperscaler beginning to contribute initial revenue.

Quarterly earnings call transcripts for Credo Technology Group Holding.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more