Earnings summaries and quarterly performance for Cerence.

Research analysts who have asked questions during Cerence earnings calls.

Aman Gupta

Goldman Sachs Group, Inc.

4 questions for CRNC

Itay Michaeli

TD Cowen

4 questions for CRNC

Jeff Van Rhee

Craig-Hallum Capital Group LLC

4 questions for CRNC

Colin Langan

Wells Fargo & Company

3 questions for CRNC

Nicolas Doyle

Needham & Company, LLC

3 questions for CRNC

Jeffrey Van Rhee

Craig-Hallum Capital Group

2 questions for CRNC

Mark Delaney

The Goldman Sachs Group, Inc.

2 questions for CRNC

Daniel Hibshman

Craig-Hallum Capital Group LLC

1 question for CRNC

Jeffrey Osborne

TD Cowen

1 question for CRNC

Nick Doyle

Needham & Company

1 question for CRNC

Wei Ong

Goldman Sachs

1 question for CRNC

Recent press releases and 8-K filings for CRNC.

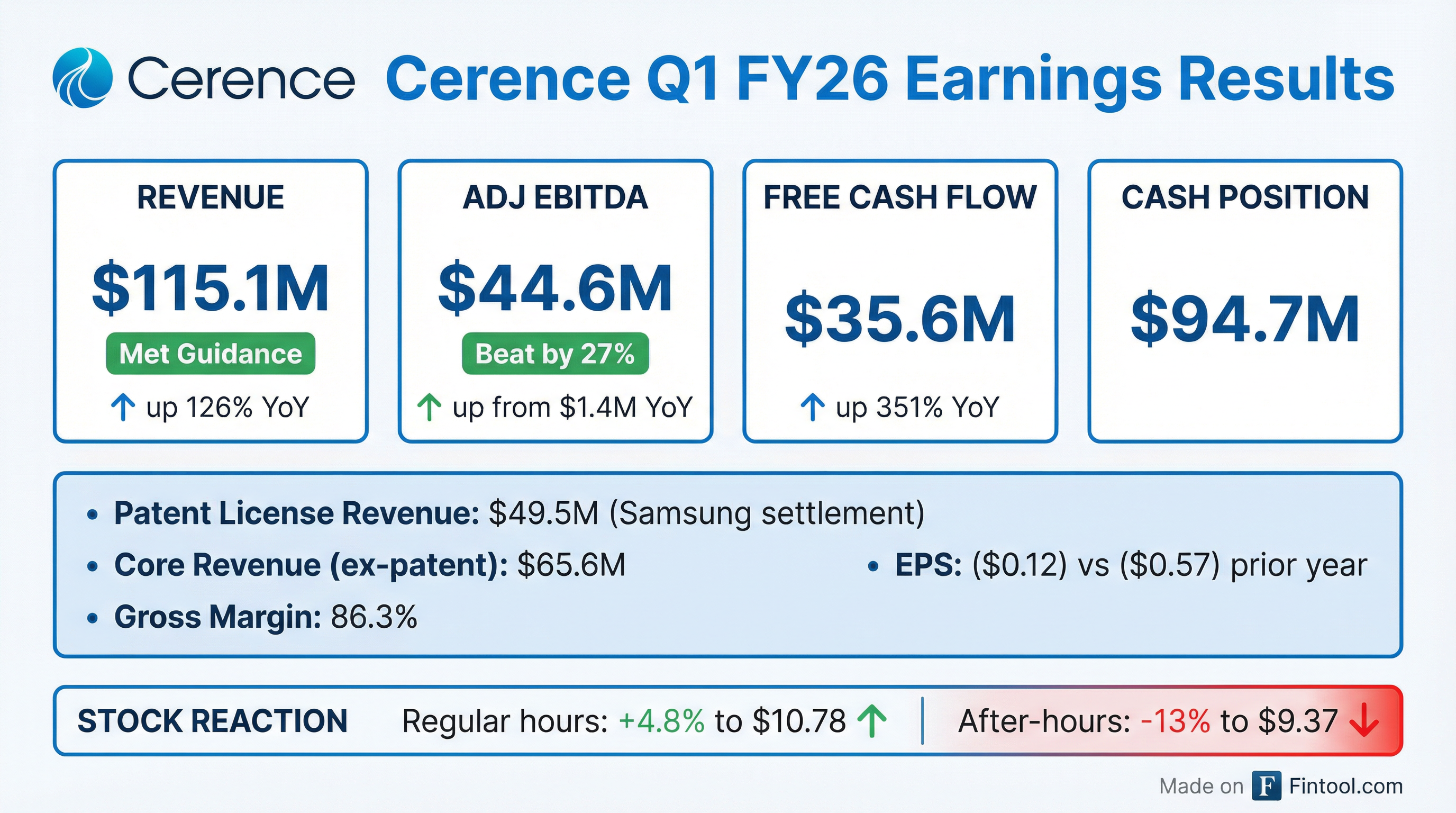

- Cerence Inc. reported strong Q1 FY26 results, with revenue of $115.1 million, which included a $49.5 million patent license payment, and achieved a record-setting free cash flow of $35.6 million.

- The company's Adjusted EBITDA for Q1 FY26 was $44.6 million, exceeding guidance.

- Cerence Inc. reaffirmed its full-year fiscal 2026 guidance, projecting revenue between $300 million and $320 million and Adjusted EBITDA between $50 million and $70 million.

- For Q2 FY26, revenue is expected to be in the range of $58 million to $62 million, with Adjusted EBITDA anticipated between $2 million and $6 million.

- The company is experiencing accelerating customer momentum for Cerence xUI, with five programs in progress and the first xUI-powered cars expected to hit roads in 2026.

- Cerence reported strong Q1 2026 financial results, with revenue of $115.1 million and adjusted EBITDA of $44.6 million, exceeding the high end of guidance, and achieved record quarterly free cash flow of $35.6 million.

- The quarter's performance included $49.5 million in patent license revenue from a successful settlement with Samsung, contributing to a 126% year-over-year revenue increase.

- The company reaffirmed its full-year fiscal 2026 guidance for revenue ($300 million-$320 million), adjusted EBITDA ($50 million-$70 million), and free cash flow ($56 million-$66 million).

- Strategic progress includes securing five significant customer programs for Cerence xUI with higher per-unit revenues, and the introduction of new AI agents, such as the Mobile Work AI Agent developed in partnership with Microsoft.

- Cerence also focused on balance sheet strength, repurchasing $30 million of principal debt due in 2028 and ending the quarter with $92.1 million in cash.

- Cerence reported strong Q1 2026 revenue of $115.1 million and Adjusted EBITDA of $44.6 million, exceeding guidance, significantly boosted by $49.5 million in patent license revenue from a settlement with Samsung.

- The company achieved a record quarterly free cash flow of $35.6 million and reduced debt by paying down $30 million of principal on its 2028 convertible notes.

- Cerence reaffirmed its full-year fiscal 2026 guidance for revenue ($300 million-$320 million), Adjusted EBITDA ($50 million-$70 million), and free cash flow ($56 million-$66 million).

- The company secured five significant customer programs for xUI, including new awards from a major Chinese EV OEM and a major volume global automaker, with these deals expected to deliver higher PPU.

- CRNC reported Q1 FY26 total revenue of $115.1 million, a net loss of $(5.2) million, and diluted EPS of $(0.12).

- Adjusted EBITDA for Q1 FY26 was $44.6 million.

- Q1 FY26 revenue included $49.5 million from a one-time patent license revenue reflecting the successful resolution of patent litigation with Samsung.

- For Q2 FY26, the company expects revenue between $58 million and $62 million, and diluted EPS between $(0.01) and $0.08.

- Full-year FY26 guidance projects revenue of $300 million to $320 million and diluted EPS of $(0.18) to $0.25.

- Cerence reported strong financial results for Q1 fiscal 2026, with revenue of $115.1 million and adjusted EBITDA of $44.6 million, both above the high end of guidance, and generated record quarterly free cash flow of $35.6 million.

- The company recorded $49.5 million in patent license revenue during Q1 2026, stemming from the successful resolution of patent litigation with Samsung.

- Cerence is experiencing significant customer traction for its Cerence xUI platform, securing five major customer programs including new awards from a major Chinese EV OEM and a global automaker, with these deals demonstrating higher PPUs than the current run rate.

- The company reaffirmed its full-year fiscal 2026 guidance, expecting revenue between $300 million-$320 million, adjusted EBITDA between $50 million-$70 million, and free cash flow between $56 million-$66 million.

- In Q1 2026, Cerence paid down $30 million of principal debt due in 2028 using cash on hand.

- Cerence reported strong Q1 FY26 results for the quarter ended December 31, 2025, with revenue of $115.1 million, which included a $49.5 million patent license payment, and Adjusted EBITDA of $44.6 million, exceeding the high end of guidance.

- The company achieved a quarterly record for free cash flow of $35.6 million and net cash provided by operating activities of $37.9 million.

- Customer momentum for Cerence xUI is accelerating, with five significant customer programs and the first xUI-powered cars anticipated to launch in 2026.

- Cerence reaffirmed its full-year fiscal 2026 guidance, projecting revenue between $300 million and $320 million, Adjusted EBITDA between $50 million and $70 million, and free cash flow between $56 million and $66 million.

- Cerence reported Q4 fiscal 2025 revenue of approximately $60 million with a 73% gross margin, $8 million Adjusted EBITDA, and $12 million cash flow from operations. For the full fiscal year 2025, the company achieved approximately $252 million in revenue, $48 million Adjusted EBITDA, and $46 million free cash flow.

- The company provided full fiscal year 2026 guidance, projecting revenue between $300 million and $320 million, approximately $60 million Adjusted EBITDA, and $60 million Free Cash Flow.

- This FY2026 revenue guidance includes a $49 million patent license sale to Samsung for non-automotive revenue in Q1 FY2026. Core technology revenue is expected to grow at high single digits, contributing to an overall business growth of 23% at the mid-range.

- Cerence is actively pursuing additional IP monetization outside of automotive, with cases against Sony and TCL currently in ITC court, though no revenue from these is included in the FY2026 guidance.

- Cerence reported FY2025 revenue of ~$252 million with $48 million in Adjusted EBITDA and $46 million in Free Cash Flow, and provided FY2026 revenue guidance of $300 million to $320 million, projecting ~$60 million in Adjusted EBITDA and ~$60 million in Free Cash Flow.

- The company's Q1 FY2026 revenue guidance of $110 million to $120 million includes a $49 million patent license sale to Samsung for non-automotive handhelds, contributing to an overall projected 23% business growth at the mid-range for FY2026.

- Cerence is enhancing its automotive voice AI with Large Language Models (LLMs), enabling natural language interaction and personalization, targeting a market where 80%-95% of cars are expected to be connected by the end of the decade and 80% of car buyers desire embedded AI.

- Growth is further driven by the fastest-growing recurring revenue stream from connected services, increasing price per unit for new technology, and a strategic focus on monetizing its IP outside of automotive.

- Cerence reported Q4 FY2025 revenue of approximately $60 million and full-year FY2025 revenue of about $252 million, achieving $48 million in Adjusted EBITDA and $46 million in Free Cash Flow for FY2025, marking a return to profitability and positive cash flow after a Q4 2024 restructuring.

- For fiscal year 2026, Cerence projects revenue between $300 million and $320 million, with mid-range estimates of $60 million for Adjusted EBITDA and $60 million for Free Cash Flow. This guidance includes $49 million from a patent license sale to Samsung in Q1 FY2026, contributing to a projected 23% total business growth at the mid-range.

- Cerence's core technology revenue is growing at high single digits%, with future growth anticipated from increasing connected car penetration (projected to rise from 40% to over 90% by the end of the decade), higher price per unit for new technology, and further IP monetization outside of automotive.

- The company highlights its leadership in embedded AI (Small Language Models) for automotive, which enables offline functionality and is a key differentiator against cloud-focused competitors. The connected portion of its revenue is its fastest-growing and recurring segment.

- Cerence Inc. announced on December 24, 2025, the repurchase of $30 million aggregate principal amount of its 1.50% Convertible Senior Notes Due 2028.

- The notes were repurchased at a cash price equal to 92% of their principal amount, along with accrued and unpaid interest.

- This strategic decision aims to reduce interest expense, eliminate potential dilution from refinancing, and lower leverage, which is intended to deliver a net positive outcome for shareholders.

- Following this transaction, $180 million of the Notes will remain outstanding through their maturity in 2028.

Quarterly earnings call transcripts for Cerence.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more