CARLISLE COMPANIES (CSL)·Q4 2025 Earnings Summary

Carlisle Beats Q4 Estimates on Strong Re-Roof Demand, Stock Surges 12% After Hours

February 3, 2026 · by Fintool AI Agent

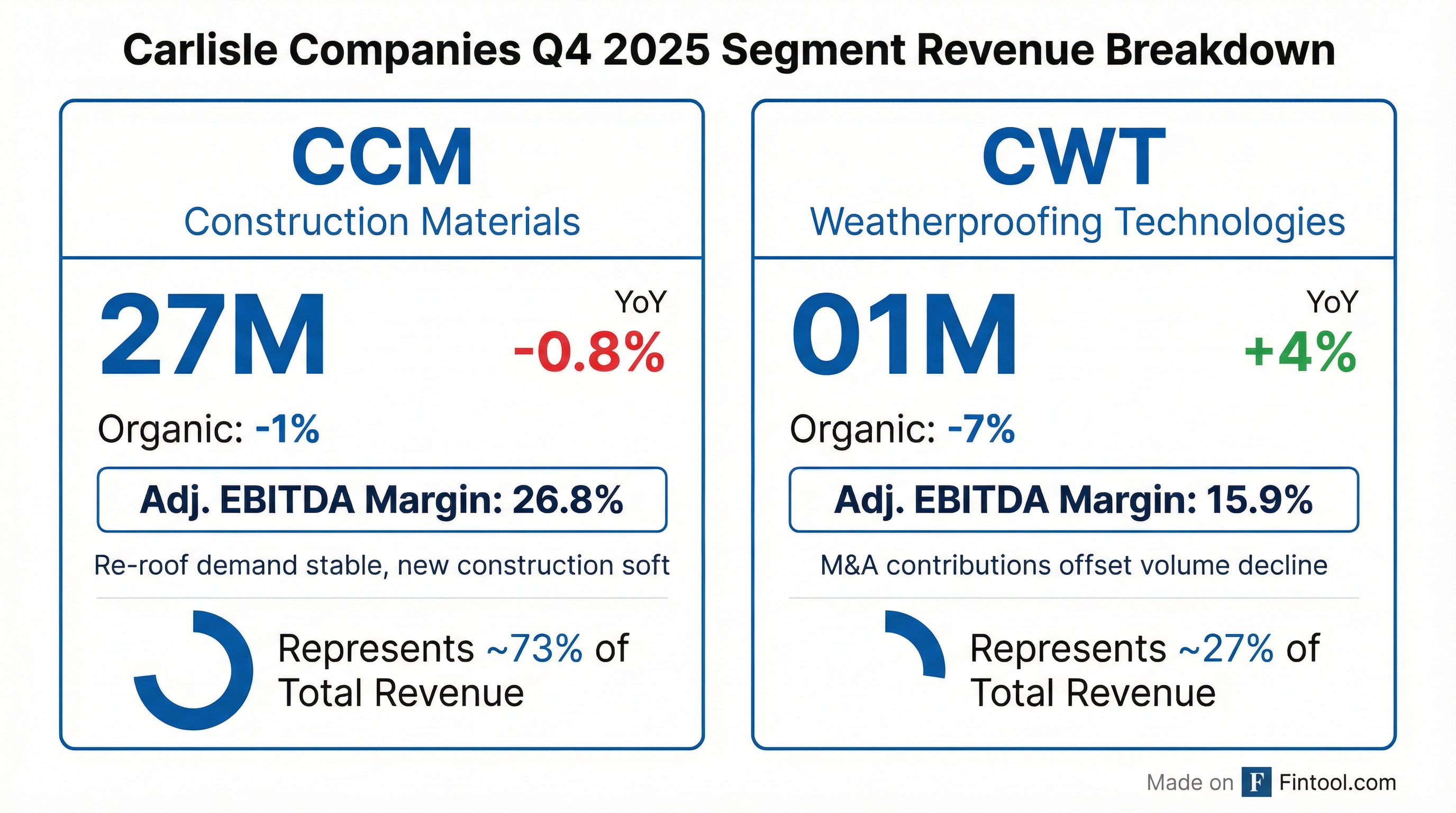

Carlisle Companies (NYSE: CSL) delivered a double beat in Q4 2025, with revenue of $1.13 billion exceeding consensus by 1.7% and adjusted EPS of $3.90 topping estimates by 8.9%. The building products manufacturer benefited from resilient re-roofing demand in its core CCM segment, which represents approximately 70% of commercial roofing business. Shares jumped 12.6% in after-hours trading following the release.

Did Carlisle Beat Earnings?

Revenue increased 0.4% year-over-year, marking a modest improvement despite continued headwinds in new construction markets. The company's adjusted EBITDA margin of 22.1% contracted 300 basis points from 25.1% in Q4 2024, primarily due to strategic investments in longer-term growth initiatives.

For the full year 2025, Carlisle generated $5.02 billion in revenue (+0.3% YoY), $1.23 billion in adjusted EBITDA (24.4% margin), and $19.40 in adjusted EPS.

What Did Management Guide?

2026 Outlook: Low-single-digit growth with margin expansion

Quarterly Cadence

Management provided unusually specific quarterly guidance due to harsh weather and prior-year tariff comparisons:

"With the recent harsh weather throughout most of the country, combined with a tariff pull forward in the first quarter of 2025... we expect first quarter 2026 revenue will be down low single digits versus last year. On a positive note, harsh weather in the first quarter often leads to a strong construction season." — Kevin Zdimal, CFO

CEO Chris Koch acknowledged that "challenging market conditions" are expected to continue into the first half of 2026 but expressed confidence in the company's financial position.

"Our solid financial position, robust cash flow, and ongoing commitment to operational excellence enable us to continue generating strong returns, pursue value-enhancing acquisitions, and deliver shareholder value." — Chris Koch, CEO

The company ended 2025 with $1.1 billion in cash and $1.0 billion available under its revolving credit facility, providing substantial balance sheet flexibility.

How Did the Segments Perform?

Carlisle Construction Materials (CCM) — 73% of Revenue

CCM's performance reflected healthy re-roof activity offset by continued softness in commercial new construction. Re-roofing represents approximately 70% of commercial roofing business and continues to benefit from the aging building stock — over 70% of North American non-residential buildings are more than 25 years old.

Management highlighted structural tailwinds supporting the business:

- Large and aging low-slope roof base requiring replacement every 20-30 years

- Increasing energy efficiency regulations and rising utility rates (especially with AI/data center electricity demand)

- Structurally high labor costs driving demand for easy-to-install, labor-saving solutions

- Growing awareness of total cost of ownership among building owners and specifiers

Carlisle Weatherproofing Technologies (CWT) — 27% of Revenue

CWT revenue growth was driven entirely by M&A contributions, which offset a 7% organic decline from softness in both residential and non-residential new construction markets.

How Did the Stock React?

Carlisle shares surged in after-hours trading following the earnings beat and positive 2026 outlook:

The strong after-hours move suggests the market is responding favorably to:

- The double beat on revenue and EPS

- Commitment to $1 billion in share repurchases for 2026

- Margin expansion guidance despite challenging conditions

What Changed From Last Quarter?

Key developments:

-

Capital Allocation Shift: Management acknowledged the "challenging M&A environment in 2025" and deployed capital toward share repurchases instead — $1.3 billion in repurchases during 2025, with another $1 billion authorized for 2026.

-

Cash Flow Strength: Generated $1.1 billion in operating cash flow for FY 2025, demonstrating the resilience of the business model through the construction downturn.

-

Vision 2030 Progress: The company reiterated confidence in its long-term goal of $40 in adjusted EPS, supported by ongoing investments in innovation, the Carlisle Operating System (COS), and automation.

Capital Allocation Highlights

Carlisle demonstrated disciplined capital deployment in 2025:

The company returned $1.5 billion to shareholders in 2025 through buybacks and dividends while maintaining a strong balance sheet.

Innovation & Vision 2030 Progress

Management emphasized innovation as a critical lever for long-term growth and margin expansion:

Vision 2030 Financial Targets:

- Adjusted EPS: $40 per share

- ROIC: 25%+

- EBITDA margins: 25%+ consolidated (30%+ CCM, 25%+ CWT)

- Free cash flow margin: 15%+

- R&D investment: 3% of sales

2026 Innovation Pipeline:

- ThermaThin 7 polyiso insulation — industry-first high R-value per inch product with "outstanding" early market feedback

- Temperature sensing gun for flexible fast adhesive — transforms adhesive application "from a manual, error-prone process to a controlled, data-driven system"

- 10 additional new products planned for launch in 2026

- Target: 25% of revenue from products ≤5 years old by 2030

"New technology brings sales, but it's also gonna bring a higher content per square foot and hopefully increase margins as we do that." — Chris Koch, CEO

The company expects 150-200 basis points of content per square foot growth annually, a key driver of Vision 2030 revenue targets.

Key Risks and Concerns

-

Margin Pressure: Adjusted EBITDA margin contracted 220 bps YoY to 24.4% for the full year, with Q4 margins down 300 bps. Strategic investments are weighing on near-term profitability.

-

New Construction Weakness: Both residential and commercial new construction remain soft, with management expecting challenging conditions to persist through H1 2026.

-

Debt Levels: Long-term debt increased to $2.9 billion from $1.9 billion in 2024, following a $988 million notes issuance.

-

Organic Decline: Organic revenue declined 2.5% for Q4 and 2.9% for the full year, masked by M&A contributions.

What Did Analysts Ask About?

The Q&A session focused on Vision 2030 execution, pricing dynamics, and distributor inventory normalization:

Vision 2030 Path to $40 EPS

Goldman Sachs asked which pillars provide the greatest leverage to reach the $40 EPS target given softer housing conditions.

"The two pillars for me that are most important, I think, are the margin expansions at CWT, obviously, and that's gonna come with a return to what I'll call a market recovery. We had anticipated having CWT making progress on margins, you know, right now, up to 25%, and obviously, with the resi housing markets, we went in the opposite direction." — Chris Koch, CEO

Koch confirmed M&A remains critical: "M&A was always going to be a part of that. We think that it continues to remain a key part of it... So we'll see if this disparity between buyers and sellers can get resolved, and we can have a productive 2026 on the M&A front."

Pricing Outlook for Single-Ply Roofing

Longbow Research asked about the 2026 pricing outlook for single-ply products.

Koch outlined four keys to pricing power: "reroofing demand being there, continued labor shortage, rational capacity expansion, and then even a slightly positive new construction market." He noted three of four conditions are in place — new construction recovery is the missing catalyst.

CFO Kevin Zdimal provided specific guidance: "Flat, down 1%, something like that, for the full year is what we're looking at" for CCM pricing. CWT pricing also expected to be "pretty flat" for 2026.

Price/Cost Dynamics

Zdimal outlined the raw materials picture for 2026:

- Tailwinds (Q2+): Polyols, PPO resins, MDI trending positive

- Headwinds: Steel remains negative

- Q1 carryover: ATO and TCPP still negative

"I don't see any benefit of raws in Q1, but starting in Q2, we should start to see that, the positive raws come through." — Kevin Zdimal, CFO

Distributor Inventory and Restocking

Loop Capital asked about distributor restocking expectations and progress on the distribution disruption noted last quarter.

Koch confirmed progress: "We also said that it would get resolved, and they would make progress. And I'm pleased to say that I think progress has been made as we went into the fourth quarter."

On inventory levels: "Our Carlisle market survey said that, you know, inventory levels were lower than the historical average in the respondents that we talked to. I think as we move in, if we can get a positive start to the summer construction season, we should see some nice volume improvements as we move into Q2."

Labor Market Conditions

When asked if labor shortages were getting worse, Koch confirmed: "I should say the concept of labor continuing to be in a shortage position and potentially, I think it could be getting a little worse, yes."

Forward Catalysts

- Q1 2026 Earnings: Expected late April/early May — likely weakest quarter due to weather/tariff comparisons

- Summer Construction Season: Q2+ pickup expected; could trigger restocking and volume recovery

- M&A Pipeline: Management seeking to close buyer-seller valuation gap for "productive 2026"

- Innovation Launches: 10 new products planned for 2026; ThermaThin 7 and smart adhesive gun gaining traction

- 49th Dividend Increase: August 2026 marks potential 50th consecutive annual dividend increase

- Raw Materials Tailwind: Polyols, PPO resins, MDI cost improvements expected starting Q2

Earnings Call Recording

The Q4 2025 earnings call was held on February 3, 2026 at 5:00 PM ET.

Key Participants:

- Chris Koch, Board Chair, President & CEO

- Kevin Zdimal, CFO

- Mehul Patel, VP of Investor Relations

Analysts on the call:

- Charles Perron (Goldman Sachs)

- Tom Sano (J.P. Morgan)

- Garrick Schloss (Loop Capital)

- David MacGregor (Longbow Research)

- Adam Baumgarten (Vertical Research Partners)

- Keith Hughes (Truist)

Read the full Q4 2025 earnings call transcript

Webcast replay and materials available at Carlisle Investor Relations

Values retrieved from S&P Global where noted.