CSW INDUSTRIALS (CSW)·Q3 2026 Earnings Summary

CSW Industrials Q3 FY2026: Record Revenue, But Interest Costs Crush EPS — Stock Drops 10%

January 29, 2026 · by Fintool AI Agent

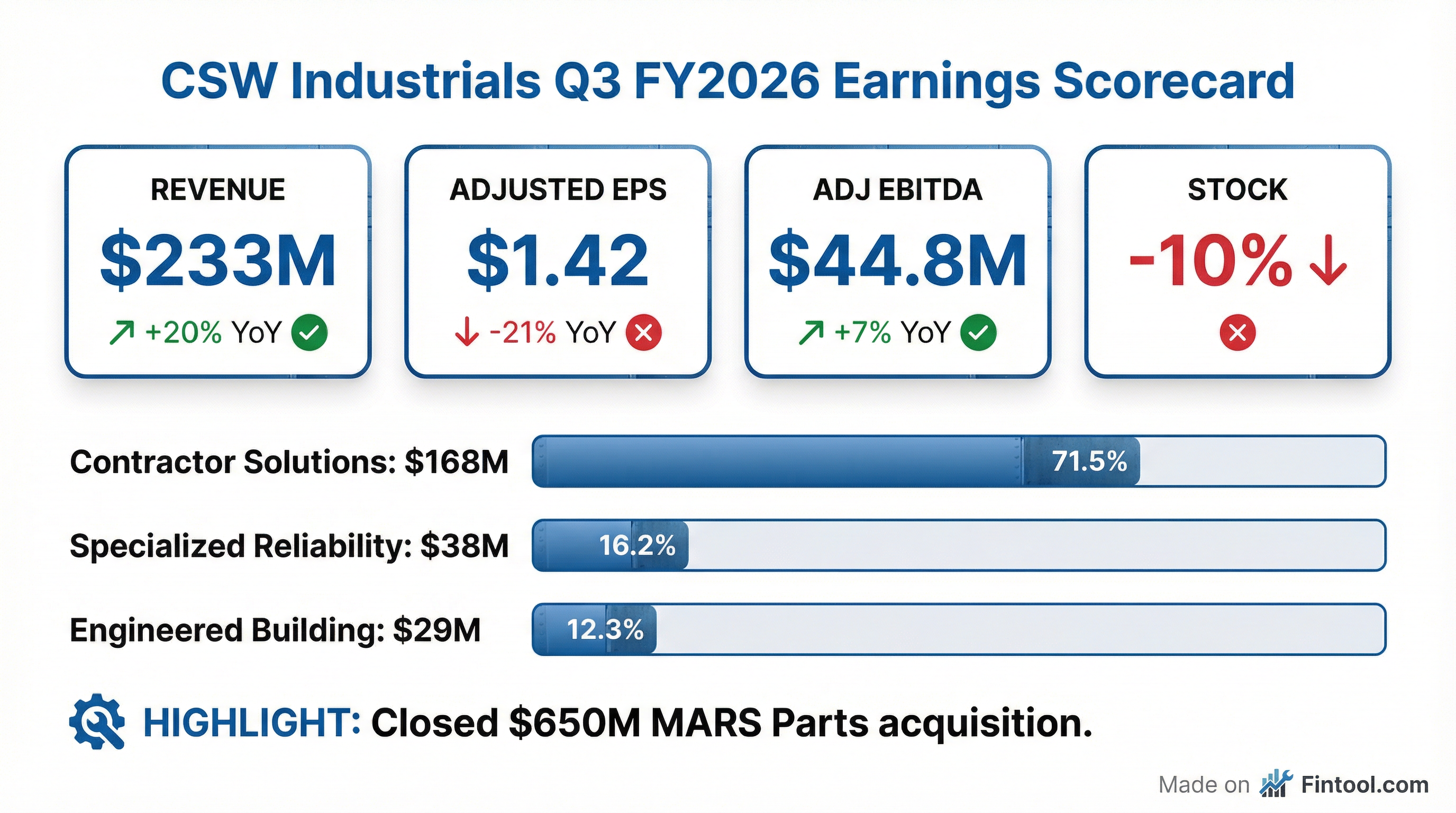

CSW Industrials delivered record Q3 revenue of $233.0 million, up 20.3% year-over-year, powered by $1 billion in acquisitions over the past year . But the acquisition strategy came at a cost: adjusted EPS plunged 21% to $1.42 as interest expense swung from $2.0 million of income to $8.1 million of expense . The stock dropped approximately 10% including after-hours trading, reflecting investor concern over margin compression and organic revenue decline.

Did CSW Industrials Beat Earnings?

CSW reported a mixed quarter with strong top-line growth but significant bottom-line pressure:

The headline numbers tell a tale of two stories: acquisition-driven revenue growth vs. integration and financing headwinds.

What Drove the Revenue Growth?

Revenue growth of $39.3 million was entirely acquisition-driven. Organic revenue actually declined 2.9% :

The organic decline reflects ongoing weakness in the residential HVAC/R end market and reduced distributor inventory levels heading into year-end .

Segment Performance: Contractor Solutions Leads, Building Solutions Lags

Contractor Solutions — $168.0M (+27.1% YoY)

The largest segment delivered strong acquisition-fueled growth but saw organic revenue decline 5.1% :

- Inorganic growth: +$42.7M from MARS Parts, Aspen Manufacturing, PF WaterWorks

- Organic decline: -$6.8M due to weaker housing activity

- Adjusted operating margin: 14.1% vs. 20.9% prior year

- Adjusted EBITDA: $41.1M (+9.6% YoY)

Including MARS Parts, Aspen, and PF WaterWorks as if owned in the prior year, organic revenue would have declined 7.3% .

Specialized Reliability Solutions — $38.3M (+10.8% YoY)

Mixed performance with organic growth partially offset by margin pressure :

- Organic growth: +$1.4M (+4.0%)

- Inorganic growth: +$2.3M (+6.8%)

- Revenue grew in general industrial and mining; declined in energy and rail

- Adjusted EBITDA margin: 16.9% vs. 19.1% prior year

Engineered Building Solutions — $28.5M (-1.3% YoY)

The only segment with declining revenue faced competitive pricing pressure :

- Operating margin: 11.8% vs. 12.6% prior year

- Decline driven by increased material costs and strategic pricing

Why Did EPS Drop So Much?

The 61% decline in GAAP EPS and 21% decline in adjusted EPS resulted from a perfect storm of acquisition-related headwinds:

1. Interest Expense Swing: -$10.1M Impact

The company went from earning interest on cash from its September 2024 equity offering to paying interest on $600M Term Loan A and revolver borrowings used for acquisitions .

2. Gross Margin Compression: -170bps

Gross margin fell to 39.7% from 41.4% due to :

- Lower-margin acquired businesses

- Material cost inflation

- Tariff impacts

3. Integration and Transaction Costs: $8.3M

Non-recurring items included :

- Transaction and integration expenses for closed acquisitions

- Discrete inventory write-down from distribution strategy realignment

How Did the Stock React?

CSW shares fell approximately 10% following the earnings release:

The stock had been trading near $315-320 before earnings, up from lows around $230 in mid-2025, reflecting optimism around the acquisition strategy. Today's selloff suggests the market is reassessing the near-term earnings dilution from deal financing.

What Did Management Say?

CEO Joseph B. Armes struck an optimistic tone despite the earnings pressure:

"I am pleased to report record revenue and adjusted EBITDA for the fiscal third quarter and fiscal year-to-date of 2026. These impressive results reflect the success of our growth strategy, including the recent acquisition and integration of businesses that broadened our HVAC/R and plumbing product offerings."

On integration progress:

"We are integrating these acquisitions aggressively and we are highly confident in our ability to achieve our operational and financial goals for these newly-acquired businesses."

Capital Allocation and Balance Sheet

CSW deployed $1.0 billion in acquisitions year-to-date while maintaining solid liquidity :

The company hedged $300M of the Term Loan at a SOFR rate of 3.416% .

Shareholder Returns

Despite the aggressive M&A, CSW continued returning cash to shareholders :

- Share repurchases YTD: $92.6M

- Dividends YTD: $13.6M

- Next dividend: $0.27/share payable February 13, 2026

Year-to-Date Performance

The nine-month results show the cumulative impact of the acquisition strategy:

On a year-to-date basis, adjusted EPS is up 1.8%, demonstrating that the full-year impact is more muted than the quarterly swing.

Key Risks and Concerns

-

Organic Revenue Decline: The 2.9% organic decline (7.3% on a pro forma basis) suggests underlying demand weakness in core HVAC/R markets

-

Margin Dilution: Acquired businesses carry lower margins, and synergies have not yet been realized

-

Interest Rate Exposure: Only half of the $600M Term Loan is hedged, leaving exposure to rate movements

-

Integration Execution: Management must deliver on operational and financial goals for three major acquisitions simultaneously

-

Housing Market Dependency: Ongoing weakness in residential housing activity is pressuring the core Contractor Solutions business

What to Watch Going Forward

- Synergy realization from MARS Parts, Aspen, and PF WaterWorks integrations

- Organic revenue inflection as housing market potentially stabilizes

- Margin recovery as acquisition-related costs normalize

- Debt paydown trajectory and potential for deleveraging

- Q4 guidance and fiscal 2027 outlook on the earnings call

Q&A Highlights: What Management Revealed

Order Momentum — A Key Positive Signal

The most actionable insight from the call came during the Q&A. CFO James Perry revealed encouraging order trends:

"We exited December with a good order rate. October and November stayed relatively soft as we expected... We were encouraged by December. The exit rate was good. Hard to quantify January yet, but Jeff certainly tells us that orders have been very good."

Management confirmed they held detailed conversations with top customers this week and received positive feedback that customer inventory levels are getting more in balance as destocking plans are completed .

MARS Integration: Ahead of Plan

CEO Armes updated that synergy expectations have been raised above initial targets:

"We have already actioned a majority of the identified synergies, and we now expect to exceed this initial objective" of $10M run rate synergies .

Key integration milestones:

- ERP system conversion completed earlier this month

- Product harmonization initiatives well underway

- On track to achieve 30% EBITDA margin target within 12 months

Future M&A: "Quarters, Not Years"

When asked about the timeline for future deals:

"I've been asked about future acquisitions and how long will it take to be able to be in a position to do another acquisition. And I've said that will be quarters, not years."

SRS Restructuring: Targeting 20% Margins

Management disclosed restructuring actions taken earlier this month in the SRS segment to address margin performance:

"We've got synergy and margin goals with the acquisitions... We also saw some administrative and other roles that we could reduce and combine... We'll have some charges here in the fourth quarter that we'll quantify on the earnings call. Those will all then be tailwind for us as we enter the new fiscal year, April 1st."

The stated goal: sustained 20% EBITDA margin in SRS, up from the current 16-17% range .

Tariff Mitigation Strategy

CFO Perry provided specifics on geographic sourcing in Contractor Solutions by end of FY26 :

This represents continued progress reducing China exposure, a multi-year strategic initiative.

Seasonality: Understanding the New Business Mix

With MARS Parts and Aspen now in the portfolio, CFO Perry explained the magnified seasonality:

"Our legacy Contractor Solutions business is kind of a 50%-55% in our stronger two fiscal quarters, 45%-50% in the others. Aspen and Mars are probably more like 60/40."

The repair-focused acquisitions experience greater seasonal swings because consumers don't discover HVAC repair needs in winter when systems aren't running .

What Changed From Last Quarter?

This article was updated following the Q3 FY2026 earnings call on January 29, 2026. View the full transcript.