Earnings summaries and quarterly performance for CSW INDUSTRIALS.

Research analysts who have asked questions during CSW INDUSTRIALS earnings calls.

Recent press releases and 8-K filings for CSW.

CSW Industrials Reports Record Q3 2026 Revenue and Adjusted EBITDA Driven by Acquisitions

CSW

Earnings

M&A

Share Buyback

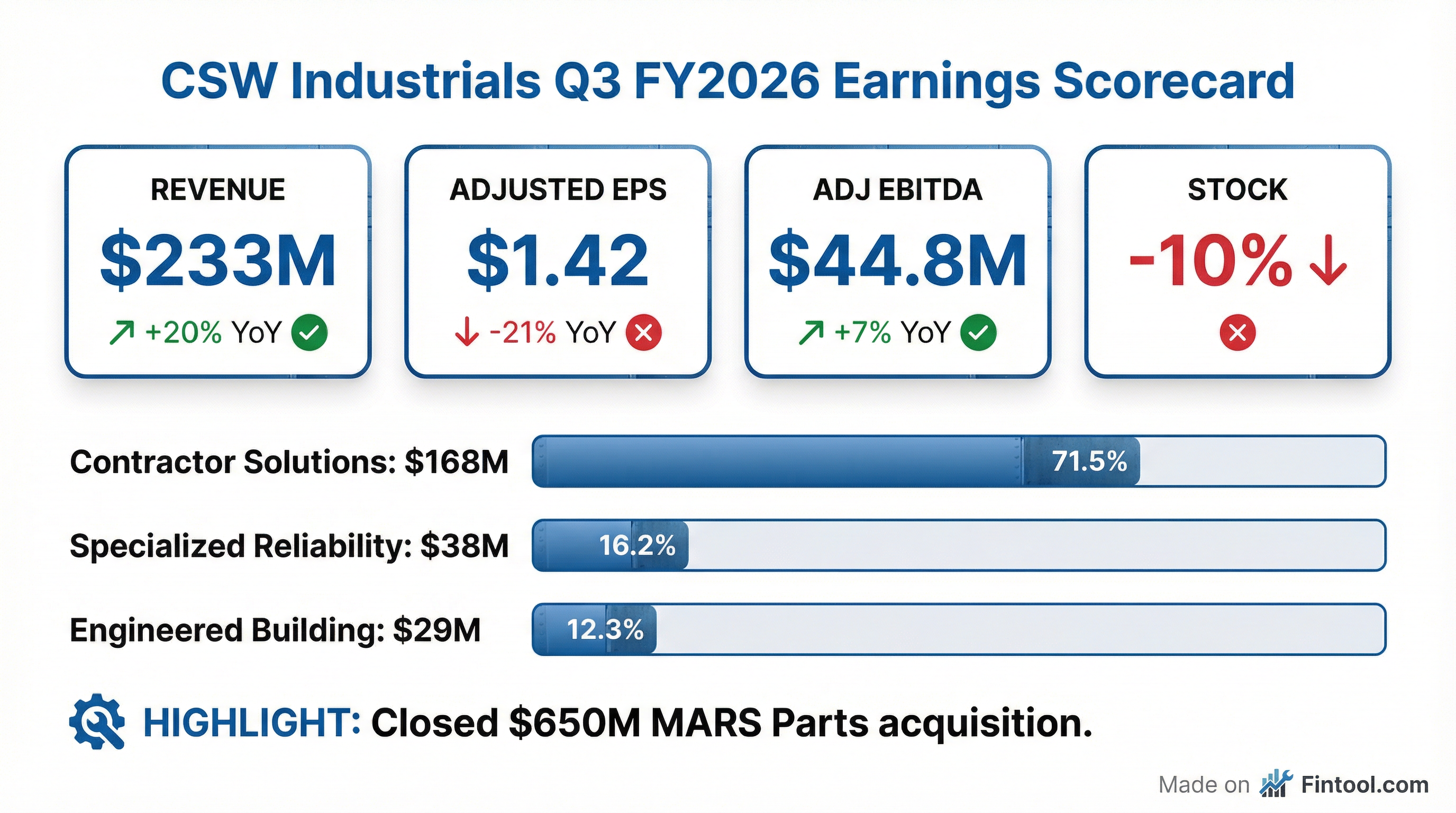

- CSW Industrials reported record revenue of $233 million, a 20% increase, and record adjusted consolidated EBITDA of $45 million, up 7%, for Q3 2026, primarily driven by recent acquisitions.

- The company invested approximately $1 billion in acquisitions over the past year, including MARS Parts for $650 million in Q3 2026, funded by cash and low-cost debt, resulting in a net debt-to-EBITDA ratio of 2.3 times.

- Adjusted EPS for the quarter decreased 21% to $1.42, primarily due to $10 million higher interest expense and increased amortization from the new capital structure and acquisitions.

- CSW repurchased $70 million of its stock during the quarter and noted encouraging order volume in December and January, with customer inventory levels rebalancing.

Jan 29, 2026, 3:00 PM

CSW Industrials Reports Record Q3 2026 Revenue and Adjusted EBITDA Driven by Acquisitions

CSW

Earnings

M&A

Share Buyback

- CSW Industrials achieved record fiscal third quarter 2026 revenue and Adjusted EBITDA, with revenue growing 20% and Adjusted EBITDA growing 7%, primarily driven by recent acquisitions.

- The company completed three acquisitions in the quarter, including MARS Parts for $650 million, contributing to approximately $1 billion in total acquisition investment over the last 12 months.

- Adjusted EPS for Q3 2026 was $1.42, a 21% reduction year-over-year, largely due to $10 million in higher interest expense from funding acquisitions and share repurchases.

- CSW repurchased approximately $70 million of its stock in the open market and maintains a net debt-to-EBITDA ratio of 2.3 times, with management indicating a "quarters, not years" digestion period for acquisitions before new M&A.

Jan 29, 2026, 3:00 PM

CSW Reports Record Q3 2026 Revenue and Adjusted EBITDA Driven by Acquisitions

CSW

Earnings

M&A

Share Buyback

Jan 29, 2026, 3:00 PM

CSW Industrials Reports Record Fiscal 2026 Third Quarter Results

CSW

Earnings

M&A

Share Buyback

- CSW Industrials reported record total revenue of $233.0 million for the fiscal 2026 third quarter, a 20.3% increase over the prior year, and record adjusted EBITDA of $44.8 million, up 6.6%. These results were primarily driven by acquisitions.

- Diluted earnings per share (EPS) for the third quarter decreased 61.3% to $0.62, and adjusted EPS decreased 21.1% to $1.42, mainly due to increased interest expense incurred from acquisitions.

- The company closed the MARS Parts acquisition for $650 million in cash and invested approximately $1.0 billion in acquisitions year-to-date.

- CSW Industrials returned $106.2 million to shareholders year-to-date through $92.6 million in share repurchases and $13.6 million in dividends.

Jan 29, 2026, 11:44 AM

CSW Industrials Completes Acquisition of MARS Parts

CSW

M&A

Debt Issuance

New Projects/Investments

- CSW Industrials completed the acquisition of Motors & Armatures Parts (MARS Parts) on November 4, 2025, for approximately $650 million in cash.

- The cash purchase price represents 10.4x pro-forma trailing twelve-month (TTM) EBITDA adjusted for identified synergies and 12.4x MARS Parts’ estimated adjusted TTM EBITDA of $52.3 million.

- This strategic acquisition expands CSW’s existing product portfolio in the HVAC/R end market with the addition of motors, capacitors, and other electrical components, and is expected to drive above-market growth and diversify into repair versus replacement solutions.

- The transaction was funded using a $600 million five-year Syndicated Term Loan A and borrowings under an extended $700 million revolving credit facility, with a $300 million, three-year syndicated interest rate hedge implemented to mitigate interest rate risk.

Nov 4, 2025, 9:00 PM

CSW Industrials Reports Record Q2 2026 Results and Announces Mars Parts Acquisition

CSW

Earnings

M&A

Demand Weakening

- CSW Industrials reported record quarterly results for revenue, adjusted EBITDA, adjusted net income, and adjusted EPS in Q2 2026, driven by 22% revenue growth from recent acquisitions.

- The company entered a definitive agreement to acquire Mars Parts for $650 million in cash, with closing expected in November 2025, which will expand its HVACR product portfolio and is anticipated to increase the net leverage ratio to approximately two times.

- Despite a 7.7% organic decline in its legacy business, the overall organic growth rate, including recent acquisitions, increased by 2.8% in Q2 2026, reflecting strong performance from acquisitions like Aspen Manufacturing and PF WaterWorks.

- CSW Industrials maintained a strong balance sheet with a net debt to EBITDA leverage ratio of 0.12 times and repurchased over $18 million of its stock during the quarter.

- Due to market volatility and uncertainty, the company is not providing updated organic growth guidance for the rest of fiscal year 2026.

Oct 30, 2025, 2:00 PM

CSW Industrials Reports Record Q2 2026 Results and Mars Parts Acquisition

CSW

Earnings

M&A

Share Buyback

- CSW Industrials delivered record quarterly results for revenue, adjusted EBITDA, adjusted net income, and adjusted earnings per diluted share in Q2 2026.

- Revenue grew 22% to $277 million in Q2 2026, primarily due to inorganic growth from acquisitions, which was partially offset by a 5.6% reduction in consolidated organic revenue.

- The company announced a definitive agreement to acquire Mars Parts for $650 million in cash at closing, plus an additional $20 million of potential consideration, with the acquisition expected to close in November 2025.

- During the quarter, CSW Industrials repurchased over $18 million of its stock and maintained a strong balance sheet with a net debt to EBITDA leverage ratio of 0.12 times.

- Chairman, CEO, and President Joseph Armes stated his intention to continue serving as CEO for the next several years.

Oct 30, 2025, 2:00 PM

CSW Industrials Reports Record Q2 2026 Results and Announces Major Acquisition

CSW

Earnings

M&A

Demand Weakening

- CSW Industrials reported record quarterly results for Q2 2026, with revenue of $277 million, representing 22% growth, adjusted EBITDA of $73 million, a 20% increase, and adjusted EPS of $2.96, up 15.2% compared to the prior year.

- The company's revenue growth was primarily inorganic, driven by recent acquisitions, while consolidated organic revenue declined by 5.6%, concentrated in the Contractor Solutions segment due to broader market disruptions in the U.S. residential HVAC/R end market.

- CSW Industrials announced a definitive agreement to acquire Mars Parts for $650 million in cash, with an additional $20 million of potential consideration, marking its largest acquisition to date and expected to close in November 2025. Mars Parts currently generates over $200 million in revenue with mid-20% margins, with a target to reach 30% EBITDA margins through $10 million in synergies.

- The company maintained a strong balance sheet, ending the quarter with a net debt to EBITDA leverage ratio of 0.12 times, and repurchased over $18 million of its stock in the open market. The net leverage ratio is expected to be approximately two times after the Mars Parts acquisition.

- Joseph Armes, Chairman, CEO, and President, communicated his intention to continue serving as CEO for the next several years, citing passion for the business and the opportunity for long-term success.

Oct 30, 2025, 2:00 PM

CSW Industrials Reports Record Q2 and First Half 2026 Results, Announces $650 Million Acquisition

CSW

Earnings

M&A

Dividends

- CSW Industrials reported record results for the fiscal 2026 second quarter, with total revenue increasing 21.5% to $277.0 million and diluted earnings per share (EPS) rising 6.7% to $2.41.

- The company announced a definitive agreement to acquire Motors & Armatures Parts (MARS Parts) for $650 million, with the transaction expected to close in November 2025.

- For the fiscal 2026 second quarter, Adjusted EBITDA grew 19.9% to $72.9 million, and the company strengthened its balance sheet by paying down $35.0 million of debt.

- Fiscal 2026 first half results also set records, with total revenue of $540.6 million and net income attributable to CSW of $81.6 million, while $32.1 million was returned to shareholders through share repurchases and dividends.

- Despite the overall revenue growth driven by acquisitions, organic revenue for Q2 2026 decreased 5.6% due to headwinds in the residential HVAC/R end market.

Oct 30, 2025, 10:44 AM

CSW Industrials Announces Definitive Agreement to Acquire Motors & Armatures Parts

CSW

M&A

New Projects/Investments

- CSW Industrials, Inc. has entered into a definitive agreement to acquire Motors & Armatures Parts (MARS Parts) for $650 million in cash, with a potential earn-out of up to $20 million.

- The acquisition is expected to expand CSW's product portfolio in the HVAC/R end market and be immediately accretive to CSW’s EPS and EBITDA.

- The transaction values MARS Parts at approximately 10.5x identified synergies-adjusted Trailing Twelve Month (TTM) EBITDA or approximately 12.5x TTM adjusted EBITDA based on an estimated $51.8 million.

- CSW plans to fund the acquisition using a combination of a Syndicated Term Loan A and borrowings under its existing $700 million revolving credit facility, with closing anticipated in the third quarter of CSW's 2026 fiscal year.

Oct 1, 2025, 1:31 PM

Quarterly earnings call transcripts for CSW INDUSTRIALS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more