Earnings summaries and quarterly performance for Corteva.

Executive leadership at Corteva.

Charles V. Magro

Chief Executive Officer

David P. Johnson

Executive Vice President, Chief Financial Officer

Jennifer A. Johnson

Senior Vice President, Chief Legal Officer

Robert D. King

Executive Vice President, Crop Protection Business Unit

Samuel R. Eathington

Executive Vice President, Chief Technology & Digital Officer

Board of directors at Corteva.

David C. Everitt

Director

Gregory R. Page

Chair of the Board

Janet P. Giesselman

Director

Karen H. Grimes

Director

Kerry J. Preete

Director

Klaus A. Engel

Director

Lamberto Andreotti

Director

Marcos M. Lutz

Director

Michael O. Johanns

Director

Nayaki R. Nayyar

Director

Patrick J. Ward

Director

Research analysts who have asked questions during Corteva earnings calls.

Edlain Rodriguez

Mizuho Securities

8 questions for CTVA

Kevin McCarthy

Vertical Research Partners

8 questions for CTVA

Vincent Andrews

Morgan Stanley

8 questions for CTVA

Joel Jackson

BMO Capital Markets

7 questions for CTVA

Patrick Cunningham

Citigroup

7 questions for CTVA

David Begleiter

Deutsche Bank

6 questions for CTVA

Kristen Owen

Oppenheimer & Co. Inc.

6 questions for CTVA

Matthew Deyoe

Bank of America

5 questions for CTVA

Aleksey Yefremov

KeyBanc Capital Markets

4 questions for CTVA

Arun Viswanathan

RBC Capital Markets

4 questions for CTVA

Chris Parkinson

Wolfe Research, LLC

4 questions for CTVA

Christopher Parkinson

Wolfe Research

4 questions for CTVA

Duffy Fischer

Goldman Sachs

4 questions for CTVA

Jeffrey Zekauskas

JPMorgan Chase & Co.

4 questions for CTVA

Josh Spector

UBS Group

4 questions for CTVA

Frank Mitsch

Fermium Research

3 questions for CTVA

Joshua Spector

UBS

3 questions for CTVA

Aaron Viswanathan

RBC Capital Markets

2 questions for CTVA

Aleksey V. Yefremov

KeyBanc Capital Markets Inc.

2 questions for CTVA

Ben Thayer

Barclays

2 questions for CTVA

Carol Jiang

Jefferies

2 questions for CTVA

Dan Rizwan

Jefferies

2 questions for CTVA

Jeff Zekauskas

JPMorgan

2 questions for CTVA

Michael Sison

Wells Fargo

2 questions for CTVA

Richard Garchitorena

Wells Fargo

2 questions for CTVA

Steve Byrne

Bank of America

2 questions for CTVA

Edlain Rodriguez

Mizuho Securities USA LLC

1 question for CTVA

Emily Fusco

Deutsche Bank

1 question for CTVA

Patrick Fischer

Goldman Sachs

1 question for CTVA

Rachel Leon

Citigroup Inc.

1 question for CTVA

Salvo Latiano

Bank of America

1 question for CTVA

Recent press releases and 8-K filings for CTVA.

- 2025 financials: Reported $3.85 billion EBITDA (up 14%), 22.1% EBITDA margin, $2.9 billion free cash flow (75% conversion) and $1.5 billion returned via buybacks and dividends.

- 2026 outlook: Forecast 7% EBITDA growth, net royalty neutrality, $50 million of separation dis-synergies and $80 million of tariff headwinds built into guidance.

- Spin-off plan: Targeting separation into two pure-play Crop Protection and Seed companies in Q4 2026, with $100 million of expected run-rate dis-synergies (half already in 2026 guide).

- Crop Protection strategy: At a cyclical trough but poised for volume-driven growth in 2026; focusing R&D (~6–6.5% of sales) on differentiated portfolio with a $9 billion pipeline of new actives and Biologicals.

- Seed growth initiatives: Advancing a multi-decade out-licensing model to turn net royalties positive (potential $1 billion in next decade) and launching hybrid wheat in 2027 with a $1 billion revenue opportunity over the next ten years.

- 2025 performance: EBITDA of $3.85 billion (+14%), margin expanded to 22.1% (+215 bps), free cash flow of $2.9 billion (>75% conversion) and $1.5 billion returned via buybacks and dividends.

- 2026 guidance: EBITDA expected to rise ~7%, net royalty position to reach neutral two years early, with $50 million of separation dis-synergies and $80 million of tariff headwinds built into the plan.

- Separation update: On track for a fourth-quarter 2026 split into pure-play crop protection and seed companies, targeting $100 million annual net dis-synergies (with $50 million in 2026 guide); HQ locations and leadership teams to be announced in H1 2026.

- Innovation pipelines: Crop protection R&D spend at 6–6.5% of revenue supporting a $9 billion pipeline; Enlist E3 trait now on 65% of US soybean acres and next-gen HT4 trait co-developed with BASF; hybrid wheat launching in the US in 2027 with a potential $1 billion revenue opportunity over a decade; AI tools accelerating discovery and regulatory submissions.

- Strong 2025 performance: Corteva generated $3.85 billion of EBITDA (+14%), expanded margins to 22.1% (+215 bps), converted ~75% of EBITDA into $2.9 billion of free cash flow, and returned $1.5 billion in buybacks/dividends.

- 2026 outlook: Management guides to 7% EBITDA growth, assumes $50 million of separation dis-synergies (ramping to $100 million run rate) and an $80 million tariff headwind, and expects to reach a neutral net royalty position (from –$700 million five years ago).

- Separation on track: Corteva will spin into two independent, market-leading companies—Crop Protection and Seed—in Q4 2026, finalizing headquarters, leadership teams, and capital structures in H1 2026.

- Robust R&D pipeline: Crop Protection invests 6–6.5% of revenue in R&D, supporting a $9 billion pipeline (including the Haviza soybean rust fungicide), while Seed invests ~$1 billion annually targeting $1 billion in biologicals and $2 billion in new product sales.

- Growing out-licensing business: Seed’s royalty position moves from –$700 million to neutral in 2026, paving the way for a >$1 billion licensing revenue opportunity over the next decade across corn, canola, and wheat traits.

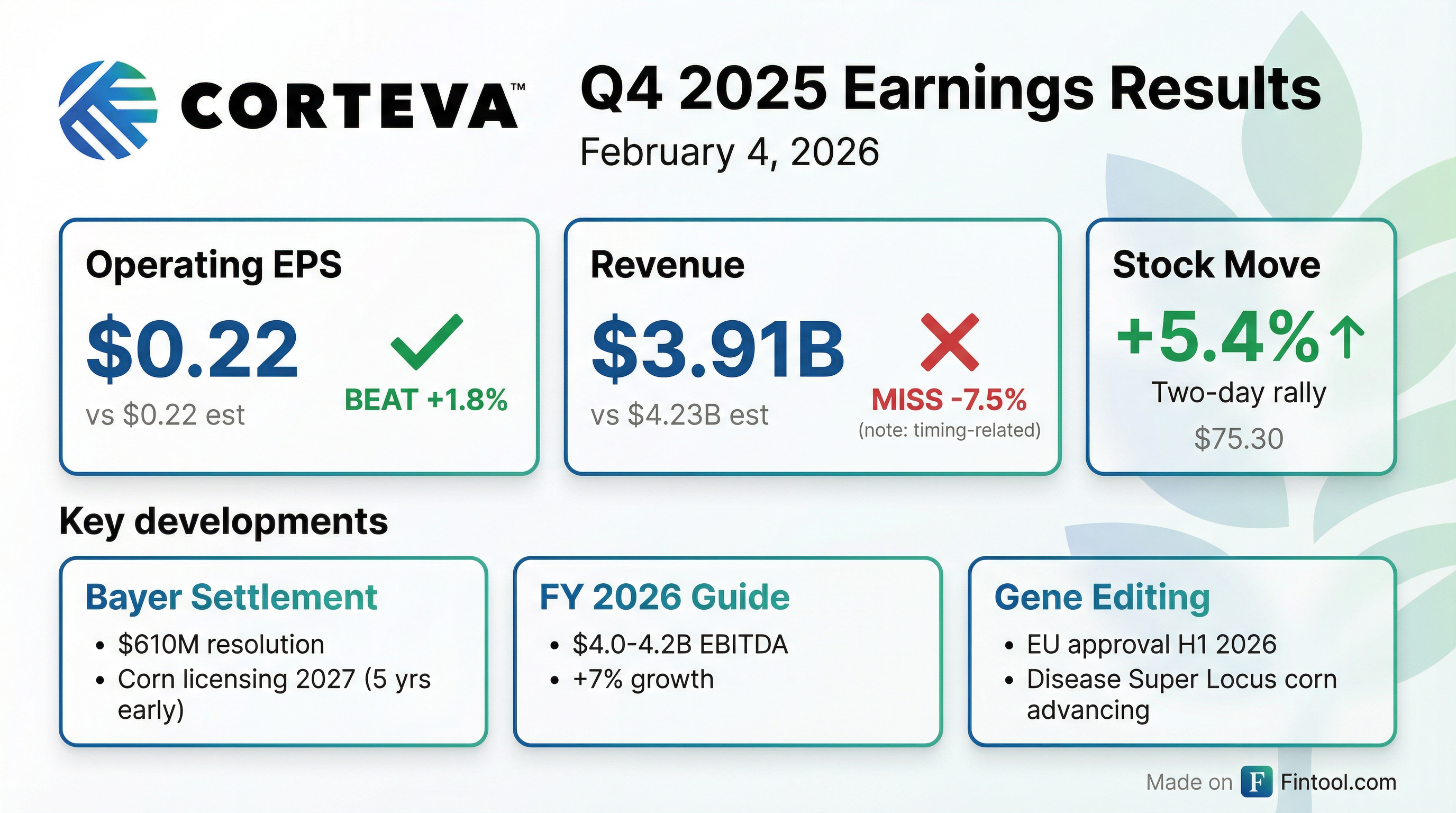

- Net sales of $3.91 billion in Q4 2025, down 2% year-over-year; GAAP Operating EBITDA was $446 million (–15%), with margin at 11.4% (–179 bps).

- Seed net sales of $1.74 billion (–2%), with Seed Operating EBITDA up 33% to $124 million; Crop Protection Operating EBITDA declined to $360 million from $461 million in Q4 2024.

- Q4 Operating EPS of $0.22 (–31%) versus $0.32 in Q4 2024; GAAP EPS loss of $0.80 per share versus a loss of $0.08.

- Full-year Operating EPS of $3.34 (up from $2.57 in FY 2024), driven by volume/price gains and cost savings; FY 2026 guidance calls for low-to-mid single-digit revenue growth and $4.0–$4.2 billion of Operating EBITDA.

- 2025 organic sales rose 4% with operating EBITDA up 14% to $3.85 billion and margins expanding above 22%; free cash flow improved by $1.2 billion to $2.9 billion.

- 2026 guidance set at $4.0–4.2 billion operating EBITDA (+7%) and $3.45–3.70 operating EPS, targeting $500 million of share repurchases in H1.

- Separation on track for a Q4 2026 spin-off with net dyssynergies of $100 million (of which $50 million is in 2026 guidance).

- Settled litigation with Bayer, achieving royalty neutrality in 2026, accelerating corn licensing to 2027, entering U.S. cotton licensing, and unlocking $1 billion upside over the next decade.

- Q4 organic sales declined 4%, while full-year organic sales grew 4%; full-year operating EBITDA rose 14% to $3.85 billion with margins over 22%, and free cash flow improved by $1.2 billion to $2.9 billion.

- 2026 guidance set operating EBITDA at $4.0–4.2 billion (midpoint $4.1 billion, +7% y/y) and operating EPS at $3.45–$3.70; the company expects 60% of sales and 85% of EBITDA in H1 2026 and plans $500 million of share repurchases in the period.

- Key 2026 assumptions include slight seed price gains offset by low-single-digit crop protection price declines, flat seed volumes, mid-single-digit crop protection volume growth, $120 million net royalty improvement, $200 million productivity benefits, $80 million tariff headwind, and $75 million FX tailwind.

- Reached a comprehensive resolution with Bayer, paying $610 million in 2025 to resolve litigation, accelerate royalty neutrality to 2026, and unlock ~$1 billion of licensing income over the next decade; accelerates corn licensing to 2027, next-gen trait licensing by 2030, and grants cotton licensing rights.

- Returned $1.5 billion to shareholders in fiscal 2025 via dividends and buybacks, with continued focus on capital return as separation progresses.

- Separation plan on track for the second half of 2026, most likely in Q4, with a global CEO search, Form 10 filings, board appointments, and Investor Day in mid-September 2026.

- Q4 2025 organic sales down 4%; seed pricing +3% vs. volume –8%, crop protection volume –2% and price –1%. Full year organic sales +4%, operating EBITDA up 14% to $3.85 billion and margins above 22%.

- Free cash flow rose by $1.2 billion to $2.9 billion in 2025, with a $610 million commitment paid toward Bayer resolution.

- 2026 guidance: operating EBITDA of $4.0–4.2 billion (+7% at midpoint), EPS of $3.45–$3.70, targeting $500 million of share repurchases in H1 2026 and maintaining the quarterly dividend.

- Resolved Bayer seed litigation, securing freedom to operate, achieving royalty neutrality in 2026 (two years early), accelerating corn licensing to 2027, entering U.S. cotton licensing, and underpinning an expected $1 billion of aggregate earnings upside over ten years.

- Q4 2025 GAAP net sales were $3.91 B with a GAAP loss from continuing operations of $537 M (EPS $(0.80)); non-GAAP organic sales were $3.82 B, operating EBITDA $446 M, and operating EPS $0.22.

- FY 2025 net sales rose 3% to $17.40 B, GAAP EPS was $1.75, and non-GAAP operating EBITDA reached $3.85 B (operating EPS $3.34).

- Generated $3.5 B in operating cash flow (+51%) and $2.9 B in free cash flow (+69%), supporting over $1.5 B returned to shareholders in 2025.

- Full-year 2026 guidance calls for operating EBITDA of $4.0–$4.2 B and operating EPS of $3.45–$3.70.

- Reached comprehensive litigation resolution with Bayer to accelerate licensing and freedom to operate, with a $610 M cash outflow expected in Q1 2026.

- Q4 2025 results included net sales of $3.91 B, a GAAP loss per share of $(0.80), and non-GAAP EPS of $0.22

- Full-year 2025 net sales were $17.40 B (up 3% vs. 2024); non-GAAP Operating EBITDA was $3.85 B and Operating EPS was $3.34

- Cash provided by operations was $3.5 B (+51%) with free cash flow of $2.9 B (+69%), supporting over $1.5 B returned to shareholders

- 2026 guidance calls for Operating EBITDA of $4.0–4.2 B and Operating EPS of $3.45–3.70 per share

- The company remains on track to complete its planned separation in the second half of 2026

- Corteva and bp have formed a 50:50 joint venture, Etlas, to produce oil from canola, mustard and sunflower crops as feedstock for sustainable aviation fuel (SAF) and renewable diesel (RD).

- Etlas targets 1 million metric tonnes of feedstock per year by the mid-2030s (enough to yield over 800,000 tonnes of biofuel) and plans to begin initial supply in 2027.

- The venture will source intermediate crops grown on existing cropland between main food seasons, enhancing soil health and providing farmers with new revenue streams.

- Ignacio Conti will serve as CEO and Gaurav Sonar as Chair of the Board of Directors for Etlas.

Quarterly earnings call transcripts for Corteva.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more