CAVCO INDUSTRIES (CVCO)·Q3 2026 Earnings Summary

Cavco Industries Plunges 18% After Missing EPS and Revenue on Acquisition Drag

January 30, 2026 · by Fintool AI Agent

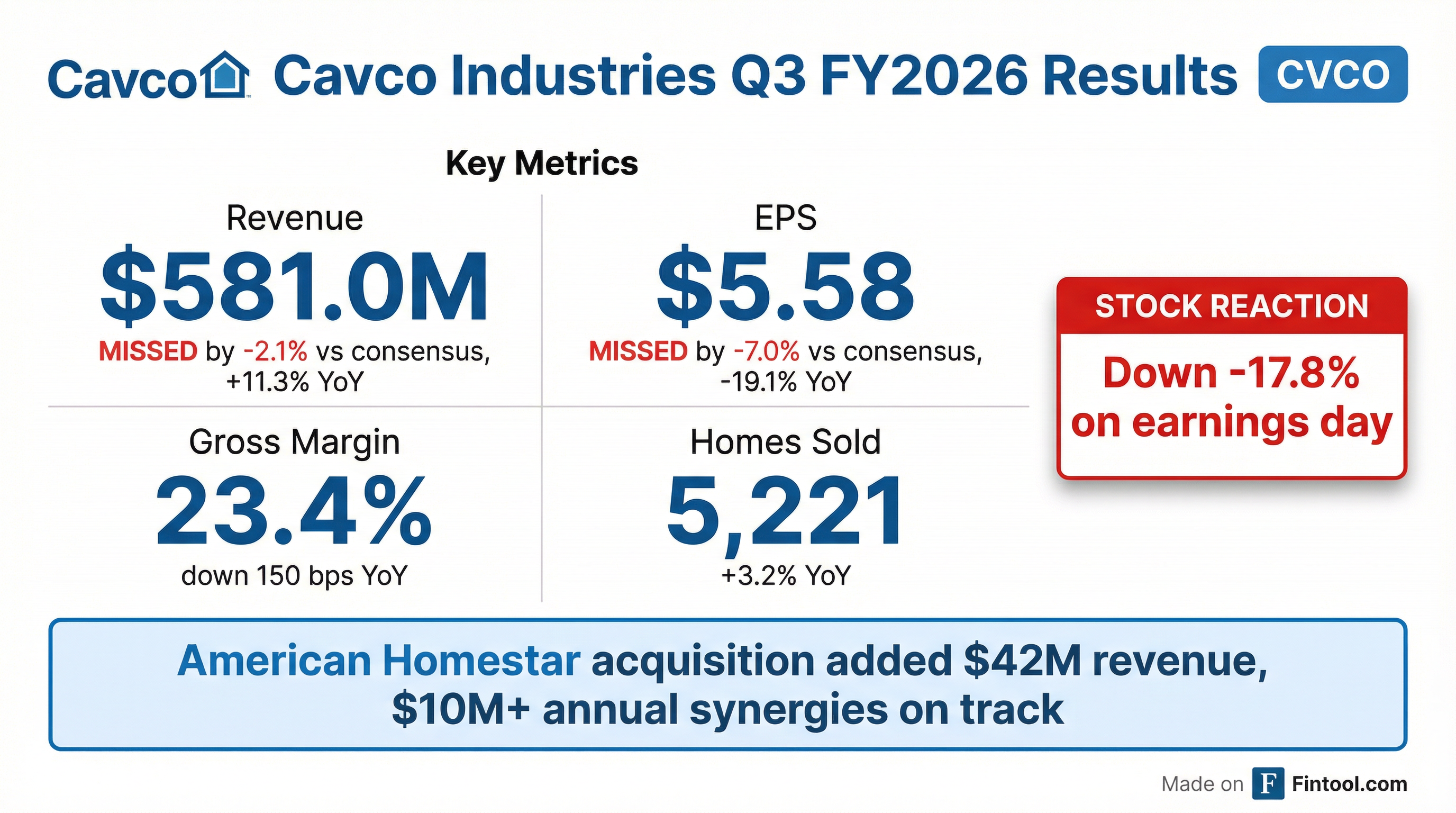

Cavco Industries (NASDAQ: CVCO) reported Q3 FY2026 results that missed on both revenue and EPS, sending shares down nearly 18% as investors reacted to margin compression and industry headwinds. Revenue of $581.0 million missed consensus by 2.1%, while diluted EPS of $5.58 fell 7.0% below estimates and 19.1% year-over-year as American Homestar integration costs and a higher tax rate pressured profitability.

Did Cavco Beat Earnings?

Revenue: Missed by -2.1% — Cavco posted $581.0 million versus the $593.4 million consensus estimate.* Despite the miss versus expectations, revenue grew 11.3% YoY, driven by the American Homestar acquisition ($42M contribution) and higher average selling prices.

EPS: Missed by -7.0% — GAAP diluted EPS of $5.58 came in below the $6.00 consensus and fell 19.1% from last year's $6.90. The miss was driven by:

- Higher tax rate (23.5% vs 18.6% YoY) due to expiring ENERGY STAR credits and nondeductible deal costs

- $2.9 million in one-time acquisition transaction costs

- $6.9 million in incremental SG&A from American Homestar operations

*Estimates from S&P Global consensus

How Did the Stock React?

CVCO shares collapsed 17.8% on earnings day, the worst single-day drop in years:

- Previous close: $617.50

- Open: $548.60 (-11.2% gap down)

- Day low: $493.00 (-20.2%)

- Close: $507.50 (-17.8%)

- Volume: 523,530 shares (2.7x average)

The severe reaction likely reflects:

- Double miss on both revenue and EPS versus consensus

- Industry shipment slowdown — HUD data showed Oct/Nov shipments down 13% YoY

- Margin compression — Factory-built gross margin fell 190 bps to 21.7%

- Tariff headwinds — Management estimated ~$3 million cost impact this quarter

The stock is now down 29% from its 52-week high of $713.01 and trades at 4.0x book value.

What Changed From Last Quarter?

Industry shipments slowed sharply — HUD seasonally-adjusted shipment rate dropped from ~106,000 in early 2025 to 96,000 in October and 93,000 in November. CEO Bill Boor noted "the drop-off in October, November was more than you would expect from seasonality."

Southeast rebounded, communities weakened — After underperforming last quarter, the Southeast "was the strongest quarter as far as holding volume." However, community sales (vs retail) drove most of the volume decline.

Retail margin compression — Management flagged "some compression between retail and wholesale prices" in company-owned stores, primarily in Texas. They don't view this as systemic: "We don't believe that price compression is either an indication of the broader market or that it represents a meaningful shift over time."

Synergies ahead of plan — American Homestar synergies are now expected to exceed $10 million annually, up from prior estimates. About half was achieved in the run rate entering Q4, though offset by integration costs in Q3.

What Did Management Say?

CEO Bill Boor struck a cautiously optimistic tone on the earnings call despite the miss:

On production strategy:

"Increasing production in a plant is tougher than pulling back production because you've got to have the teams in place, you've got to have a level of training. And so our tactical decision... even when you expect the third quarter to possibly be a little bit slower, we really held production rate. We held our staffing, we held production rate."

On backlog stability (mid-quarter update):

"As we sit here today, we're pretty comfortable that our backlogs are holding... we're not feeling like that backlog's falling out from under us."

On industry sentiment at the Louisville show:

"When you're at the Louisville show and when you're talking to our plants and operating reviews and when you're talking to customers, there is not a feeling of gloom. People are generally optimistic."

On acquisition synergies:

"Our total view of these tangible and measurable synergies is now above $10 million on an annual basis, and we estimate that about half has been achieved in the run rate as we entered Q4... It's good news that the current picture is significantly higher than our pre-deal internal estimates."

Q&A Highlights

On utilization and production plans: Management deliberately maintained daily production rates even during slower October/November, taking "a little extra time at the holidays" rather than reducing staffing. Plants are positioned to "continue moving up if we get the spring selling season we're hoping and expecting." Some plants ran Saturday shifts in January to make up for weather-related downtime.

On gross margin drivers: CFO Allison Aden explained margins were down year-over-year "due to increases in input costs... prices did not increase enough to offset the input cost." Retail margin compression was a factor but is viewed as "isolated" to the South Central region.

On tariff impact: Management estimated approximately $3 million in tariff-related cost impact this quarter, noting "the supplier's ability to pass through tariffs is also partially a function of the level of demand for the products." If lumber/steel demand heats up, "we're likely to see the full impact of tariffs."

On inventory levels: No evidence of dealer destocking or overstocking. "Because backlogs are where they're at, it's not a long wait to get that home. So they're not jumping back in line with multiple orders."

On Texas zoning legislation: Bill Boor noted new Texas legislation effective mid-2026 to "level the playing field" for manufactured housing zoning, plus potentially more impactful changes in Kentucky. "It's a great example of that slow progress, but definitely progress that the industry is going to make over time about zoning."

Segment Performance

Factory-Built Housing

Average selling price reached $107,000, driven by: (1) higher proportion of multi-section homes, (2) more sales through company-owned stores (1,339 vs 1,075 YoY), (3) American Homestar integration effects (~$1,000), and (4) modest price increases.

Financial Services

The standout segment again, with gross margin expanding nearly 1,000 bps on "lower weather-related claims, the growing impact of rate increases, and underwriting changes."

Capital Allocation

- Share repurchases: $44 million in Q3 FY2026

- Remaining authorization: ~$98 million

- Unrestricted cash: $225 million (down from $400M after acquisition)

- Balance sheet: No debt, $1.09B total equity

CFO Allison Aden outlined capital priorities: "enhancing our plant facilities, pursuing additional acquisitions, and consistently assessing opportunities within our lending operations. Share buybacks will then serve as a mechanism to responsibly manage our balance sheet after considering these initiatives."

Looking Ahead

No formal guidance provided, but management offered several directional comments:

- Q4 production: Expect to "hold production here" with potential upside if spring orders materialize. Plants are "not in the mode of feeling like we got to pull back."

- Backlog: Stable at 4-6 weeks, "could increase" if orders pick up

- Tax rate: Expect ~22.5% going forward (23.5% minus 1% nonrecurring deal costs)

- Synergies: $10M+ annual run rate expected, with integration costs declining

- Tariff risk: Monitoring lumber/steel costs; $3M Q3 impact could grow if demand increases

January weather (storms) caused some lost production days, but "those sales don't go away" and plants are running Saturdays to catch up.

This analysis was generated by Fintool AI Agent based on Cavco Industries' Q3 FY2026 earnings call transcript dated January 30, 2026. Estimates data from S&P Global.