Earnings summaries and quarterly performance for CAVCO INDUSTRIES.

Executive leadership at CAVCO INDUSTRIES.

Bill Boor

President & Chief Executive Officer

Allison Aden

Executive Vice President, Chief Financial Officer & Treasurer

Brian Cira

President, Manufacturing

Jack Brandom

President, CountryPlace Acceptance Corp.

Matt Niño

President, Retail

Regan Fackrell

President, Standard Casualty Company

Seth Schuknecht

Executive Vice President, General Counsel, Chief Compliance Officer & Corporate Secretary

Board of directors at CAVCO INDUSTRIES.

Research analysts who have asked questions during CAVCO INDUSTRIES earnings calls.

Greg Palm

Craig-Hallum Capital Group LLC

5 questions for CVCO

Jay McCanless

Wedbush Securities

4 questions for CVCO

Jesse Lederman

Zelman & Associates

4 questions for CVCO

Daniel Moore

CJS Securities, Inc.

3 questions for CVCO

Dan Moore

B. Riley Securities

2 questions for CVCO

Danny Eggerichs

Craig-Hallum Capital Group LLC

1 question for CVCO

Ian Lapey

Gabelli Funds

1 question for CVCO

Justin Ages

CJS Securities

1 question for CVCO

Recent press releases and 8-K filings for CVCO.

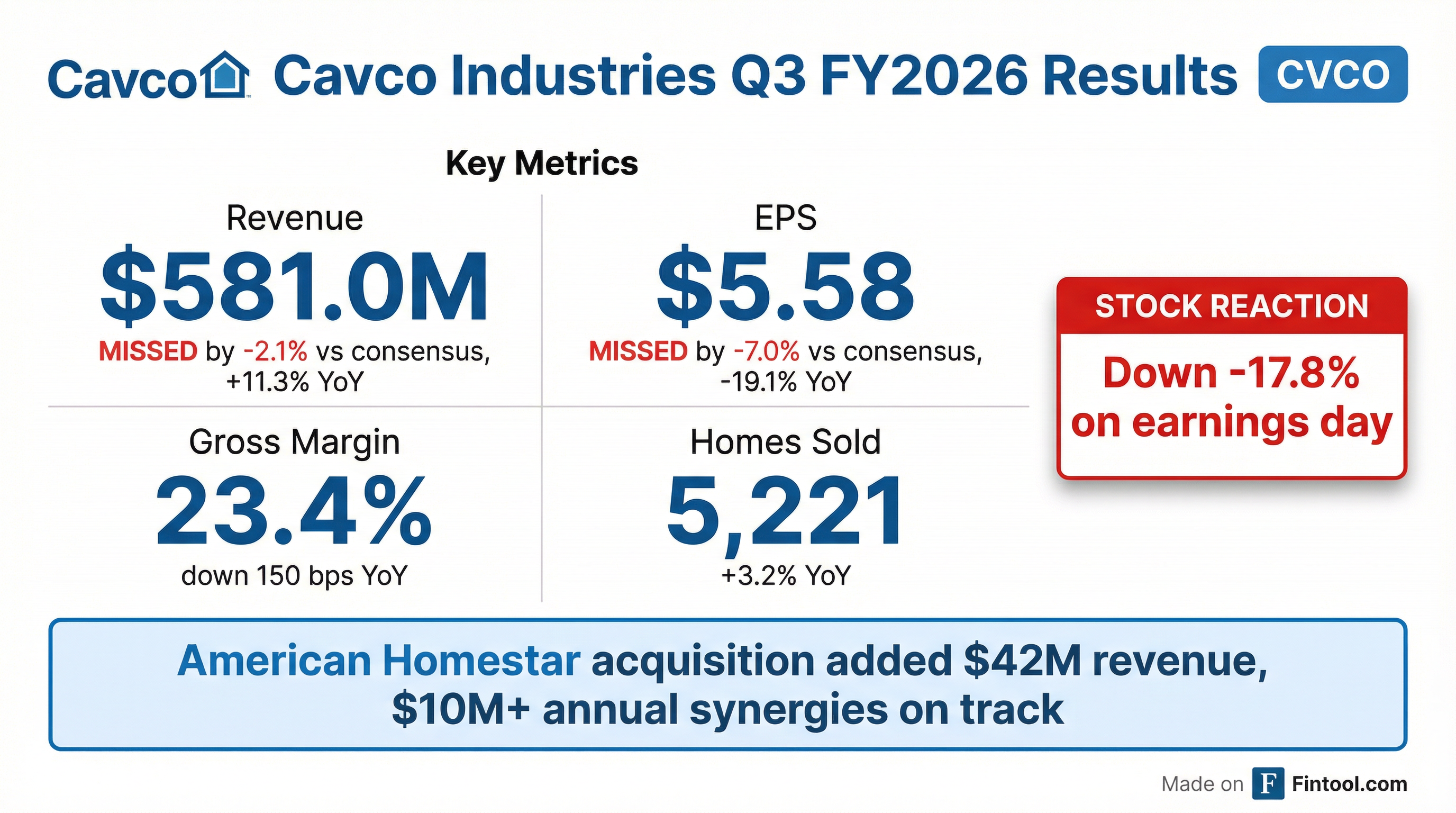

- Cavco Industries reported net revenue of $581 million for Q3 2026, an 11.3% increase from the prior year, primarily driven by the American Homestar acquisition. However, diluted earnings per share (EPS) decreased to $5.58 from $6.90 in the prior year quarter, mainly due to a higher tax rate, increased selling, general, and administrative (SG&A) expenses from the acquisition, and higher per-unit costs.

- The American Homestar acquisition, which closed in Q3 2026, contributed $42 million to net revenues and added $6.9 million in operating costs and $2.9 million in deal-related expenses to SG&A. The company now estimates annualized synergies from the acquisition to be above $10 million, with about half achieved in the run rate entering Q4.

- Industry shipments slowed in October and November by 13% compared to the calendar 2024 period, and Cavco's base volume (excluding American Homestar) was down. Despite this, the company maintained daily production rates, and backlogs finished in the 4-6 weeks range, with early indications suggesting stability or potential increase.

- During the quarter, Cavco repurchased $44 million of common shares, with approximately $98 million remaining under authorization, and maintained an unrestricted cash balance of $225 million at the end of Q3.

- Cavco Industries reported net revenue of $581 million for Q3 2026, an 11.3% increase year-over-year, driven by the American Homestar acquisition which contributed $42 million.

- Net income decreased to $44.1 million and diluted EPS to $5.58 in Q3 2026, down from $56.5 million and $6.90 respectively in the prior year quarter. This was impacted by a lower consolidated gross margin of 23.4% (down from 24.9%) due to higher per unit costs and retail price compression, as well as increased SG&A expenses from the acquisition and higher compensation.

- The company repurchased $44 million of common shares during the quarter, with $98 million remaining under authorization. The unrestricted cash balance at the end of Q3 was a healthy $225 million.

- Cavco expects annual cost reduction synergies from the American Homestar acquisition to be above $10 million, with about half achieved in the run rate entering Q4. The effective income tax rate for Q4 is projected to be around 22.5%, adjusting for a non-recurring deal cost impact in Q3.

- Management noted an optimistic tone in the market with healthy leading indicators like quotes and retail traffic, and anticipates loan originations and sales to pick up in coming quarters.

- Cavco Industries reported net revenue of $581 million for Q3 2026, an 11.3% increase year-over-year, largely due to the American Homestar acquisition which contributed $42 million.

- Net income decreased to $44.1 million and diluted EPS to $5.58 in Q3 2026, impacted by higher SG&A expenses (including $6.9 million in operating costs and $2.9 million in deal-related expenses from the acquisition) and a higher effective income tax rate of 23.5%.

- The company repurchased $44 million of common shares during the quarter and expects over $10 million in annual tangible cost reduction synergies from the American Homestar acquisition, with about half achieved by Q4.

- Industry shipments slowed in October and November, down 13% from the calendar 2024 period, leading to a 4% year-over-year decrease in Cavco's base business volume.

- Cavco Industries, Inc. reported net revenue of $581.0 million for the fiscal third quarter ended December 27, 2025, an 11.3% increase compared to the prior year.

- Diluted net income per share for the quarter decreased 19.1% to $5.58, down from $6.90 in the prior year quarter.

- The American Homestar acquisition, completed on September 29, 2025, contributed $42 million to Net revenue and resulted in $2.9 million of deal costs during the quarter.

- The company repurchased approximately $44 million of stock in the quarter, with about $98 million remaining under previously authorized programs.

- Gross profit as a percentage of Net revenue for factory-built housing decreased to 21.7% from 23.6% in the prior year, while for financial services, it increased to 65.2% from 55.5%.

- Cavco Industries reported net revenue of $581.0 million for the third fiscal quarter ended December 27, 2025, an increase of 11.3% compared to the prior year quarter.

- Diluted net income per share for the quarter was $5.58, a 19.1% decrease from $6.90 in the prior year quarter.

- The acquisition of American Homestar Corporation, completed on September 29, 2025, contributed $42 million to Net revenue and 343 homes sold in the quarter.

- The company repurchased approximately $44 million of stock during the quarter, with approximately $98 million remaining available for repurchases.

- CVCO reported strong Q2 2026 financial results, with net revenue of $556.5 million, up 9.7% year-over-year, and diluted earnings per share of $6.55. Consolidated gross profit as a percentage of revenue increased to 24.2%.

- The company's operating profit increased by 27% year-over-year, driven by focused execution across operations. Factory utilization rose to 75% from 70% in the prior year period.

- While year-to-date national shipments were up over 3% through August, the Southeast region experienced a 10% decline in shipments in July and August, prompting production adjustments. The average selling price increased sequentially due to a higher proportion of retail sales and a mix shift towards multi-section homes.

- CVCO completed the American HomeStar acquisition after the quarter, expanding its operational footprint from 31 to 33 plants and approximately 80 to 100 stores. The company also repurchased $36 million of common shares during the quarter, with $142 million remaining under authorization.

- The financial services segment demonstrated a significant turnaround, moving from a loss last year to an $8 million profit this year, an increase of $14 million, primarily due to aggressive actions in the insurance business.

- Cavco Industries reported strong fiscal Q2 2026 results with net revenue of $556.5 million, an increase of 9.7% compared to the prior year's second quarter.

- Diluted net income per share attributable to common stockholders was $6.55, marking a 24% increase from the prior year quarter.

- The company successfully closed the acquisition of American Homestar Corporation and welcomed Lisa Daniels to its Board of Directors.

- Cavco repurchased approximately $36 million in stock during the quarter.

- Cavco Industries, Inc. completed the acquisition of American Homestar Corporation, also known as Oak Creek Homes, effective September 29, 2025.

- The acquisition involved a purchase price of $190 million, which was funded using cash on hand.

- American Homestar's operations include two manufacturing facilities, nineteen retail locations, manufactured home loans, and acting as an agent for third-party insurers.

- Cavco Industries, Inc. completed the acquisition of American Homestar Corporation and its subsidiaries, effective September 29, 2025.

- The purchase price for American Homestar totaled $190 million, which was funded with cash on hand.

- American Homestar, known as Oak Creek Homes, is a vertically integrated factory-built housing company operating two manufacturing facilities and nineteen retail locations, and also provides manufactured home loans and acts as an agent for third-party insurers.

- At the effective time of the merger, each share of American Homestar's Class A common stock was converted into the right to receive $20.62 per share in cash.

Quarterly earnings call transcripts for CAVCO INDUSTRIES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more