COMMVAULT SYSTEMS (CVLT)·Q3 2026 Earnings Summary

Commvault Crushes Q3 as ARR Tops $1B Milestone

January 27, 2026 · by Fintool AI Agent

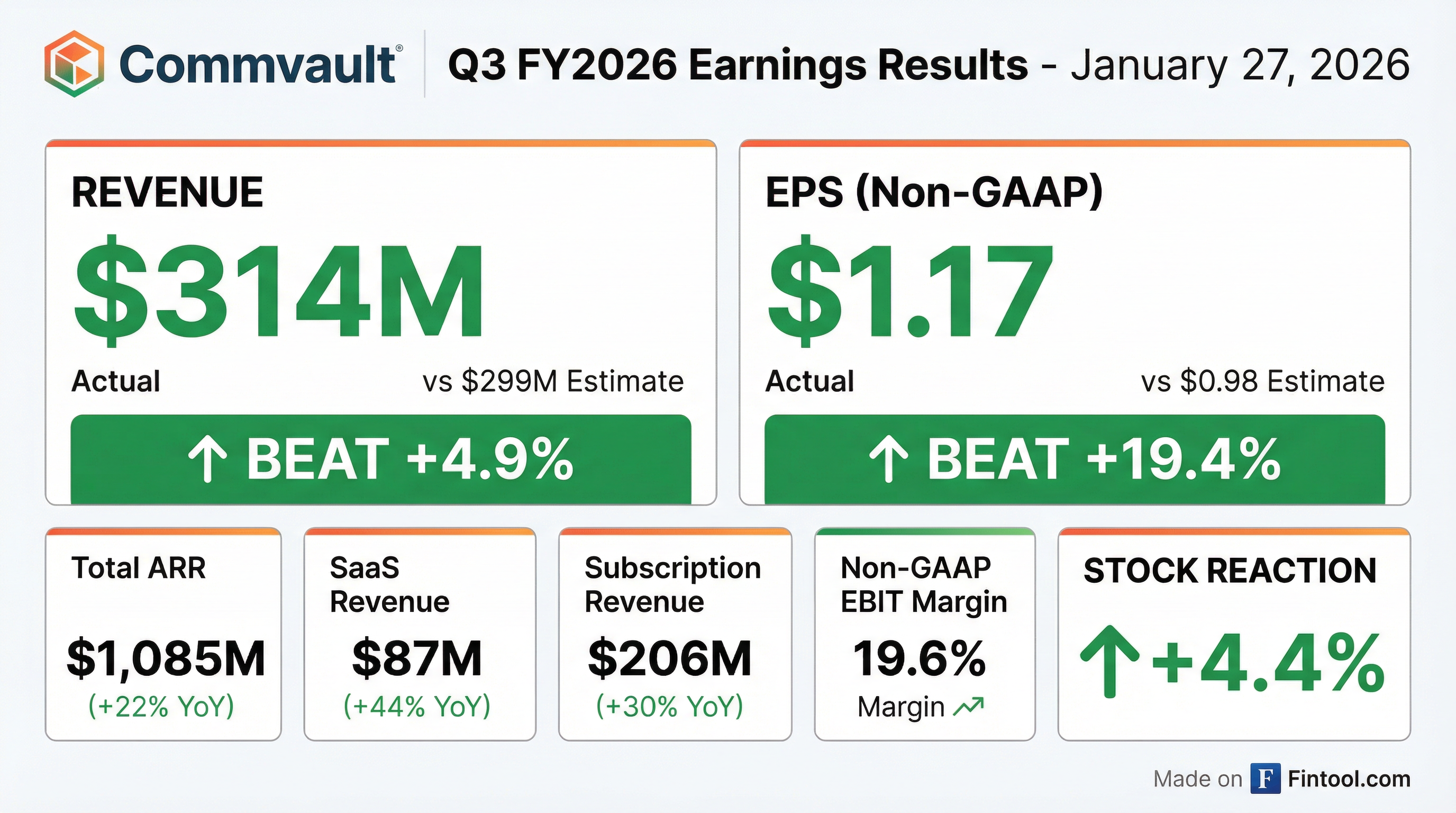

Commvault (NASDAQ: CVLT) delivered a strong Q3 FY2026, beating both revenue and earnings estimates as total annualized recurring revenue crossed the $1 billion mark for the first time. The stock rose 4.4% following the announcement.

Did Commvault Beat Earnings?

Yes — and convincingly on EPS. Commvault beat on both the top and bottom line:

The 19% year-over-year revenue growth was fueled by strong subscription momentum, with SaaS revenue surging 44% YoY to $87M and term-based license revenue up 22% YoY to $119M.

How Did the Stock React?

CVLT shares jumped 4.4% following the earnings release, trading up to $129.36 after opening at $123.85. The stock remains well below its 52-week high of $200.68 but has found support at the $114-$125 range over the past month.

What Are the Key Business Metrics?

The headline story is ARR momentum. Total ARR crossed the $1 billion milestone, reaching $1.085B — up 22% year-over-year (17% constant currency). Subscription customers grew 23% YoY to 14,100.

Customer Acquisition Strength:

- 700 new subscription customers added in Q3

- Best-ever term software land quarter for new customer additions

- Second-best SaaS customer acquisition quarter in company history

- Nearly 50% of enterprise SaaS customers now use more than one offering — up 7-8 points YoY

Rule of 40 Achievement: Commvault achieved the Rule of 40 in Q3 with a healthy balance between growth (19% revenue growth) and profitability (19.6% EBIT margin). Year-to-date, the company is operating at a Rule of 41.

What Did Management Say?

CEO Sanjay Mirchandani emphasized the AI-enabled platform strategy:

"Customers and partners are turning to Commvault because they require an AI-enabled platform that addresses rapidly evolving identity and emerging threats, supports compliance, and brings resilience to hybrid and multi-cloud environments."

Key strategic developments:

- Commvault Cloud Unity Platform — New release unifying data security, cyber recovery, and identity resilience across cloud, hybrid, and on-premise environments. Unity brings ResOps (Resilience Operations) — a discipline that unifies operations, security, and infrastructure.

- Identity Resilience Momentum — Active Directory offering ARR has more than doubled year-over-year, becoming one of Commvault's largest SaaS offerings. Hundreds of customers embraced identity resilience capabilities in Q3.

- AWS European Sovereign Cloud — Launch partner for AWS's European Sovereign Cloud, enabling secure, compliant resilience for European organizations.

- AWS Recognition — Named 2025 AWS Global Storage Partner of the Year and achieved AWS resilience competency in the recovery category.

- Pinecone Partnership — Enables protection of vector databases within enterprise AI stacks, targeted for GA in Q2 calendar 2026.

- Satori Integration — The acquired data security posture management technology is being integrated into the platform (not standalone). Management noted: "The true value of Satori was giving our customers the ability to inspect and look at their data, structured, unstructured, and really have a policy-related, compliance capability... With us, it's a feature you just turn on, and then you are protected."

- 1,600 Lifetime Patents — Awarded 1,600th lifetime patent, underscoring innovation leadership.

On AI as a Tailwind:

"We believe that AI is an emerging tailwind for us. It dramatically increases the volume of data that needs to be protected, introduces new threats that need to be addressed, and requires a solution that brings resilience to the services, models, and databases that power AI."

Market Opportunity: Commvault addresses a $24B total addressable market spanning data security, cloud security, and core data protection. Management expects this market to grow to $38B by 2028 at a 12%+ CAGR, driven by secular tailwinds in cyber resilience. When asked about long-term growth relative to the 12% TAM CAGR, CEO Mirchandani stated: "We will definitely outpace market."

What Did Management Guide?

Q4 FY2026 Guidance:

Full Year FY2026 Guidance (Updated):

Commvault raised full-year revenue guidance by ~$15M at the midpoint and lifted EBIT margin guidance by 50bps, signaling continued confidence in demand. The modest reduction in free cash flow guidance reflects working capital timing rather than fundamental deterioration.

What Changed From Last Quarter?

Improvements:

- Revenue acceleration: Q3 +19% YoY vs Q2 +18% YoY

- SaaS growth remains strong at 44% despite tougher comps

- Record new customer additions

- International growth accelerated to +26% YoY (vs +22% in Q2)

Areas to Watch:

- Free cash flow timing: Only $2M in Q3 due to 60%+ of deals closing in the last few weeks of the quarter plus an extra payroll cycle for US and Canada. Management expects normalization in Q4.

- Net new ARR mix: 70% of net new ARR from SaaS (vs 60% expected), landing at 2-3x smaller ASPs than software customers

- Initiated cost optimization program (restructuring) with $12-15M in one-time payments expected in Q4

- Perpetual license revenue declined 17% YoY — expected as business model transitions

Capital Allocation and Balance Sheet

Commvault ended the quarter with a strong balance sheet:

The significant cash increase reflects a $900M convertible notes issuance during Q1 FY26.

Shareholder Returns:

- Repurchased ~327,000 shares for $41M in Q3

- Board recommitted share repurchase program to $250M as of January 14, 2026

Revenue Mix and Geographic Performance

Revenue by Type (Q3 FY26):

Revenue by Geography:

International growth outpacing Americas is notable, though some of this reflects FX tailwinds.

Margin Trends

Gross margins are holding steady despite mix shift to SaaS (which carries higher delivery costs). Non-GAAP EBIT margin of 19.6% reflects continued investment in growth while maintaining profitability.

What Did Analysts Ask About?

The Q&A focused heavily on understanding the delta between expected and actual net new ARR. Key exchanges:

On Net New ARR Shortfall: Analysts noted constant currency net new ARR of $39M came in below the ~$45M midpoint management discussed last quarter. Management explained the delta:

"What we saw this quarter is land customers... coming at much longer durations... And we saw 70% of our net new ARR driven by SaaS. As a reminder, we land those customers at 2-3 times smaller ASP than software. So what you're seeing in the ARR is just a reflection of that math."

On SaaS Mix Shift: The share of net new ARR from SaaS jumped to 70% this quarter versus 61% last quarter. CEO Sanjay Mirchandani emphasized this is a positive signal:

"By every stretch of the imagination, it was a very strong quarter... We had our best land software quarter ever. We had our second-best land SaaS quarter ever."

On Free Cash Flow Timing: CFO Danielle Abrahamson addressed the weak Q3 FCF ($2M vs $30M prior year):

"Over 60% of our deals actually closed in the last few weeks of the quarter... We had an additional payroll cycle for both the US and Canada... Both of those things are putting pressure on Free Cash Flow."

On SaaS Net Dollar Retention Decline (121% vs higher historical): Management attributed the modest decline to three factors:

- Much larger customer base (now 9,000+ SaaS customers)

- Strong new customer additions not yet reflected in NRR calculation

- Modest mix shift in product capabilities among certain early adopter customers

"There's no churn impact here... Any unusual that's important." — CEO Sanjay Mirchandani

On Cost Optimization: Management clarified the restructuring is company-wide, not targeted at R&D, and includes a voluntary retirement program that was well-received:

"What this does is strengthen where we want to go, not weaken. So we're not cutting back on R&D or any such thing. This is really about strengthening where we think the opportunity lies."

On Pricing Discipline: When asked about discounting in the context of longer deal durations, CEO Mirchandani emphasized tight controls:

"Our Chief Commercial Officer was our Chief Financial Officer, so there's a very high degree of discipline that goes into discounting inside of the company... That's not my concern at all."

Restructuring and Cost Optimization

Commvault initiated a cost optimization program in Q3 aimed at:

- Aligning cost structure to evolving business needs

- Enhancing organizational agility

- Reorganizing the business technology function

The restructuring includes workforce reductions, technology transitions, and office lease closures. The company expects both restructuring plans to be substantially completed during FY2027.

Restructuring charges of $11.9M impacted GAAP results this quarter.

Risks and Concerns

-

SaaS Transition Impacts ARR Math — The accelerating SaaS mix (70% of net new ARR vs 60% expected) lands customers at 2-3x smaller ASPs than software. While this builds a larger customer base for future expansion, it creates near-term ARR optics pressure.

-

Cash Flow Timing — Free cash flow of $2M was significantly below prior year due to 60%+ of deals closing in the final weeks of the quarter plus an extra payroll cycle. Full-year guidance of $215-220M implies Q4 normalization.

-

Restructuring Execution — Multiple restructuring plans running simultaneously create execution risk. Management emphasizes it's company-wide and "strengthens where we want to go."

-

Term Duration Variability — Longer-duration term software deals (driven by large enterprise wins) create ARR dilution in the near term. Management notes median duration remains in normal range.

-

Competitive Pressure — The data protection market is increasingly competitive with well-funded players like Rubrik (recently IPO'd) and private equity-backed Veeam. Commvault counters with 1,600 lifetime patents and recognition as a market leader by Gartner and Forrester.

Forward Catalysts

- Q4 FY2026 Earnings — Expected late April 2026

- Commvault Cloud Unity Platform Adoption — Tracking customer uptake of the unified platform

- AWS Partnership Momentum — Leveraging Global Storage Partner of the Year recognition

- FY2027 Guidance — Will be key to assess long-term growth trajectory

Conference call held January 27, 2026 at 8:30 AM ET. View Transcript