Earnings summaries and quarterly performance for COMMVAULT SYSTEMS.

Executive leadership at COMMVAULT SYSTEMS.

Board of directors at COMMVAULT SYSTEMS.

Research analysts who have asked questions during COMMVAULT SYSTEMS earnings calls.

Aaron Rakers

Wells Fargo

8 questions for CVLT

Howard Ma

Guggenheim Securities, LLC

8 questions for CVLT

James Fish

Piper Sandler Companies

8 questions for CVLT

Rudy Kessinger

D.A. Davidson & Co.

8 questions for CVLT

Eric Heath

KeyBanc Capital Markets

7 questions for CVLT

Jason Ader

William Blair & Company

7 questions for CVLT

Junaid Siddiqui

Truist Securities

3 questions for CVLT

Michael Romanelli

Mizuho Securities

2 questions for CVLT

Param Singh

Oppenheimer

2 questions for CVLT

Paramveer Singh

Oppenheimer & Co. Inc.

2 questions for CVLT

Shrenik Kothari

Robert W. Baird & Co.

2 questions for CVLT

Tom Blakey

Cantor Fitzgerald

2 questions for CVLT

Ittai Kidron

Oppenheimer & Company

1 question for CVLT

Thomas Blakey

Cantor Fitzgerald

1 question for CVLT

Thomas Lehi

Cantor Fitzgerald

1 question for CVLT

Recent press releases and 8-K filings for CVLT.

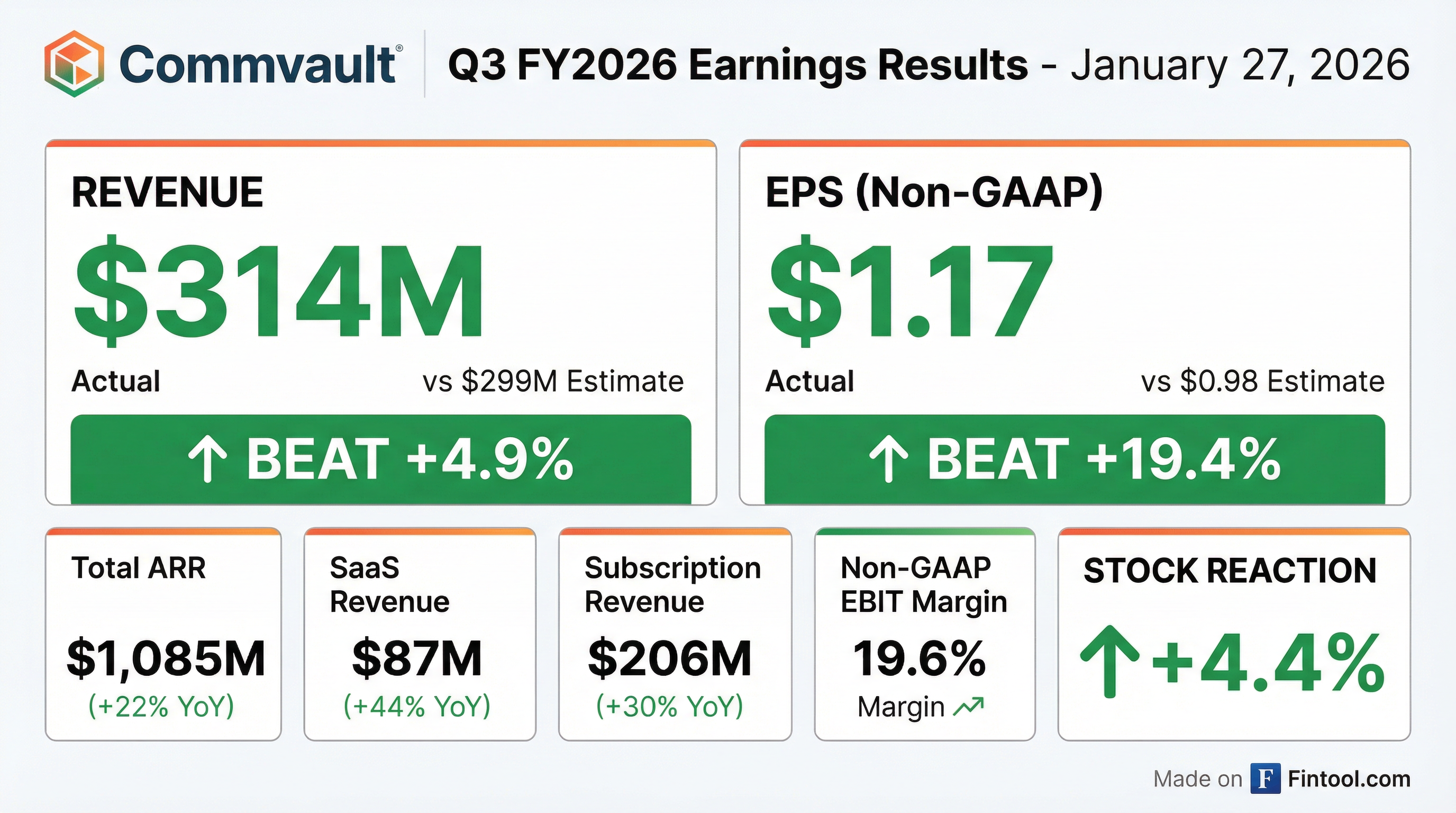

- Commvault reported strong Q3 2026 financial results, with total revenue growing 19% to $314 million and subscription revenue increasing 30% to $206 million.

- Annual Recurring Revenue (ARR) demonstrated significant momentum, with total ARR up 22% to $1.085 billion and SaaS ARR growing 40% to $364 million. The company also achieved the Rule of 40.

- The company raised its fiscal year 2026 guidance, now projecting total revenue between $1.177 billion and $1.18 billion and non-GAAP EBIT margin of 19%-20%.

- Strategic initiatives included the launch of the Commvault Cloud Unity Platform and a new partnership with Pinecone to enhance AI stack resilience. The board also recommitted its share repurchase authorization to $250 million.

- For Q3 Fiscal 2026, Commvault reported total revenue growth of 19% to $314 million, with subscription revenue increasing 30% to $206 million.

- Subscription ARR grew 28% to $941 million, and SaaS ARR increased 40% to $364 million, with the company achieving the Rule of 40.

- Commvault raised its full-year fiscal 2026 guidance, now expecting total revenue between $1.177 billion and $1.18 billion and a non-GAAP EBIT margin of 19%-20%.

- Strategic highlights include the launch of the Commvault Cloud Unity Platform, a new partnership with Pinecone, and becoming a launch partner for the AWS European Sovereign Cloud.

- The board approved recommitting the share repurchase authorization to $250 million, after $41 million in share repurchases during Q3.

- Commvault reported strong Q3 Fiscal 2026 results, with total revenue growing 19% to $314 million and subscription revenue increasing 30% to $206 million.

- The company saw significant growth in recurring revenue metrics, with Subscription ARR up 28% to $941 million and SaaS ARR up 40% to $364 million.

- Commvault added 700 new subscription customers and achieved the Rule of 40 in Q3, reflecting a healthy balance between growth and profitability.

- Strategic developments include the launch of the Commvault Cloud Unity Platform in November, which unifies data security, identity resilience, and cyber recovery, and new partnerships like the one with Pinecone for vector database resilience.

- For Q4 Fiscal 2026, the company expects total revenue between $305 million and $308 million and subscription revenue between $203 million and $207 million.

- Commvault reported Total ARR of $1,085 million and Subscription ARR of $941 million, representing 28% year-over-year growth for Q3 2026.

- SaaS ARR grew 40% year-over-year to $364 million, with a SaaS Net Dollar Retention Rate of 121% in Q3 2026.

- The company achieved a Non-GAAP Gross Margin of 81.5% and a Non-GAAP EBIT Margin of 19.6% for Q3 2026.

- Commvault provided FY 2026 guidance, forecasting Total Revenue between $1,177 million and $1,180 million and Free Cash Flow between $215 million and $220 million.

- Commvault reported record total revenue of $314 million for Q3 Fiscal 2026, marking a 19% year-over-year increase, with Annualized Recurring Revenue (ARR) growing 22% year-over-year to $1,085 million.

- Subscription revenue increased 30% year-over-year to $206 million, driven by SaaS revenue growth of 44% year-over-year to $87 million.

- GAAP net income was $18 million ($0.40 per diluted share), and operating cash flow was $4 million for the quarter ended December 31, 2025.

- The company repurchased approximately 327,000 shares for $41 million during the quarter and authorized a $250 million share repurchase program as of January 14, 2026.

- For Q4 Fiscal 2026, Commvault expects total revenues between $305 million and $308 million, and updated its full fiscal year 2026 guidance for total revenues to be between $1,177 million and $1,180 million.

- Commvault reported record total revenue of $314 million for the fiscal third quarter ended December 31, 2025, representing a 19% year-over-year increase, with annualized recurring revenue (ARR) reaching $1,085 million, up 22% year over year.

- For Q3 FY2026, the company achieved non-GAAP EBIT of $61 million, an operating margin of 19.6%, and GAAP net income of $18 million, or $0.40 per diluted share.

- Commvault provided guidance for Q4 FY2026, expecting total revenues between $305 million and $308 million, and updated full fiscal year 2026 total revenues to be between $1,177 million and $1,180 million.

- The company repurchased approximately 327,000 shares for $41 million during Q3 FY2026, and its Board of Directors approved recommitting $250 million to the share repurchase program as of January 14, 2026.

- A cost optimization program was initiated in Q3 FY2026, which includes workforce reductions and is expected to be substantially completed during fiscal 2027.

- Commvault announced the Commvault Cloud Unity platform release, which introduces a re-engineered experience for cloud-first and hybrid enterprises, centralizing resilience operations across clouds, regions, and accounts.

- The new platform features an AI-enabled interface for discovery, classification, and protection policy recommendations, designed to scale resilience in multi-cloud environments and optimize Total Cost of Ownership (TCO).

- It provides unparalleled multi-cloud and hybrid support, covering over 160 cloud regions and protecting more than 200 cloud services, and also allows for docking on-premises workloads to centralize governance.

- The platform is generally available today and can be accessed via the AWS and Microsoft Azure marketplaces, offering consumption-based pricing models.

- Commvault reported robust Q2 2026 financial results, with Total ARR reaching $1,043 million and Total Revenue of $276 million, marking an 18% year-over-year increase.

- The company's subscription-based business showed significant momentum, with Subscription ARR growing 30% year-over-year to $894 million and Subscription Revenue increasing 29% year-over-year to $173 million.

- Profitability remained strong, with a Non-GAAP Gross Margin of 80.5% and a Non-GAAP EBIT Margin of 18.6% for Q2 2026.

- Hyper-growth in the SaaS segment was evident, with SaaS ARR reaching $336 million, a 56% year-over-year increase, and a SaaS Net Dollar Retention Rate of 125%.

- For fiscal year 2026, Commvault updated its guidance, projecting Total Revenue between $1,161 million and $1,165 million and Free Cash Flow between $225 million and $230 million.

- Commvault achieved $1 billion in total Annual Recurring Revenue (ARR) in Q2 2026, two quarters ahead of its March 2026 target, with total ARR growing 22% (21% constant currency) to $1.04 billion.

- Subscription ARR increased 30% to $894 million, driven by SaaS ARR growth of 56% to $336 million, also two quarters earlier than projected.

- Total revenue for Q2 2026 grew 18% to $276 million, and the company added a record $47 million in net new ARR (constant currency).

- For Q2 2026, non-GAAP EBIT was $51 million (margin of 18.6%), and free cash flow grew 37% year-over-year to $74 million.

- Commvault updated its fiscal year 2026 guidance, expecting total ARR growth of 18% to 19% and total revenue of $1.161 billion to $1.165 billion. The company also completed the acquisition of Satori Cyber and repurchased $131 million of stock during the quarter.

- Commvault reported a strong Q2 2026, achieving $1.04 billion in total Annual Recurring Revenue (ARR), reaching the $1 billion milestone two quarters earlier than planned.

- Total revenue grew 18% to $276 million, with Subscription ARR increasing 30% to $894 million and SaaS ARR growing 56% to $336 million. The company also added a record $47 million in Net New ARR on a constant currency basis.

- For fiscal year 2026, Commvault raised its free cash flow outlook to $225 million-$230 million and increased constant currency total ARR growth expectations to 18%-19%.

- The company repurchased $131 million of stock during the quarter and ended with over $1 billion in cash. Strategic drivers include strong demand for its Cyber Resilience platform, continued cloud adoption, and innovation, exemplified by the acquisition of Satori Cyber.

Quarterly earnings call transcripts for COMMVAULT SYSTEMS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more