Earnings summaries and quarterly performance for Clearway Energy.

Executive leadership at Clearway Energy.

Board of directors at Clearway Energy.

Brian R. Ford

Lead Independent Director

Bruce MacLennan

Director

Daniel B. More

Director

E. Stanley O’Neal

Director

Jennifer Lowry

Director

Jonathan Bram

Chairman of the Board

Marc-Antoine Pignon

Director

Nathaniel Anschuetz

Director

Olivier Jouny

Director

Paige Goodwin

Director

Research analysts who have asked questions during Clearway Energy earnings calls.

Justin Clare

Roth MKM

6 questions for CWEN

Mark Jarvi

CIBC Capital Markets

6 questions for CWEN

Dimple Gosai

Bank of America

4 questions for CWEN

Hannah Velásquez

Jefferies

4 questions for CWEN

Nelson Ng

RBC Capital Markets

4 questions for CWEN

Heidi Hauch

BNP Paribas

3 questions for CWEN

Angie Storozynski

Seaport Research Partners

2 questions for CWEN

Corinne Blanchard

Deutsche Bank

2 questions for CWEN

Mike McNulty

Deutsche Bank

2 questions for CWEN

Noah Kaye

Oppenheimer & Co. Inc.

2 questions for CWEN

Steven Fleishman

Wolfe Research

2 questions for CWEN

Heidi Houpt

BNP Paribas

1 question for CWEN

Steve Fleishman

Wolfe Research, LLC

1 question for CWEN

Recent press releases and 8-K filings for CWEN.

- Clearway Energy (CWEN) delivered full-year 2025 Cash Available for Distribution (CAFD) of $430 million, at the top end of its original guidance range, and reaffirmed its 2026 CAFD guidance range of $470 million-$510 million.

- The company reiterated its 2027 CAFD per share target of $2.70 or better and its 2030 CAFD per share target of $2.90-$3.10 per share, representing a 7%-8% CAGR from 2025.

- CWEN added 1.3 GW of value-enhancing projects in 2025 and signed approximately 2 GW of new PPAs with hyperscalers and utilities serving data centers.

- The company identified approximately $1.3 billion in corporate capital investment opportunities for 2027-2028 projects at a 10.5% CAFD yield or better, with potential for at least $650 million of incremental capital deployment over 2028-2030.

- Funding efforts included closing an upsized offering of $600 million in senior unsecured notes due in 2034 and issuing $100 million of equity since late August.

- Clearway Energy (CWEN) delivered 2025 full-year cash available for distribution (CAFD) at the top end of its guidance and reaffirmed its 2026 CAFD guidance. The company reiterated its 2027 CAFD per share target of $2.70 or better and is on track for a 2030 CAFD per share target of $2.90-$3.10, representing a 7%-8% CAGR from 2025.

- Growth is supported by significant commercialization, including approximately 2 gigawatts of new PPAs with hyperscalers in 2025, and 100% of planned repowering and new construction projects for 2026 and 2027 construction vintages have been commercialized.

- Clearway has identified approximately $1.3 billion of corporate capital investment opportunities for 2027-2028 tied to commercialized projects, targeting a 10.5% CAFD yield or better. The company also expects to deploy at least $650 million of incremental capital over 2028-2030.

- The Deriva acquisition is expected to close imminently, well in advance of the end of the first half of 2026.

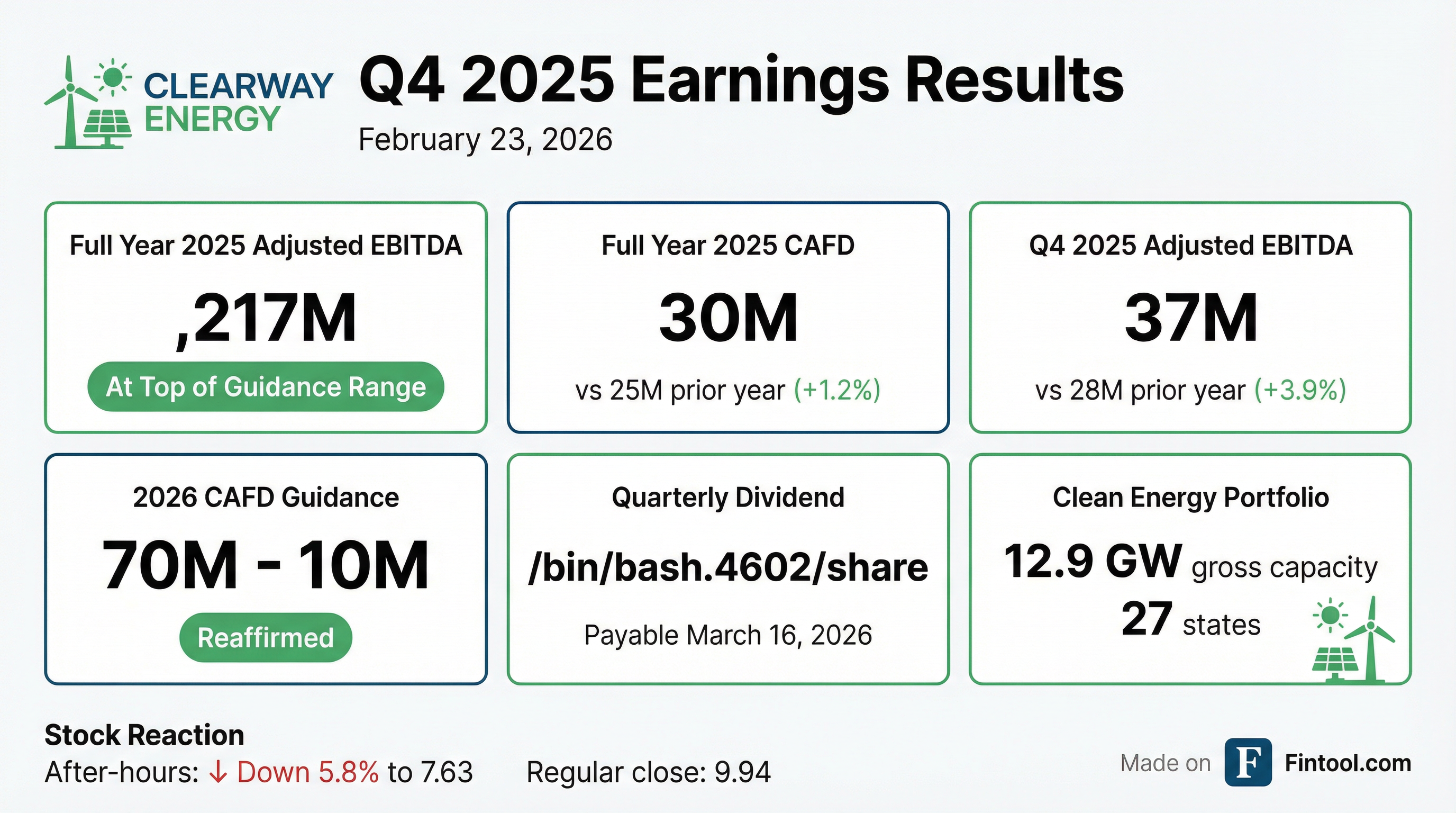

- Clearway Energy reported Q4 2025 Adjusted EBITDA of $237 million and Cash Available for Distribution (CAFD) of $35 million.

- For the full year, 2025 CAFD reached $430 million, which was above the midpoint of its original guidance range of $400 million-$440 million.

- The company reaffirmed its 2026 CAFD guidance range of $470 million-$510 million and reiterated its 2027 CAFD per share target of $2.70 or better.

- Clearway Energy remains on track for its 2030 CAFD per share target of $2.90-$3.10, representing a 7%-8% CAGR from 2025, and is optimistic about 5% to 8%+ CAFD per share growth in 2031 and beyond.

- In 2025, the company added 1.3 GW of value-enhancing projects and signed approximately 2 GW of new PPAs with hyperscalers. Funding efforts included closing a $600 million senior unsecured notes offering and $100 million in opportunistic equity issuances, with the Deriva acquisition expected to close imminently.

- Clearway Energy (CWEN) reported Q4 2025 Net Income of $50 million, Adjusted EBITDA of $250 million, and Cash Available for Distribution (CAFD) of $125 million. For the full year 2025, Net Income was $200 million, Adjusted EBITDA was $900 million, and CAFD totaled $450 million.

- The company provided 2026 guidance, projecting Adjusted EBITDA of $1 billion and CAFD of $500 million.

- CWEN demonstrated a strong funding position, including a $600 million 2034 senior unsecured notes offering at 5.75% and $50 million in equity raised in early 2026.

- Operational highlights include 1.1 GW reaching commercial operation in 2025, with 2.5 GW expected to commence construction over the next 12 months, contributing to a 4.6 GW contracted and awarded pipeline.

- Clearway Energy, Inc. achieved full year 2025 financial results at the top end of its original guidance range, reporting a Net Loss of $231 million, Adjusted EBITDA of $1,217 million, and Cash Available for Distribution (CAFD) of $430 million.

- The company advanced its sponsor-enabled growth program with signed agreements for a 291 MW storage portfolio targeting 2026 commercial operations and an outlook for 2027/2028 including offers to invest in the 520 MW Royal Slope solar plus storage and 650 MW Swan Solar projects.

- In January 2026, Clearway Group announced the execution of 1.1 GW of long-term power purchase agreements (PPAs) with Google for projects in Missouri, Texas, and West Virginia, targeting commercial operations in 2027 and 2028.

- Clearway Energy, Inc. opportunistically raised $600 million of corporate debt through senior unsecured notes due 2034 in January 2026, which were used to repay outstanding borrowings, and $50 million in equity through Class C common stock sales in Q1 2026.

- The Board of Directors declared a quarterly dividend of $0.4602 per share on Class A and Class C common stock, payable on March 16, 2026.

- Clearway Energy, Inc. reported full year 2025 financial results including a Net Loss of $231 million, Adjusted EBITDA of $1,217 million, and Cash Available for Distribution (CAFD) of $430 million.

- The company reaffirmed its 2026 full year CAFD guidance range of $470 million to $510 million.

- Clearway Energy advanced its Fleet Enhancement program and Sponsor Enabled growth program, committing to 2026 COD projects with a 291 MW storage portfolio and securing 2 GW of contracts to provide power solutions for data centers.

- Since the last earnings call, the company opportunistically raised $600 million of corporate debt and $50 million in equity.

- Clearway Energy (CWEN) has a strong outlook for 2026, with guidance well received, and is on track to fulfill its guidance for the year.

- The company is confident in achieving its 2027 goals and aims for the top end or better of its $3.10 in CAFD per share range by 2030.

- CWEN is positioned for sustainable 8%+ CAFD per share growth into the 2030s and beyond, supported by a routine tempo of 2 GW of project construction per year at 10.5% or better CAFD yields.

- Recent commercialization efforts, including a 1.2 GW deal with Google for projects mostly in 2028, have secured a majority of planned builds through 2028 and are in late stages for 2029.

- Clearway Energy (CWEN) is confident about its 2026 outlook and its path to fulfilling 2026 guidance and 2027 goals, with a clear trajectory towards its 2030 goals.

- The company aims for 8%+ sustainable growth over time, supported by constructing at least 2 GW of projects annually that are deployed into CWEN at 10.5% CAFD yields or better.

- New contracts, including a significant partnership with Google, are expected to support CAFD growth into the end of the decade, contributing to the goal of achieving the top end or better of $3.10 in CAFD per share by 2030.

- CWEN's capital allocation strategy focuses on moving towards a lower leverage ratio and payout ratio over time, using recurring cash flow for growth, and sustaining a competitive dividend per share growth rate.

- While third-party M&A is not factored into core growth plans, the current market environment presents opportunities for accretive acquisitions.

- Clearway Energy aims for 7% to 8% CAFD per share growth through 2030, with projects largely secured through 2029 to meet or exceed the upper end of this target.

- The company intends to maintain a capital allocation framework focused on a 4-4.5x leverage ratio and consistent equity issuance, with plans to move towards a lower leverage and payout ratio over time.

- Clearway Energy targets 10.5% CAFD yields and $40,000 per megawatt or better in CAFD for new assets, noting that recent projects have delivered yields above this target.

- The company anticipates a "new norm" of larger projects, expecting to build 2 gigawatts or more per year, which will lead to more frequent large-scale announcements.

- Clearway Energy plans to continue integrating gas resources into its portfolio, alongside renewables and batteries, to ensure reliability and cost-effectiveness, aiming for a mix of approximately 70% renewable generation and 30% from battery and gas facilities.

- Clearway Energy Group signed three long-term power-purchase agreements (PPAs) with Google for 1.17 GW of carbon-free projects, representing over $2.4 billion in investment, with initial sites expected online in 2027 and 2028.

- The company recently completed an upsized $600 million offering of 5.750% senior notes due 2034.

- In its most recent quarter, Clearway reported net income of $60 million, adjusted EBITDA of $385 million, operating cash flow of $225 million, and CAFD of $166 million.

- Analysts highlight potential upside from long-term contracted revenue but also note financial risks due to elevated leverage (debt-to-equity ratio of about 4.5) and an Altman Z-Score in the distress range.

Fintool News

In-depth analysis and coverage of Clearway Energy.

Quarterly earnings call transcripts for Clearway Energy.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more