Earnings summaries and quarterly performance for CyberArk Software.

Research analysts who have asked questions during CyberArk Software earnings calls.

John DiFucci

Guggenheim Securities

4 questions for CYBR

Saket Kalia

Barclays Capital

4 questions for CYBR

Jonathan Ho

William Blair & Company

3 questions for CYBR

Matthew Hedberg

RBC Capital Markets

3 questions for CYBR

Roger Boyd

UBS

3 questions for CYBR

Shaul Eyal

TD Cowen

3 questions for CYBR

Adam Borg

Stifel Financial Corp.

2 questions for CYBR

Gregg Moskowitz

Mizuho

2 questions for CYBR

Hamza Fodderwala

Morgan Stanley

2 questions for CYBR

Robbie Owens

Piper Sandler

2 questions for CYBR

Andrew Nowinski

Wells Fargo

1 question for CYBR

Brian Essex

JPMorgan Chase & Co.

1 question for CYBR

Charlotte Bedick

JPMorgan Chase & Co.

1 question for CYBR

Fatima Boolani

Citi

1 question for CYBR

Ittai Kidron

Oppenheimer & Company

1 question for CYBR

Joseph Gallo

Jefferies & Company Inc.

1 question for CYBR

Joshua Tilton

Wolfe Research

1 question for CYBR

Junaid Siddiqui

Truist Securities

1 question for CYBR

Keith Weiss

Morgan Stanley

1 question for CYBR

Madeline Brooks

Bank of America

1 question for CYBR

Recent press releases and 8-K filings for CYBR.

- On February 11, 2026, CyberArk Software Ltd. completed its merger with Palo Alto Networks, Inc. (PANW), resulting in CyberArk becoming a wholly owned subsidiary of PANW.

- Each outstanding ordinary share of CyberArk was converted into the right to receive 2.2005 shares of common stock of PANW and $45.00 in cash.

- Palo Alto Networks, Inc. (PANW) has become a guarantor of CyberArk's 0.00% Convertible Senior Notes due 2030.

- For conversions of these Notes on or after February 11, 2026, CyberArk has irrevocably elected to eliminate Physical Settlement, and the Default Settlement Method will be Cash Settlement.

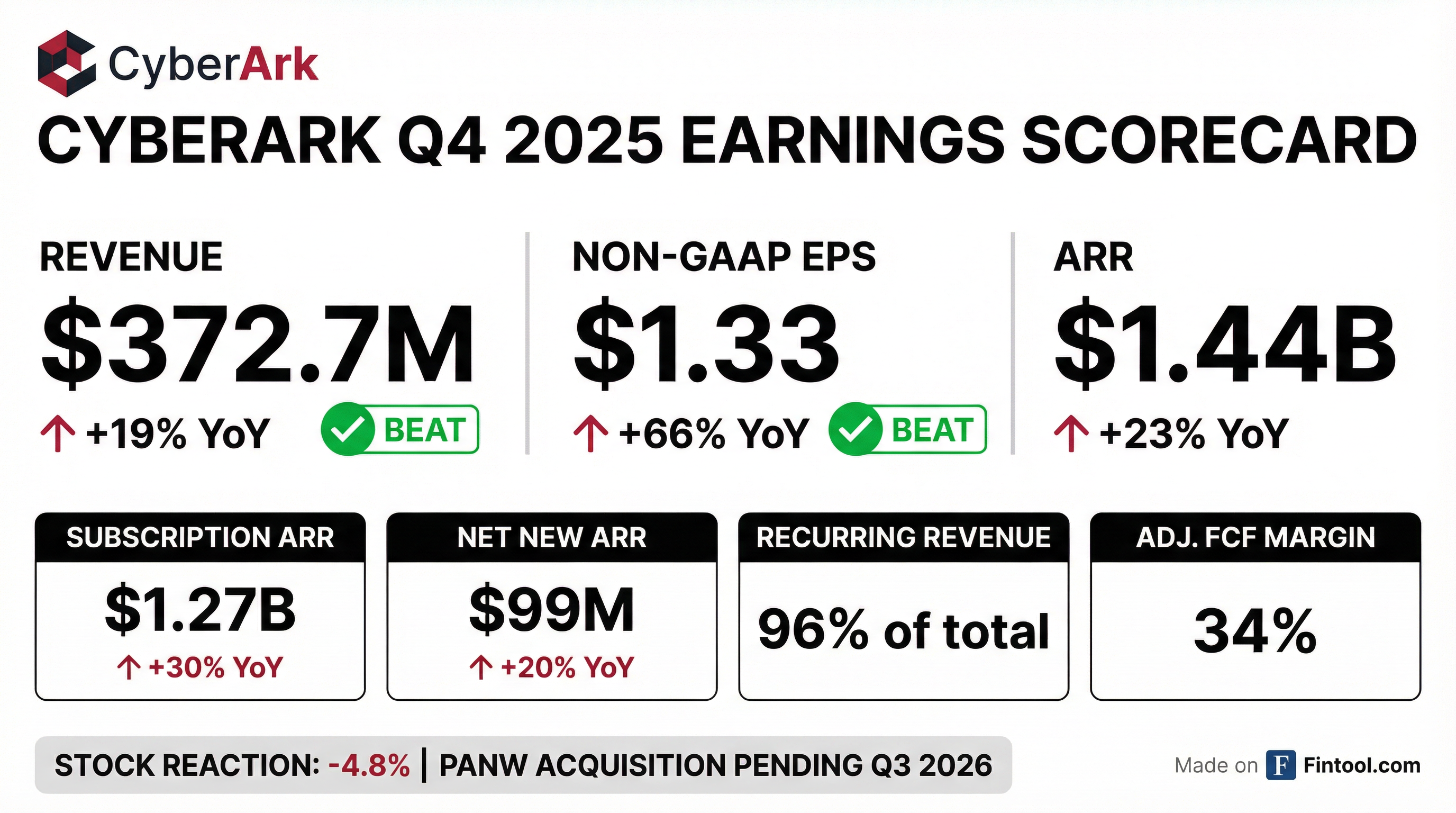

- CyberArk reported record financial results for the fourth quarter and full year ended December 31, 2025, with total revenue reaching $372.7 million in Q4 2025 (up 19% year-over-year) and $1.361 billion for the full year (up 36% year-over-year).

- Annual Recurring Revenue (ARR) increased 23% year-over-year to $1.440 billion as of December 31, 2025, driven by a 30% year-over-year growth in subscription ARR to $1.267 billion.

- The company achieved record net new ARR of $99 million, representing a 20% year-over-year increase.

- Non-GAAP net income for Q4 2025 was $72.6 million ($1.33 per diluted share), and for the full year 2025 was $233.4 million ($4.40 per diluted share).

- CyberArk has entered into a definitive agreement to be acquired by Palo Alto Networks, with the transaction anticipated to close during PANW's fiscal third quarter of 2026.

- CyberArk reported robust Q4 2025 financial results, with Total Revenue of $373 million, a 19% year-over-year increase, and Annual Recurring Revenue (ARR) reaching $1,440 million, up 23% year-over-year.

- Subscription ARR grew 30% year-over-year to $1,267 million, and Net New ARR was $99 million in Q4 2025.

- The company achieved strong profitability, with a Non-GAAP Operating Margin of 20% and an Adjusted Free Cash Flow Margin of 34% in Q4 2025.

- These results include financial contributions from the acquisitions of Venafi and Zilla, and the company noted a proposed transaction with Palo Alto Networks (PANW).

- CyberArk reported record financial results for the fourth quarter and full year ended December 31, 2025, with total revenue reaching $372.7 million in Q4 2025 (up 19% year-over-year) and $1.361 billion for the full year 2025 (up 36% year-over-year).

- The company achieved record net new Annual Recurring Revenue (ARR) of $99 million (up 20% year-over-year) and saw total ARR grow 23% year-over-year to $1.440 billion as of December 31, 2025.

- Non-GAAP net income was $72.6 million ($1.33 per diluted share) for Q4 2025 and $233.4 million ($4.40 per diluted share) for the full year 2025.

- CyberArk is subject to a proposed acquisition by Palo Alto Networks, which is expected to close during the third quarter of PANW’s fiscal 2026.

- CyberArk Software Ltd. announced that its shareholders approved the Merger Proposal at a Special General Meeting held on November 13, 2025.

- The merger agreement, dated July 30, 2025, will result in CyberArk becoming a wholly owned subsidiary of Palo Alto Networks, Inc. (PANW).

- As part of the transaction, CyberArk shareholders will receive 2.2005 shares of PANW common stock and $45.00 in cash for each ordinary share held.

- The transaction is anticipated to close during the second half of PANW’s fiscal year 2026, subject to regulatory and other customary closing conditions.

- Shareholders also approved the Company's 2024 share incentive plan.

- CyberArk's Annual Recurring Revenue (ARR) for Q3 2025 reached $1,341 million, marking a 45% increase year-over-year.

- Subscription ARR grew to $1,158 million, representing a 57% year-over-year increase.

- Total Revenue for Q3 2025 was $343 million, demonstrating 43% year-over-year growth.

- Net New ARR for the quarter was $68 million, an increase of 16% year-over-year.

- The company achieved a Non-GAAP Operating Margin of 19% and an Adjusted Free Cash Flow Margin of 15% in Q3 2025.

- CyberArk reported a 43% increase in Q3 revenue to $342.84 million, driven by a 60% jump in subscription revenue and annual recurring revenue (ARR) growth to $1.34 billion.

- Despite strong revenue growth, the company posted a net loss of approximately $50 million in Q3 and a $129.8 million net loss for the nine months ended September 30, 2025, largely due to acquisition-related and integration costs.

- CyberArk's quarterly earnings per share (EPS) of $1.20 surpassed consensus estimates by over 30%, contributing to the stock's 51.8% gain year-to-date.

- The company is preparing for a $25 billion acquisition by Palo Alto Networks, with profitability challenges persisting due to high operating expenses and a negative net margin.

- CyberArk reported total revenue of $342.8 million for the third quarter ended September 30, 2025, marking a 43% increase from the same period last year.

- Total Annual Recurring Revenue (ARR) reached $1.341 billion as of September 30, 2025, representing a 45% year-over-year growth. The subscription portion of ARR grew 57% year-over-year to $1.158 billion.

- For Q3 2025, the company reported a GAAP operating loss of $(50.1) million and a GAAP net loss of $(50.4) million, or $(1.00) per basic and diluted share.

- Non-GAAP operating income was $64.8 million (19% margin) and non-GAAP net income was $64.9 million, or $1.20 per diluted share for the third quarter of 2025.

- CyberArk announced a definitive agreement for Palo Alto Networks to acquire the company in a cash-and-stock transaction valued at approximately $25 billion in equity value, with the closing expected during the second half of PANW's fiscal 2026.

- CyberArk reported strong financial results for Q3 2025, with total revenue increasing 43% year-over-year to $342.8 million and subscription revenue growing 60% to $280.1 million.

- Non-GAAP net income for Q3 2025 was $64.9 million, or $1.20 per diluted share, compared to $45.1 million, or $0.94 per diluted share, in the same period last year.

- Total Annual Recurring Revenue (ARR) grew 45% year-over-year to $1.341 billion as of September 30, 2025, with the subscription portion of ARR increasing 57% to $1.158 billion.

- The company achieved net new ARR of $68 million in the third quarter of 2025.

- CyberArk has entered into a definitive agreement to be acquired by Palo Alto Networks for approximately $25 billion in equity value, with the transaction expected to close during the second half of PANW's fiscal 2026. As a result, CyberArk will not be providing financial guidance.

- CyberArk Software Ltd. (CYBR) has issued Supplemental Disclosures to its Proxy Statement for the proposed merger with Palo Alto Networks, Inc. (PANW), in response to shareholder demand letters alleging incomplete information.

- The merger agreement, dated July 30, 2025, will result in CyberArk becoming a wholly owned subsidiary of PANW, with a special shareholder meeting scheduled for November 13, 2025, to approve the transaction.

- The supplemental disclosures include CyberArk's cash and cash equivalents of $1,919 million and outstanding convertible debt of $1,250 million as of June 30, 2025, along with updated financial analyses from Qatalyst Partners LP.

Quarterly earnings call transcripts for CyberArk Software.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more