DANAHER CORP /DE/ (DHR)·Q4 2025 Earnings Summary

Danaher Beats on EPS, Bioprocessing Drives Strong Q4 Finish

January 28, 2026 · by Fintool AI Agent

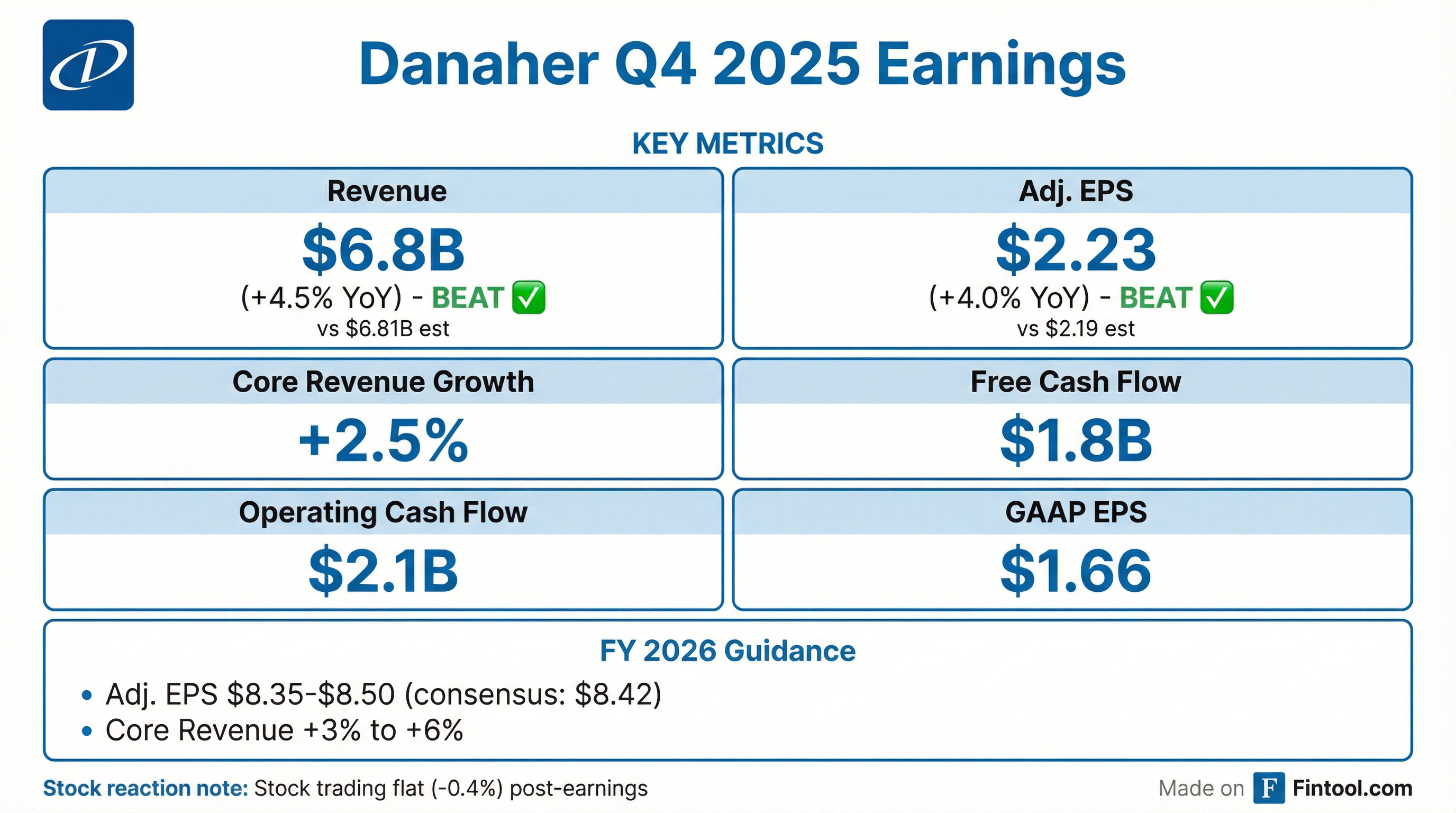

Danaher delivered a solid Q4 2025 with adjusted EPS of $2.23, beating consensus by 1.8%, while revenue of $6.8B landed essentially in-line with expectations . The standout was the Biotechnology segment, which surged 9% on continued bioprocessing strength. Management expressed optimism that gradual end-market recovery will continue into 2026, guiding adjusted EPS of $8.35-$8.50 .

Did Danaher Beat Earnings?

Danaher exceeded earnings expectations while matching revenue consensus:

For full year 2025, Danaher delivered revenue of $24.57B (+3.0% YoY, +2.0% core), adjusted EPS of $7.80 (+4.3% YoY), and free cash flow of $5.29B (1.47x net earnings conversion) .

What Changed From Last Quarter?

The improving trend Danaher flagged in Q3 2025 continued:

- Biotechnology accelerated: Core growth of +6% in Q4 vs. +5% in Q3

- Diagnostics momentum: Core growth of +2% vs. flat in Q3

- Life Sciences stabilizing: Core growth of +0.5% vs. -1% in Q3, showing gradual improvement

- Margin execution: Q4 operating margin of 22.0% vs. 21.8% in Q4 2024

- Cash generation strong: Free cash flow conversion of 1.50x net earnings in Q4

CEO Rainer Blair noted: "We delivered a strong finish to the year with better-than-expected performance across our portfolio. We were particularly encouraged by continued strength in our bioprocessing business, along with improved momentum in Diagnostics and Life Sciences."

How Did Each Segment Perform?

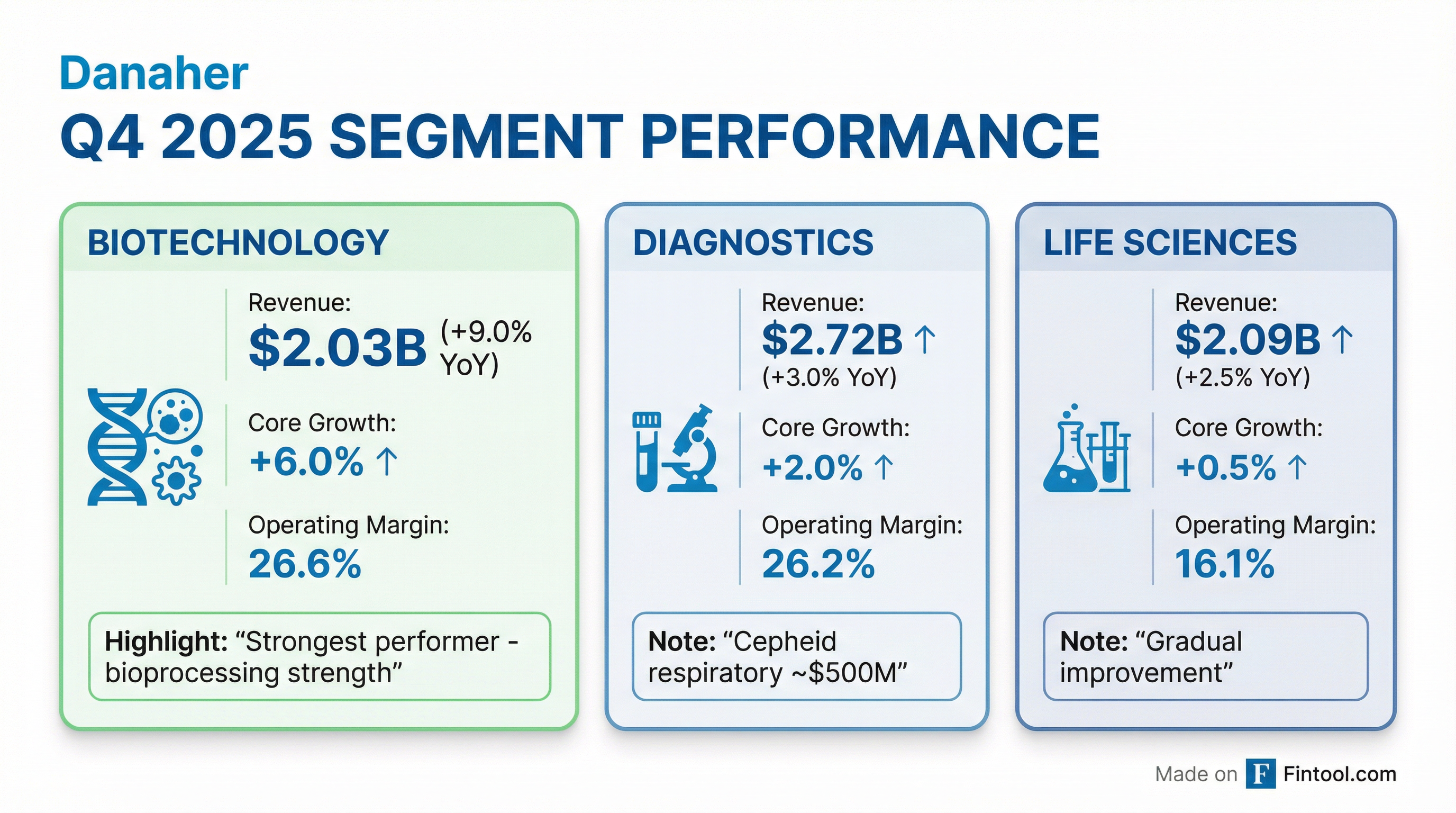

Biotechnology — The Star Performer

Cytiva's bioprocessing business led the way with high-single-digit consumables growth and mid-single-digit equipment growth . Management highlighted a third consecutive quarter of sequential equipment order growth, though orders remain below historical levels .

A key bullish data point: "Global biologic revenues surpassed small molecule drugs for the first time" in 2025, and biologics are expected to represent more than two-thirds of the top 100 drugs by 2030 .

Diagnostics — Steady Progress

Cepheid respiratory revenue was approximately $500M in Q4, exceeding expectations as customers stocked up ahead of an active flu season . Management revised their endemic respiratory assumption to ~$1.8B annually, up from prior estimates .

Non-respiratory Cepheid grew low-double-digits, highlighted by :

- Sexual health: ~30% growth (MVP panel gaining traction)

- Hospital-acquired infections: Mid-teens growth

Beckman Coulter Diagnostics delivered its sixth consecutive quarter of mid-single-digit or better core growth outside China .

Life Sciences — Gradual Recovery

SCIEX delivered mid-single-digit growth in Q4, driven by the ZenoTOF 8600 launch and continued pharma end-market improvement — the third consecutive quarter of pharma growth . Clinical and applied markets (including PFAS testing) remained robust.

End-market breakdown (in order of size) :

- Pharma: Growing for 3 consecutive quarters

- Clinical/Applied: Stable and robust

- Academic/Government: Muted but stable

What Did Management Guide?

Danaher's FY 2026 outlook aligns with consensus expectations:

Segment-level guidance for FY 2026 :

- Biotechnology: High-single digit core growth, led by consumables; equipment assumed flat for the year

- Diagnostics: Low-single digit core growth; respiratory revenue of ~$1.8B (normal season assumption)

- Life Sciences: Flat core growth; expecting modest end-market improvement through the year

EPS bridge construction (per CFO Matt McGrew) :

- Core growth assumption: 3%-4% (low end of range)

- Fall-through: 35%-40%

- $0.30 EPS benefit from 2025 cost actions (~$250M savings)

- Below-the-line items (FX, etc.): assumed neutral

Additional modeling assumptions :

- Adjusted operating margin: ~28.5% in Q1

- Effective tax rate: ~17%

- FX tailwind: ~+3.5% on Q1 sales, ~+1% on FY sales

- Corporate expense: ~$360M

- Net interest expense: ~$180M

- Avg. diluted shares: ~717M

CEO Blair was optimistic: "Looking ahead, we expect the gradual improvement in our end markets we saw through 2025 to continue, and we believe the combination of our differentiated portfolio, the power of the Danaher Business System, and the strength of our balance sheet positions Danaher for long-term value creation."

What Were the Key Q&A Highlights?

On Bioprocessing Outlook and Upside Levers

Mike Ryskin (Bank of America) asked about the path to the high end of guidance. CEO Rainer Blair identified two key upside levers :

- Life Sciences recovery — Need to see improved biotech funding translate into orders, and China life science research to accelerate

- Bioprocessing acceleration — Equipment could outperform if demand accelerates, or consumables could grow faster as biosimilars ramp

On bioprocessing specifically, Blair confirmed: "The order book fully supports the high single digit growth... we feel very good about that. Equipment orders [have been] increasing sequentially the last three quarters in a row."

On M&A Posture

Doug Schenkel (Wolfe Research) asked about capital deployment. Blair was notably constructive :

"The M&A environment is more constructive. We've seen some valuations moving in the right direction. Interest rates have moderated a little bit... our balance sheet is in a place where we're able to act on opportunities."

On Abcam Turnaround

Patrick Donnelly (Citi) pressed on Abcam's progress. Blair highlighted meaningful improvement :

"We've seen now three months of growth, particularly driven by recombinant proteins in the pharma segment... The operating margins are 500 basis points higher than when we acquired the business."

On Reshoring as a Long-Term Catalyst

Dan Leonard (UBS) asked about U.S. reshoring conversations. Blair was bullish :

"We could be in the early innings of a long-term investment cycle... There's no question that [reshoring] is going to happen. It's just a matter now of bringing that timing together."

He noted equipment investment has been muted for two years despite strong consumables demand, suggesting catch-up capex is needed just to meet existing demand — before reshoring even kicks in.

On Bioprocessing Business Mix

Dan Leonard (UBS) also asked about biotech funding sensitivity. Management clarified :

- 75% of bioprocessing is driven by commercial volume (therapies already on the market)

- 10-15% exposure to emerging biotech

- Remainder is clinical-stage programs

This explains why bioprocessing has been resilient despite biotech funding pressure.

How Did the Stock React?

Danaher shares were trading at $235.75, down 0.4% following the earnings release. The muted reaction reflects results that were largely in-line with expectations, with no major surprises on guidance.

Recent performance context:

- 52-week range: $171 - $243

- Trading at 97% of 52-week high

- Up 38% from 52-week low

- Above 50-day MA ($230) and 200-day MA ($207)

The stock has recovered strongly from 2024 lows as bioprocessing destocking concerns have faded and end-market trends have improved.

What Were the 2025 Innovation Highlights?

Danaher highlighted several product launches that strengthened its competitive position :

What Are the Key Risks?

Management flagged several uncertainties in the forward-looking statements :

- Tariffs: Impact of U.S. and international trade actions on costs and supply chains

- AI deployment: Uncertainties around AI integration in products and operations

- End-market cyclicality: Life sciences and biotech spending remains somewhat volatile

- FX exposure: ~1% FY impact expected, but rates can shift quickly

- Regulatory: Healthcare regulations and approval timelines

Balance Sheet Snapshot

Danaher maintains a strong balance sheet with ample liquidity for M&A and capital return.

The Bottom Line

Danaher delivered a clean quarter that validated the gradual recovery narrative. Biotechnology's 6% core growth shows bioprocessing demand is finally turning the corner after a prolonged destocking cycle. FY 2026 guidance of $8.35-$8.50 EPS implies 7-9% growth, reasonable given the mixed end-market outlook.

What bulls will focus on:

- Bioprocessing inflection appears real — three consecutive quarters of sequential equipment order growth

- M&A environment "more constructive" with valuations moving in right direction

- Reshoring could drive a "long-term investment cycle" in bioprocessing capex

- Abcam margins up 500 bps since acquisition, now returning to growth

- 75% of bioprocessing is commercial volume — less cyclical than perceived

What bears will focus on:

- Life Sciences remains sluggish (+0.5% core); pharma growing but academic muted

- Equipment guide of "flat" is conservative, but management burned before

- Guidance midpoint only matches consensus — no beat-and-raise

- China remains a headwind (low-single-digit decline in Q4)

The lack of stock movement suggests the market views this as a "meet expectations" quarter. But the Q&A revealed meaningful positive signals — particularly on M&A readiness and reshoring — that could drive re-rating if they materialize.

Explore more: Danaher Company Profile · Q4 2025 Documents · Q3 2025 Earnings