Earnings summaries and quarterly performance for DANAHER CORP /DE/.

Executive leadership at DANAHER CORP /DE/.

Rainer Blair

Chief Executive Officer

Brian Ellis

Senior Vice President

Georgeann Couchara

Senior Vice President, Human Resources

Jose-Carlos Gutierrez-Ramos

Senior Vice President and Chief Science Officer

Matthew Gugino

Executive Vice President and Chief Financial Officer (effective February 28, 2026)

Matthew McGrew

Executive Vice President and Chief Financial Officer

Mitchell Rales

Chairman of the Executive Committee

Steven Rales

Chairman of the Board

Board of directors at DANAHER CORP /DE/.

A. Shane Sanders

Director

Alan Spoon

Director

Charles Lamanna

Director

Elias Zerhouni

Director

Feroz Dewan

Director

Jessica Mega

Director

John Schwieters

Director

Linda Filler

Lead Independent Director

Raymond Stevens

Director

Teri List

Director

Research analysts who have asked questions during DANAHER CORP /DE/ earnings calls.

Scott Davis

Melius Research

8 questions for DHR

Michael Ryskin

Bank of America Merrill Lynch

7 questions for DHR

Tycho Peterson

Jefferies

7 questions for DHR

Jack Meehan

Nephron Research LLC

6 questions for DHR

Vijay Kumar

Evercore ISI

6 questions for DHR

Doug Schenkel

Wolfe Research LLC

5 questions for DHR

Dan Brennan

UBS

4 questions for DHR

Puneet Souda

Leerink Partners

4 questions for DHR

Daniel Brennan

TD Cowen

3 questions for DHR

Dan Leonard

UBS Group AG

3 questions for DHR

Douglas Schenkel

Wolfe Research, LLC

3 questions for DHR

Patrick Donnelly

Citi

2 questions for DHR

Rachel Vatnsdal Olson

JPMorgan

2 questions for DHR

Daniel Arias

Stifel, Nicolaus & Company, Incorporated

1 question for DHR

Daniel Leonard

Stifel Financial Corp.

1 question for DHR

Luke Sergott

Barclays

1 question for DHR

Michael Wriston

Bank of America

1 question for DHR

Rachel Vatnsdal

JPMorgan Chase & Co.

1 question for DHR

Recent press releases and 8-K filings for DHR.

- Danaher entered a definitive agreement to acquire Masimo for $180 per share in cash, implying a $9.9 billion enterprise value and a transaction multiple of 18× estimated 2027 EBITDA (15× including expected synergies).

- The acquisition is expected to close in the second half of 2026, subject to regulatory clearances and Masimo shareholder approval, and will be funded with cash on hand and debt financing.

- Masimo is projected to generate over $530 million of EBITDA in 2027, be accretive to adjusted EPS by $0.15–$0.20 in the first full year and approximately $0.70 by the fifth full year, with > $125 million of annual cost synergies and > $50 million of annual revenue synergies by year five.

- Danaher will acquire all outstanding Masimo shares for $180 per share in cash, valuing the deal at approximately $9.9 billion including debt and net of cash.

- The transaction multiple is 18× 2027 estimated EBITDA (or 15× including full synergies), and it is expected to close in H2 2026 pending regulatory and shareholder approvals.

- Masimo will operate as a standalone company within Danaher’s Diagnostics segment and is forecast to be accretive by $0.15–$0.20 per share in the first full year and $0.70 by the fifth year post-close.

- Danaher expects Masimo to generate EBITDA exceeding $530 million in 2027 and realize over $125 million in annual cost synergies plus $50 million in revenue synergies by the fifth year.

- Danaher is close to agreeing on a $9.9–$10 billion deal to acquire Masimo, a premium over Masimo’s $7 billion market valuation, with an announcement potentially imminent.

- The proposed deal would be Danaher’s largest since its $21.4 billion Cytiva acquisition, underscoring the strategic scale of the transaction.

- Masimo, known for noninvasive patient-monitoring technologies such as pulse oximeters, has seen its stock drop about 27–28% over the past year and is entangled in a patent dispute with Apple.

- Analyst consensus rates Danaher as a Strong Buy (17 Buys, 1 Hold) with an average price target implying roughly 25.2% upside.

- The market grew from $1.43 billion in 2024 to $1.59 billion in 2025, with projections to hit $2.75 billion by 2031 at a 9.7% CAGR

- Regulatory mandates, patent expirations, and complex biologic pipelines are driving mandatory LC-MS/MS adoption across all drug development phases

- Expansion of outsourced bioanalytical testing by CROs/CDMOs and the shift to complex molecules (biologics, ADCs) amplify demand for advanced mass spectrometry

- Innovator pharma and biotech companies are the top spenders on capital deployment, while high ownership costs constrain smaller firms and generics manufacturers

- The market is moderately consolidated: Thermo Fisher Scientific, Agilent, and Waters lead, with a second tier including Danaher (SCIEX)

- BCC Research projects the bioprocess filtration market to expand from $8.4 billion in 2025 to $15.6 billion by 2030, achieving a 13.1% CAGR over the period.

- Growth is driven by increasing demand for biologics, gene therapies, and cell-based treatments, expansion of CDMOs/CMOs, and rising adoption of single-use filtration systems under stringent GMP standards.

- The consumables segment (cartridges, capsules, membranes, single-use assemblies) is expected to remain dominant through 2030.

- North America leads the market, supported by major suppliers including Danaher’s Cytiva, Merck KGaA, Sartorius, and Repligen.

- Danaher’s Cytiva invested $1.6 billion in 2025 to expand global filtration and device capacity—boosting its Ilfracombe, U.K. site by 81%.

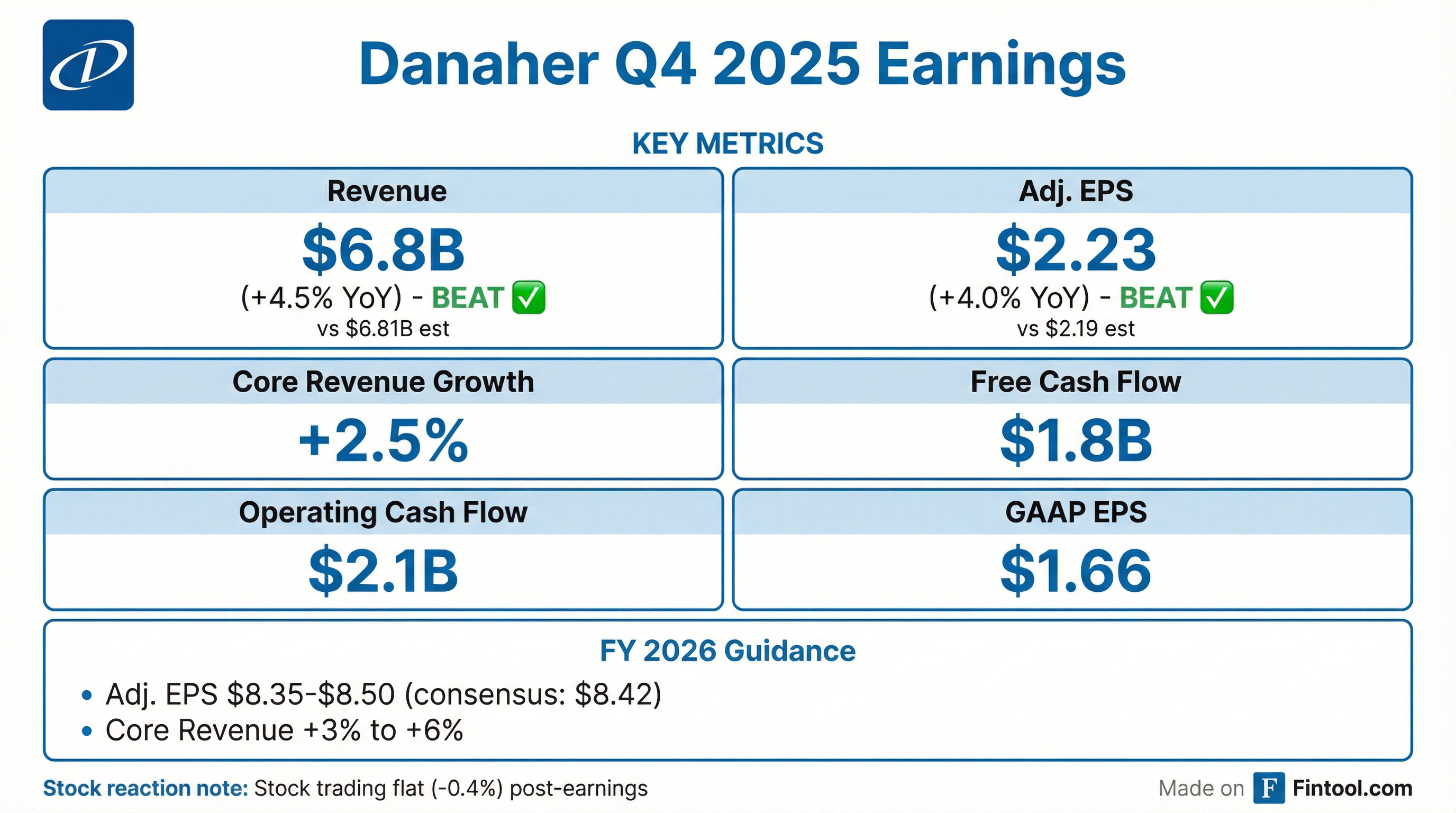

- Danaher’s Q4 2025 sales were $6.8 billion, with 2.5% core revenue growth; adjusted EPS was $2.23, and free cash flow totaled $1.8 billion.

- Full-year 2025 sales reached $24.6 billion, core revenue grew 2%, adjusted EPS was $7.80 (+4.5%), and free cash flow was $5.3 billion (145% conversion).

- For 2026, Danaher guided to 3%–6% core revenue growth, adjusted EPS of $8.35–$8.50, and Q1 core revenue up low single digits with an operating margin of ~28.5%.

- Danaher capped Q4 2025 with better-than-expected margins, earnings and cash flow, driven by high single-digit bioprocessing growth and improving diagnostics and life sciences end markets.

- Full year 2025: $24.6 B in sales (2% core growth), 28.2% adjusted operating margin, $7.80 EPS (+4.5%), and $5.3 B free cash flow (145% conversion).

- 2026 outlook: 3–6% core revenue growth and $8.35–$8.50 adjusted EPS, with Q1 revenue up low single digits and ~28.5% margin.

- Continued innovation: Cytiva rolled out 20+ biologics workflow products (e.g., new Xcellerex bioreactor formats) and SCIEX launched the ZenoTOF 8600 mass spectrometer.

- Danaher delivered Q4 2025 sales of $6.8 B (core revenue +2.5%), adjusted EPS $2.23 (+4%), and free cash flow $1.8 B.

- For full year 2025, sales reached $24.6 B (core +2%), with an adjusted operating margin of 28.2%, adjusted EPS $7.80 (+4.5%), and free cash flow $5.3 B (145% conversion).

- Q4 segment trends: bioprocessing grew high-single digits, life sciences was flat (+0.5%), and diagnostics rose 2%.

- In diagnostics, Q4 respiratory revenue was $500 M, and FY2026 respiratory revenue is expected to be $1.8 B.

- 2026 outlook: core revenue growth of 3–6%, adjusted EPS $8.35–$8.50, Q1 revenue up low single digits with ~28.5% operating margin; continued strength in bioprocessing, modest life sciences recovery, and diagnostics growth.

- Danaher reports Q4 2025 revenue of $6.838 B, up 4.5% year-over-year, driven by core growth of 2.5% and FX tailwinds of 2.5%.

- Adjusted diluted EPS rose to $2.23 (+4.0%), while Q4 free cash flow reached $1.769 B, up 17.5%.

- Segment performance: Biotechnology revenue +9.0% (core +6.0%), Life Sciences +2.5% (core +0.5%), Diagnostics +3.0% (core +2.0%).

- Q1 2026 core sales growth expected at low-single digit (biotech high-single digit, life sciences flat/-low-single digit, diagnostics ‑low-single digit); full-year 2026 core growth forecast 3.0–6.0%.

- Q4 2025 net earnings of $1.2 billion ( $1.66 diluted EPS), non-GAAP EPS of $2.23, revenues up 4.5% to $6.8 billion, operating cash flow of $2.1 billion and free cash flow of $1.8 billion

- Full year 2025 net earnings of $3.6 billion ( $5.03 diluted EPS), non-GAAP EPS of $7.80, revenues up 3.0% to $24.6 billion, operating cash flow of $6.4 billion and free cash flow of $5.3 billion

- 2026 outlook: first quarter non-GAAP core revenue growth in the low-single digit range; full year core revenue growth of 3–6%; adjusted diluted EPS of $8.35–$8.50

Fintool News

In-depth analysis and coverage of DANAHER CORP /DE/.

Danaher Acquires Masimo for $9.9 Billion in Largest Medtech Deal of 2026

Danaher to Acquire Masimo for $9.9 Billion in Cash, Ends Turbulent Chapter

Danaher Pays $9.9 Billion for Masimo, Expanding Diagnostics Empire

Danaher Nears $10 Billion Acquisition of Masimo, Largest Medtech Deal of 2026

Quarterly earnings call transcripts for DANAHER CORP /DE/.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more