Earnings summaries and quarterly performance for DANAHER CORP /DE/.

Executive leadership at DANAHER CORP /DE/.

Rainer Blair

Chief Executive Officer

Brian Ellis

Senior Vice President

Georgeann Couchara

Senior Vice President, Human Resources

Jose-Carlos Gutierrez-Ramos

Senior Vice President and Chief Science Officer

Matthew Gugino

Executive Vice President and Chief Financial Officer (effective February 28, 2026)

Matthew McGrew

Executive Vice President and Chief Financial Officer

Mitchell Rales

Chairman of the Executive Committee

Steven Rales

Chairman of the Board

Board of directors at DANAHER CORP /DE/.

A. Shane Sanders

Director

Alan Spoon

Director

Charles Lamanna

Director

Elias Zerhouni

Director

Feroz Dewan

Director

Jessica Mega

Director

John Schwieters

Director

Linda Filler

Lead Independent Director

Raymond Stevens

Director

Teri List

Director

Research analysts who have asked questions during DANAHER CORP /DE/ earnings calls.

Scott Davis

Melius Research

8 questions for DHR

Michael Ryskin

Bank of America Merrill Lynch

7 questions for DHR

Tycho Peterson

Jefferies

7 questions for DHR

Jack Meehan

Nephron Research LLC

6 questions for DHR

Vijay Kumar

Evercore ISI

6 questions for DHR

Doug Schenkel

Wolfe Research LLC

5 questions for DHR

Dan Brennan

UBS

4 questions for DHR

Puneet Souda

Leerink Partners

4 questions for DHR

Daniel Brennan

TD Cowen

3 questions for DHR

Dan Leonard

UBS Group AG

3 questions for DHR

Douglas Schenkel

Wolfe Research, LLC

3 questions for DHR

Patrick Donnelly

Citi

2 questions for DHR

Rachel Vatnsdal Olson

JPMorgan

2 questions for DHR

Daniel Arias

Stifel, Nicolaus & Company, Incorporated

1 question for DHR

Daniel Leonard

Stifel Financial Corp.

1 question for DHR

Luke Sergott

Barclays

1 question for DHR

Michael Wriston

Bank of America

1 question for DHR

Rachel Vatnsdal

JPMorgan Chase & Co.

1 question for DHR

Recent press releases and 8-K filings for DHR.

- BCC Research projects the bioprocess filtration market to expand from $8.4 billion in 2025 to $15.6 billion by 2030, achieving a 13.1% CAGR over the period.

- Growth is driven by increasing demand for biologics, gene therapies, and cell-based treatments, expansion of CDMOs/CMOs, and rising adoption of single-use filtration systems under stringent GMP standards.

- The consumables segment (cartridges, capsules, membranes, single-use assemblies) is expected to remain dominant through 2030.

- North America leads the market, supported by major suppliers including Danaher’s Cytiva, Merck KGaA, Sartorius, and Repligen.

- Danaher’s Cytiva invested $1.6 billion in 2025 to expand global filtration and device capacity—boosting its Ilfracombe, U.K. site by 81%.

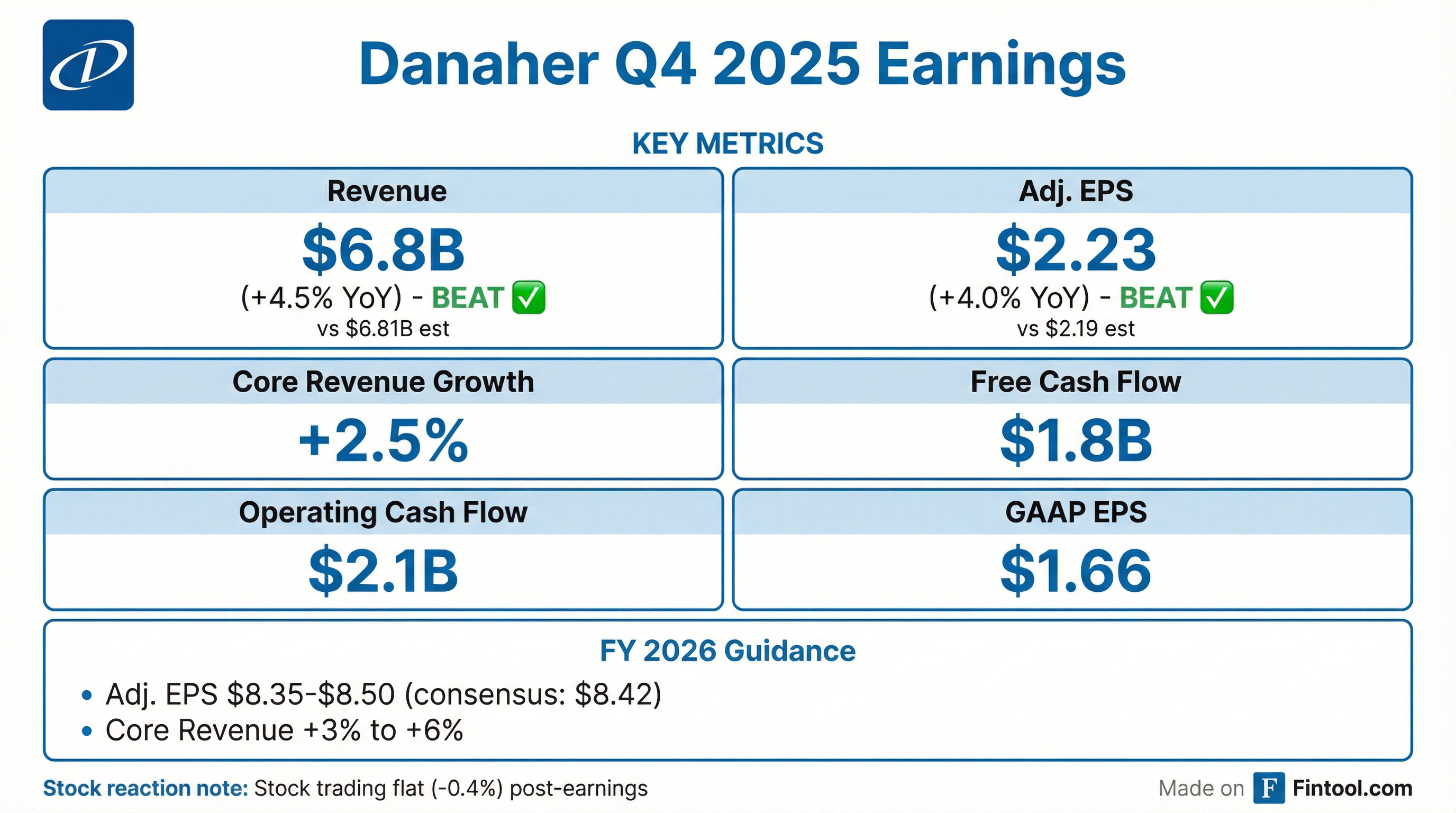

- Danaher’s Q4 2025 sales were $6.8 billion, with 2.5% core revenue growth; adjusted EPS was $2.23, and free cash flow totaled $1.8 billion.

- Full-year 2025 sales reached $24.6 billion, core revenue grew 2%, adjusted EPS was $7.80 (+4.5%), and free cash flow was $5.3 billion (145% conversion).

- For 2026, Danaher guided to 3%–6% core revenue growth, adjusted EPS of $8.35–$8.50, and Q1 core revenue up low single digits with an operating margin of ~28.5%.

- Danaher capped Q4 2025 with better-than-expected margins, earnings and cash flow, driven by high single-digit bioprocessing growth and improving diagnostics and life sciences end markets.

- Full year 2025: $24.6 B in sales (2% core growth), 28.2% adjusted operating margin, $7.80 EPS (+4.5%), and $5.3 B free cash flow (145% conversion).

- 2026 outlook: 3–6% core revenue growth and $8.35–$8.50 adjusted EPS, with Q1 revenue up low single digits and ~28.5% margin.

- Continued innovation: Cytiva rolled out 20+ biologics workflow products (e.g., new Xcellerex bioreactor formats) and SCIEX launched the ZenoTOF 8600 mass spectrometer.

- Danaher delivered Q4 2025 sales of $6.8 B (core revenue +2.5%), adjusted EPS $2.23 (+4%), and free cash flow $1.8 B.

- For full year 2025, sales reached $24.6 B (core +2%), with an adjusted operating margin of 28.2%, adjusted EPS $7.80 (+4.5%), and free cash flow $5.3 B (145% conversion).

- Q4 segment trends: bioprocessing grew high-single digits, life sciences was flat (+0.5%), and diagnostics rose 2%.

- In diagnostics, Q4 respiratory revenue was $500 M, and FY2026 respiratory revenue is expected to be $1.8 B.

- 2026 outlook: core revenue growth of 3–6%, adjusted EPS $8.35–$8.50, Q1 revenue up low single digits with ~28.5% operating margin; continued strength in bioprocessing, modest life sciences recovery, and diagnostics growth.

- Danaher reports Q4 2025 revenue of $6.838 B, up 4.5% year-over-year, driven by core growth of 2.5% and FX tailwinds of 2.5%.

- Adjusted diluted EPS rose to $2.23 (+4.0%), while Q4 free cash flow reached $1.769 B, up 17.5%.

- Segment performance: Biotechnology revenue +9.0% (core +6.0%), Life Sciences +2.5% (core +0.5%), Diagnostics +3.0% (core +2.0%).

- Q1 2026 core sales growth expected at low-single digit (biotech high-single digit, life sciences flat/-low-single digit, diagnostics ‑low-single digit); full-year 2026 core growth forecast 3.0–6.0%.

- Q4 2025 net earnings of $1.2 billion ( $1.66 diluted EPS), non-GAAP EPS of $2.23, revenues up 4.5% to $6.8 billion, operating cash flow of $2.1 billion and free cash flow of $1.8 billion

- Full year 2025 net earnings of $3.6 billion ( $5.03 diluted EPS), non-GAAP EPS of $7.80, revenues up 3.0% to $24.6 billion, operating cash flow of $6.4 billion and free cash flow of $5.3 billion

- 2026 outlook: first quarter non-GAAP core revenue growth in the low-single digit range; full year core revenue growth of 3–6%; adjusted diluted EPS of $8.35–$8.50

- Danaher reported Q4 2025 net earnings of $1.2 billion (GAAP) or $1.66 EPS and non-GAAP adjusted EPS of $2.23 (+4.0%), on revenues of $6.8 billion (+4.5% YoY), with operating cash flow of $2.1 billion and non-GAAP free cash flow of $1.8 billion.

- For full year 2025, GAAP net earnings were $3.6 billion (EPS $5.03) and non-GAAP adjusted EPS was $7.80 (+4.5%), on revenues of $24.6 billion (+3.0%), with operating cash flow of $6.4 billion and non-GAAP free cash flow of $5.3 billion.

- In 2025, Danaher launched key innovations including Cytiva’s expanded Xcellerex X-platform bioreactors (500L and 2,000L), SCIEX’s ZenoTOF 8600 mass spectrometer, an expanded DxI 9000 immunoassay menu, and Cepheid’s FDA-cleared Xpert GI Panel PCR test.

- Looking ahead, Danaher expects Q1 2026 non-GAAP core revenue growth in the low-single digit range and full-year 2026 core revenue growth of 3%–6%, with adjusted diluted EPS guidance of $8.35–$8.50.

- Danaher expects Q4 2025 core revenue growth at the high end of its low single-digit guidance, with full-year adjusted EPS towards the high end of $7.70–$7.80, driven by strong consumables and equipment momentum.

- For 2026, Danaher reaffirmed targets of 3–6% core revenue growth, >100 bps adjusted operating margin expansion, and high-single-digit adjusted EPS growth.

- The company, with ~$25 billion in revenue, operates three segments (biotechnology, life sciences, diagnostics), delivers ~80% recurring revenue, ~60% gross margins, ~30% operating margins, and >$6 billion in operating cash flow.

- Danaher’s capital allocation remains biased toward disciplined M&A, evaluating targets on secular growth, defensible market positions with value reserves, and financial returns, supported by a strong balance sheet.

- Q4 2025 core revenue growth expected at the high end of low-single digits and FY 2025 adjusted EPS toward the high end of the $7.70–$7.80 range

- 2026 targets: 3–6% core revenue growth, >100 bps adjusted operating margin expansion, and high-single-digit adjusted EPS growth

- 2025E segment revenues: Diagnostics ~$9.9 B, Biotechnology ~$7.3 B, Life Sciences ~$7.3 B; financial profile includes 59.5% gross margin, 28.6% adj. op. margin, and >$6 B cash flow

- New product innovations spotlight the ZenoTOF 8600 mass spectrometer, Xcellerex X-platform bioreactors, and Dxl 9000 immunoassay analyzer to drive next-generation diagnostics and biomanufacturing

- Danaher expects Q4 2025 core revenue growth at the high end of low-single-digit guidance and FY 2025 adjusted EPS at the upper end of the $7.70–$7.80 range.

- For 2026, Danaher targets 3%–6% core revenue growth, >100 bp expansion in adjusted operating margin, and high-single-digit adjusted EPS growth.

- The $25 billion company operates in biotechnology, life sciences, and diagnostics with ~60% gross margin, ~30% operating margin, and 80% recurring revenue.

- Long-term secular drivers include an aging global population (1.5 billion aged 65+ by 2050), over 20,000 biologics in development, and a 2.5× expansion in molecular diagnostics since 2019.

- Recent product innovations include a high-sensitivity mass spectrometer, Cytiva’s Xcellerex X-platform (3× higher oxygen transfer), and Beckman’s DxI 9000 immunoassay enabling early Alzheimer’s detection via blood.

Quarterly earnings call transcripts for DANAHER CORP /DE/.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more