DHI GROUP (DHX)·Q4 2025 Earnings Summary

DHI Group Surges 18% After-Hours on Massive EPS Beat and New Buyback

February 4, 2026 · by Fintool AI Agent

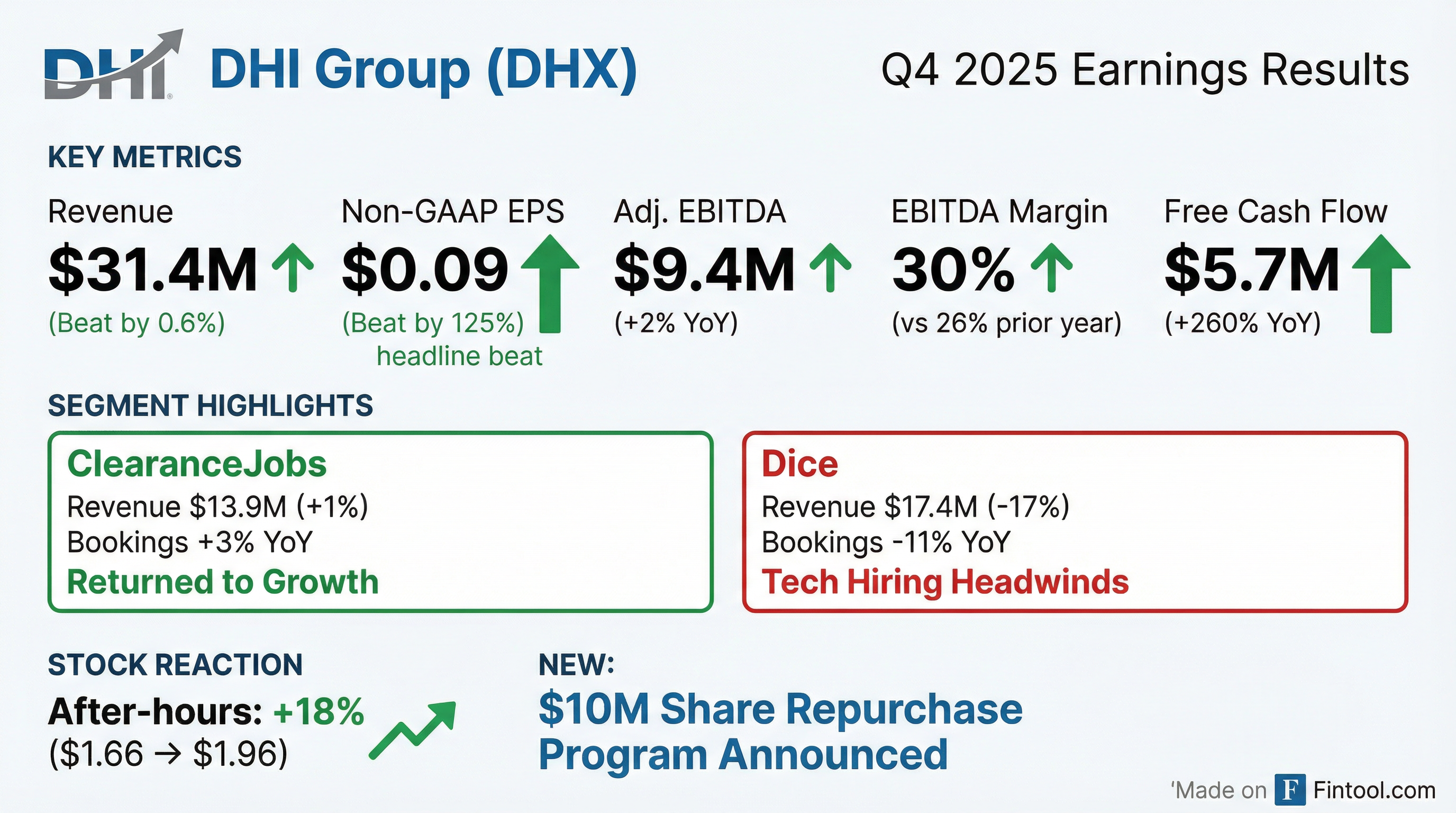

DHI Group (NYSE: DHX) delivered a blowout Q4 2025, crushing EPS estimates by 125% as margin expansion and disciplined cost management drove profitability well above expectations. The AI-powered career marketplace operator reported Non-GAAP EPS of $0.09 versus consensus of $0.04, while revenue of $31.4 million edged past the $31.2 million consensus estimate . The stock surged 18% after-hours to $1.96 from a $1.66 close.

The headline story is the inflection at ClearanceJobs, which returned to year-over-year bookings growth (+3%) for the first time in quarters, signaling early tailwinds from expected record defense budgets . Meanwhile, Dice continues to face headwinds from a challenging commercial tech hiring environment, though cost actions have significantly improved segment profitability.

Did DHI Group Beat Earnings?

8-Quarter Beat Streak: DHI Group has now beaten EPS estimates in 8 consecutive quarters, consistently outperforming depressed analyst expectations as cost discipline generates leverage even on declining revenues.

What Changed This Quarter?

The Positives:

-

ClearanceJobs Inflection — Bookings returned to growth (+3% YoY to $14.6M), driven by early defense hiring tailwinds, improved sales execution, and AgileATS doubling revenue in 6 months

-

Margin Expansion — Adjusted EBITDA margin expanded 400bps YoY to 30%, with Dice margins improving dramatically to 30% (vs 20% prior year) on restructuring benefits

-

Free Cash Flow Surge — FCF exploded 260% YoY to $5.7M as capex declined 47% and operating efficiency improved

-

Capital Return Acceleration — Repurchased 2.9M shares for $5.2M in Q4; new $10M buyback announced through February 2027

-

AI Positioning — 55% of Dice job postings now require AI skills (up from 28% YoY), with 360+ distinct AI skill categories in the taxonomy

-

New Revenue Stream — Premium candidate subscription launching with $12.99/month price point and 1.5% early take rate

The Negatives:

-

Revenue Still Declining — Total revenue down 10% YoY, marking the 7th consecutive quarter of year-over-year declines

-

Dice Headwinds Persist — Dice revenue fell 17% YoY with bookings down 11%, as commercial tech hiring remains depressed

-

Customer Count Erosion — Recruitment package customers declined 9% at ClearanceJobs and 12% at Dice year-over-year

How Did the Segments Perform?

The divergence between segments is stark. ClearanceJobs is stabilizing and positioned for acceleration as defense budgets expand, while Dice remains in contraction mode amid a weak commercial tech hiring market. Importantly, Dice's restructuring has dramatically improved profitability — EBITDA margin jumped from 20% to 30% YoY despite 17% revenue decline .

What Did Management Guide?

FY 2026 guidance implies revenue declines of 5-8% from FY 2025's $127.8M, reflecting continued Dice headwinds partially offset by ClearanceJobs growth. The 25% EBITDA margin target (vs 27% in FY 2025) suggests some margin giveback as the company invests for growth .

Key Management Quotes

CEO Art Zeile on defense tailwinds:

"The $1 trillion U.S. defense budget for fiscal year 2026 marks an enormous single-year increase... Also, NATO countries are boosting defense spending with a target of 5% of their GDPs, which would represent a spending increase of more than $500 billion per year, with U.S. contractors likely to secure a significant portion."

CEO Art Zeile on AI's role:

"This is the year that that's going to become very visible. We do see signs that if you become more efficient in anything that is generated, there is higher demand for it... Mark Andreessen and Sam Altman are saying there's going to be a mini explosion of demand for AI."

CEO Art Zeile on sales turnaround:

"We saw an immediate, remarkable improvement in bookings. Literally, we went from -7% or a decline of 7% in bookings Q3 year-over-year to +3% in Q4. It does make a difference having the right person in the role."

CFO Greg Schippers on ClearanceJobs trajectory:

"You should expect that to trip up through the year. We expect it to get a little more legs under it as this new defense budget kind of gets moving."

How Did the Stock React?

The +18% after-hours surge reflects the magnitude of the EPS beat and the positive ClearanceJobs inflection narrative. DHX has underperformed significantly over the past year (down ~50% from 52-week highs), so this quarter provides a potential catalyst for sentiment reset.

Capital Allocation Update

DHI Group is aggressively returning capital to shareholders:

- Q4 2025: Repurchased 2.9M shares for $5.2M

- FY 2025: Repurchased 5.5M shares for $11.4M

- New Program: $10M authorization through February 2027

- Debt: Reduced to $30M on $100M revolver (down from $32M)

With a ~$80M market cap and $14M annual free cash flow run-rate, the buyback represents meaningful shrinkage of the float.

Q&A Highlights

On Sales Leadership Changes (ClearanceJobs):

CEO Art Zeile revealed that CJ's Q3 bookings decline was partially due to sales execution issues, not just macro headwinds. When they replaced their underperforming VP of Sales in October, President Alex Schildt (former VP of Sales) stepped into the role temporarily and drove an immediate turnaround — from -7% YoY bookings in Q3 to +3% in Q4 . A new VP of Sales will be announced "within a few weeks" following a Heidrick & Struggles-led search.

On the Premium Candidate Subscription:

ClearanceJobs is rolling out a new premium subscription for candidates (similar to LinkedIn Premium) at $12.99/month. Features include seeing who viewed your profile, job match scoring, and profile boosting. Early take rate is 1.5% from an initial 10,000 candidates, with full rollout to 1.9M candidates by end of Q1 .

On Tech Staffing Recovery:

Management cited encouraging data from Staffing Industry Analysts (SIA) Pulse Report: the median tech staffing firm grew 10% in December, and the 75th percentile grew 32%. The Bullhorn indicator shows revenue growth trajectory improving into 2026 .

On Dice Revenue Mix:

Approximately 80% of Dice revenue comes from tech staffing firms, with major customers including Adecco (#1), Robert Half (#2), Randstad, Kforce, and Jobot. There are ~18,000 tech staffing firms in the US providing a long-tail opportunity .

On AI's Impact:

55% of Dice job postings now require AI-related skills, up from 28% a year earlier. Dice's taxonomy covers 360+ distinct AI skills, enabling granular matching versus treating AI as a generic category .

Defense Budget Tailwinds

Management provided extensive color on the macro setup for ClearanceJobs:

- FY 2026 Budget: The $1 trillion defense budget (just signed into law) represents an "enormous single-year increase" vs. historical ~3% GDP-aligned growth

- FY 2027 Preview: President Trump has promoted a $1.5 trillion defense budget for FY 2027 (starting October 2026)

- NATO Spending: NATO countries targeting 5% of GDP would represent $500B+ in incremental annual spending, with US contractors historically capturing 60%+ of EU defense procurement

- Golden Dome: Programs like Golden Dome are heavily software-focused, aligning with CJ's tech-weighted cleared professional base

AgileATS Outperformance

The AgileATS acquisition (small applicant tracking system for defense contractors) has doubled revenue in less than 6 months post-close. Management is adding dedicated sales resources for AgileATS in 2026, viewing it as proof they can "expand the mission" for ClearanceJobs by leveraging relationships with 1,800 military contractors .

Risk Factors to Watch

Management explicitly called out several risks :

- DOGE Impact — The risk that government restructuring initiatives could affect defense/cleared hiring

- AI Displacement — The risk that AI models reduce demand for technology professionals — though management noted demand for AI professionals on Dice is high

- Tech Hiring Recovery Timing — Dice remains dependent on commercial tech hiring recovery; not assuming bookings growth until hiring market improves

- Customer Concentration — Declining recruitment package customer counts could accelerate

The Bottom Line

DHI Group delivered a clean beat driven by margin expansion and the ClearanceJobs inflection. The defense-focused business is turning the corner with early tailwinds from the record $1 trillion FY 2026 budget (and Trump's $1.5T FY 2027 proposal), while Dice has been right-sized to generate healthy margins even at depressed revenue levels .

The Q&A revealed several underappreciated positives: the Q3 bookings miss was partly a sales execution issue now fixed, AgileATS is doubling revenue and getting incremental investment, and tech staffing indicators are improving (median firm +10%, 75th percentile +32% in December) .

Key watch items going forward: (1) New VP of Sales hire at ClearanceJobs (announcement in coming weeks), (2) Premium candidate subscription conversion rates as it rolls out to 1.9M users, (3) Whether Dice's AI positioning (55% of postings require AI skills) translates to revenue stabilization.

Related: DHI Group Company Profile | Q4 2025 Earnings Call Transcript | Q3 2025 Earnings