Earnings summaries and quarterly performance for DHI GROUP.

Executive leadership at DHI GROUP.

Board of directors at DHI GROUP.

Research analysts who have asked questions during DHI GROUP earnings calls.

Kevin Liu

K. Liu & Company

8 questions for DHX

Also covers: NTCT, PRSO

GP

Gary Prestopino

Barrington Research

6 questions for DHX

Also covers: ACVA, AIOT, CARS +19 more

Zach Cummins

B. Riley Securities

5 questions for DHX

Also covers: AEYE, BLZE, EVER +9 more

MM

Max Michaelis

Lake Street Capital

2 questions for DHX

Also covers: BHE, KE, PAR +4 more

MM

Maxwell Michaelis

Lake Street Capital Markets

2 questions for DHX

Also covers: APEI, BCOV, BLZE +10 more

Recent press releases and 8-K filings for DHX.

DHI Group Presents 2025 Financial Performance and Strategic Initiatives

DHX

Share Buyback

New Projects/Investments

Demand Weakening

- DHI Group reported $128 million in revenue and $126 million in bookings for 2025, achieving a 27% Adjusted EBITDA margin and $14 million in free cash flow.

- The company repurchased $11.4 million worth of shares in 2025 and announced a new $10 million buyback program for 2026, ending 2025 with net debt of $27 million and a leverage ratio of less than 1x.

- ClearanceJobs generated $55 million in revenue in 2025, with Q4 bookings up 3% and Q4 revenue up 1% year-over-year. Dice generated $73 million in revenue in 2025, but experienced a Q4 bookings decrease of 11% and a Q4 revenue decline of 17% year-over-year due to challenging HR tech market conditions.

- Strategic initiatives include the launch of a new self-service option for Dice, testing a premium candidate experience for ClearanceJobs, and the acquisition of Agile ATS, which has roughly doubled its revenue since its acquisition in mid-2025.

Feb 5, 2026, 6:00 PM

DHI Group Reviews 2025 Financial Performance and Strategic Outlook

DHX

Earnings

Share Buyback

Guidance Update

- DHI Group reported $128 million in revenue and $35 million in Adjusted EBITDA (27% margin) for 2025, generating $14 million in free cash flow and ending the year with $27 million in net debt.

- The company repurchased $11.4 million worth of shares in 2025 and instituted a new $10 million share buyback program for 2026.

- ClearanceJobs (CJ) revenue was $55 million in 2025, with Q4 bookings up 3% year-over-year and a 9% five-year bookings CAGR; the company expects CJ to return to double-digit bookings growth as it exits 2026, supported by the $1 trillion defense budget.

- Dice revenue was $73 million in 2025, but Q4 bookings decreased 11% year-over-year, and its five-year bookings CAGR declined 7%, reflecting persistent challenges in the HR tech hiring environment.

- DHI implemented restructurings in 2023, 2024, and 2025, reducing operating costs by approximately $35 million and targeting a 25% Adjusted EBITDA margin for 2026.

Feb 5, 2026, 6:00 PM

DHI Group Discusses 2025 Financial Performance and Strategic Outlook

DHX

Share Buyback

Guidance Update

Demand Weakening

- DHI Group reported $128 million in revenue and $35 million in Adjusted EBITDA for 2025, achieving a 27% Adjusted EBITDA margin, while reducing operating costs by approximately $35 million through restructurings since 2023.

- The company repurchased $11.4 million in shares during 2025 and initiated a new $10 million share buyback program for 2026, ending 2025 with $27 million in net debt and a leverage ratio below 1x.

- ClearanceJobs generated $55 million in revenue in 2025, with a 12% five-year revenue CAGR, and is expected to return to double-digit bookings growth as it exits 2026, supported by the $1 trillion defense budget.

- Dice's 2025 revenue was $73 million, experiencing a -4% five-year revenue CAGR and a 17% year-over-year decline in Q4 2025 revenue due to a challenging HR tech hiring environment, though the tech staffing sector (80% of Dice's revenue) is showing signs of recovery.

- Over 90% of DHI's revenue is recurring from subscription contracts, with most including an auto-renewal clause and a 10% automatic price escalator.

Feb 5, 2026, 6:00 PM

DHI Group Reports Q4 2025 Results and Initiates New Share Buyback Program

DHX

Earnings

Guidance Update

Share Buyback

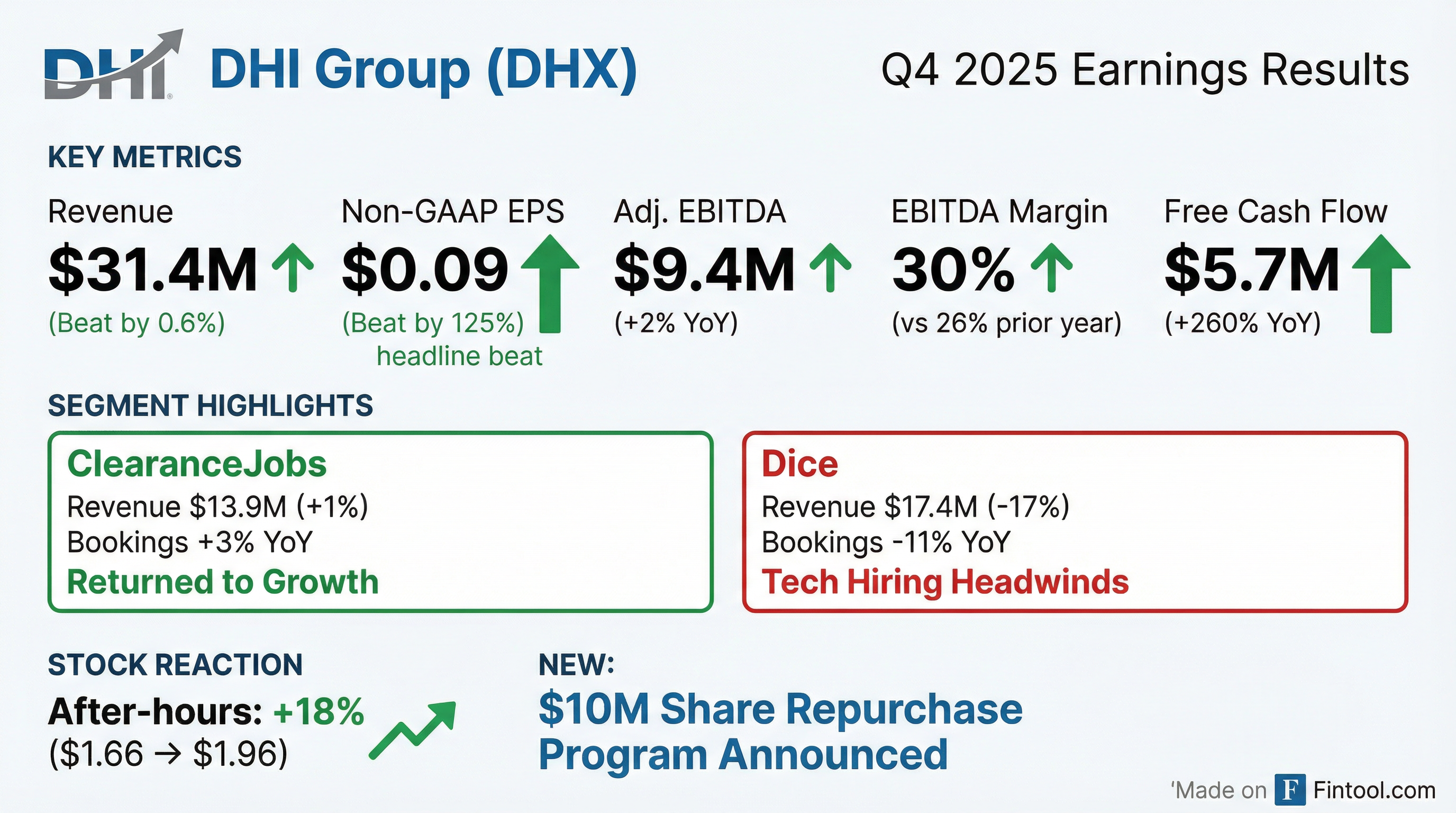

- DHI Group reported Q4 2025 total revenue of $32.4 million, a 10% year-over-year decrease, with total bookings down 5% to $31.2 million. Net income was $1.3 million, or $0.03 per diluted share, while non-GAAP EPS was $0.09 per share.

- ClearanceJobs revenue increased 1% year-over-year to $13.9 million, with bookings up 3% to $14.6 million, marking an inflection point with positive year-over-year growth. In contrast, Dice revenue decreased 17% year-over-year to $17.4 million, with bookings down 11% to $16.6 million, reflecting a challenging commercial tech hiring environment.

- The company achieved an Adjusted EBITDA of $9.4 million for Q4 2025, representing a 30% margin, and generated $5.7 million in free cash flow for the quarter, contributing to $13.8 million for the full year 2025.

- For full-year 2026, DHI Group expects total revenue between $118 million and $122 million, with a targeted Adjusted EBITDA margin of 25%. ClearanceJobs bookings are expected to grow, while Dice bookings growth is not anticipated until the tech hiring market improves.

- The board approved a new $10 million stock repurchase program starting in February 2026, following $11.4 million in share repurchases during full-year 2025. The company also reduced annual operating expenses and capitalized development costs by approximately $35 million.

Feb 4, 2026, 10:00 PM

DHI Group Reports Strong Q4 2025 Results and Authorizes New Share Buyback Program

DHX

Earnings

Share Buyback

Guidance Update

- DHI Group reported net income of $1.3 million ($0.03 per diluted share) and Adjusted EBITDA of $9.4 million (30% margin) for Q4 2025. Free cash flow for the quarter was $5.7 million, contributing to a full-year 2025 free cash flow of $13.8 million.

- The company issued full-year 2026 revenue guidance of $118 million-$122 million and targets an Adjusted EBITDA margin of 25%. ClearanceJobs bookings improved to +3% in Q4 2025 and are expected to grow in 2026, while Dice's growth is tied to a recovery in the commercial tech hiring market.

- A new $10 million stock repurchase program was authorized, commencing in February 2026, following the repurchase of 5.5 million shares for $11.4 million in 2025.

- DHI Group ended Q4 2025 with $2.9 million in cash and $30 million in total debt, maintaining a leverage ratio of 0.85x adjusted EBITDA. ClearanceJobs is expected to benefit from defense budget growth, and Dice, with 80% of its revenue from tech staffing firms, is seeing signs of recovery in that sector.

Feb 4, 2026, 10:00 PM

DHI Group Reports Q4 2025 Results and Provides 2026 Guidance

DHX

Earnings

Guidance Update

Share Buyback

- DHI Group reported Q4 2025 total revenue of $32.4 million, a 10% year-over-year decrease, with total bookings at $31.2 million, down 5% year-over-year. The company achieved net income of $1.3 million or $0.03 per diluted share and Non-GAAP EPS of $0.09 per share.

- ClearanceJobs revenue increased 1% year-over-year to $13.9 million, with bookings up 3% year-over-year to $14.6 million, marking a return to positive growth. Its adjusted EBITDA margin was 43%. This segment is expected to be the primary growth engine, driven by defense spending and improved execution.

- Dice revenue was $17.4 million, down 17% year-over-year, and bookings were $16.6 million, down 11% year-over-year, reflecting a challenging commercial tech hiring environment. Dice's adjusted EBITDA margin was 30%.

- For full-year 2026, DHI Group expects total revenue between $118 million and $122 million, with an adjusted EBITDA margin target of 25%. The company also announced a new $10 million stock repurchase program.

Feb 4, 2026, 10:00 PM

DHI Group Reports Q4 and Full Year 2025 Financial Results, Announces New Share Repurchase Program

DHX

Earnings

Share Buyback

Demand Weakening

- DHI Group reported total revenue of $31.4 million for Q4 2025, a 10% decrease from Q4 2024, with net income of $1.4 million or $0.03 per diluted share.

- For the full year 2025, the company recorded a net loss of $13.5 million or $0.30 per diluted share, largely attributable to $26.2 million in restructuring and impairment charges.

- The company generated strong cash flow from operations of $7.2 million and free cash flow of $5.7 million in Q4 2025, reducing total debt to $30.0 million at quarter-end.

- DHI Group's Board of Directors authorized a new $10 million stock repurchase program, effective February 9, 2026, through February 8, 2027, after completing a prior $5 million program in January 2026.

Feb 4, 2026, 9:21 PM

DHI Group Reports Fourth Quarter and Full Year 2025 Financial Results

DHX

Earnings

Share Buyback

Demand Weakening

- DHI Group reported total revenue of $31.4 million for Q4 2025 and $127.8 million for the full year 2025, both representing a 10% decrease year-over-year.

- For Q4 2025, net income was $1.4 million ($0.03 diluted EPS) and Non-GAAP EPS was $0.09. For the full year 2025, the company reported a net loss of $13.5 million ($0.30 diluted EPS) due to $26.2 million in restructuring and impairment charges, but Non-GAAP EPS was $0.29.

- ClearanceJobs revenue increased 1% in both Q4 2025 ($13.9 million) and full year 2025 ($54.9 million), while Dice revenue decreased 17% in both periods ($17.4 million in Q4 2025 and $72.9 million in full year 2025).

- The company generated free cash flow of $5.7 million in Q4 2025 and $13.8 million for the full year 2025, marking a 94% increase year-over-year for the full year.

- DHI Group repurchased 2.9 million shares for $5.2 million in Q4 2025 and a total of 5.5 million shares for $11.4 million in FY 2025, also launching a new $10 million share repurchase program in January 2026.

Feb 4, 2026, 9:15 PM

DHI Group Reports Q3 2025 Earnings

DHX

Earnings

Guidance Update

Demand Weakening

- DHI Group Inc. reported adjusted EPS of $0.09 for Q3 2025, surpassing estimates by 50%, despite a 9% year-over-year revenue decline to $32.12 million.

- The company recorded a $9.6 million impairment charge on intangible assets, resulting in a net loss of $4.27 million, though the core business showed resilience with adjusted EBITDA of $10.3 million and a 32% margin.

- Key business segments, including ClearanceJobs and Dice, demonstrated growth and profitability improvements through operational enhancements and a shift to advanced self-service platforms.

- Management provided a Q4 revenue forecast between $29.5 million and $31.5 million and maintains a positive outlook, anticipating benefits from increased demand for AI in tech hiring and growth in defense spending.

- The company's stock currently trades around 10 times projected earnings, down from 19 times three months prior, and has seen a 1.1% loss year-to-date, underperforming the S&P 500.

Nov 11, 2025, 12:37 AM

DHI Group Reports Q3 2025 Financial Results

DHX

Earnings

Guidance Update

Share Buyback

- DHI Group reported Q3 2025 total revenue of $32.1 million, a 9% year-over-year decrease, and total bookings of $25.4 million, down 12% year-over-year. Despite this, Adjusted EBITDA increased to $10.3 million, representing a 32% margin, benefiting from approximately $35 million in annual operating expense reductions from restructurings.

- ClearanceJobs' revenue grew 1% year-over-year to $13.9 million, with a positive long-term outlook supported by a proposed $1.1 trillion U.S. defense budget for fiscal year 2026 and the integration of AgileATS.

- Dice revenue declined 15% year-over-year to $18.2 million, though over 50% of its job postings now require AI skills, up from 10% at the beginning of 2024, indicating a significant demand trend. The new Dice platform, offering monthly subscriptions at $650 a month, has migrated over half of its customers.

- The company reaffirmed its annual revenue guidance of $126-$128 million and raised its full-year Adjusted EBITDA margin guidance to 27%. Additionally, the board authorized a new $5 million stock repurchase program.

Nov 10, 2025, 10:00 PM

Fintool News

In-depth analysis and coverage of DHI GROUP.

Quarterly earnings call transcripts for DHI GROUP.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more