Earnings summaries and quarterly performance for DAILY JOURNAL.

Executive leadership at DAILY JOURNAL.

Board of directors at DAILY JOURNAL.

Research analysts covering DAILY JOURNAL.

Recent press releases and 8-K filings for DJCO.

Daily Journal Corporation Announces First Quarter Fiscal 2026 Financial Results

DJCO

Earnings

Revenue Acceleration/Inflection

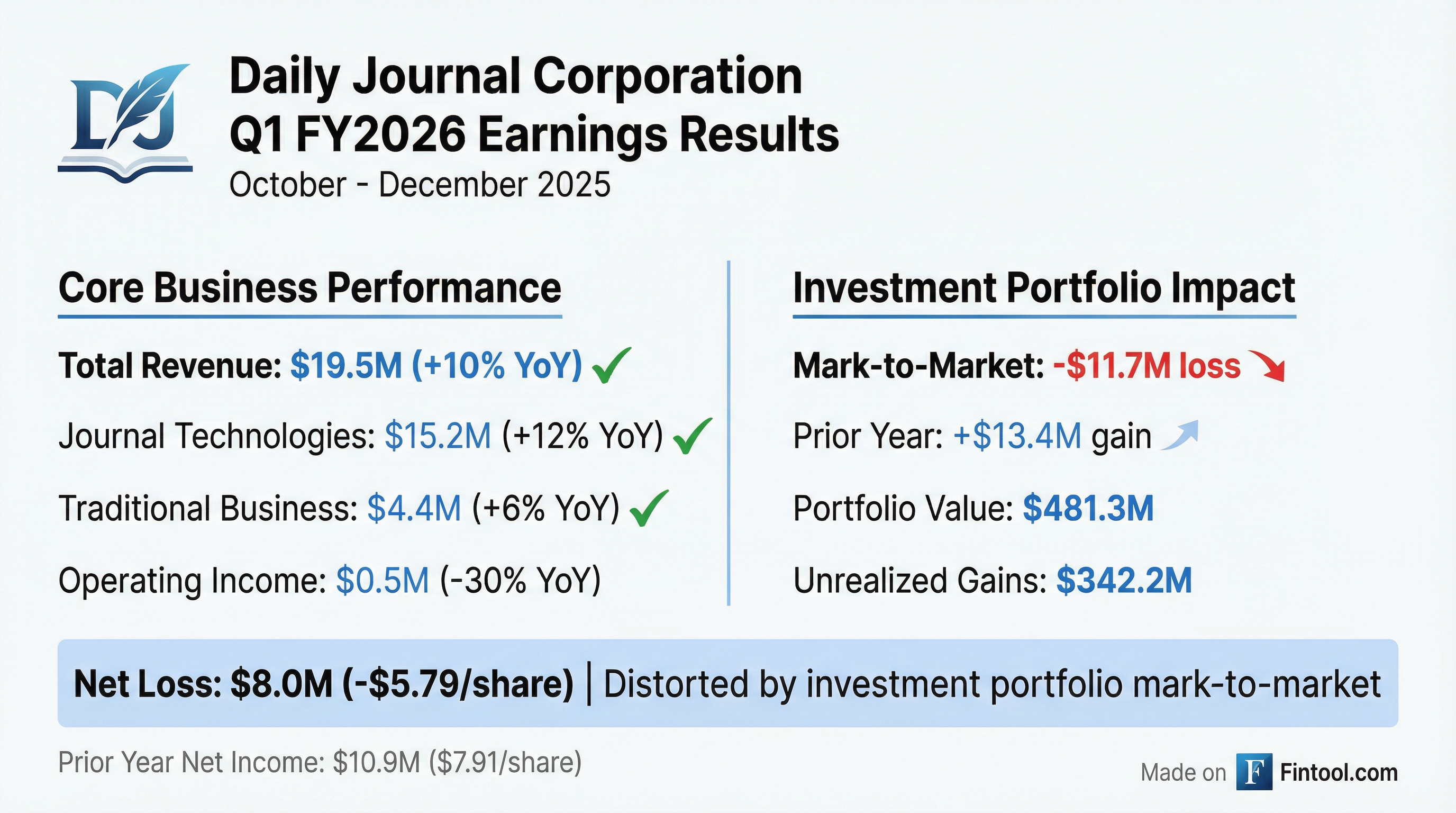

- Daily Journal Corporation reported a 10% increase in total consolidated revenue to $19.5 million for the three months ended December 31, 2025, primarily driven by Journal Technologies' 12% growth.

- The company posted a net loss of $8.0 million, or ($5.79) per basic and diluted share, for Q1 Fiscal 2026, a significant shift from net income of $10.9 million in the prior-year quarter.

- This net loss was largely due to net unrealized losses on marketable securities of $11.7 million, compared to net unrealized gains of $13.4 million in the prior-year period.

- Income from operations decreased to $0.5 million from $0.7 million in the prior-year quarter, mainly due to higher personnel, accounting, and legal costs.

Feb 17, 2026, 11:09 AM

Daily Journal Corporation Announces First Quarter Fiscal 2026 Results

DJCO

Earnings

Revenue Acceleration/Inflection

- Daily Journal Corporation reported total consolidated revenue of $19.5 million for the three months ended December 31, 2025 (Q1 Fiscal 2026), representing a 10% increase year-over-year, primarily driven by growth at Journal Technologies.

- The company experienced a net loss of $8.0 million, or ($5.79) per basic and diluted share, for the quarter, compared to a net income of $10.9 million, or $7.91 per diluted share, in the prior-year quarter.

- This net loss was largely attributable to net unrealized losses on marketable securities of $11.7 million, which contrasted with net unrealized gains of $13.4 million in the prior-year quarter.

- Income from operations for the three months ended December 31, 2025, was $0.5 million, a decrease from $0.7 million in the prior-year quarter, primarily due to higher personnel costs and increased accounting, legal, and professional expenses.

Feb 17, 2026, 11:00 AM

DAILY JOURNAL CORP Announces Fiscal Year 2025 Financial Results

DJCO

Earnings

Revenue Acceleration/Inflection

New Projects/Investments

- DAILY JOURNAL CORPORATION reported total consolidated revenue of $87.7 million for fiscal year 2025, representing a 25% increase from the prior fiscal year.

- Net income for fiscal year 2025 was $112.1 million, or $81.41 per diluted share, an increase of 44% compared to fiscal year 2024.

- Journal Technologies revenue grew 32% to $69.9 million in fiscal year 2025, driven by increases in consulting fees, other public service fees, and license and maintenance fees, and the segment secured 17 multi-year contracts.

- Operating income for fiscal year 2025 was $9.5 million, or 10.9% of revenue, compared to $4.1 million, or 5.8% of revenue, in fiscal year 2024.

- As of September 30, 2025, the company's marketable securities had a total fair market value of $493.0 million.

Dec 29, 2025, 9:31 PM

Daily Journal Corporation Announces Fiscal Year 2025 Financial Results

DJCO

Earnings

Revenue Acceleration/Inflection

- Daily Journal Corporation reported total consolidated revenue of $87.7 million for fiscal year 2025, a 25% increase from $69.9 million in fiscal year 2024. This growth was primarily driven by Journal Technologies, which saw revenue increase by 32% to $69.9 million in fiscal year 2025.

- The company achieved operating income of $9.5 million (10.9% of revenue) for fiscal year 2025, up from $4.1 million (5.8% of revenue) in fiscal year 2024.

- Net income for fiscal year 2025 was $112.1 million, or $81.41 per diluted share, marking a 44% increase compared to $78.1 million, or $56.73 per diluted share, in fiscal year 2024.

- Daily Journal Corporation generated $13.3 million in operating cash flow during fiscal year 2025.

- As of September 30, 2025, the company's marketable securities had a total fair market value of $493.0 million, including accumulated pretax unrealized gains of $353.9 million.

Dec 29, 2025, 9:30 PM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more