Dolby Laboratories (DLB)·Q1 2026 Earnings Summary

Dolby Raises Guidance After Q1 Beat; Growth Segments Approach 50% of Licensing

January 29, 2026 · by Fintool AI Agent

Dolby Laboratories delivered a strong Q1 FY2026, beating analyst estimates on both revenue and earnings and raising full-year guidance. Revenue and Non-GAAP EPS came in above the high end of guidance, driven by deal timing and a $7 million favorable true-up from Q4 shipments. The company highlighted that Dolby Atmos, Dolby Vision, and Imaging Patents are now approaching 50% of licensing revenue and growing 15%-20% annually.

Did Dolby Beat Earnings?

Yes — Dolby beat on both revenue and EPS:

The revenue beat was driven by deals coming in earlier than expected and a $7 million favorable true-up for Q4 shipments (primarily from gaming and broadcast).

Year-over-year performance:

What Changed in Licensing Revenue?

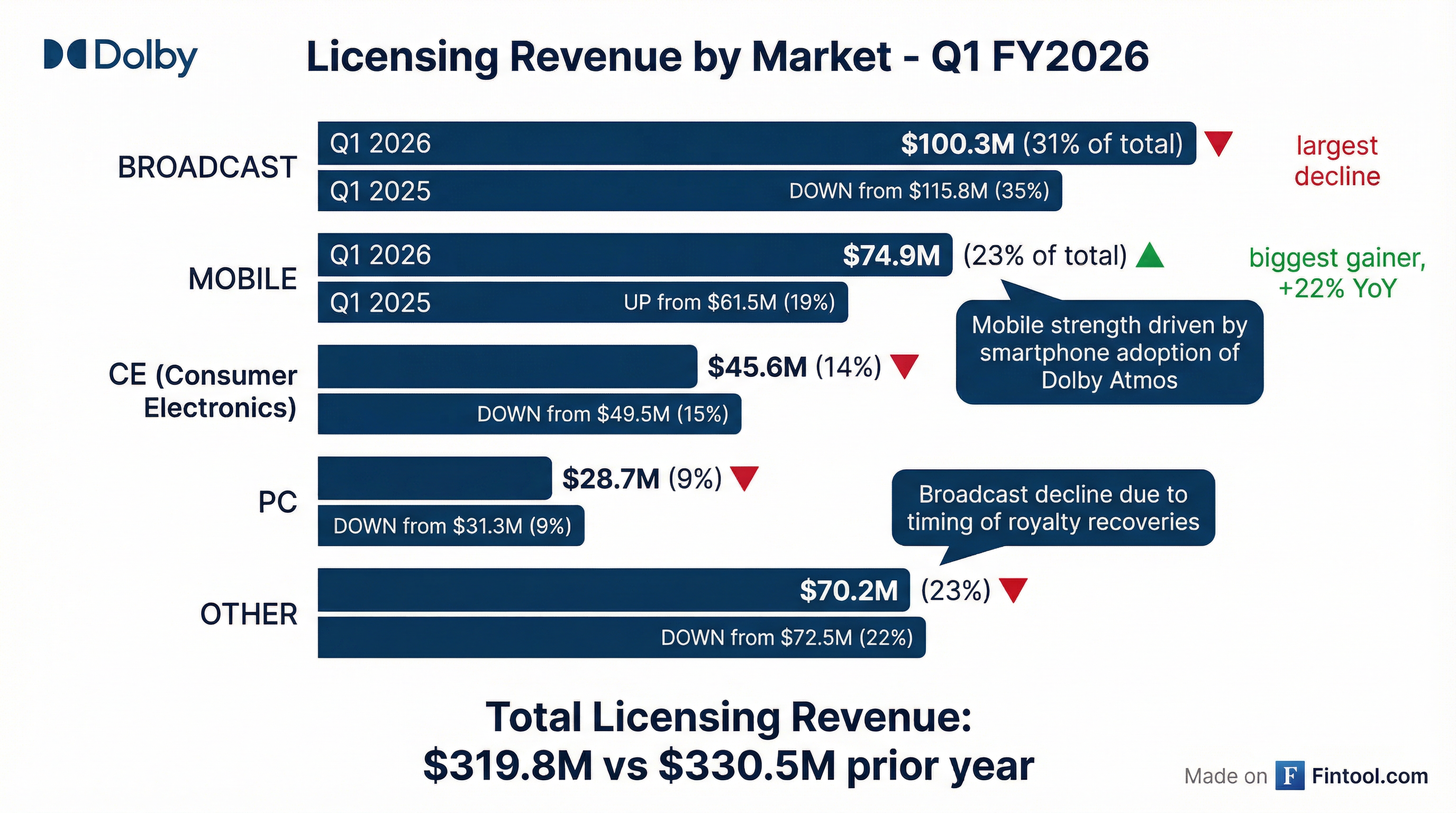

Mobile was the clear bright spot, growing over 20% year-over-year primarily driven by deal timing. Broadcast revenue was down mid-teens year-over-year, also primarily driven by timing. Management expects both mobile and broadcast to be up mid-single digits for the full year.

Segment performance:

The broadcast decline reflects timing of royalty recoveries rather than structural weakness. Mobile strength is driven by continued adoption of Dolby Atmos in smartphones and tablets.

What Did Management Guide?

Dolby raised full-year guidance, reflecting the Q1 true-up and stronger-than-expected deal activity.

Q2 FY2026 Guidance:

FY2026 Full-Year Guidance (RAISED):

The raised guidance reflects the Q1 true-up and some deals coming in earlier and stronger than forecast. Management noted slight revisions to the outlook including potential impact from memory pricing, which varies by end market and customer.

Segment Growth Outlook:

- Dolby Atmos, Dolby Vision, and Imaging Patents: Growing ~15% YoY, comprising nearly half of licensing revenue

- Foundational revenue: Expected to be down slightly

- End markets: Growth in Other, Mobile, and Broadcast; declines in PC and CE

Key Business Highlights

CEO Kevin Yeaman highlighted the company's strategic momentum: "We're confident in our ability to grow Dolby Atmos, Dolby Vision, and Imaging Patents at 15%-20% per year over the next few years. Now that these segments are approaching 50% of our licensing revenue, it is having a greater impact on our overall growth rate."

Automotive expansion accelerating:

- 35+ auto OEMs now embrace Dolby Atmos, up from 20 this time last year

- Qualcomm partnership integrating Dolby Atmos and Dolby Vision into Gen 5 Snapdragon automotive platform

- Mahindra released first SUV in India with Dolby Atmos and Dolby Vision

- Hyundai launched first car with Dolby Atmos (crossover SUV in China)

- NIO Horizon featuring Dolby Atmos and Dolby Vision — demonstrating full in-car entertainment experience

Dolby Vision 2 momentum:

- First Dolby Vision 2 TVs available by end of fiscal year

- Peacock announced support for Dolby Vision 2 across movies, originals, and live sports (including Super Bowl and Winter Olympics)

- TP Vision (Philips brand), Hisense, and TCL announced as launch partners

- Designed to enhance mid-range TVs, not just top-of-the-line models

Streaming and social media:

- Meta now supports Dolby Vision on both Facebook and Instagram

- Douyin (Chinese TikTok) expanded Dolby Vision support to Android devices

- Roku became first U.S. streamer to join video distribution patent pool

Dolby OptiView expansion:

- NFL partnership delivered RedZone through NFL Plus app with record streaming quality

- New customers: Veikkaus (Finland's lottery and sports betting) and SIS (Sports Information Solutions, serves 300+ sports betting companies)

- Combined with video distribution program, targeting 10% of revenue from content service providers in 3 years

How Did the Stock React?

Dolby shares closed up +3.0% at $63.03 on earnings day, rising from an open of $61.10. In after-hours trading, shares pulled back to $61.11 (-3.0% from close).

The stock remains well below its 52-week high of $89.66 and trades at a discount to both moving averages. The after-hours pullback may reflect profit-taking after the initial pop, or investor concerns about the year-over-year declines in foundational segments.

Capital Allocation

Dolby continues returning capital to shareholders:

- Share repurchases: $70 million of common stock in Q1

- Remaining authorization: $207 million

- Dividend declared: $0.36 per share, up 9% YoY

- Operating cash flow: ~$55 million generated in Q1

- Cash and investments: ~$730 million

- GAAP expenses included $10M restructuring charge as company streamlines operations

Q&A Highlights

On deal timing and macro environment: CEO Kevin Yeaman: "I wouldn't extrapolate to any generalization in the macro. We're pleased to have had some of our deals come in earlier. It has the effect of kind of de-risking some of the outlook for the year."

On memory pricing impact: Memory pricing is most directly impacting the mobile end market, though effects vary significantly by customer based on forward purchasing and hedge strategies. PC is also affected and expected to be down for the full year. TVs see minimal impact as memory is not a significant percentage of the BOM.

On video distribution patent pool progress: Management sees the pool "off to a good start" with a handful of licensees last quarter including large ones in China, and now Roku as the first U.S. streamer. There are pricing incentives to encourage early sign-ups.

On Sony TV venture/TCL partnership: Yeaman declined to comment on the pending transaction but noted strong relationships with both TCL and Sony. Focus remains on increasing Dolby Vision attach rates across all TV partnerships.

On Dolby Vision 2 opportunity: "When you see two mid-range TVs side by side at CES, like $300 TVs, it's just significantly better. So we're excited about that opportunity to bring Dolby Vision 2 to those mid-range TVs." First Dolby Vision 2 TVs expected by end of fiscal year.

What to Watch

- 50% milestone: Atmos/Vision/Imaging Patents approaching half of licensing revenue with 15%-20% annual growth target

- Dolby Vision 2 launch: First TVs expected by end of FY2026 — watch for mid-range TV penetration

- Automotive depth: 35+ OEMs now, up from 20 last year — tracking move from music to full in-car entertainment

- Video distribution pool: Roku signed; watch for additional U.S. streamers joining

- Memory pricing: Mobile end market most exposed; full-year guide assumes mid-single digit mobile growth

Historical Earnings Summary

Dolby has beaten EPS estimates for 8 consecutive quarters.

Data sourced from Dolby's Q1 FY2026 earnings call transcript and S&P Global estimates.