Earnings summaries and quarterly performance for Dolby Laboratories.

Research analysts who have asked questions during Dolby Laboratories earnings calls.

Ralph Schackart

William Blair

8 questions for DLB

Also covers: APP, CARG, DIBS +6 more

Patrick Sholl

Barrington Research

7 questions for DLB

Also covers: CCO, CMLS, CNK +14 more

SF

Steven Frankel

Rosenblatt Securities

6 questions for DLB

Also covers: HLIT, IMAX, LINC +4 more

VK

Vikram Kesavabhotla

Robert W. Baird & Co.

4 questions for DLB

Also covers: DOCS, GDDY, RCM +3 more

SF

Steve Frankel

Rosenblatt

1 question for DLB

Also covers: IMAX, SONO, UTI

SF

Steven Frenkel

Rosenblatt

1 question for DLB

Recent press releases and 8-K filings for DLB.

Dolby Laboratories Reports Strong Q1 2026 Results and Raises Full-Year Guidance

DLB

Earnings

Guidance Update

New Projects/Investments

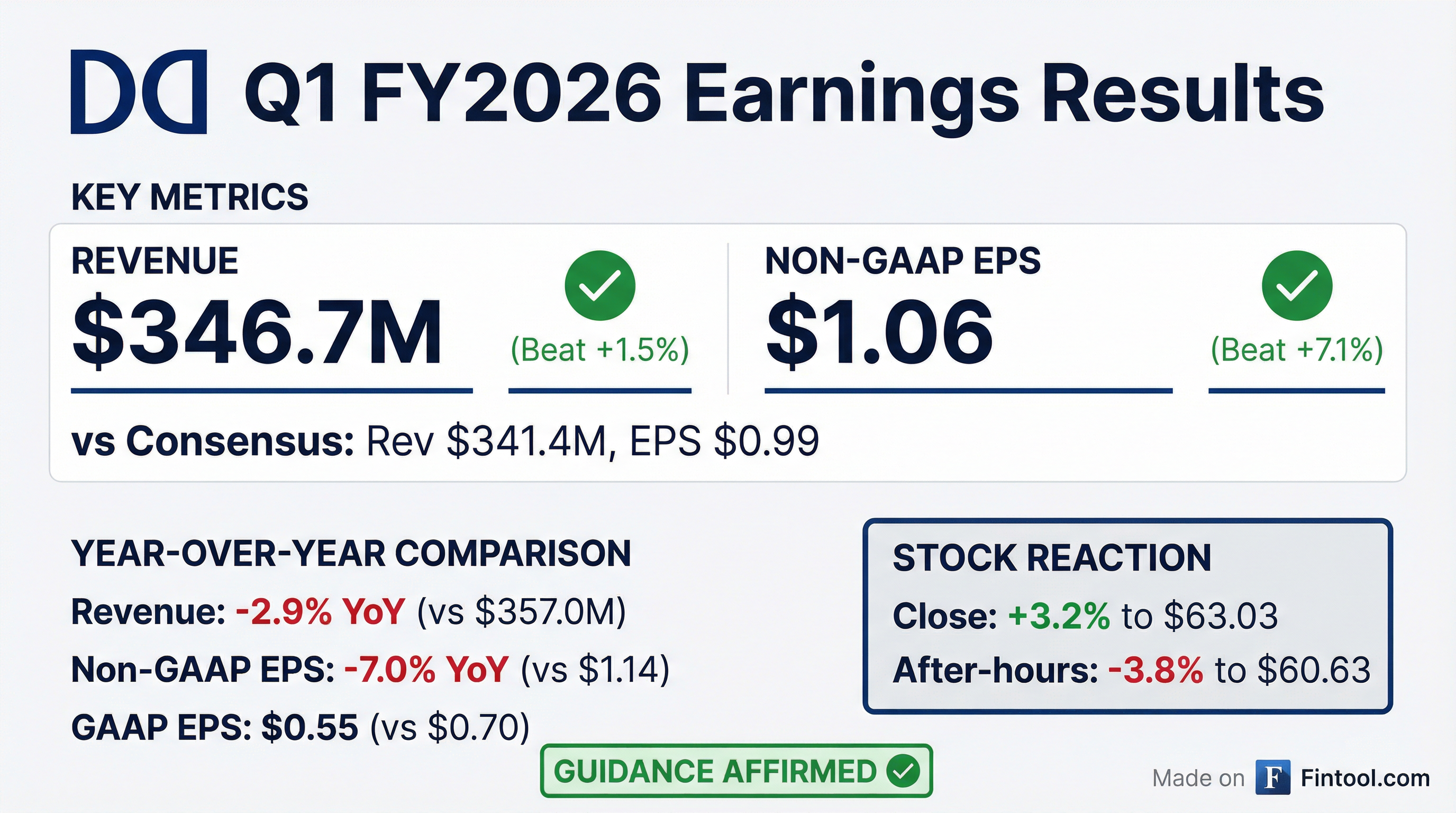

- Dolby Laboratories (DLB) exceeded Q1 2026 expectations, reporting revenue of $347 million and Non-GAAP earnings per share of $1.06, both above the high end of guidance.

- The company raised its full-year fiscal 2026 revenue guidance to between $1.4 billion and $1.45 billion and Non-GAAP earnings per share to between $4.30 and $4.45.

- Strategic growth initiatives are showing strong momentum, with automotive OEM partnerships increasing to over 35 , Dolby Vision 2 gaining traction with partners like Peacock , and Roku becoming the first U.S. streamer to license the video distribution patent pool.

- DLB returned capital to shareholders by repurchasing $70 million of common stock and declaring a $0.36 dividend, a 9% increase from the prior year.

Jan 29, 2026, 10:00 PM

Dolby Laboratories Reports Strong Q1 2026 Results and Raises Full-Year Guidance

DLB

Earnings

Guidance Update

New Projects/Investments

- Dolby Laboratories reported Q1 2026 revenue of $347 million and non-GAAP earnings per share of $1.06, both exceeding the high end of guidance.

- The company raised its full-year fiscal 2026 revenue guidance to $1.4 billion - $1.45 billion and non-GAAP earnings per share to $4.30 - $4.45.

- Growth initiatives are progressing, with automotive partnerships increasing to over 35 OEMs , Dolby Vision 2 TVs expected by year-end , and expanded Dolby Vision support on mobile platforms like Meta and Douyin.

- Dolby Atmos, Dolby Vision, and Imaging Patents are anticipated to grow 15%-20% annually over the next few years, now representing nearly half of licensing revenue.

- In Q1 2026, Dolby generated approximately $55 million in operating cash flow, repurchased $70 million of common stock, and declared a $0.36 dividend, a 9% increase from the prior year.

Jan 29, 2026, 10:00 PM

Dolby Laboratories Exceeds Q1 2026 Expectations and Raises Full-Year Guidance

DLB

Earnings

Guidance Update

Product Launch

- Dolby Laboratories reported strong Q1 2026 revenue of $347 million and non-GAAP EPS of $1.06, both exceeding the high end of guidance, leading to a raised full-year fiscal 2026 revenue outlook of $1.4 billion to $1.45 billion.

- The company is experiencing significant momentum in automotive, now partnering with over 35 OEMs, and received enthusiastic partner response for Dolby Vision 2 at CES, with the first TVs expected by year-end.

- Strategic growth initiatives are expanding the addressable market, including the video distribution program for imaging patents with Roku as a new licensee, and growing adoption of Dolby OptiView. These initiatives, along with Dolby Atmos and Dolby Vision, are expected to drive 15%-20% annual growth for nearly half of licensing revenue.

Jan 29, 2026, 10:00 PM

Dolby Laboratories Reports Q1 Fiscal 2026 Financial Results and Provides Outlook

DLB

Earnings

Guidance Update

Share Buyback

- Dolby Laboratories reported Q1 fiscal 2026 total revenue of $347 million and GAAP diluted earnings per share of $0.55, compared to $357 million and $0.70 respectively for the first quarter of fiscal 2025.

- The company repurchased approximately one million shares for $70 million and declared a cash dividend of $0.36 per share.

- For Q2 fiscal 2026, Dolby estimates total revenue to range from $375 million to $405 million and non-GAAP diluted earnings per share from $1.29 to $1.44. For the full fiscal year 2026, total revenue is expected to range from $1.4 billion to $1.45 billion, with non-GAAP diluted earnings per share anticipated between $4.30 and $4.45.

- CEO Kevin Yeaman expressed optimism about the company's market position and growth opportunities, citing momentum with Dolby Atmos and Dolby Vision, and expansion into imaging patent programs and Dolby OptiView.

Jan 29, 2026, 9:15 PM

Dolby Laboratories Reports Q1 Fiscal 2026 Results and Provides Outlook

DLB

Earnings

Guidance Update

Share Buyback

- Dolby Laboratories reported total revenue of $347 million for the first quarter of fiscal 2026, compared to $357 million for the first quarter of fiscal 2025.

- GAAP diluted earnings per share for Q1 fiscal 2026 was $0.55, and non-GAAP diluted earnings per share was $1.06.

- The company repurchased approximately one million shares of its common stock for approximately $70 million and declared a cash dividend of $0.36 per share.

- For the second quarter of fiscal 2026, total revenue is estimated to range from $375 million to $405 million, with non-GAAP diluted earnings per share anticipated to range from $1.29 to $1.44.

- The full fiscal year 2026 outlook projects total revenue between $1.4 billion and $1.45 billion, and non-GAAP diluted earnings per share between $4.30 and $4.45.

Jan 29, 2026, 9:15 PM

Dolby Laboratories Reports Q4 and Full-Year 2025 Results, Provides FY2026 Guidance, and Highlights Strategic Growth Initiatives

DLB

Earnings

Guidance Update

New Projects/Investments

- Dolby Laboratories reported Q4 FY2025 revenue of $307 million and non-GAAP EPS of $0.99 (or $0.71 excluding a discrete tax benefit), with FY2025 revenue up 6% to $1.35 billion. For FY2026, the company forecasts revenue between $1.39 billion and $1.44 billion (up 3%-7% year-over-year) and non-GAAP EPS between $4.19 and $4.34.

- The company launched Dolby Vision 2 for TVs and secured significant partnerships for Dolby Atmos and Dolby Vision with Instagram, Douyin (TikTok), and several automotive brands. Dolby Atmos, Dolby Vision, and Imaging Patents are projected to grow 15%-20% per year over the next three to five years.

- Dolby is expanding into consumption-based revenue models, including a new video distribution program for content streamers and Dolby OptiView, which is being used by the NFL. These new models are anticipated to contribute 10% of revenue from service provider customers in three years. The company also declared a $0.36 dividend (up 9%) and has approximately $277 million remaining for share repurchases.

Nov 18, 2025, 10:00 PM

DLB Reports Q4 2025 Results and Provides FY 2026 Guidance

DLB

Earnings

Guidance Update

Product Launch

- Dolby Laboratories reported Q4 2025 revenue of $307 million and non-GAAP EPS of $0.99 (or $0.71 excluding a discrete tax benefit), with full fiscal year 2025 revenue growing 6% to $1.35 billion and non-GAAP operating margins expanding by 180 basis points.

- For fiscal year 2026, the company expects revenue between $1.39 billion and $1.44 billion (up 3%-7% year-over-year) and non-GAAP earnings per share between $4.19 and $4.34.

- Dolby Atmos, Dolby Vision, and imaging patents revenue grew just over 14% in FY 2025 and is projected to grow approximately 15% in FY 2026, with a long-term target of 15%-20% annual growth over the next three to five years.

- Strategic initiatives include the launch of Dolby Vision 2, new automotive agreements, expanded Dolby Vision support on Instagram and Douyin, and the introduction of new consumption-based revenue models like a patent pool for content streamers and Dolby OptiView, aiming for 10% of revenue from service provider customers in three years.

Nov 18, 2025, 10:00 PM

Dolby Laboratories Reports Q4 and Full-Year 2025 Results, Provides FY2026 Guidance

DLB

Earnings

Guidance Update

New Projects/Investments

- Dolby Laboratories reported Q4 2025 revenue of $307 million and non-GAAP EPS of $0.99 (or $0.71 excluding a discrete tax benefit), with full fiscal year 2025 revenue reaching $1.35 billion, up 6% year-over-year.

- For fiscal year 2026, the company provided guidance of revenue between $1.39 billion and $1.44 billion (up 3%-7% year-over-year) and non-GAAP EPS between $4.19 and $4.34.

- The company expects Dolby Atmos, Dolby Vision, and Imaging Patents revenue to grow approximately 15% in FY2026, and 15%-20% annually over the next three to five years, with this segment now approaching 50% of licensing revenue.

- Key growth drivers include the announcement of Dolby Vision 2, new automotive partnerships, and the adoption of Dolby Vision by Instagram and Douyin (TikTok), which are expected to further penetrate mobile and TV markets.

- Dolby is expanding its total addressable market through new consumption-based revenue models, such as the video distribution program for content streamers and Dolby OptiView for live sports streaming, with these new offerings potentially contributing 10% of revenue from service providers in three years.

Nov 18, 2025, 10:00 PM

Dolby Laboratories Reports Fourth Quarter and Fiscal Year 2025 Financial Results and Provides Fiscal 2026 Outlook

DLB

Earnings

Guidance Update

Dividends

- Dolby Laboratories reported total revenue of $307 million for the fourth quarter of fiscal 2025 and $1.35 billion for the full fiscal year 2025.

- For the fourth quarter of fiscal 2025, GAAP diluted earnings per share was $0.51 and non-GAAP diluted earnings per share was $0.99. For the full fiscal year 2025, GAAP diluted earnings per share was $2.62 and non-GAAP diluted earnings per share was $4.24.

- The company repurchased approximately 479,000 shares of its common stock for approximately $35 million during Q4 fiscal 2025 and declared a cash dividend of $0.36 per share payable on December 10, 2025.

- For the first quarter of fiscal 2026, Dolby estimates total revenue to range from $315 million to $345 million and non-GAAP diluted earnings per share to range from $0.79 to $0.94.

- For the full fiscal year 2026, total revenue is expected to range from $1.390 billion to $1.440 billion, with non-GAAP diluted earnings per share anticipated to range from $4.19 to $4.34.

Nov 18, 2025, 9:15 PM

Dolby Laboratories Reports Strong Q4 and Full Year Fiscal 2025 Results, Issues FY2026 Outlook

DLB

Earnings

Dividends

Share Buyback

- Dolby Laboratories reported total revenue of $307 million for the fourth quarter of fiscal 2025 and $1.35 billion for the full fiscal year 2025, an increase from the prior year.

- For Q4 FY2025, GAAP diluted earnings per share (EPS) was $0.51 and non-GAAP diluted EPS was $0.99. For the full fiscal year 2025, GAAP diluted EPS was $2.62 and non-GAAP diluted EPS was $4.24.

- The company announced a cash dividend of $0.36 per share payable on December 10, 2025, and repurchased approximately 479,000 shares for $35 million during Q4 FY2025.

- For the first quarter of fiscal 2026, Dolby estimates total revenue to range from $315 million to $345 million and non-GAAP diluted EPS from $0.79 to $0.94.

Nov 18, 2025, 9:15 PM

Quarterly earnings call transcripts for Dolby Laboratories.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more