DML1 (DML1)·Q2 2026 Earnings Summary

Elevra Lithium Posts Record Revenue but Cuts Guidance on Mining Challenges

January 27, 2026 · by Fintool AI Agent

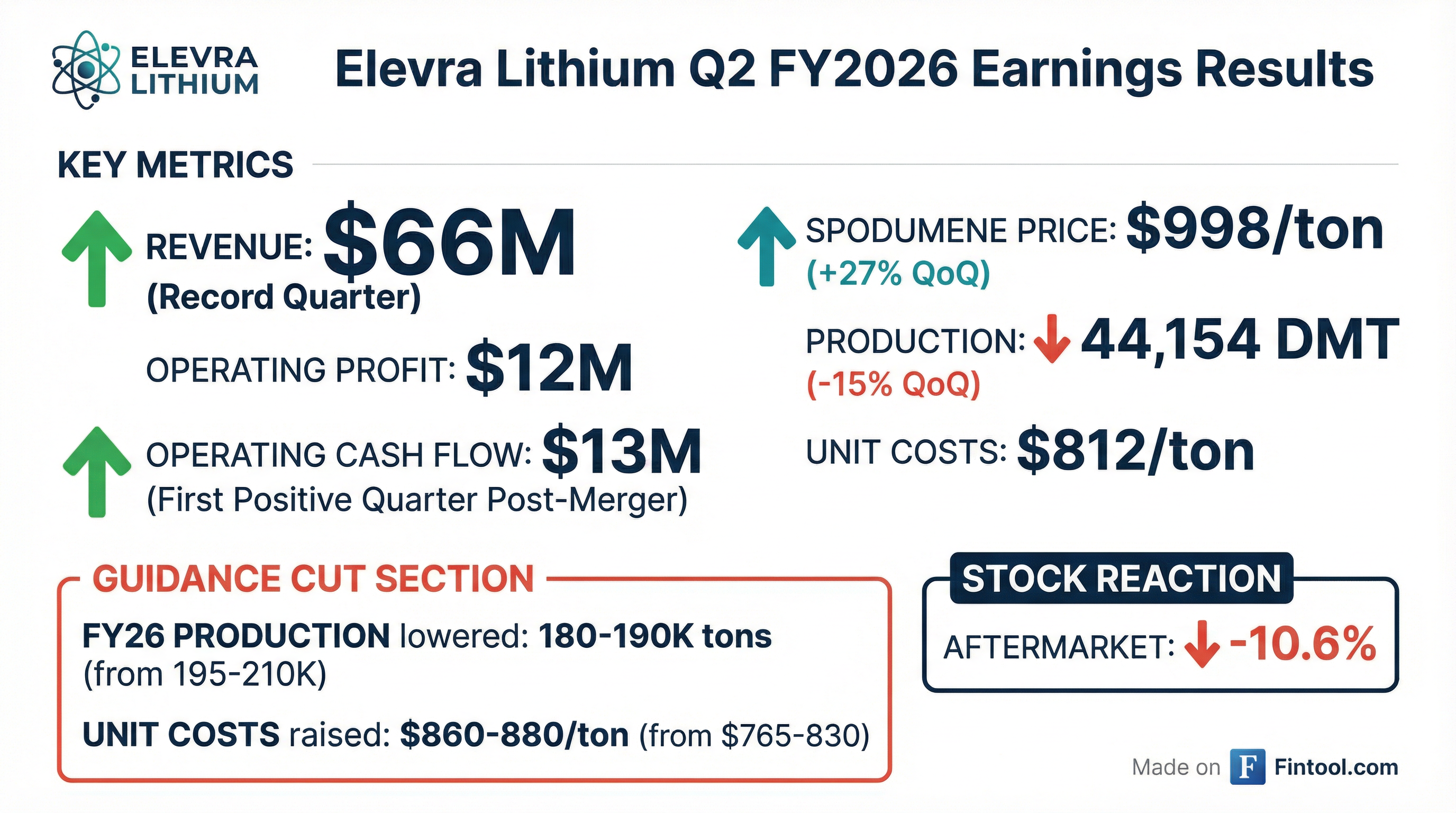

Elevra Lithium (ASX: DML, NASDAQ: ELVR) delivered record quarterly revenue of $66 million and its first positive operating cash flow since the Sayona-Piedmont merger, but shares fell ~10% in aftermarket trading after management cut FY26 production and sales guidance by approximately 10% due to operational challenges at the North American Lithium (NAL) mine.

Did Elevra Beat Expectations?

With limited analyst coverage, there's no consensus estimate to compare against. However, the quarter showed meaningful improvements in key areas:

The strong quarter was driven by a strategy of timing sales through the December quarter to capture improved pricing, combined with stable unit operating costs.

What Drove the Guidance Cut?

Despite the record revenue, management lowered FY26 guidance due to operational challenges:

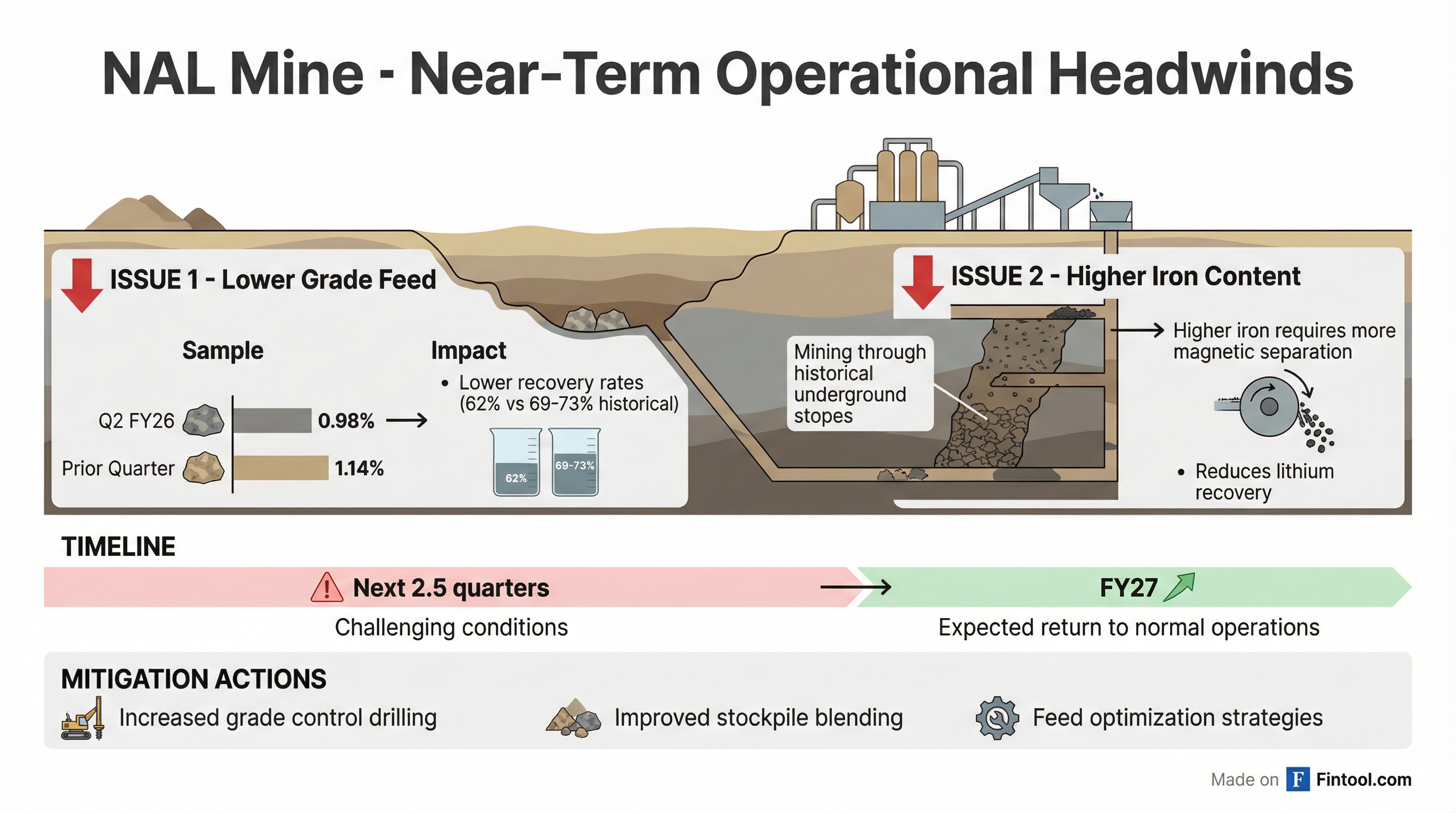

The core issue: Mining progressed into areas adjacent to historical underground workings within Phase 3, which reduced in-pit ore availability and encountered ore with lower lithium grades and higher iron content.

Key operational impacts:

- Feed grade dropped to 0.98% vs 1.14% prior quarter

- Recovery rates fell to 62% vs historical 69-73%

- Production declined 15% QoQ to 44,154 DMT

What Did Management Say About the Outlook?

CEO Lucas Dow emphasized these challenges are transitional, not structural:

"The operational headwinds we have seen in relation to lower head grades and higher iron content are not representative of the NAL life-of-mine ore body and are more reflective of a point in time rather than a longer-term trend."

Timeline for normalization:

- Next 2.5 quarters: Challenging conditions expected to persist

- FY27: Operations expected to return to normal levels, concentrate grades back to 5.2%+

- Underground stopes: Represent less than 2% of life-of-mine volume

Mitigation actions underway:

- Additional grade control drilling to improve geological model accuracy

- Enhanced stockpile blending and feed optimization strategies

- Next quarter expected head grade improvement to ~1.03%

How Did the Stock React?

The sharp aftermarket decline reflects the market's disappointment with the guidance cut, despite the strong revenue quarter. The stock had rallied significantly since the Sayona-Piedmont merger closed in September 2025.

What Changed From Last Quarter?

Positive developments:

- First positive operating cash flow ($13M) since merger

- Record mill throughput despite planned shutdown

- Mill utilization improved to 89%

- Pricing leverage captured (+27% realized price)

Negative developments:

- Production down 15% QoQ

- Cash declined from $97.9M to $81.3M

- Full-year guidance cut ~10%

- Unit cost guidance raised ~8%

Growth Projects Update

NAL Expansion (Priority):

- Accelerated staged approach announced

- Updated scoping study expected early next quarter

- Moving directly to detailed engineering (bypassing traditional DFS)

Moblan (Quebec):

- Environmental studies nearing completion

- Updated DFS expected late CY26/early CY27

- Investissement Québec remains JV partner

Carolina Lithium (U.S.):

- General stormwater permits secured

- Engaging with U.S. government (DOE, DoD, NSC)

- One of only two hard rock spodumene deposits in the U.S.

Ewoyaa (Ghana):

- Mining lease submitted to government

- Subject to ratification and financing

Balance Sheet & Capital Position

Cash flow drivers (Q2):

- Operating cash flow: +$13M

- Merger transaction costs (non-recurring): -$14M

- CapEx and corporate costs: -$7M

CFO Christian Cortes noted: "At current pricing, we'll be profitable at group level, not only at NAL. That will also allow us to allocate capital for sustaining purposes as well as continuing on with some of the growth projects."

Q&A Highlights

On when conditions normalize (William Jones, Canaccord): Management expects FY27 concentrate grades to return to 5.2%+ levels. The next 2.5 quarters will be "a grind" but not representative of long-term performance.

On recovery rates (Company Q&A): Recovery rate decline is transitional, not structural. Historical 69-73% recovery expected when feed grades and iron content normalize.

On operating margins at current pricing: At $812/ton FOB costs and current spot prices (~$1,100+), margins are strong. Even with guided H2 costs of $860-880/ton, group-level profitability is expected at current prices.

Key Risks & Concerns

- Execution risk: Additional 2.5 quarters of challenging mining conditions

- Price sensitivity: Profitability dependent on spodumene prices staying elevated

- Model uncertainty: Need updated drilling to validate geological model accuracy

- Growth funding: Multiple projects require capital; prioritization decisions ahead

Forward Catalysts

Bottom Line

Elevra Lithium delivered a record revenue quarter and critical proof of positive cash generation at NAL, validating the leverage to higher lithium prices that management has emphasized throughout the downcycle. However, the 10% guidance cut and acknowledgment of 2.5 more challenging quarters weighed on shares.

Bulls will point to: Record revenue, positive cash flow, strong pricing leverage, minimal debt, compelling U.S. project portfolio, management transparency on issues.

Bears will focus on: Guidance cut, execution uncertainty, geological model concerns, cash burn on growth projects, dependence on favorable lithium prices.

The stock's -10% aftermarket reaction appears to price in the near-term headwinds. The key question is whether FY27 truly represents a return to normalized operations—or if mining challenges persist longer than management expects.

Analysis based on Elevra Lithium Q2 FY2026 earnings call held January 27, 2026.