Earnings summaries and quarterly performance for DML1.

Research analysts covering DML1.

Recent press releases and 8-K filings for DML1.

Elevra Lithium Reports Record Q2 2026 Revenue Amid Operational Challenges and Revised FY 2026 Guidance

DML1

Earnings

Guidance Update

New Projects/Investments

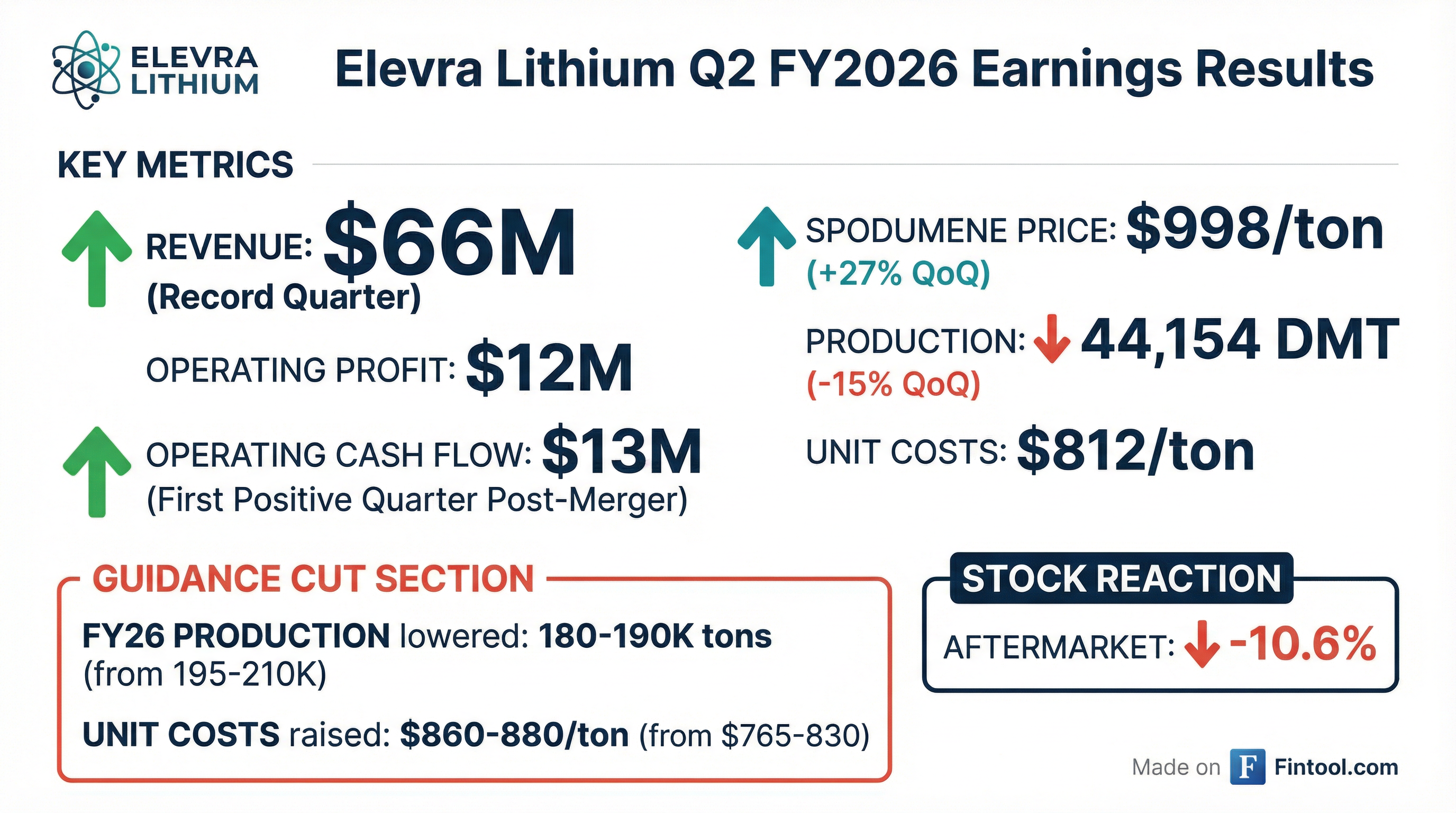

- Elevra Lithium reported record revenue of $66 million and $12 million operating profit at North American Lithium (NAL) for the December 2025 quarter (Q2 2026), driven by 66,016 dry metric tons sold at an average realized price of $998 per ton, a 27% increase quarter-over-quarter.

- Despite record mill throughput, spodumene concentrate production declined 15% quarter-on-quarter to 44,154 dry metric tons due to lower feed grade (0.98%) and higher iron content in mined areas, which negatively impacted lithium recovery. These operational headwinds are considered temporary and not representative of the life-of-mine ore body.

- The company revised its FY 2026 guidance, lowering spodumene concentrate production and sales to a range of 180,000-190,000 tons and 170,000-190,000 tons, respectively, and increasing unit operating costs to $860-$880 per dry metric ton. Concentrate grade for the second half of FY 2026 is expected to be 5%.

- Elevra Lithium ended December 2025 with a cash balance of $81.3 million, down from $97.9 million in September, primarily due to $14 million in non-recurring merger transaction costs and $7 million in planned capital expenditures.

Jan 27, 2026, 11:30 PM

Elevra Lithium Reports Record Q2 2026 Revenue and Updates FY26 Guidance

DML1

Earnings

Guidance Update

New Projects/Investments

- Elevra Lithium reported a quarterly record revenue of $66 million and a $12 million operating profit from North American Lithium (NAL) operations in Q2 2026, driven by a 27% increase in average realized price to $998 per ton and stable unit operating costs of $812 per ton sold.

- NAL experienced a 15% quarter-on-quarter decline in spodumene concentrate production to 44,154 dry metric tons due to mining in areas with lower lithium grade (average feed grade 0.98%) and higher iron content, which negatively impacted processing recoveries. These operational headwinds are considered transitional and not structural, with conditions expected to normalize in FY27.

- The company revised its FY26 guidance, lowering spodumene concentrate production to 180,000-190,000 tons and sales to 170,000-190,000 tons, while increasing unit operating costs to $860-$880 per dry metric ton.

- Elevra finished December with a cash balance of $81.3 million, down from $97.9 million, primarily due to $14 million in non-recurring merger transaction costs and $7 million in capital expenditures and operating outflows. The company is also advancing growth projects, including a staged NAL expansion and environmental studies for Moblan.

Jan 27, 2026, 11:30 PM

Elevra Lithium Reports Record Q2 2026 Revenue Amidst Operational Challenges and Revised FY26 Guidance

DML1

Earnings

Guidance Update

New Projects/Investments

- Elevra Lithium achieved record revenue of $66 million and $13 million in operating cash flow at North American Lithium (NAL) in Q2 FY26 (December 2025 quarter), benefiting from a 27% increase in average realized price to $998 per ton.

- Operational challenges at NAL, including lower lithium grade and higher iron content, led to a 15% quarter-on-quarter decline in spodumene concentrate production to 44,154 dry metric tons.

- As a result, the company revised its FY26 guidance, lowering spodumene concentrate production to 180,000-190,000 tons and sales to 170,000-190,000 tons, and increasing unit operating costs to $860-$880 per dry metric ton. These issues are expected to be short-term.

- The company ended December with a cash balance of $81.3 million, down from $97.9 million in September due to $14 million in merger transaction costs and capital expenditures, but remains well-capitalized with no secured debt.

- Elevra Lithium continues to advance its growth projects, including a staged NAL expansion, environmental fieldwork at Moblan, and permitting for Carolina Lithium.

Jan 27, 2026, 11:30 PM

Elevra Lithium Reports Strong FY 2025 Performance and Outlines Growth Strategy

DML1

M&A

Guidance Update

New Projects/Investments

- Elevra Lithium, formed by the merger of Piedmont Lithium and Sayona Mining, reported $223 million in revenue for FY 2025 and achieved strong operational performance at North American Lithium (NAL), including a 31% increase in tons produced and a 9% reduction in operating costs.

- For FY 2026, the company expects spodumene concentrate production and sales volumes to be between 195,000-210,000 tons with unit operating costs (on a ton sold basis) of AUD 1,175-1,275 per ton.

- Elevra is advancing its NAL Brownfield Expansion, which is projected to increase annual concentrate production to 315,000 tons per year at C1 cash costs of approximately $560 US per ton, with an estimated $270 million capital cost and first production in late 2029.

- The company anticipates a potential reversal of some or all of the $271 million impairment taken at the end of FY 2025, following the completion of the merger and the elimination of the Piedmont offtake agreement.

Nov 21, 2025, 12:30 AM

Elevra Lithium Reports Strong FY 2025 Performance and Outlines Growth Strategy

DML1

M&A

New Projects/Investments

Guidance Update

- Elevra Lithium, formed through the merger of Piedmont Lithium and Sayona Mining, reported a strong FY 2025 performance with a 31% increase in tons produced and a 9% reduction in operating costs at North American Lithium (NAL), generating $223 million in revenue.

- The company plans a NAL Brownfield Expansion to increase annual concentrate production to 315,000 tons per year with C1 cash costs of approximately $560 US per ton, requiring an estimated $270 million capital cost and targeting first production in late 2029.

- For FY 2026, Elevra Lithium expects spodumene concentrate production and sales volumes between 195,000-210,000 tons, with unit costs of AUD 1,175-AUD 1,275 per ton, and capital expenditure of approximately AUD 40 million.

- The board has undergone a major refresh, increasing independent directors and gender diversity, with remuneration now fully performance-based and tied to operational and financial success.

Nov 21, 2025, 12:30 AM

Elevra Lithium Reports Strong FY 2025 Performance and Outlines FY 2026 Guidance and Growth Plans

DML1

Guidance Update

New Projects/Investments

M&A

- Elevra Lithium, formed through the merger of Piedmont Lithium and Sayona Mining, reported $223 million in revenue for FY 2025. The company achieved record production at North American Lithium (NAL), with a 31% increase in tons produced and a 9% reduction in operating costs compared to 2024.

- For FY 2026, Elevra Lithium expects spodumene concentrate production and sales volumes to be between 195,000-210,000 tons, with unit operating costs between AUD 1,175-1,275 per ton. Capital expenditure is projected at approximately AUD 40 million.

- The company is advancing its NAL Brownfield Expansion, aiming to increase annual concentrate production to 315,000 tons per year with C1 cash costs of approximately $560 US per ton. This expansion has an estimated capital cost of $270 million and is expected to achieve first production in late 2029.

- Elevra has refreshed its board, emphasizing independent directors and gender diversity, and has tied remuneration to operational and financial success. The company highlights its strong position with no secured debt and a cleaner portfolio following the merger, aiming to capitalize on forecasted lithium supply deficits.

Nov 21, 2025, 12:30 AM

Elevra Lithium Reports Q1 2026 Results, Completes Merger, and Advances Growth Projects

DML1

Earnings

M&A

New Projects/Investments

- Elevra Lithium completed its merger between Sayona Mining and Piedmont Lithium, establishing the new entity and raising $69 million in capital from Resource Capital Fund.

- The company reported $31 million in revenue for the September quarter (Q1 2026), driven by a 14% quarter-on-quarter increase in average realized price to $784 per tonne (USD).

- Operationally, North American Lithium (NAL) produced 52,003 tonnes of spodumene concentrate and sold 25,975 tonnes, ending the quarter with 51,000 tonnes in inventory. Unit operating costs were $818 per tonne sold (USD).

- Elevra Lithium concluded the quarter with a cash balance of $148.8 million.

- Strategic initiatives include advancing the NAL expansion study, which aims to increase production capacity to 315,000 tonnes per year, and a 30% increase in the Moblan mineral resource estimate to 120 million tonnes.

Oct 28, 2025, 10:30 PM

Elevra Lithium Completes Merger, Reports Q1 2026 Results, and Outlines Growth Plans

DML1

Earnings

M&A

New Projects/Investments

- Elevra Lithium was formally established through the merger of Sayona Mining and Piedmont Lithium, and completed a $69 million capital raise with Resource Capital Fund.

- The North American Lithium (NAL) operation produced 52,003 tonnes of spodumene concentrate at a 5.2% average grade but strategically sold only 25,975 tonnes in Q1 2026, building 51,000 tonnes of inventory to capture expected higher realized pricing in the December quarter.

- Revenue for the quarter was $31 million, with an average realised price of $784 per tonne (USD), while unit operating costs increased to $818 per tonne sold (USD) due to lower sales volumes and planned maintenance. The company finished the quarter with a $148.8 million cash balance.

- Elevra Lithium plans to expand NAL's production capacity to approximately 315,000 tonnes of concentrate per year, aiming to reduce unit operating costs by 30% to $562 per tonne (USD), with a final investment decision targeted for H2 2027. The Moblan project also saw a 30% increase in its mineral resource estimate.

Oct 28, 2025, 10:30 PM

Elevra Lithium Reports Q1 2026 Results, Merger Completion, and Growth Initiatives

DML1

Earnings

M&A

New Projects/Investments

- Elevra Lithium was formally established through the merger of Sayona Mining and Piedmont Lithium, now controlling North America's largest operating hard rock lithium mine.

- For the September quarter (Q1 2026), the company reported AUD 31 million in revenue, with an average realized price increasing 14% quarter-on-quarter to AUD 1,198 per tonne FOB (or $784 per tonne on a U.S. dollar basis).

- Operational performance at the North American Lithium (NAL) operation included producing 52,003 tonnes of spodumene concentrate at an average grade of 5.2% and achieving 87% mill utilization. Sales volume was intentionally lower at 25,975 tonnes to prioritize December quarter shipments for expected higher pricing, resulting in 51,000 tonnes of finished product in inventory.

- Elevra Lithium ended the quarter with a cash balance of AUD 148.8 million and is advancing expansion plans for NAL to potentially increase production to 315,000 tonnes of concentrate per year and reduce unit operating costs. Additionally, the JORC-compliant MRE at Moblan increased 30% to 120 million tonnes.

Oct 28, 2025, 10:30 PM

Quarterly earnings call transcripts for DML1.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more