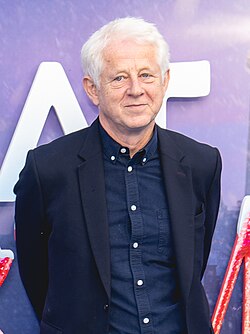

Richard Tobin

About Richard Tobin

Richard J. Tobin is Dover’s Chairman, President and CEO (Board Chair since February 10, 2024), age 61, director since 2016, with a BA from Norwich University and an MBA from Drexel University . 2024 operating performance: revenue $7,746 million (+1%), GAAP diluted EPS $10.09 (+50%), adjusted EPS $8.29 (+4%), free cash flow $920 million (~12% of revenue), and total segment earnings margin 21.7% . Pay-versus-performance shows CAP-linked alignment with TSR; a $100 Dover investment was $175 by year-end 2024 vs $142 in 2023, and compensation actually paid rose as TSR improved . Mr. Tobin’s prior CEO roles at CNH Industrial and senior finance/operations roles at SGS give deep global industrial, capital markets, and operations expertise .

Past Roles

| Organization | Role | Years | Strategic Impact |

|---|---|---|---|

| CNH Industrial N.V. | Chief Executive Officer | Not disclosed | Led efficiency, technology innovation, geographic expansion, and portfolio optimization at a complex global industrial |

| Fiat Industrial S.p.A | Group Chief Operating Officer | Not disclosed | Global operations leadership across diversified industrial portfolio |

| CNH Global N.V. | President & CEO; CFO | Not disclosed | Drove portfolio and performance; capital markets leadership as CFO |

| SGS Group | Chief Finance Officer & Head of IT; COO North America | Not disclosed | International finance, IT modernization, and regional operations leadership |

| U.S. Army | Officer | Not disclosed | Leadership foundation; governance and discipline |

External Roles

| Organization | Role | Years | Strategic Impact |

|---|---|---|---|

| KeyCorp | Director | Not disclosed | Capital markets and risk oversight perspectives to a large financial institution |

| John G. Shedd Aquarium | Trustee | Not disclosed | Community and governance engagement |

| U.S. Chamber of Commerce | Former Director | Not disclosed | Public policy and business advocacy experience |

| Business Roundtable | Former Member | Not disclosed | CEO-level policy dialogue and governance |

Fixed Compensation

| Metric | 2022 | 2023 | 2024 |

|---|---|---|---|

| Base Salary ($) | 1,261,250 | 1,292,500 | 1,337,000 |

| Bonus / AIP Paid ($) | 1,951,101 | 1,999,920 | 3,461,120 |

| Stock Awards (Grant-date FV, $) | 6,213,263 | 8,086,100 | 8,196,451 |

| Option Awards (SSARs, Grant-date FV, $) | 4,201,489 | 5,209,390 | 5,965,757 |

| All Other Compensation ($) | 516,149 | 207,191 | 270,202 |

| Total ($) | 14,143,252 | 16,795,101 | 19,230,530 |

- CEO employment agreement renewed March 5, 2024 through May 30, 2027; minimum base salary $1.2 million, minimum target bonus 125% of salary, and annual equity grants ≥$7 million grant-date fair value .

- 2024 AIP target for Mr. Tobin was $2,163,200 (implies ~162% of 2024 base salary), as disclosed in Grants of Plan-Based Awards .

Performance Compensation

| Component | Metric | Weighting | Target / Plan | Actual / Outcome | Payout / Vesting |

|---|---|---|---|---|---|

| AIP Financial Objective | Adjusted Earnings | 60% | Target $1,245.9M; Threshold 85% (50% payout); Max 107% (200% payout) | Actual $2,806.3M (includes 2024 gains on De‑Sta‑Co and ESG divestitures) | 200% for Financial Factor → 120% weighted |

| AIP Strategic Objectives (CEO) | Five pillars incl. productivity/margins, capital markets & investor engagement, portfolio management, talent & succession, ESG | 40% (20% each pillar) | Pre-defined annual objectives | Committee assessed performance | Strategic Objectives Factor: 100% |

| LTIP PSUs (2024 grants) | 50% Relative TSR vs S&P 500 Industrials; 50% Average Tangible ROIC (3-year, to 12/31/2026) | 40% of LTIP | Earnout 0–300% of target, TSR capped at 100% if negative; ROIC formula defined (Adjusted Net Earnings / Total Tangibles) | In-cycle | Vest/pay after 3 years, per achievement |

| LTIP SSARs (2024 grants) | Stock price | 40% of LTIP | Exercise begins 3 years after grant; 7-year exercise window thereafter; 10-year life | Grant on 2/8/2024 at $160.11 exercise price | Exercisable 2/8/2027–2/8/2034 |

| LTIP RSUs (2024 grants) | Stock price | 20% of LTIP | Time-based vesting | 13,116 units for CEO | Vest ratably over 3 years starting 3/15/2025 |

Performance shares vested in 2024 (2022 grant cycle) paid at 78.8% of target; CEO target shares 22,471; actual 17,707 .

Equity Ownership & Alignment

| Item | Detail |

|---|---|

| Total beneficial ownership | 1,001,822 shares for Mr. Tobin, including 3,126 deferred stock units, 736,520 shares from vested SSARs, 12,250 RSUs scheduled to vest 3/15/2025, and 548 shares in the 401(k) plan; less than 1% of shares outstanding |

| Director & officer group | 1,596,515 shares as a group, ~1.2% of shares outstanding |

| Ownership guidelines | CEO required to hold shares equal to 5x base salary; all NEOs currently in compliance |

| Hedging/pledging | Prohibited for directors and executive officers; no margin or pledged shares allowed |

| 2024 equity activity | CEO had 30,202 stock awards vest in 2024 (value realized $5,509,486); no SSAR exercises reported for CEO in 2024 |

Vesting schedule highlights and potential selling pressure indicators:

- RSUs: 13,116 granted on 2/8/2024 vest in three equal tranches beginning 3/15/2025 .

- SSARs: 116,587 granted on 2/8/2024, exercisable from 2/8/2027, expire 2/8/2034 (exercise price $160.11) .

- PSUs: 2024 grants for 2024–2026 performance; payout contingent on TSR and Tangible ROIC .

Employment Terms

| Term / Provision | Details |

|---|---|

| Employment agreement | Renewed effective March 5, 2024; term through May 30, 2027 |

| Minimum fixed/target | Base salary ≥$1.2M; target bonus ≥125% of salary; annual equity grant ≥$7M grant-date FV |

| Non‑change‑in‑control severance | CEO: 1.5x (salary + target bonus), 18 months COBRA; other NEOs: 12 months (salary + target bonus), 12 months COBRA; plus prorated AIP and PSUs, and outplacement up to $25,000; cash severance capped ≤2.99x without shareholder approval |

| Change-in-control plan | Double trigger only; 2.0x (salary + target bonus), prorated target bonus; full acceleration of unvested SSARs & RSUs; PSUs vest at target; 24 months COBRA; outplacement up to $25,000; cap at ≤2.99x (no excise tax gross-up) |

| Clawback | NYSE/SEC-compliant clawback for erroneously awarded incentive compensation (3-year lookback) effective Oct 2, 2023; additional clawbacks in PRP and severance plans for cause/breaches |

| Non-compete (retirement vesting benefits) | Enhanced vesting during retirement vesting windows conditioned on non-compete; violation requires forfeiture and repayment of realized benefits |

Illustrative 12/31/2024 termination values (incremental, CEO):

- Involuntary not-for-cause: ~$5.34M (cash severance, COBRA, outplacement) .

- CIC termination: ~$31.13M (cash severance, equity acceleration, benefits) .

Board Governance

- Board service: Director since 2016; unanimously appointed Board Chair effective February 10, 2024; classified as not independent due to CEO role; serves on no Board committees .

- Committee independence: All standing committees composed entirely of independent directors; 8 of 9 director nominees are independent .

- Lead Independent Director: Robust LID authority; Michael F. Johnston served as LID in 2024; Keith E. Wandell appointed LID upon re-election in 2025 .

- Attendance: Board met six times in 2024; directors’ attendance was 100% .

- Governance proposal: 2025 shareholder proposal to require an independent Board Chair; Board recommends against to preserve structural flexibility while maintaining strong LID oversight .

Compensation Structure Analysis

- Mix and pay-for-performance: Majority of CEO target pay is performance-based, with long-term incentives paid in stock and vesting over three years; program includes ESG oversight in CEO objectives and comprehensive clawback policy .

- LTIP evolution: In 2024, PSUs added Tangible ROIC (50%) to complement relative TSR (50%), strengthening capital efficiency alignment; prior cycles used TSR alone (2022–2024 payout 78.8% of target) .

- No shareholder-unfriendly features: No hedging/pledging, no tax gross-ups, no option repricing/reloads; double-trigger CIC only .

- Peer benchmarking: Compensation compared against a diversified industrial peer set (e.g., AMETEK, Fortive, ITW, Ingersoll Rand, Roper, etc.) with reference to peer median and internal equity .

Say-on-Pay & Shareholder Feedback

- Say-on-Pay support: ~94% approval at 2024 annual meeting; continued engagement with holders of ~62% of outstanding shares and meetings with investors representing ~42% .

- Program enhancements from feedback: Added Tangible ROIC to PSUs (2024), reduced special meeting threshold, removed charter supermajority provisions, strengthened LID responsibilities .

Equity Ownership & Alignment (Detail)

| Item | Count / Value |

|---|---|

| RSUs unvested (selected) | 13,116 granted 2/8/2024; 8,266 (2023 grant) and 3,745 (2022 grant) outstanding as of 12/31/2024; RSUs valued at $187.60 per share for market value disclosure |

| SSARs (selected tranches) | 116,587 (2024 grant, $160.11 strike, exercisable 2/8/2027–2/8/2034); 110,205 (2023 grant, $153.25); 99,869 (2022 grant, $160.21); legacy tranches fully exercisable |

| 2024 vesting/exercises | 30,202 shares vested from RSUs/PSUs; no CEO SSAR exercises reported |

Performance & Track Record

- 2024 execution: Portfolio reshaping (sale of De‑Sta‑Co and Environmental Solutions Group), eight acquisitions (~$674M), dividend increased (69th consecutive year), $500M ASR completed, free cash flow ~12% of revenue, and margin expansion via mix and productivity .

- Capital allocation and discipline: Segment earnings margin reached 21.7%; sustained investment-grade policy and balanced reinvestment vs. returns to shareholders .

- TSR linkage: CAP tracks TSR; 2024 improvement reflected in higher compensation actually paid vs 2023 .

Investment Implications

- Alignment: Strong pay-for-performance design (AIP tied to adjusted earnings with rigorous curves; PSUs tied to relative TSR and Tangible ROIC), robust clawbacks, and anti-hedging/pledging support shareholder alignment and mitigate risk .

- Retention risk: Low near-term risk given renewed employment agreement through 2027 with competitive equity-heavy mix and double-trigger CIC protections; vesting schedules extend through 2027–2034 for SSARs and through 2026+ for RSUs/PSUs .

- Trading signals: 2024 CEO did not exercise SSARs; RSU/PSU vesting continues; watch future PSU outcomes vs. Tangible ROIC and relative TSR targets for potential sell pressure from vest events .

- Governance watch: Combined Chair/CEO structure offset by empowered LID and majority-independent Board; monitor 2025 vote on independent chair proposal for governance sentiment and potential leadership structure changes .

- Execution focus: Portfolio actions, disciplined capital deployment, and margin expansion under Tobin’s leadership are positive for FCF and EPS compounding; continued progress on ROIC-linked PSUs is a key indicator of value creation durability .