Earnings summaries and quarterly performance for DOVER.

Executive leadership at DOVER.

Richard Tobin

Chairman, President and Chief Executive Officer

Chris Woenker

Senior Vice President and Chief Financial Officer

Girish Juneja

Senior Vice President & Chief Digital Officer

Ivonne Cabrera

Senior Vice President, General Counsel & Secretary

Jeffrey Yehle

Senior Vice President & Chief Human Resources Officer

Board of directors at DOVER.

Research analysts who have asked questions during DOVER earnings calls.

Jeffrey Sprague

Vertical Research Partners

6 questions for DOV

Julian Mitchell

Barclays Investment Bank

6 questions for DOV

Nigel Coe

Wolfe Research, LLC

6 questions for DOV

Scott Davis

Melius Research

6 questions for DOV

Andrew Kaplowitz

Citigroup

5 questions for DOV

Brett Linzey

Mizuho Securities

5 questions for DOV

Deane Dray

RBC Capital Markets

5 questions for DOV

Michael Halloran

Baird

4 questions for DOV

Andrew Obin

Bank of America

3 questions for DOV

C. Stephen Tusa

JPMorgan Chase & Co.

3 questions for DOV

Joseph O'Dea

Wells Fargo & Company

3 questions for DOV

Joseph Ritchie

Goldman Sachs

3 questions for DOV

Amit Mehrotra

UBS

2 questions for DOV

David Ridley-Lane

Bank of America

2 questions for DOV

Joe Ritchie

Goldman Sachs

2 questions for DOV

Mike Halloran

Robert W. Baird & Co. Incorporated

2 questions for DOV

Stephen Tusa

J.P. Morgan

2 questions for DOV

Christopher Snyder

Morgan Stanley

1 question for DOV

Joe O'Dea

Wells Fargo

1 question for DOV

Joseph O'Dea

Wells Fargo

1 question for DOV

Steve Tusa

JPMorgan Chase & Co.

1 question for DOV

Recent press releases and 8-K filings for DOV.

- Dover reports order acceleration entering 2026, with a stronger Q4 backlog supported by lower interest rates and easing tariff uncertainty, positioning the company to exit a credit position on backlog.

- Top-line and profit growth are expected from Clean Energy—where the fueling solutions business has doubled via M&A and a three-year upcycle is anticipated, supplemented by expanded cryogenic components in LNG through propane—and Climate & Sustainability, driven by brazed plate heat exchangers in data centers/district heating and a retail/CO₂ refrigeration rebound (now $300 million+ in 18 months).

- Incremental margins are forecast to moderate as growth broadens across the portfolio; about 50% of 2026 restructuring savings will derive from prior-period M&A synergies and completed footprint consolidations.

- The company maintains a disciplined M&A strategy, sitting on $1.5 billion of liquidity while waiting for attractive middle-market opportunities amid elevated multiples; share repurchases are the fallback if deal economics remain prohibitive.

- Dover experienced an unusual acceleration in orders during Q4 2025, entering 2026 with a net positive backlog due to easing tariffs and lower interest rates boosting short-cycle CapEx demand.

- The Clean Energy and Climate & Sustainability segments are expected to deliver the most revenue and profit growth in 2026, driven by a projected three-year upcycle in Fueling Solutions and secular LNG-to-propane investments in cryogenic components, with footprint consolidation completing by mid-year.

- In Climate & Sustainability, retail refrigeration CapEx deferred by 2025 tariffs and brazed plate heat exchanger adoption in data centers and district heating support strong growth, while CO₂ refrigeration systems have scaled from zero to over $300 million in 18 months.

- The vehicle aftermarket segment remains the weakest due to European retail softness but is not expected to further contract; overall, 2026 revenue growth should be volume-led rather than price-driven for the first time in three years.

- Dover holds $1.5 billion in liquidity, will stay patient in a high-multiple M&A market, and may deploy excess cash to share buybacks if acquisition valuations remain unattractive, while continuing to realize synergies from prior deals.

- Strong Q4 order acceleration and higher backlog, combined with lower interest rates, underpin a positive setup for 2026 in Dover’s short-cycle industrial business.

- Clean Energy (fueling solutions) and Climate & Sustainability segments are set to drive top-line and profit growth, with fueling solutions entering a three-year upcycle and CO₂ refrigeration revenues exceeding $300 million.

- Portfolio optimization is largely complete through strategic divestments; 50% of restructuring roll-forward savings come from prior M&A, with disciplined approach to high multiples and cash returns as an option if deal valuations remain elevated.

- Modest data center exposure in Thermal Connectors and Brazed Plate Heat Exchangers supports stable pricing; Pumps & Process margins exceed 30%, driven by mix rather than accretive M&A.

- Dober announced the acquisition of the Agronomy and Water Treatment segments of Lygos’ Soltellus™ business, enhancing its specialty chemicals portfolio.

- The deal gives Dober full control over manufacturing, quality and R&D, with production at Hazleton, PA and development at Woodridge, IL.

- Lygos will retain Soltellus™ Home and Personal Applications and its proprietary polymer technology for home care, personal care and hygiene markets.

- The transaction is expected to be seamless for customers and supports Dober’s strategic growth in high-performance agronomy products.

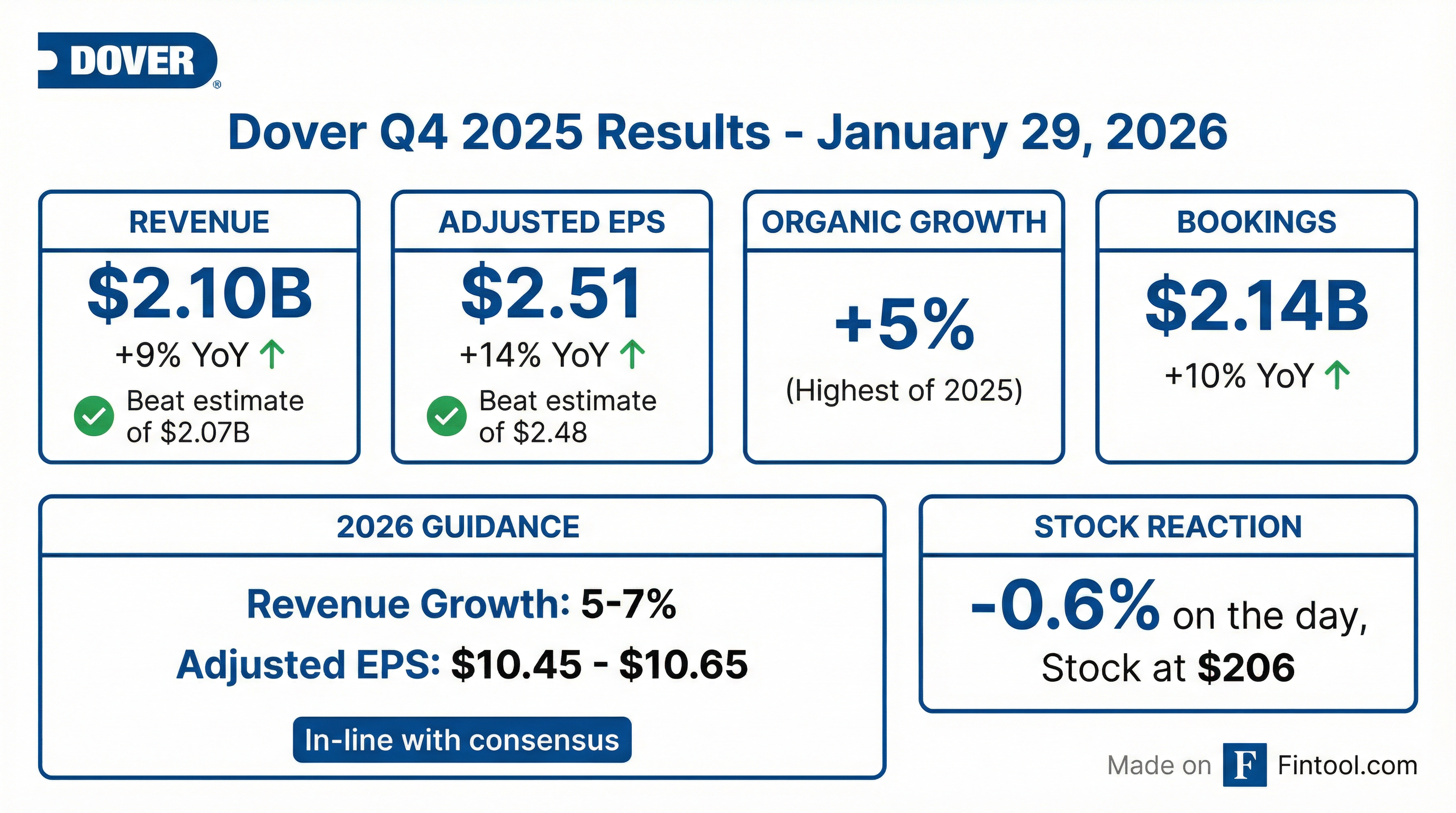

- Q4 organic revenue growth of 5%, bookings up 10% with a book-to-bill of 1.02, segment EBITDA margin improving 60 bps to 24.8%, and adjusted EPS of $9.61 (+14% in Q4; +16% for FY)

- Q4 free cash flow of $487 million (23% of revenue); full-year FCF at 14% of revenue, up nearly $200 million YoY; 2026 FCF guidance of 14–16% of revenue

- 2026 adjusted EPS guidance of $10.45–$10.65, implying double-digit growth at the midpoint

- 2025 capital deployment included $700 million for four strategic acquisitions and a $500 million accelerated share repurchase, with balance-sheet flexibility retained for further M&A and buybacks

- Dover delivered 5% organic revenue growth in Q4, 10% bookings growth for the quarter (6% for the full year), and a book-to-bill of 1.02.

- All-in adjusted EPS was $9.61, up 14% year-over-year (16% for the full year), with 2026 EPS guidance of $10.45–$10.65.

- Free cash flow in Q4 was $487 million (23% of revenue) and 14% of revenue for full-year 2025, with 2026 FCF conversion targeted at 14%–16% of revenue.

- Capital deployment included $700 million in acquisitions, a $500 million accelerated share repurchase, and over $50 million of incremental organic CapEx in 2025.

- Dover reported Q4 2025 revenue of $2.1 B (+9% all-in, +5% organic) and FY 2025 revenue of $8.1 B (+4% all-in, +2% organic).

- Q4 adjusted segment EBITDA margin rose 60 bps to 24.8%, while bookings increased 10% for a book-to-bill of 1.02.

- Q4 free cash flow was $487 M (23% of revenue), contributing to FY 2025 free cash flow of $1,118 M (14% of revenue) .

- FY 2026 guidance calls for 5–7% all-in revenue growth (3–5% organic), Adjusted EPS of $10.45–$10.65, and free cash flow at 14–16% of revenue.

- Dover delivered 5% organic revenue growth in Q4, supported by broad-based demand, with bookings up 10% in the quarter (6% for FY 2025) and a book-to-bill ratio of 1.02 in Q4 2025.

- Reported all-in adjusted EPS of $9.61, up 14% in Q4 and 16% for the full year, while segment EBITDA margin expanded 60 bps to 24.8% in the quarter.

- Generated $487 million of free cash flow in Q4 (23% of revenue) and achieved 14% free cash flow conversion for FY 2025, up nearly $200 million year-over-year.

- Issued 2026 guidance for adjusted EPS of $10.45–$10.65 (double-digit growth at midpoint) and free cash flow conversion of 14–16% of revenue.

- Dover’s fourth-quarter revenue rose 9% to $2.1 billion (organic +5%), and GAAP diluted EPS from continuing operations was $2.01, up 17% year-over-year.

- For full year 2025, revenue reached $8.1 billion (+4%/+2% organic); GAAP diluted EPS was $7.97, down 21% due to a prior-year disposition gain, while adjusted EPS was $9.61, up 16%.

- Management issued 2026 guidance for GAAP EPS of $8.95–$9.15 and adjusted EPS of $10.45–$10.65, on revenue growth of 5–7% (organic 3–5%).

- In Q4, Dover initiated a $500 million accelerated share repurchase and completed four acquisitions in FY 2025 totaling $665 million to bolster strategic segments.

- Dover’s Q4 2025 revenue was $2.10 billion, up 9% year-over-year (5% organic), with GAAP earnings from continuing operations of $275 million (+15%) and GAAP diluted EPS of $2.01 (+17%); adjusted EPS was $2.51, up 14%.

- For FY 2025, revenue reached $8.09 billion, up 4% (2% organic); GAAP earnings from continuing operations fell 22% to $1.10 billion and GAAP diluted EPS declined 21% to $7.97, while adjusted EPS rose 16% to $9.61.

- Dover forecasts 2026 GAAP EPS of $8.95–$9.15 (adjusted EPS of $10.45–$10.65) on full-year revenue growth of 5–7% (3–5% organic).

- The company initiated a $500 million accelerated share repurchase in Q4 2025 and noted that recent acquisitions are performing above deal models, supporting its capital allocation strategy.

Quarterly earnings call transcripts for DOVER.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more