Earnings summaries and quarterly performance for ECOLAB.

Executive leadership at ECOLAB.

Christophe Beck

Chief Executive Officer

Darrell Brown

President & Chief Operating Officer

Greg Cook

Executive Vice President and President, Institutional Group

Harpreet Saluja

Executive Vice President, Corporate Strategy & Business Development

Jandeen Boone

Executive Vice President, General Counsel and Secretary

Jennifer Bradway

Senior Vice President and Corporate Controller

Larry Berger

Executive Vice President and Chief Technical Officer

Laurie Marsh

Executive Vice President, Human Resources

Nicholas Alfano

Executive Vice President and President, Global Industrial Group

Sam De Boo

Executive Vice President and President, Global Markets

Scott Kirkland

Chief Financial Officer

Soraya Hlila

Executive Vice President and General Manager, Global Pest

Board of directors at ECOLAB.

David MacLennan

Lead Independent Director

Eric Green

Director

John Zillmer

Director

Judson Althoff

Director

Julie Whalen

Director

Lionel Nowell III

Director

Marion Gross

Director

Michael Larson

Director

Michel Doukeris

Director

Shari Ballard

Director

Suzanne Vautrinot

Director

Tracy McKibben

Director

Victoria Reich

Director

Research analysts who have asked questions during ECOLAB earnings calls.

Ashish Sabadra

RBC Capital Markets

8 questions for ECL

David Begleiter

Deutsche Bank

8 questions for ECL

Jason Haas

Wells Fargo

8 questions for ECL

John McNulty

BMO Capital Markets

8 questions for ECL

Patrick Cunningham

Citigroup

8 questions for ECL

Vincent Andrews

Morgan Stanley

8 questions for ECL

Laurence Alexander

Jefferies

7 questions for ECL

Manav Patnaik

Barclays

7 questions for ECL

Jeffrey Zekauskas

JPMorgan Chase & Co.

6 questions for ECL

John Ezekiel Roberts

Mizuho Securities

6 questions for ECL

Josh Spector

UBS Group

6 questions for ECL

Kevin McCarthy

Vertical Research Partners

6 questions for ECL

Mike Harrison

Seaport Research Partners

6 questions for ECL

Shlomo Rosenbaum

Stifel, Nicolaus & Company, Incorporated

6 questions for ECL

Chris Parkinson

Wolfe Research, LLC

5 questions for ECL

Scott Schneeberger

Oppenheimer & Co. Inc.

5 questions for ECL

Andrew J. Wittmann

Robert W. Baird & Co.

3 questions for ECL

Christopher Parkinson

Wolfe Research

3 questions for ECL

Matthew Deyoe

Bank of America

3 questions for ECL

Timothy Mulrooney

William Blair & Company

3 questions for ECL

Andres Castanos-Mollor

Berenberg

2 questions for ECL

Andy Whitman

Baird

2 questions for ECL

Bobby Zolper

Raymond James

2 questions for ECL

Edlain Rodriguez

Mizuho Securities

2 questions for ECL

Jeff Zekauskas

JPMorgan

2 questions for ECL

Joshua Spector

UBS

2 questions for ECL

Luke McFadden

William Blair & Company

2 questions for ECL

Matt Hauer

Vertical Research Partners

2 questions for ECL

Matthew Devoit

Bank of America

2 questions for ECL

Michael Harrison

Seaport Research Partners

2 questions for ECL

Seth Weber

Wells Fargo

2 questions for ECL

Steve Byrne

Bank of America

2 questions for ECL

Tim Mulrooney

William Blair

2 questions for ECL

Andre Castanos Muller

Warner

1 question for ECL

Andrew Whittman

Baird

1 question for ECL

Benjamin Luke McFadden

William Blair & Company L.L.C.

1 question for ECL

Charles Neivert

Piper Sandler

1 question for ECL

Daniel Rizzo

Jefferies

1 question for ECL

Justin Hauke

Robert W. Baird & Co.

1 question for ECL

Pavel Molchanov

Raymond James

1 question for ECL

Ronan Kennedy

Barclays

1 question for ECL

Recent press releases and 8-K filings for ECL.

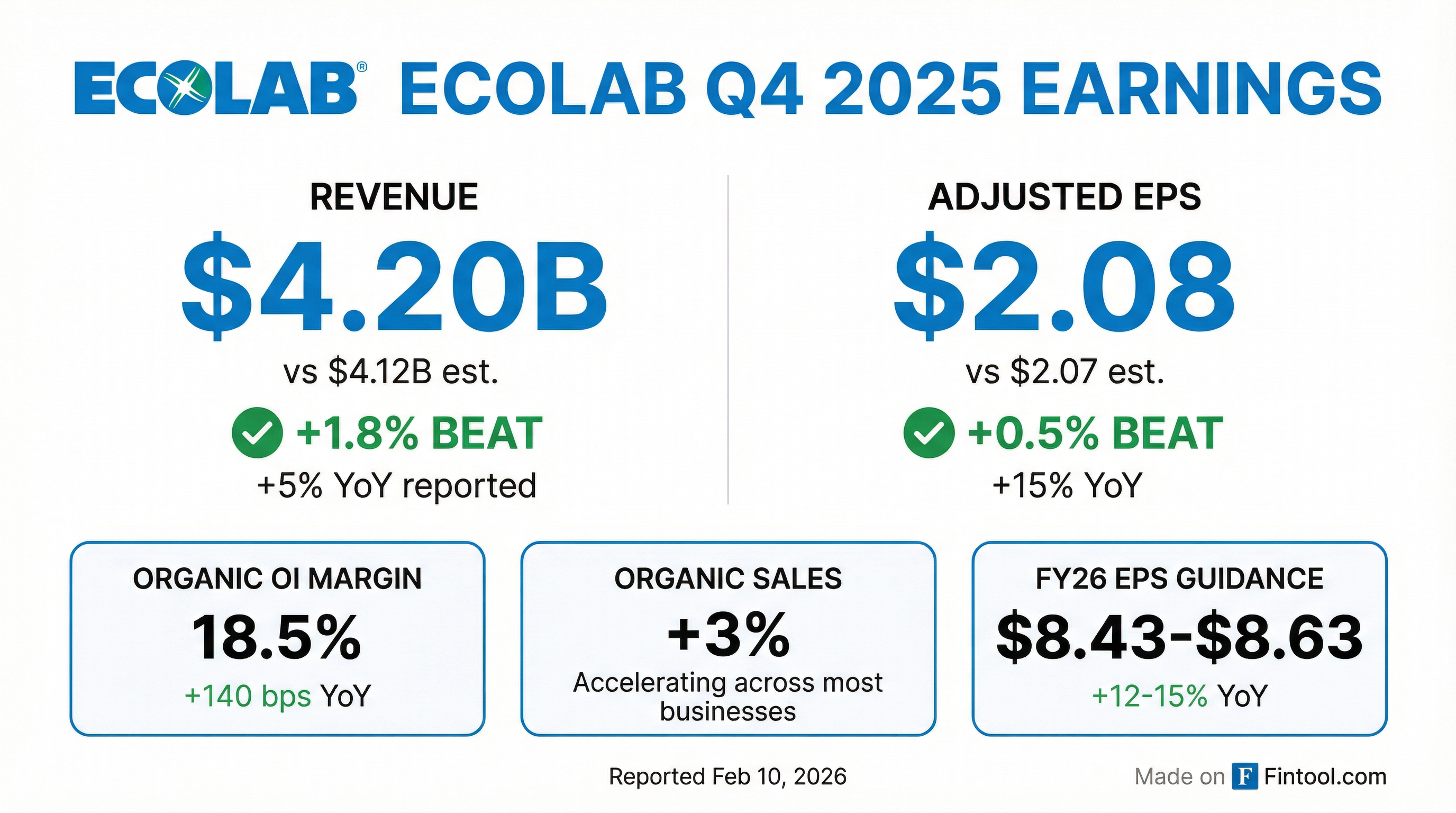

- Ecolab delivered 5% reported sales growth and 3% organic growth, led by Food & Beverage, Pest Elimination and Life Sciences; Q4 adjusted EPS was $2.08 (+15%).

- Operating income margin expanded 140 bps to 18.5%, with adjusted operating income up 12% and gross margin improving 70 bps to 44.1%.

- Pest Elimination and Life Sciences each achieved 7% organic growth, and Global High-Tech maintained strong double-digit expansion.

- Full-year 2026 guidance includes 7–9% reported sales growth, 3–4% organic growth, and adjusted EPS of $8.43–$8.63 (+12–15%); Q1 EPS is guided at $1.67–$1.73 (+11–15%).

- Record 2025 performance: Q4 adjusted EPS grew 15%, organic sales rose 3%, and full-year operating income margin reached 18% (up 150 bps year-over-year).

- Segment momentum: In Q4, Food & Beverage sales accelerated 5%, while Pest Elimination, Life Sciences, and Specialty each grew 7% organically.

- One Ecolab cost savings: Delivered over $100 million in SG&A savings in 2025 and raised the cumulative target to $325 million by 2027.

- 2026 guidance: Reported sales expected to grow 7–9%, organic sales 3–4%, with operating income margin expanding 100–150 bps to over 19%, driving 14–16% OI growth and 12–15% EPS growth.

- Ecolab delivered 15% adjusted EPS growth, 3% organic sales growth, and expanded its organic operating income margin by 140 bps to 18.5% in Q4, lifting full-year operating margin to 18% (+150 bps).

- For 2026, the company guides to 3–4% organic sales growth (7–9% reported), 100–150 bps OI margin expansion to over 19%, 14–16% operating income growth, and 12–15% EPS growth (including Ovivo amortization).

- Core segments remain on strong footing: Food & Beverage up 5%, Life Sciences up 7%, Specialty up 7%, with double-digit growth in Global High Tech and Ecolab Digital; distributor inventory drag in Institutional is expected to normalize in Q1 2026.

- The One Ecolab initiative achieved over $100 million SG&A savings in 2025 and raised its cost-savings target to $325 million by 2027 through global centers of excellence and AI applications.

- Growth engines (≈20% of portfolio), including the Ovivo acquisition for ultra-pure water and digital Pest Elimination, are growing double-digit and enhancing margins.

- Ecolab delivered 15% adjusted EPS growth in Q4 2025 on 3% organic sales growth (3% value pricing, positive volumes), with Food & Beverage, Pest Elimination, Life Sciences, and Specialty accelerating and lifting underlying volume by 2%.

- For 2026, the company guides 7–9% reported sales growth, 3–4% organic sales growth, 100–150 bps OI margin expansion, 14–16% operating income growth, and 12–15% EPS growth, including Ovivo impacts.

- The One Ecolab program achieved over $100 million in SG&A savings by year-end 2025 and has increased its target to $325 million by 2027.

- Growth engines—including the Ovivo acquisition, Global High-Tech, Life Sciences, and Ecolab Digital—now represent about 20% of sales and are expected to grow double-digit, supported by new solutions like direct-to-chip cooling and CIP-IQ.

- GAAP Q4 profit was $563.9 million, or $1.98 per share (up 19% YoY), on $4.196 billion in revenue.

- Adjusted EPS rose to $2.08 (+15% YoY) and adjusted operating margin expanded 162 bps to 18.7%.

- Fiscal 2026 guidance: double-digit EPS growth; reported sales +7–9%; organic sales +3–4%; operating margin +100–150 bps; Q1 EPS $1.67–$1.73.

- One Ecolab program targets ~$325 million in annualized savings by 2027, alongside $334 million in restructuring costs and ~$425 million in one-time implementation charges.

- Ecolab delivered a record fourth quarter, with reported net sales of $4.2 billion (+5%) and organic sales up 3%; reported diluted EPS was $1.98 and adjusted diluted EPS $2.08 (+15%).

- Fourth quarter reported operating income margin was 17.0%, while organic operating income margin expanded 140 bps to 18.5%.

- 2026 outlook: full-year adjusted diluted EPS of $8.43–$8.63 (+12%–15%), including approximately $0.13 per share of non-cash amortization related to the Ovivo Electronics acquisition; Q1 2026 EPS expected at $1.67–$1.73 (+11%–15%).

- Ecolab delivered $16 billion in sales in 2025 with 3–4% organic sales growth and an 18% adjusted operating income margin, targeting >20% OI margin by 2027.

- Adjusted diluted EPS reached $7.53 in 2025 and is guided to $8.30 in 2026, supporting a 12–15% EPS growth framework.

- The portfolio is diversified across end markets (Water 49%, Institutional & Specialty 38%, Life Sciences 5%, Pest 8%) and geographies (North America 56%, EMEA 24%, Asia Pacific 9%).

- Ecolab is building high-margin growth engines—Pest Elimination, Life Sciences, Global High-Tech and Digital—with $370 million in digital sales in 2025 and OI margin targets of >20%.

- The company has returned over $10 billion of cash to shareholders via dividends and share repurchases from 2016–2025.

- Ecolab reaffirmed its commitment to 12%–15% EPS growth, driven by a 3%–4% core revenue increase, and plans to lift its operating margin from 18% in 2025 to 20% by 2027.

- The company serves 3 million customers in 172 countries within a $165 billion total available market, targeting a 10% share and a $60 billion opportunity to deepen penetration among existing clients.

- It is investing in four $3 billion growth platforms—Pest Intelligence, Life Sciences, Global High Tech, and Ecolab Digital—using IoT and AI to boost margins, exemplified by a Pest Intelligence system that reduces inspection effort by 95%.

- Digital and AI initiatives now connect over 100 000 devices, generating about $400 million in Q3 digital revenue and delivering $225 million in cost savings via its One Ecolab process automation.

- Ecolab targets 12-15% adjusted EPS growth and 3-4% organic sales growth, aiming to expand operating income margin beyond 20% by 2027.

- Long-term financial objectives include 5-7% sales growth, 90-100% free cash flow conversion, and maintaining leverage at ~2x Net Debt/Adjusted EBITDA.

- Growth strategy focuses on high-margin engines: Pest Elimination (22% OI margin target), Life Sciences (30%), Global High-Tech (>20%), and Ecolab Digital (>>20%).

- 2024 sales reached $16 B, consisting of $11 B core businesses, $3 B growth engines, and $2 B in challenged markets.

- Q3 organic sales grew 4% (pricing +3%, volumes +1%), with underperforming Basic Industries and Paper down 3% and impacting volume by 1 pp.

- Growth engines drove double-digit gains: Pest Elimination +6% with ~21% margins; Life Sciences +6%; Global High-Tech +25%; Ecolab Digital +25% (annualized sales > $380 million).

- Achieved a record organic operating income margin of 18.7% (+110 bps); full-year 2025 margin expected at ~18%.

- Raised 2025 adjusted diluted EPS midpoint to $7.53; reaffirming 12–15% EPS growth for 2026 and targeting a 20% operating income margin by 2027.

Quarterly earnings call transcripts for ECOLAB.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more