Earnings summaries and quarterly performance for SPX Technologies.

Executive leadership at SPX Technologies.

Gene Lowe

President and Chief Executive Officer

Cherée Johnson

Vice President, Chief Legal Officer and Secretary

John Swann

Segment President, Detection & Measurement

Mark Carano

Chief Financial Officer, Vice President and Treasurer

Randall Data

President, Global Operations

Sean McClenaghan

Segment President, HVAC

Board of directors at SPX Technologies.

Research analysts who have asked questions during SPX Technologies earnings calls.

Bryan Blair

Oppenheimer

6 questions for SPXC

Ross Sparenblek

William Blair & Company

6 questions for SPXC

Bradley Hewitt

Wolfe Research

4 questions for SPXC

Steve Ferazani

Sidoti & Company

4 questions for SPXC

Walter Liptak

Seaport Research Partners

4 questions for SPXC

Damian Karas

UBS

3 questions for SPXC

Jeff Van Sinderen

B. Riley Securities

3 questions for SPXC

Amit Mehrotra

UBS

2 questions for SPXC

Andrew Obin

Bank of America

2 questions for SPXC

Jamie Cook

Truist Securities

2 questions for SPXC

Joe O'Dea

Wells Fargo

2 questions for SPXC

Joseph Giordano

TD Cowen

2 questions for SPXC

Brad Hewitt

Wolfe Research, LLC

1 question for SPXC

Recent press releases and 8-K filings for SPXC.

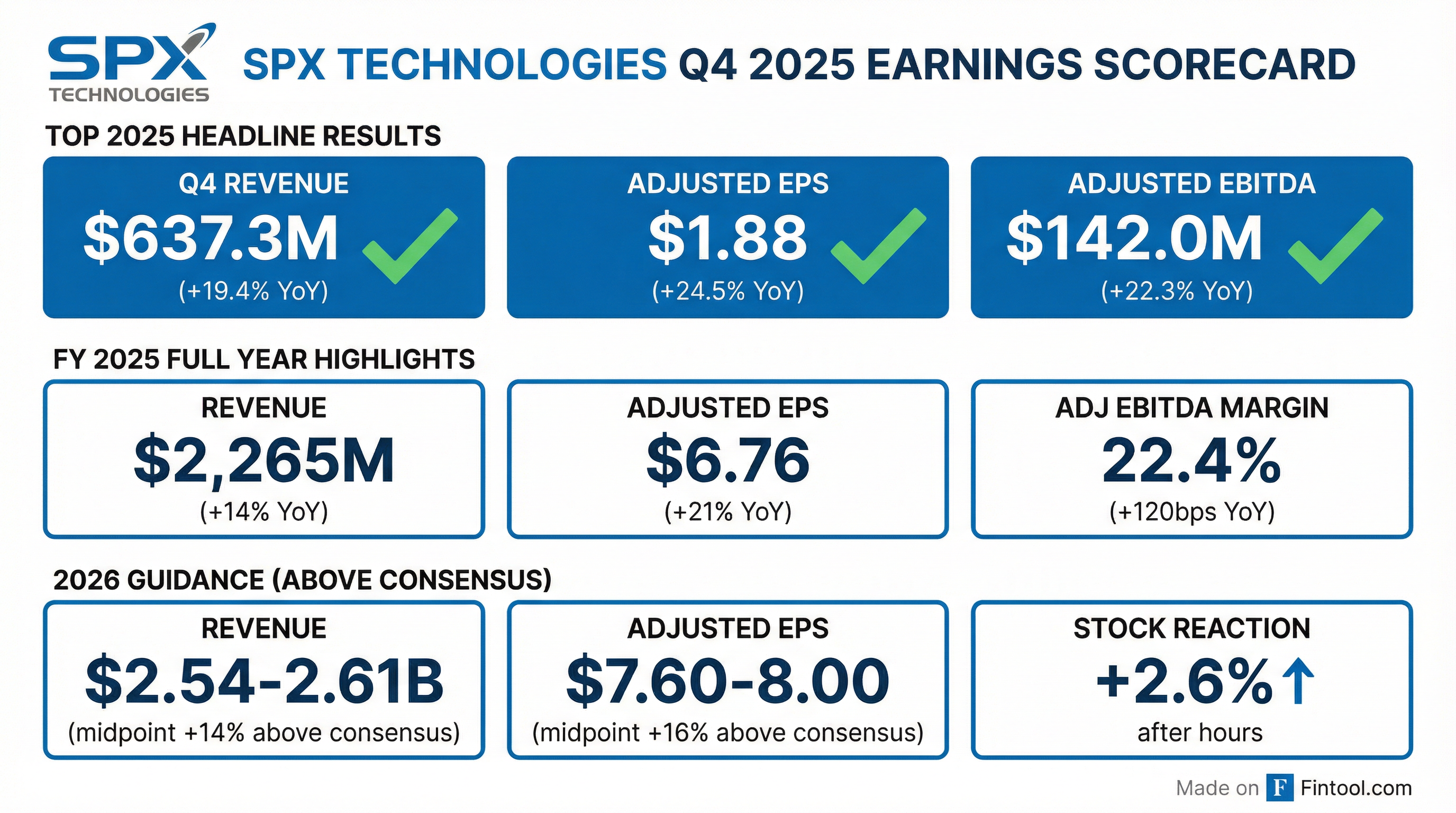

- SPX Technologies concluded 2025 with strong performance, reporting Q4 revenue growth of 19.4% and a 25% increase in adjusted EPS to $1.88. For the full year, adjusted EBITDA and adjusted EPS both grew by 21%, with adjusted EPS reaching $6.76.

- The company issued full-year 2026 guidance, projecting total revenue between $2.535 billion and $2.605 billion, adjusted EBITDA between $590 million and $620 million (implying approximately 20% growth at the midpoint), and adjusted EPS between $7.60 and $8.00 (reflecting approximately 15% growth at the midpoint).

- SPX is making significant investments in its HVAC segment, including approximately $100 million in 2026, to expand capacity, which is expected to add roughly $700 million of incremental revenue potential once at full production by 2028. Data center revenue, which was about $200 million (9% of total revenue) in 2025, is anticipated to grow by approximately 50% in 2026.

- The company completed the acquisitions of Thermelec, Air Enterprises, and Rahn Industries in Q1 2026 to strengthen its HVAC segment, and maintains a very active M&A pipeline with a pro forma leverage ratio of 1.0 times net debt to EBITDA, indicating capacity for further strategic investments.

- SPX Technologies reported a strong close to 2025, with full-year adjusted EPS growing 21% to $6.76 and Q4 revenue increasing 19.4%.

- The company provided 2026 full-year guidance, anticipating total revenue between $2.535 billion and $2.605 billion and adjusted EPS in the range of $7.60 to $8.00, implying approximately 15% growth at the midpoint.

- Strategic investments in HVAC capacity expansion include approximately $100 million in 2026 (following $60 million in 2025) to add roughly $700 million of incremental capacity for data center and custom air handling solutions, with full production expected by 2028.

- SPX Technologies completed strategic acquisitions of Thermelec, Air Enterprises, and Rahn Industries in Q1 2026, strengthening its position in electric heat and engineered air movement markets, with these acquisitions expected to contribute approximately $110 million in revenue for 11 months in 2026.

- SPX Technologies reported a strong close to 2025, with full-year adjusted EBITDA and adjusted EPS growing by 21%. For Q4 2025, revenue increased by 19.4% and adjusted EBITDA by approximately 22% year-over-year. Adjusted EPS for Q4 2025 was $1.88, up 25%, and full-year adjusted EPS was $6.76.

- The company introduced full-year 2026 guidance, projecting total revenue between $2.535 billion and $2.605 billion, adjusted EBITDA between $590 million and $620 million (implying approximately 20% growth at midpoint), and adjusted EPS between $7.60 and $8.00 (reflecting approximately 15% growth at midpoint).

- In Q4 2025, SPX Technologies completed the purchase of a new 459,000 sq ft facility in Madison, Alabama, for data center and custom air handling solutions. In Q1 2026, it completed the acquisitions of Thermelec, Air Enterprises, and Rahn Industries to strengthen its HVAC segment. These expansion investments are expected to require approximately $100 million of capital in 2026 and add roughly $700 million of incremental capacity at full production.

- Data center revenue constituted about 9% of total revenue in 2025, totaling over $200 million, and is expected to grow by approximately 50% in 2026, reaching about 12% of total revenue.

- SPX Technologies reported Q4 2025 revenue growth of 19.4% to $637 million and Adjusted EPS of $1.88.

- For the full year 2025, Adjusted EBITDA grew 21% to $507 million, and Adjusted EPS reached $6.76, also up 21% year-over-year.

- The company introduced its 2026 guidance, forecasting revenue between $2.535 billion and $2.605 billion and Adjusted EPS between $7.60 and $8.00.

- Strategic actions in 2025 included expanding HVAC manufacturing capacity with a new facility in Madison, AL, and acquiring Thermolec, Air Enterprises, and Rahn Industries to enhance HVAC capabilities.

- SPX Technologies reported Q4 2025 revenue of $637.3 million, an increase of 19.4%, and full-year 2025 revenue of $2,265.1 million, up 14.2%.

- Adjusted EPS for Q4 2025 was $1.88, a 24.5% increase, and full-year 2025 Adjusted EPS was $6.76, up 21.1%.

- For full-year 2026, the company introduced guidance projecting revenue between $2.535 billion and $2.605 billion and Adjusted EPS between $7.60 and $8.00.

- CEO Gene Lowe highlighted healthy demand, strong operational execution, and contributions from recent acquisitions, with continued momentum from additions to the HVAC segment in Q1 2026.

- SPX Technologies reported fourth quarter 2025 revenue of $637.3 million, an increase of 19.4%, and Adjusted EPS of $1.88, up 24.5% compared to the fourth quarter of 2024.

- For the full year 2025, the company achieved revenue of $2,265.1 million, a 14.2% increase, and Adjusted EPS of $6.76, up 21.1% from full-year 2024.

- The company provided 2026 guidance, projecting revenue between $2.535 billion and $2.605 billion (up approximately 13% at the midpoint) and Adjusted EPS between $7.60 and $8.00 (up approximately 15% at the midpoint).

- The CEO highlighted healthy demand across key end markets, strong operational execution, and significant contributions from recent acquisitions, expressing optimism for continued double-digit growth in 2026.

- SPX Technologies has completed its acquisition of Crawford United Corporation for an aggregate transaction value of approximately $300 million, with Crawford United shareholders receiving about $83.86 per share.

- The acquisition expands SPX's HVAC portfolio by integrating Crawford United's Commercial Air-Handling Equipment segment, which includes the Air Enterprises and Rahn Industries businesses.

- Crawford United's Industrial & Transportation Products segment is deemed non-core to SPX and will be recorded as assets held for sale, with its results reported as discontinued operations.

- SPX management plans to provide 2026 guidance, including the impact of the Crawford United acquisition, on February 24, 2026, when the company reports its Q4 2025 results.

- SPX Technologies, Inc. has completed the acquisition of Thermolec Ltd. for a total cash consideration of CA$ 195 million (approximately US$ 140 million).

- Thermolec is a Montr\u00e9al-based manufacturer of custom electric duct heating solutions, generating annual revenues of approximately US$ 35 million.

- Thermolec will become part of SPX\u2019s HVAC segment, and SPX Technologies plans to expand Thermolec\u2019s U.S. sales while leveraging Thermolec\u2019s Canadian customer relationships to expand MEP\u2019s sales in Canada.

- SPX Technologies reported strong Q3 2025 performance, with adjusted EPS growing by 32% to $1.84 and revenue increasing by 23% year-over-year. Adjusted EBITDA also grew approximately 31% year-over-year, accompanied by 150 basis points of margin expansion.

- The company raised its full-year 2025 adjusted EPS guidance to a range of $6.65 to $6.80, representing approximately 21% year-over-year growth at the midpoint. Adjusted EBITDA is now anticipated to exceed $500 million, implying approximately 20% growth year-over-year.

- SPX Technologies strengthened its financial position by completing a $575 million common stock offering and increasing its revolving credit facility capacity by $500 million to $1.5 billion, which boosted liquidity by over $1 billion without diluting 2025 EPS. The leverage ratio at quarter end was approximately 0.5 times.

- Strategic growth initiatives are progressing, including capacity expansion plans for engineered air movement businesses, such as a new TAMCO facility in Tennessee, and the company is on track to achieve $50 million in Olympus Max product bookings in 2025 for 2026 revenue.

- SPX Technologies reported strong Q3 2025 results, with adjusted EPS growing 32% to $1.84 and total revenue increasing 23% year-over-year. The company raised its full-year 2025 guidance, now expecting adjusted EPS in the range of $6.55-$6.80 and adjusted EBITDA to exceed $500 million at the midpoint.

- The company significantly strengthened its financial position by completing a $575 million equity offering and increasing its revolving credit facility by $500 million to $1.5 billion, resulting in an increase of over $1 billion in liquidity with no dilutive effect on 2025 EPS.

- SPX Technologies is progressing on organic growth initiatives, including expansion plans for engineered air movement businesses and the launch of the Olympus Max product, targeting $50 million in orders for 2025. The M&A pipeline remains robust, with several attractive opportunities identified in both HVAC and Detection & Measurement segments.

Quarterly earnings call transcripts for SPX Technologies.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more