Earnings summaries and quarterly performance for OSHKOSH.

Executive leadership at OSHKOSH.

John Pfeifer

President and Chief Executive Officer

Ignacio Cortina

Executive Vice President, Chief Legal and Administrative Officer and Secretary

Jayanthi Iyengar

Executive Vice President and Chief Technology and Strategic Sourcing Officer

Mahesh Narang

Executive Vice President and President, Access Segment

Matthew Field

Executive Vice President and Chief Financial Officer

Michael Pack

Executive Vice President and President, Vocational Segment

Board of directors at OSHKOSH.

Annette Clayton

Director

David Perkins

Director

Douglas Davis

Director

Duncan Palmer

Director

Keith Allman

Chair of the Board

Kimberley Metcalf-Kupres

Director

Sandra Rowland

Director

Tyrone Jordan

Director

William Burns

Director

Research analysts who have asked questions during OSHKOSH earnings calls.

Kyle Menges

Citigroup

8 questions for OSK

Jamie Cook

Truist Securities

7 questions for OSK

Angel Castillo Malpica

Morgan Stanley

6 questions for OSK

Mircea Dobre

Robert W. Baird & Co.

6 questions for OSK

Tami Zakaria

JPMorgan Chase & Co.

6 questions for OSK

David Raso

Evercore ISI

5 questions for OSK

Jerry Revich

Goldman Sachs Group Inc.

5 questions for OSK

Steven Fisher

UBS

5 questions for OSK

Tim Thein

Raymond James Financial

5 questions for OSK

Stephen Volkmann

Jefferies

4 questions for OSK

Chad Dillard

AllianceBernstein

3 questions for OSK

Charles Albert Dillard

Bernstein

3 questions for OSK

Steve Barger

KeyBanc Capital Markets Inc.

3 questions for OSK

Christian Dialon

KeyBank

2 questions for OSK

Christian Zylon

KeyBanc

2 questions for OSK

Mig Dobre

Baird

2 questions for OSK

Mike Shlisky

D.A. Davidson

2 questions for OSK

Timothy Thein

Raymond James

2 questions for OSK

Brendan Shea

Morgan Stanley

1 question for OSK

Christian Zyla

KeyBanc Capital Markets

1 question for OSK

Judah Aronovitz

UBS Group AG

1 question for OSK

Michael Shlisky

D.A. Davidson

1 question for OSK

Stefan Diaz

Morgan Stanley

1 question for OSK

Recent press releases and 8-K filings for OSK.

- Oshkosh forecasts $11 billion in revenue for 2026, with the Access and Vocational segments each projected at $4.2 billion, and the Transport segment at $2.5 billion.

- The company targets an overall operating income margin of 12%-14% by 2028, up from approximately 10% in 2026. A significant driver is the Transport segment, which aims to increase its margin from 4% in 2026 to 10% by 2028 through new defense contracts and the Next Generation Delivery Vehicle (NGDV) ramp-up.

- The NGDV production ramp is slower than anticipated due to robotics issues, with 2026 production expected around 16,000 units. However, the company anticipates exiting 2026 at the higher end of its 16,000-20,000 unit annual capacity range.

- In the Vocational segment, a $150 million investment is underway to increase fire apparatus capacity by 25%-30% to address a backlog extending into 2028. The refuse business is experiencing a temporary "pause" in orders as municipalities delay long-term contracts due to tariff uncertainty.

- Capital allocation priorities include investing in the business, returning cash to shareholders via an 11% dividend increase this year and $278 million in share repurchases in 2025, and pursuing bolt-on M&A.

- Oshkosh projects $11 billion in revenue for 2026, with the Access and Vocational segments each contributing $4.2 billion, and the Transport segment $2.5 billion. The company aims for a company-wide operating income margin of 12%-14% by 2028, an increase from 9.6% last year and approximately 10% this year.

- The Transport segment is expected to significantly improve its margin from 4% in 2026 to 10% by 2028, driven by new heavy and medium truck contracts and the ramp-up of Next Generation Delivery Vehicle (NGDV) production. NGDV production for 2026 is anticipated to be around 16,000 units, with an exit rate towards the higher end of its 16,000-20,000 unit annual capacity.

- The Vocational segment is investing $150 million to increase fire apparatus capacity by 25%-30% to address a backlog extending into 2028. The refuse business is experiencing a temporary pause due to municipal contract delays related to tariff uncertainty.

- The Access segment anticipates favorable price-cost for the full year 2026, supported by ongoing cost reductions, despite the full impact of tariffs.

- Capital allocation priorities include funding business growth, a steadily increasing dividend (11% increase this year), and share repurchases ($278 million last year), alongside bolt-on M&A.

- Oshkosh's 2026 revenue guidance is approximately $11 billion, with the Access and Vocational segments each projected at $4.2 billion, and the Transport segment at $2.5 billion.

- The Transport segment is undergoing a significant margin transformation, with an expected increase from 4% in 2026 to 10% by 2028, driven by new defense contracts and the ramp-up of Next Generation Delivery Vehicle (NGDV) production.

- The Vocational segment, including municipal fire apparatus and AeroTech, shows strong long-term potential, with $150 million being invested to increase fire truck capacity by 25%-30% to address an extended backlog into 2028.

- NGDV production is steadily increasing towards the lower end of its 16,000-20,000 units/year capacity for 2026, with the company expecting to exit the year at the higher end of this range, despite a slower-than-anticipated ramp due to new plant robotics.

- Capital allocation priorities include maintaining a healthy balance sheet, funding internal investments, providing a steadily increasing dividend (including an 11% increase this year), and opportunistic share repurchases ($278 million bought back last year) and bolt-on M&A.

- Oshkosh Defense was awarded an additional $25 million contract from the U.S. Army for FMTV A2 Low-Velocity Airdrop (LVAD) 4x4 Cargo vehicles and kits.

- This order demonstrates strong and sustained customer demand for Oshkosh's mission-critical tactical mobility solutions.

- To date, the U.S. Army has placed orders for a total of 797 Oshkosh FMTV A2 LVADs, which are designed to be parachuted from aircraft to support airborne and rapidly deploying units.

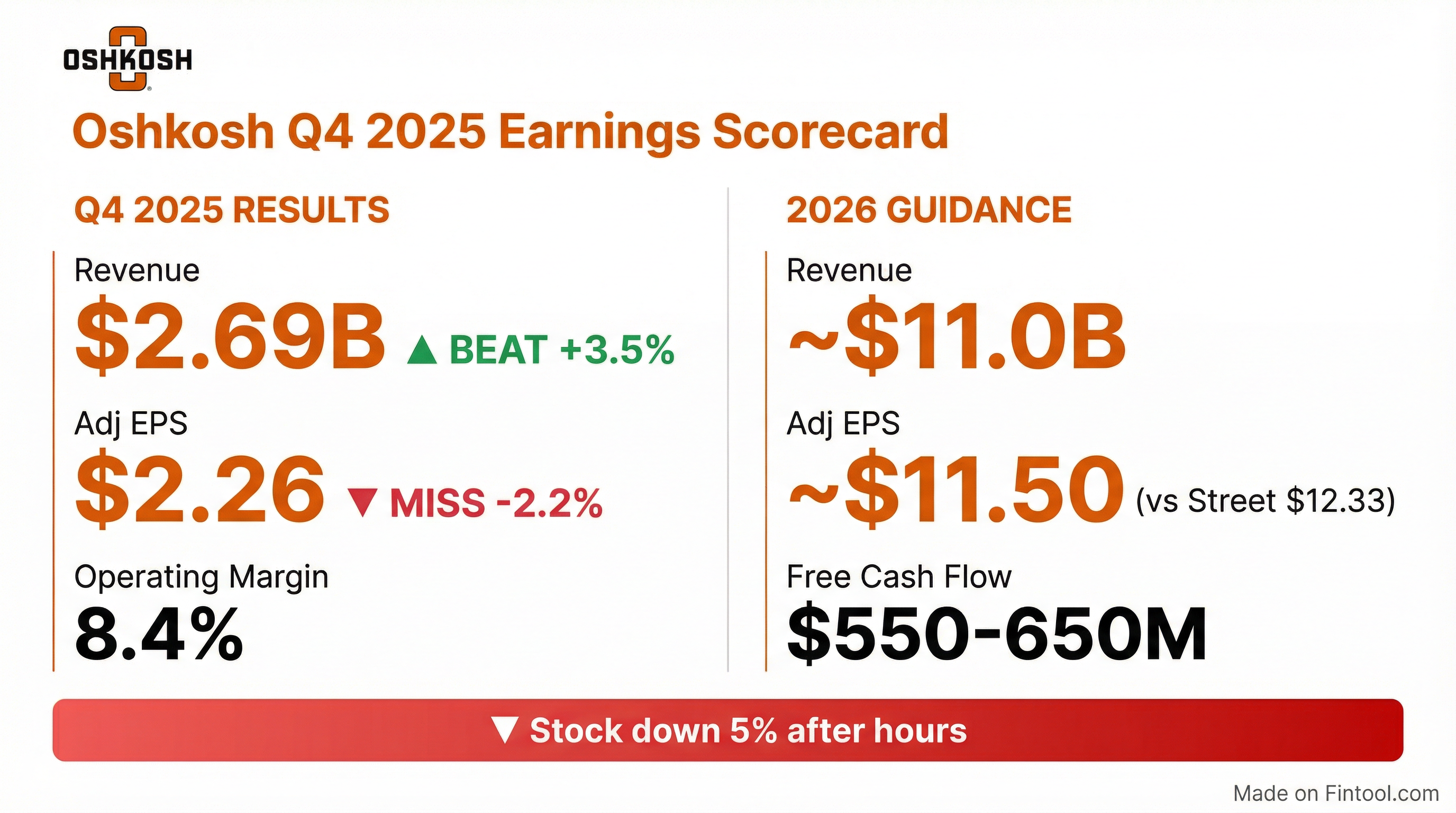

- Oshkosh reported fourth-quarter 2025 revenue of $2.69 billion, an increase of 2.5% year-over-year, and provided full-year 2026 revenue guidance centered near $11.0 billion.

- Fourth-quarter 2025 non-GAAP EPS was $2.26, missing consensus, and the company's adjusted EPS guidance for fiscal 2026 is $11.50 at the midpoint, which came in below analyst estimates.

- The board approved an 11.8% increase to the quarterly dividend, to $0.57 per share, raising the forward yield to about 1.56%.

- The company highlighted a backlog of approximately $14.2 billion supporting near-term demand.

- The FY2026 adjusted EPS target of $11.50 is being driven by strength in its vocational business and the ramp-up of the NGDV program.

- Oshkosh reported full-year 2025 revenue of $10.4 billion and adjusted earnings per share (EPS) of $10.79, with Q4 2025 revenue at $2.7 billion and adjusted EPS at $2.26.

- For 2026, the company forecasts adjusted EPS of $11.50 and consolidated sales of approximately $11 billion, anticipating strong performance in the vocational and transport segments, partially offset by weaker conditions in the access segment.

- The company expects Q1 2026 adjusted EPS to be about half of last year's, primarily due to pull-forward sales in Q4 2025 for access products and an estimated $200 million impact from tariffs in 2026.

- Oshkosh announced a quarterly dividend of $0.57 per share and plans to continue share repurchases, having repurchased $278 million in 2025.

- Key operational highlights include receiving multiple innovation awards at CES for technologies like JLG robotics and CAMS, and the vocational segment holding a backlog of over $6.6 billion.

- Oshkosh reported Q4 2025 adjusted EPS of $2.26 on $2.7 billion in revenue, contributing to full-year 2025 adjusted EPS of $10.79 and $10.4 billion in revenue.

- For full-year 2026, the company forecasts adjusted EPS of approximately $11.50 and consolidated sales of approximately $11 billion.

- The company anticipates Q1 2026 adjusted EPS to be about half of last year's due to expected weaker market conditions in the access segment and the impact of strong Q4 2025 sales pulled forward by pricing actions.

- Oshkosh announced a quarterly dividend of $0.57 per share and plans to continue share repurchases in 2026, having repurchased $278 million in 2025.

- Oshkosh Corporation (OSK) reported full year 2025 consolidated revenue of $10.42 billion and adjusted EPS of $10.79.

- For Q4 2025, consolidated net sales were $2,688.8 million and adjusted EPS was $2.26.

- The company provided a 2026 outlook, projecting revenues of approximately $11.0 billion and adjusted EPS of approximately $11.50.

- OSK anticipates free cash flow between $550 million and $650 million for 2026.

- The Vocational segment demonstrated strong Q4 2025 performance with $922.4 million in net sales and an adjusted operating income margin of 16.2%.

- Oshkosh Corporation reported Q4 2025 consolidated sales of nearly $2.7 billion and adjusted EPS of $2.26, contributing to full-year 2025 revenue of $10.4 billion and adjusted EPS of $10.79.

- For fiscal year 2026, the company projects consolidated sales of approximately $11 billion and adjusted EPS of approximately $11.50, with an anticipated $200 million impact from tariffs.

- The company expects weaker market conditions in the access segment for 2026, forecasting sales of approximately $4.2 billion, while the vocational segment has a backlog of over $6.6 billion.

- Oshkosh continued to advance its technology, showcasing innovations at CES and ramping up NGDV shipments, with the fleet exceeding 10 million miles driven.

- Oshkosh Corporation reported fourth quarter 2025 sales of $2.69 billion and adjusted diluted earnings per share (EPS) of $2.26.

- For the full year 2025, the company achieved net sales of $10.42 billion and adjusted diluted EPS of $10.79.

- The company initiated its 2026 adjusted diluted EPS guidance at approximately $11.50 on projected net sales of approximately $11.0 billion.

- The Board of Directors declared a quarterly cash dividend of $0.57 per share.

- In the fourth quarter of 2025, Oshkosh repurchased 911,873 shares of common stock for $118.7 million.

Quarterly earnings call transcripts for OSHKOSH.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more