OSHKOSH (OSK)·Q4 2025 Earnings Summary

Oshkosh Q4 2025: Revenue Beats, But 2026 EPS Guidance Disappoints — Stock Falls 5%

January 29, 2026 · by Fintool AI Agent

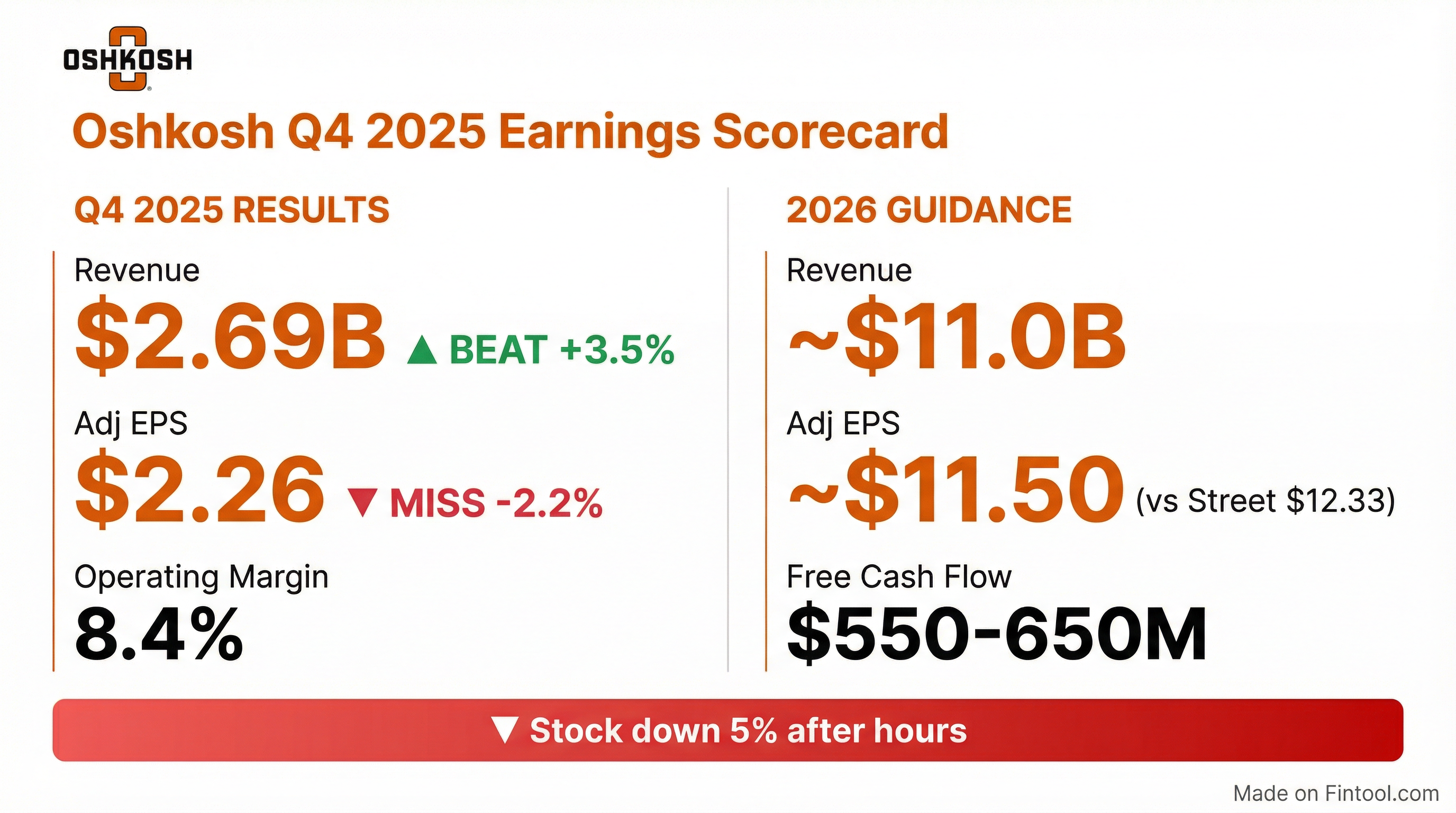

Oshkosh Corporation delivered a mixed Q4 2025, beating revenue expectations but missing on earnings. The real story is the 2026 guidance: the company's $11.50 adjusted EPS outlook came in 6.7% below Street consensus of $12.33, driven largely by a 5x jump in tariff costs from ~$35M (2025) to ~$200M (2026). Shares fell ~5% after hours on the news.

Did Oshkosh Beat Earnings?

Q4 2025 was a split decision — revenue beat but EPS missed expectations:

*Values retrieved from S&P Global

The company cited product mix and manufacturing overhead costs as headwinds to EPS, partially offset by lower incentive compensation and higher sales volume.

Full Year 2025 came in largely as expected, with modest beats on revenue:

Capital allocation update: The Board declared a quarterly dividend of $0.57 per share, payable March 3, 2026. The company also repurchased ~912K shares ($119M) in Q4 and $278M for the full year.

What Did Management Guide?

2026 guidance disappointed the Street — revenue was in-line but EPS came in well below expectations:

*Values retrieved from S&P Global

Segment-level 2026 guidance shows Vocational leading the way on margins:

Why the guidance gap? The company disclosed that tariff costs are expected to jump from ~$35M in 2025 to ~$200M in 2026 — a nearly 5x increase that alone represents ~$2.50 of EPS headwind. Combined with continued Access segment weakness and NGDV ramp challenges, management chose to set conservative expectations.

What's Happening in Each Segment?

Access Segment — Facing Headwinds

The Access segment delivered $1.17B in Q4 revenue (+1.3% YoY), but margins compressed significantly:

Key issues:

- Price/cost dynamics from tariffs (~$150M of the $200M full-year tariff impact hits Access)

- Unfavorable product mix

- Sales discounts in a competitive market

Management noted on prior calls that customers are being "cautious with CapEx spending" amid tariff uncertainty and higher interest rates. The 30% decline in backlog is concerning heading into 2026.

Q1 2026 Warning: Management expects Q1 adjusted EPS to be "about half of last year" — a significant sequential decline driven by strong Q4 sales pulling forward demand and tariff cost absorption before pricing fully kicks in. Price-cost is expected to turn positive in the back half of 2026.

Vocational Segment — The Bright Spot

Vocational continues to outperform with strong fire truck demand and AeroTech growth:

Pierce fire trucks and Oshkosh AeroTech (jet bridges, ground support equipment) are driving growth. Fire apparatus deliveries were up nearly 10% in the second half vs. a year ago. The $6.6B backlog provides excellent visibility for the next 2-3 years.

CapEx Investment: Management is investing ~$150M to support improved throughput across three key manufacturing locations, with ~$70M spent to date.

Transport Segment — NGDV Ramp Continues

The Transport segment showed sequential improvement as NGDV production scales:

The Next Generation Delivery Vehicle (NGDV) program for USPS is ramping nicely. Key milestones: The company surpassed 5,000 units produced and the fleet has exceeded 10 million miles driven. NGDVs now operate in nearly all 50 states, including Alaska. Management expects to deliver 16,000-20,000 units per year, with 2026 at the low end of that range. About half of 2026 Transport revenue (~$1.25B) will come from NGDV deliveries.

As of December 31, 2025, the company has received orders for 51,500 vehicles out of a potential 165,000 units over 10 years. Key risk: Deferred contract costs exceed future profits on existing orders by ~$135M — if USPS orders fewer units than expected, this could result in an impairment.

How Did the Stock React?

OSK shares fell sharply following the earnings release:

The sell-off was driven primarily by the 2026 EPS guidance miss. With the Street expecting $12.33 and management guiding to ~$11.50, the ~7% gap created immediate downward pressure.

Valuation context: At $143.25, OSK trades at ~12.5x the 2026 EPS guidance of $11.50, below its 5-year average of ~14x. The stock is down from a 52-week high of $158.53 but remains well above the 52-week low of $76.82.

What's the Long-Term Story?

Despite near-term headwinds, management reiterated confidence in the 2028 targets set at the June 2025 Investor Day:

The path to roughly doubling EPS by 2028 relies on:

- Access recovery as construction activity normalizes and tariff headwinds ease

- Vocational throughput gains at Pierce fire trucks

- NGDV full-rate production driving Transport profitability

- Technology differentiation — autonomy, electrification, and connected products

What Technology Did Oshkosh Showcase at CES 2026?

Management highlighted significant third-party recognition at CES 2026, winning two Best of Innovation awards and several honoree designations:

Key technology showcased:

- Welding robot concept — JLG boom lift coupled with autonomous scissor lifts, AI software, and sensing technologies that can execute jobs autonomously

- Modular airport robot platform — Can serve multiple roles on the tarmac; perimeter detection robot trialed at airports

- CAMS — AI-powered collision avoidance system for firefighters and first responders on active roadways; being field tested with fire departments in large cities

ConExpo 2026 Preview: Management highlighted the upcoming ConExpo show in March, where they'll announce new products and demonstrate the boom lift with robotic end effector concept.

Key Risks to Monitor

- Tariff escalation — Tariffs cost ~$35M in 2025 but are estimated to increase to ~$200M in 2026 — a 5x jump that significantly pressures margins

- Access demand softness — The 30% backlog decline suggests continued caution from rental customers

- NGDV contract overhang — Deferred contract costs exceed future profits on existing orders by ~$135M at Dec 31, 2025. If USPS orders fewer units than expected, this could result in an impairment

- New DoD executive order — In January 2026, a presidential executive order directed DoD to prioritize speed, affordability, and domestic sourcing in procurement. This could result in changes to pricing expectations, contract structures, or supplier selection that adversely affect Oshkosh's defense business

- Federal budget uncertainty — The continuing resolution expires January 30, 2026. A government shutdown could delay or cancel key programs

Q&A Highlights — What Analysts Asked

On Access vs. United Rentals guidance disconnect (Jamie Cook, Truist):

Management explained that rental companies have different exposures. United Rentals, with heavy mega-project exposure, may see different dynamics than independent rental companies more exposed to private non-res construction, which "is still under pressure."

On Transport margin path to 10% by 2028 (Kyle Menges, Citi):

CFO Matt Field confirmed "all the building blocks are there" — new pricing on FMTV contracts coming in H2 2026, steady NGDV production increases, and expected follow-on NGDV orders throughout the year.

On the tariff environment (Chad Dillard, Bernstein):

Management assumes current tariff rates sustain throughout 2026. If IEEPA gets overturned, "our assumption is that something equivalent will go in place." Three-quarters of the ~$200M tariff impact hits the Access segment.

On Vocational fire truck mix (Steven Fisher, UBS):

The Q4 margin headwind from adverse mix was due to more "snowflakes" (one-off custom orders) vs. batches in the quarter. Management doesn't see this as a sustained issue.

The Bottom Line

Oshkosh's Q4 2025 was a tale of two stories: solid execution in Vocational offset by persistent Access headwinds. The real disappointment was the 2026 EPS guidance of $11.50, which came in 6.7% below Street expectations of $12.33.

For bulls: The 2028 targets of $18-22 EPS remain intact, Vocational momentum is strong, and Access should benefit from eventual Fed rate cuts and tariff clarity. The stock at ~12.5x forward earnings offers value if management executes.

For bears: Access backlog down 30%, NGDV ramp challenges, and a guidance miss suggest 2026 will be another transition year. The path to 2028 targets requires significant improvement that isn't yet visible in the numbers.

Oshkosh reports fiscal year-end December 31. Q4 2025 covers October-December 2025.

Related: OSK Company Profile | Q4 2025 Transcript | Q3 2025 Earnings