Earnings summaries and quarterly performance for FRANKLIN ELECTRIC CO.

Executive leadership at FRANKLIN ELECTRIC CO.

Joseph Ruzynski

Chief Executive Officer

DeLancey Davis

Vice President and President, Headwater Companies

Greg Levine

Vice President and President, Global Water

Jennifer Wolfenbarger

Chief Financial Officer and Chief Accounting Officer

Jonathan Grandon

Vice President, Chief Administrative Officer, General Counsel and Corporate Secretary

Board of directors at FRANKLIN ELECTRIC CO.

Research analysts who have asked questions during FRANKLIN ELECTRIC CO earnings calls.

Bryan Blair

Oppenheimer

7 questions for FELE

Matt Summerville

D.A. Davidson & Co.

7 questions for FELE

Ryan Connors

Northcoast Research Partners

7 questions for FELE

Walter Liptak

Seaport Research Partners

7 questions for FELE

Michael Halloran

Baird

4 questions for FELE

Mike Halloran

Robert W. Baird & Co. Incorporated

4 questions for FELE

Recent press releases and 8-K filings for FELE.

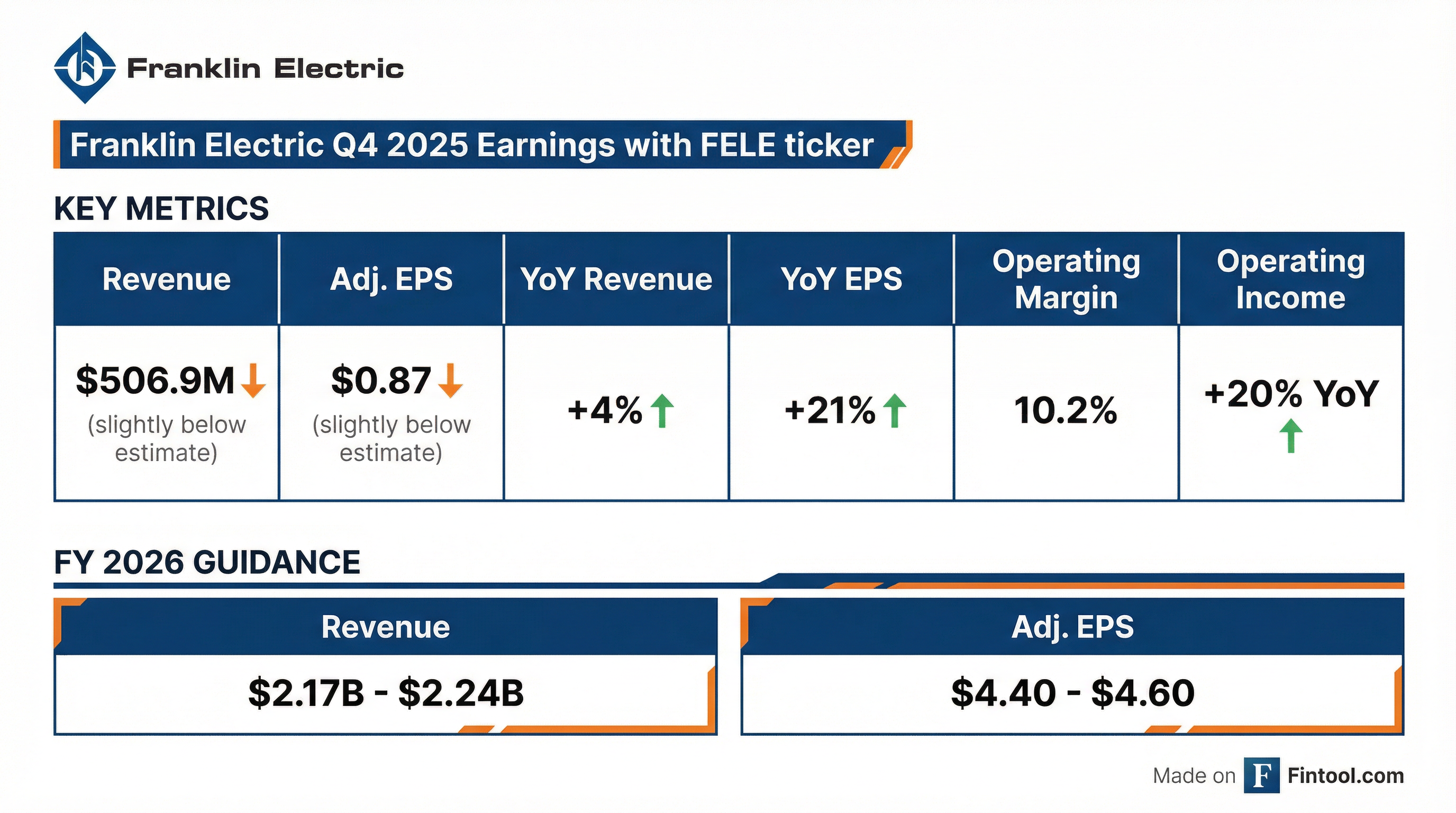

- Franklin Electric reported consolidated sales of $506.9 million for Q4 2025, a 4.4% year-over-year increase, and full-year 2025 consolidated sales of $2.1 billion, up 5.4% from the prior year.

- For the full year 2025, adjusted diluted earnings per share (EPS) was $4.14, an increase of 6% compared to $3.92 in 2024.

- The company provided full-year 2026 guidance, expecting sales to be in the range of $2.17 billion to $2.24 billion and adjusted EPS to be between $4.40 and $4.60.

- In 2025, Franklin Electric completed approximately $120 million in acquisitions and $160 million in share buybacks, while also increasing its quarterly cash dividend by 5.7%, marking the 34th consecutive year of increases.

- Strategic initiatives include the launch of a Value Acceleration Office in 2025, aimed at streamlining operations, managing costs, and driving growth, with expected strong contributions to margins in the coming years.

- Franklin Electric reported Q4 2025 consolidated sales of $506.9 million, a 4.4% year-over-year increase, and full-year 2025 sales of $2.1 billion, up 5.4%. Full-year adjusted diluted EPS was $4.14, an increase of 6% from 2024.

- The company provided full-year 2026 guidance, projecting sales in the range of $2.17 billion-$2.24 billion and adjusted EPS between $4.40-$4.60, with midpoint EPS growth of approximately 9%.

- In 2025, Franklin Electric achieved a cash conversion of 126%, completed approximately $120 million in acquisitions, and executed about $160 million in share buybacks.

- A quarterly cash dividend of $0.28 was announced, marking a 5.7% increase and the 34th consecutive year of dividend increases. The company also launched a Value Acceleration Office in 2025 to streamline operations and manage costs.

- Franklin Electric reported strong financial performance for Q4 and full-year 2025, with Q4 sales up 4.4% to $506.9 million and full-year sales up 5.4% to $2.1 billion.

- The company's full-year 2025 adjusted diluted EPS increased 6% to $4.14, compared to $3.92 in 2024.

- Strategic initiatives in 2025 included approximately $120 million in acquisitions and $160 million in share buybacks, alongside the launch of a Value Acceleration Office aimed at streamlining operations and improving margins.

- Franklin Electric increased its quarterly cash dividend to $0.28, a 5.7% increase, marking the 34th consecutive year of dividend increases.

- For full-year 2026, the company expects sales to be in the range of $2.17 billion to $2.24 billion and adjusted EPS to be between $4.40 and $4.60.

- Franklin Electric reported Q4 2025 consolidated net sales of $506.9 million, a 4% increase from the prior year, and full year 2025 consolidated net sales of $2.1 billion, up 5%.

- Operating income for Q4 2025 increased 20% to $51.6 million, with a 10.2% operating margin. For the full year 2025, operating income grew 10% to $269.0 million, achieving a 12.6% operating margin.

- GAAP fully diluted earnings per share (EPS) for Q4 2025 was $0.87, a 21% increase. Full year 2025 GAAP fully diluted EPS was $3.22, while adjusted fully diluted EPS was $4.14, representing a 6% increase over the prior year. The full year EPS was impacted by a $0.91 per share net of tax charge from a US Pension Plan termination.

- For full year 2026, the company projects sales to be between $2.17 billion and $2.24 billion, with Adjusted Diluted EPS expected in the range of $4.40 to $4.60.

- Franklin Electric reported Q3 2025 consolidated sales of $581.7 million, an increase of 9% year over year, and adjusted fully diluted earnings per share of $1.30, up 11% compared to Q3 2024. GAAP EPS was $0.37, significantly impacted by a $0.93 per share pre-tax charge from the termination of its U.S. pension plan.

- The company maintained its full-year 2025 sales guidance of $2.09 billion to $2.15 billion and tightened its GAAP EPS guidance range to $4.00 to $4.20 per share, adjusted for the pension impact.

- Gross profit margin increased by 20 basis points to 35.9%, and operating income margin rose by 80 basis points to 14.6%. Water Systems sales grew 11% year over year, while Energy Systems sales increased 15%, though its operating margin declined by 280 basis points primarily due to tariffs and geographic mix. Distribution sales were up 3%, with operating margin improving by 190 basis points.

- Franklin Electric announced a quarterly cash dividend of $0.265 and has 1.1 million shares remaining authorized for repurchase after repurchasing 1.4 million shares year-to-date.

- The company is launching a new pressure-boosting platform with three new products and expects a new factory in Izmir, Turkey, to start production in Q1.

- Franklin Electric reported Q3 2025 consolidated sales of $581.7 million, an increase of 9% year over year, with adjusted fully diluted earnings per share (EPS) rising 11% to $1.30.

- The company's fully diluted EPS for Q3 2025 was $0.37, impacted by a $0.93 per share charge from the termination of its U.S. pension plan.

- Gross profit increased to $208.7 million, with the gross profit margin expanding by 20 basis points to 35.9%. Operating income grew 16% to $85.1 million, with the operating income margin improving to 14.6%.

- Franklin Electric is holding its full-year 2025 sales expectations of $2.09 billion to $2.15 billion and maintaining the midpoint of its GAAP EPS guidance at $4.00 to $4.20 per share, adjusted for the pension program impact.

- The company announced a quarterly cash dividend of $0.265 per share, payable November 20 to shareholders of record on November 6.

- Franklin Electric reported strong Q3 2025 financial results, with sales of $581.7 million, up 9% year-over-year, and adjusted EPS of $1.30, an 11% increase year-over-year.

- Sales growth was observed across all segments, driven by favorable pricing, higher volumes, and a 3% contribution from acquisitions.

- The company is maintaining the midpoint of its 2025 EPS guidance, narrowing the range to $4.00 to $4.20, and expects full-year sales between $2.09 to $2.15 Billion.

- Franklin Electric is investing $10 million in an Izmir Factory Expansion to support regional growth for its Water and Energy businesses, with new plants expected to go live in Q1 2026 and Q1 2027 respectively.

- Franklin Electric delivered Q3 2025 consolidated sales of $581.7 million, an increase of 9% year-over-year, and adjusted fully diluted earnings per share of $1.30, up 11% compared to the prior year.

- The company achieved gross margins of 35.9%, an increase of 20 basis points, and consolidated operating income of $85.1 million, up 16% from the prior year, reflecting strong execution and cost control.

- Sales growth was broad-based across segments, with Water Systems sales increasing 11%, Energy Systems sales increasing 15%, and Distribution sales increasing 3% year-over-year.

- Franklin Electric maintained its full-year sales expectations of $2.09 billion-$2.15 billion and tightened its adjusted GAAP EPS guidance to a range of $4.00-$4.20 per share.

- Strategic initiatives include the launch of a new pressure-boosting platform with three new products and progress on a new factory in İzmir, Turkey, which is set to start production in Q1.

- Franklin Electric Co., Inc. reported consolidated net sales of $581.7 million for the third quarter of 2025, an increase of 9% compared to the prior year.

- Operating income for Q3 2025 was $85.1 million, a 16% increase from Q3 2024, with an operating margin of 14.6%.

- GAAP fully diluted earnings per share (EPS) was $0.37 for Q3 2025, while adjusted diluted EPS increased 11% to $1.30 compared to the third quarter of 2024.

- The company incurred a pre-tax settlement charge of $55.3 million from the termination of its US Pension Plan, which had an EPS impact of approximately $0.93 per share net of tax.

- Franklin Electric is maintaining its full year 2025 sales guidance between $2.09 billion and $2.15 billion and full year 2025 EPS guidance between $4.00 and $4.20, excluding the pension termination impact.

- Franklin Electric reported Q4 2024 consolidated sales of $485.7 million, a 3% year-over-year increase, and diluted earnings per share (EPS) of $0.72, which was down from $0.82 in Q4 2023, partly due to $3.4 million in restructuring expenses.

- The company announced a segment name change from Fueling Systems to Energy Systems, reflecting its evolving portfolio, with energy-related products now comprising approximately 25% of the segment's revenues. The Energy Systems segment saw a 5% sales increase to $68.8 million and an improved operating income margin of 35.9% in Q4 2024.

- For full year 2025, Franklin Electric expects sales in the range of $2.09-$2.15 billion and GAAP EPS between $4.05-$4.25. This guidance includes an estimated $50 million revenue impact and approximately $0.03 EPS accretion from two recent acquisitions.

- The company increased its quarterly cash dividend by 6% to $0.265, marking the 33rd consecutive year of dividend increases, and generated $261.4 million in net cash flows from operating activities in 2024.

Quarterly earnings call transcripts for FRANKLIN ELECTRIC CO.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more